Which index funds to invest in and why?

What are index funds, why invest in them and how to choose one?

What are index funds, why invest in them and how to choose one?

This article is a part of our detailed article series on the concept of index funds in India. Ensure you have read the other parts here:

This article gives an easy to use Excel list of Index Funds in India for you to know which ones to avoid and which ones can be considered for investing.

This article shows the steps that a new index fund investor can follow to shortlist an index fund for investing

Understanding the risk of every asset class in our portfolio is essential. This article talks about the risk in index funds.

An index fund invests in the same stocks and proportion as a stock market index like Nifty 50 or Sensex. This is called passive investment, where returns are similar to the index, and there is no objective to get better returns than the fund benchmark. In an index fund, the number of active decisions taken by the fund manager (which stock to buy/sell etc.) is kept to a minimum since the fund follows the index and replicates its underlying constituents as closely as possible. Common index funds in India track the Nifty 50, Nifty Next 50 and Sensex indices. Nowadays, funds tracking mid and small-cap indices, factor indices, bond indices and US markets (S&P500 and Nasdaq 100) are available. In addition, many ETFs track the same index and may be considered for investment post understanding their pros and cons over open-ended mutual funds. Funds that are not index funds are called active funds.

Index funds reduce active decision-making as per definition. There are two sources of active decision:

These active decisions frequently reduce investor returns. This lower risk of index funds is described in more detail in this post: Are index funds less risky than active funds?

Also, an index fund does not magically give the best possible returns in the market. What it does, always and without fail, is give higher return than the worst funds in the category and lower returns than the best funds again in the same category. Since the best and worst funds in any ranking table keep changing places, it is not possible to predict in advance what they will do.

The active fund manager spends considerable time and effort in beating the index. Naturally, this results in higher fees (via the fund’s expense ratio), but there is no guarantee that the fund will outperform its benchmark index.

There are many different funds in the same category. For example, in May 2021, 46 funds in the Large Cap category are benchmarked to indices like Nifty 50, Sensex or Nifty 100. It is not possible (can be mathematically proven) that all of them give a better return than the benchmark index in any given year.

Also, the same fund cannot give index-beating returns year after year since eventually, the fund manager’s active decisions go wrong. Also, fund managers are paid irrespective of performance, so the only loser if the fund underperforms the market is the investor. This is not the case in index funds since the performance is very close to the market.

The investor cannot know which fund will underperform in advance (since the prediction of the future is not possible) and gets lower returns than the market especially considering the high fees of active funds. Another tendency in active management easily missed by investors is closet indexing, where a high-fee active fund surreptitiously mimics an index fund.

A typical retail investor chooses funds via social media (blogs, YouTube, Twitter, Facebook etc.), fund ranking portals and traditional media (like newspapers). Some get advice from distributors. Ultimately this leads to 3-4 funds in the same category in two ways: new funds enter the portfolio based on recent past returns. In contrast, old ones stay, or systematic investment (SIP) is started in multiple funds simultaneously. This is where the investor is trying to maximize the chances of one fund giving a better return than the market. A rigorous analysis of the fund manager’s history, risk vs return (rolling risk and return), suitability of the investment style etc., is generally not a part of the selection process.

If out of multiple funds, some underperform the benchmark, the outperformance or alpha of the rest is negated, especially considering the higher expense of the active funds.

Retail investors also need to evaluate the performance regularly of their active funds vs peers and the benchmark and then switch funds once they feel their current fund is not giving “good returns”. This is an attempt at predicting the future, which does not end well. Also, this return chasing leads to losses due to taxes which is a permanent loss of capital.

Suppose by luck, the investor has invested in an active fund X that will outperform the index for the next 20 years say. In that case, there will be multiple cases in the intervening period where there will be underperformance vs the index. At this point, the investor will not have the conviction for staying invested, seeing that other funds and the index are all doing better. So even if the fund itself outperforms, the investor would have exited a long time back.

If they have chosen an index suitable for their goal and asset allocation, index fund investors have a lot less to monitor and a lesser number of decisions to be taken. In general, the more actions that need to be taken, the more decisions to be made, and the more the risk of second-guessing and making mistakes that can cause lower returns.

Investing in index funds is the first step in the journey towards lazy portfolios: What are lazy portfolios and why you should implement them for your goals?.

However, this post is not meant to convince anyone that index funds are “better” than active funds. Instead, it focuses more on selecting an index fund and ongoing review of one. Interested investors wishing to know more about how index funds are currently performing vs active funds in India can check out the freely available S&P SPIVA reports.

