First time home buyers: should you choose fixed, floating or overdraft type home loan?

This article helps you choose a home loan that is suitable for your personal situation.

This article helps you choose a home loan that is suitable for your personal situation.

A term loan is a standard loan type where a fixed amount is taken as a loan, called the principal, and then paid back in installments, called EMI, every month. The EMI is designed to be fixed over the term of the loan. If the interest rate of the loan changes over time, the EMI will change. This point is the distinction between fixed and floating types of term loans.

The bank gives a home loan to own the property while using it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that has both interest and principal in the same amount.

EMI = Principal + Interest

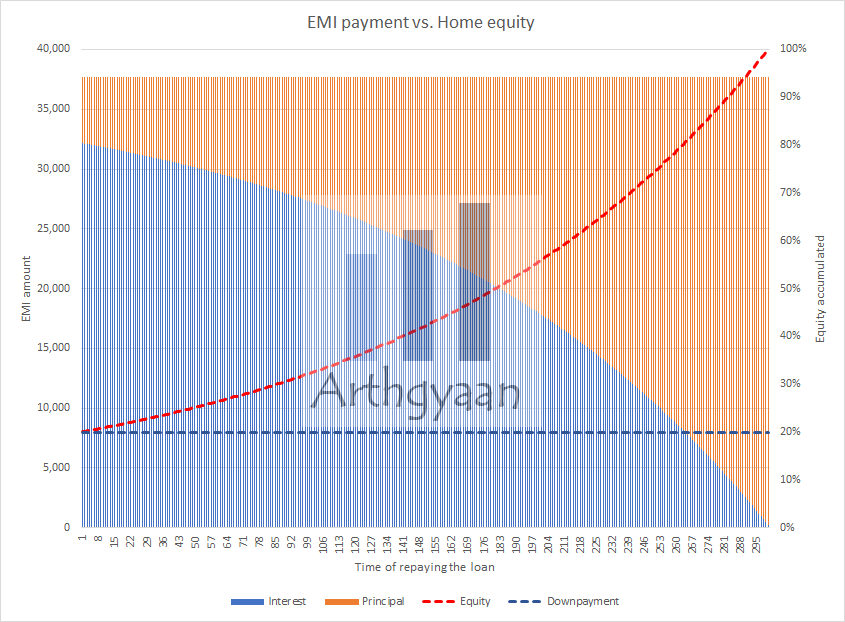

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point, and the rest of the EMI is the principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

This article is the next part of our guide to purchasing your dream home. Read the other parts here:

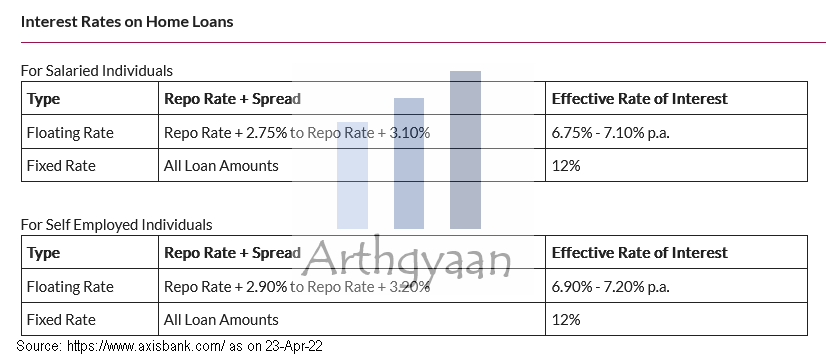

Floating rate loans are the most common type of loans offered for home loans.

Floating rate = Base rate like Repo or MCLR + Spread

The interest rate on your home loan will typically be a floating rate that will fluctuate with overall interest rates in the economy. Usually, movements of the RBI repo rate indicate the direction of interest rates in the economy, while home loans are tied to the Repo Linked Loan Rate (RLLR) or Marginal Cost of Funds-based Lending Rate (MCLR) as per RBI.

As interest rates fluctuate, so will your EMI over time. As the economy matures, interest rates are expected to decrease, taking down the amount you pay per month on your home loan. Similarly, while inflation is also likely to reduce with time, the purchasing power of the money paid as EMI will decrease as well over time.

