How do you get from goal to SIP amount: Part 1

Walk-through: Get the SIP amount for a single payment goal

Walk-through: Get the SIP amount for a single payment goal

We have already covered

In this example, we will consider a single payment goal like a foreign vacation, buying a car, kid’s marriage or for the down-payment of a house.

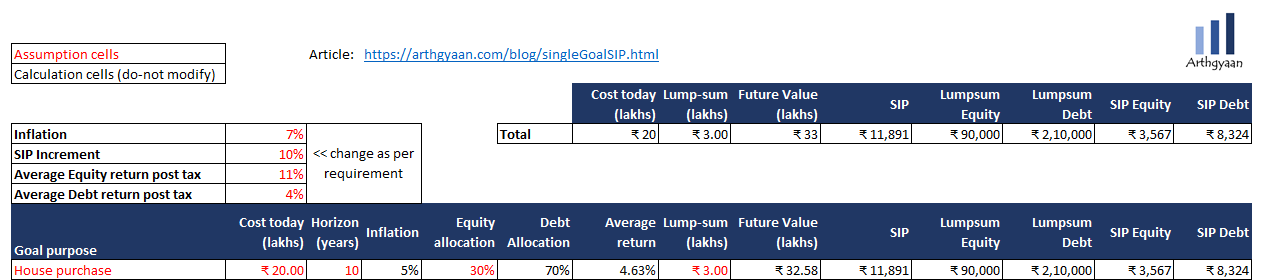

Taking the example of a house down-payment as a goal, let us construct this example:

Future Value = Current Value * (1 + Inflation) ^ TIme_to_goal

When the house is actually bought, due to 5% inflation over 10 years the down-payment will be higher. Let us call this future value (F)

F = C * (1+I)^H = 20 * (1+0.5)^10 = 32.58 lakhs

So we need to invest monthly an amount of ₹ 12,089 (as per the calculator linked below) in equity and debt. Based on the return expectation of each of the funds chosen and the asset allocation, you can arrive at a return expectation for the investments as per this post: How much returns should you estimate for your goals?.

This is the SIP amount assuming constant investment every year. Typically people increase their investments every year by 10% and the same is assumed here. The starting value of L i.e. 3 lakhs should be invested via this method as per asset allocation (E=30%, Debt=70%) as per the choice of equity and debt funds.

Once this is done, the following will be completed:

These calculations are explained in this Google Sheets workbook which has a few worked-out examples for more goals.

The following needs to be done in this order:

Repeat the steps in the “Find SIP amount for a goal” section above with these new values. See this detailed post for the process

This article is part of our Series on “How to purchase a home”:

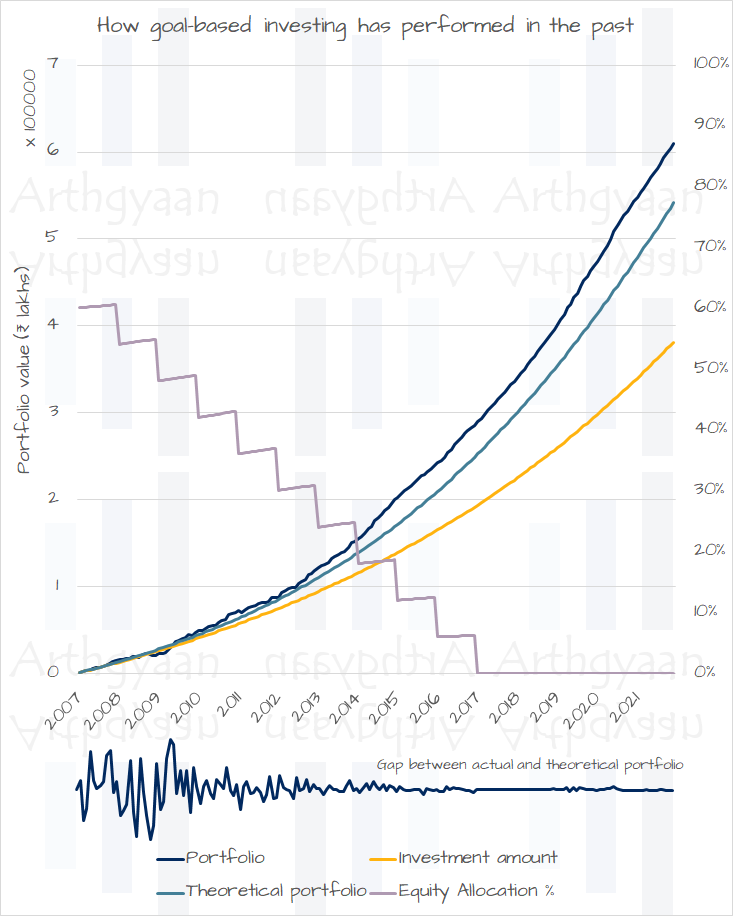

We show this example of a goal for which investment was started in 2007. Every year, the invested amount was increased by 10%, and the asset allocation was made more and more conservative over time. We can see how the equity allocation was reduced to zero as the goal moved closer.

The key learning here is that the variability between the actual and theoretical portfolios slowly came close to zero over time.