Term loan Terminologies

Fixed rate loans are a slight misnomer though on paper they offer loans with rates that do not change with the movement of interest rates in the economy. These loans seem to be a good solution to the problem of interest rate rises that increase your EMI. If the rates never rise (or fall), then you no longer have to worry about this problem. The EMI will always be the same. Except when they are not:

If you are thinking to take a fixed-rate loan, you will be better off with a floating-rate loan and keep the difference in an EMI buffer fund.

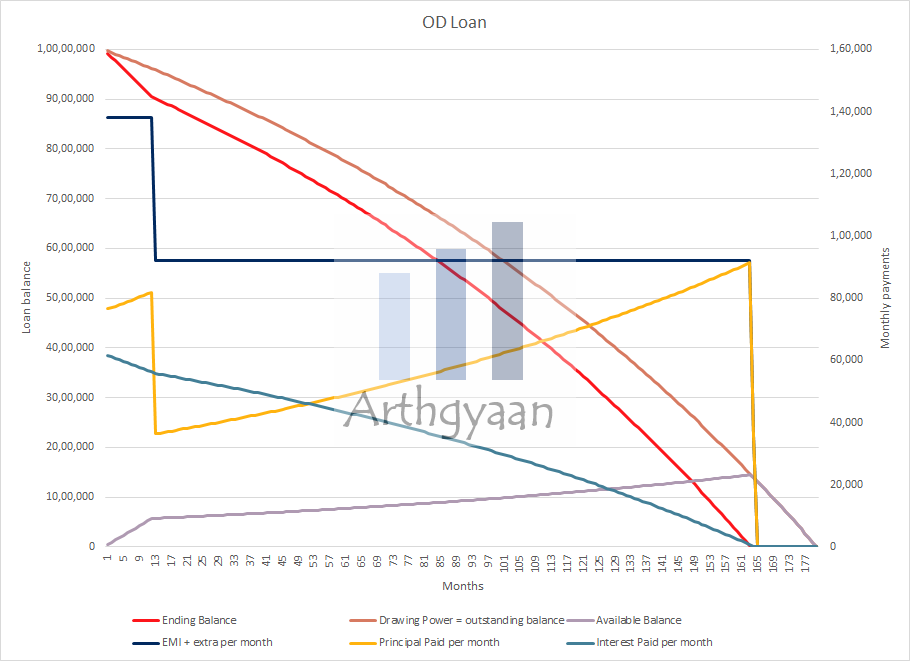

This type of loan is a special case of the floating rate loan. Any surplus money kept in the OD account saves interest since the principal is reduced by the value of this surplus when interest calculation is done. We have covered this concept in detail in this article and you should review it before proceeding further: How does an overdraft loan like SBI Maxgain work?.

In the previous article on the mechanics of the OD home loan, we discussed three ways of using the OD account to park excess cash and the rationale for doing the same:

We will now show the calculations to decide if these methods will work for you.

Please note that the OD account does not generate returns directly; instead, the returns come from interest saved on the loan. Whether that interest saving is material will depend on the quantum of money that passes through the OD account as surplus cash.

Average extra account balance to be added every month to the OD account, as a percentage of OD loan EMI, to come to the same result as the non-OD term loan (7.4% rate for OD, 7% for normal):

This list shows that unless you can park an extra surplus of at least ₹3,260/month or around ₹39,000/year continuously when the EMI is ₹1 lakh for a 15-year loan, then you should not go for an OD loan.

Using the same rates of 7.4% for OD and 7% for a term loan, we can calculate the extra interest to be paid as a % of principal vs term loan:

This list shows that for a 15-year loan, an extra 4.05% of the principal, e.g. 4.05 lakhs/crore borrowed, is to be paid in case of an OD loan vs a standard term loan. This table shows that if you are planning to pay off the loan in a short period, the extra interest on an OD account is less making the OD loan more attractive.