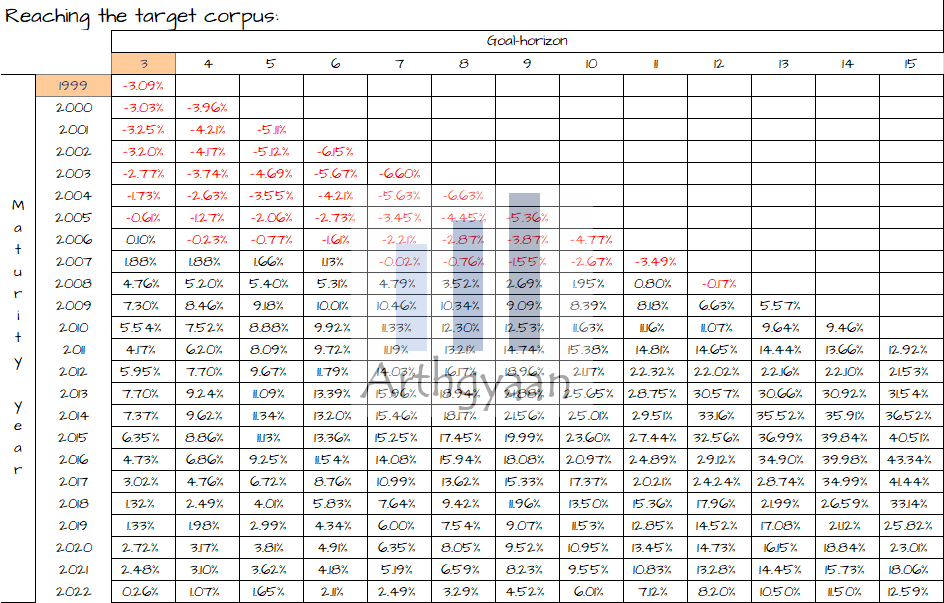

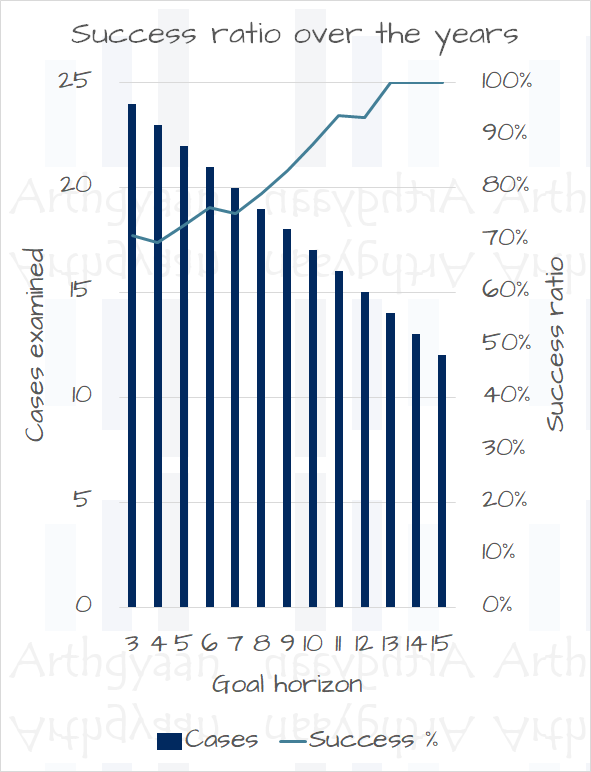

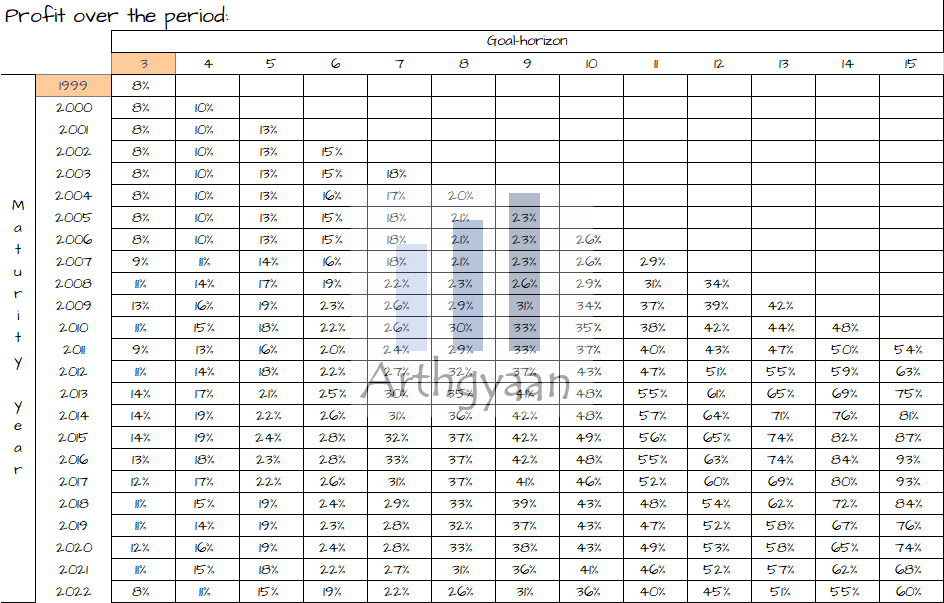

We see that except for goals maturing before 2008, in all other cases, the return has been higher than the theoretical return like this:

But there has not been a single case where the ending value has been lower than the starting value:

Read more: Goal-based investing: does it work in India?

We have covered the practical aspects of investing for a goal like this in detail here: How to invest for a single goal using Target Date Funds in India?.

At all times ensure that you have the following in place

Please see below:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How do you get from goal to SIP amount: Part 1 first appeared on 04 Jun 2021 at https://arthgyaan.com