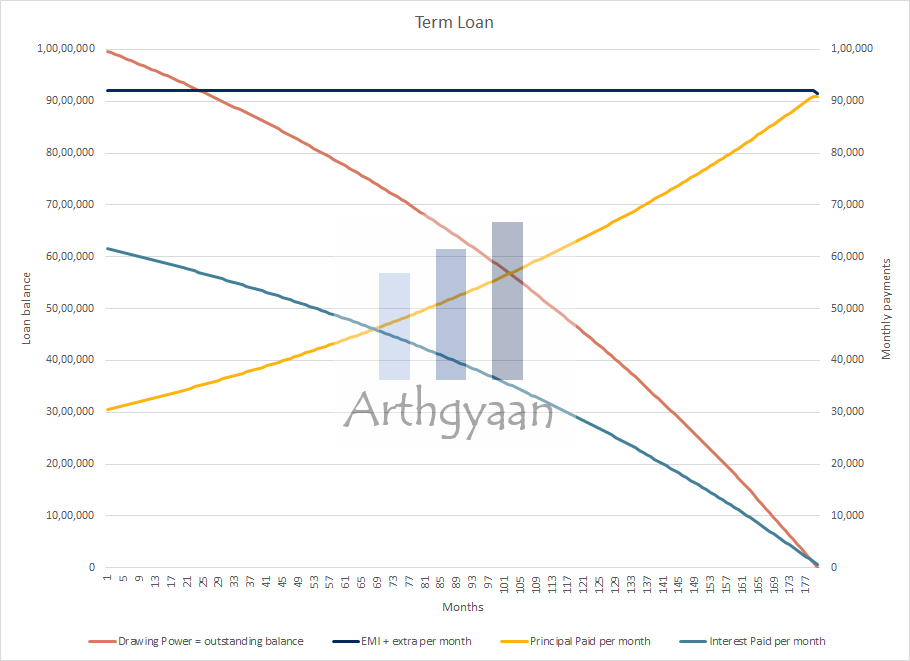

We always advocate having 6-12 months of EMI included in the emergency fund when a home loan is taken. Additionally, if a buffer fund can be created to manage expenses in case interest rates go up. This entire fund can be parked in the OD account. Since parking this buffer fund in the OD account reduces the loan tenure, we will contrast this case with a term loan where a slight prepayment is done so that both loans can end simultaneously.

In each of the cases below, we will do this:

| Year | 3x EMI | 6x EMI | 9x EMI | 12x EMI |

|---|---|---|---|---|

| 5 | 5.98% | 12.88% | 20.94% | 27.93% |

| 6 | 4.78% | 10.10% | 16.16% | 24.98% |

| 7 | 3.89% | 9.34% | 14.26% | 21.25% |

| 8 | 4.11% | 8.72% | 12.80% | 18.53% |

| 9 | 3.50% | 7.36% | 12.56% | 17.46% |

| 10 | 3.02% | 7.01% | 11.48% | 15.64% |

| 11 | 3.18% | 6.68% | 10.57% | 14.92% |

| 12 | 2.79% | 6.38% | 9.79% | 13.57% |

| 13 | 2.90% | 6.10% | 9.64% | 13.01% |

| 14 | 2.58% | 5.83% | 8.98% | 12.49% |

| 15 | 2.65% | 5.57% | 8.82% | 11.98% |

| 16 | 2.69% | 5.33% | 8.64% | 11.48% |

| 17 | 2.42% | 5.41% | 8.08% | 11.41% |

| 18 | 2.44% | 5.16% | 7.90% | 10.92% |

| 19 | 2.45% | 4.93% | 7.70% | 10.79% |

| 20 | 2.44% | 4.94% | 7.76% | 10.62% |

Taking the 15-year loan as an example, we see from the table that:

While having a large enough emergency fund to cover the EMI for a few months is always recommended, some families with sufficient liquid assets may choose the normal loan plus prepayment route instead of the OD loan.

The only reason a borrower may choose a fixed-rate home loan when both of the following conditions are true:

All other investors should avoid a fixed-rate loan.

Overdraft loans may be chosen if at least 1-2 of the following conditions are true:

Every borrower who does not fall under the loan categories above should take a normal floating-rate loan. The only thing to keep in mind is to take a repo-linked (RLLR) based loan, instead of an MCLR based one, since the RLLR based loans react faster to rate reductions than MCLR.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled First time home buyers: should you choose fixed, floating or overdraft type home loan? first appeared on 25 May 2022 at https://arthgyaan.com