This video dispels some of the myths regarding index funds:

All of these factors make index funds the ideal option for all investors, especially the new entrants who do not need to chase underperformance by investing in active funds: What are the best mutual funds for first-time investors?.

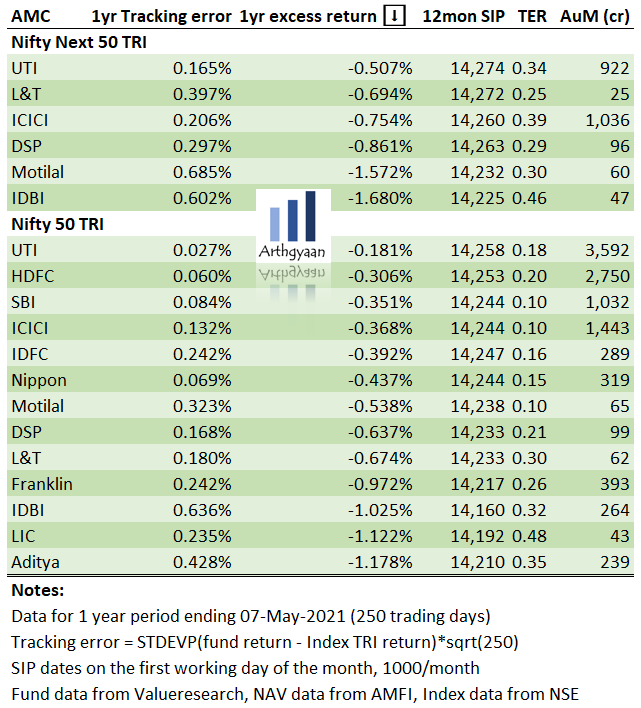

There are now multiple AMCs that have index funds. For example, there are now (May 2021) 30 different index funds in the Large Cap category as per Valueresearchonline. While most index funds are similar, some are worse than the rest. Index funds are available that invest both in Indian and International markets.

Here is how you choose an index fund once you have decided which benchmark index (like Nifty 50, Nifty Next 50, S&P 500 or MSCI World) you want to invest in:

Total Expenses Ratio (TER) is what AMCs charge to a fund as the cost of running that fund. This includes salaries of the fund manager and team, trading and related costs of buying/selling and distributor costs. Index funds generally have lower TER than active funds since there is not much to do for both AMC employees, trading is less, and distributors have no incentive to push them vs high-cost active funds.

Since all index funds give returns similar to the index by design, a fund with lower expenses, i.e. TER, will provide better returns than another fund with higher fees. Everything else remains the same. Mutual fund portals generally give TER for all funds as a convenient list/table. Keep a watch on this one since AMCs have a habit of abruptly increasing it.

Index funds returns will vary slightly from index returns since it is impossible to perfectly replicate the index by buying and selling stocks all the time since that will become too expensive to trade frequently. The difference between the index return and fund return is called excess return. Tracking error (TE) measures how much these excess returns vary from each other (mathematically, TE = standard deviation of excess returns).

It is generally advisable to go for the lowest tracking error since that indicates consistency in how the fund is run. This information is usually present in fund information documents. Alternatively, investors can calculate this from index data from the NSE/BSE website and fund NAV data from AMFI using at least one year of trading data.

However, if Tracking Error data is not available, choose funds with low TER and not too much return difference from the index (i.e. low excess returns) and go with that.

AuM is an easy metric to check since this is present in all fund portals, AMFI, and AMC websites. The bigger the size of the fund, the easier it is for the fund manager to buy/sell stocks as per the index. Also, it is easier for the fund to deploy cash from inflows and handle redemptions if the fund size is larger. However, for some indexes, too much AuM may create liquidity issues if the underlying stocks are not traded, for example, in the mid and small-cap universe. This will lead to higher tracking errors.

If you are looking for a step-by-step guide, refer to this article: What are the best index funds for new investors in India?.

This article has an updated list of funds and their tracking errors: Which are the best and worst index funds of India?

As explained in detail in this post, the fund must have the words Direct and Growth in the name.

All New Fund Offerings (NFOs) can be avoided since the fund is new and has no history. For active funds, a track record is essential. Unfortunately, NFO does not have any track record and is pushed by sales teams to investors touting unproven benefits.

However, index fund NFOs might fill a niche previously absent in the market, for example, index funds tracking US stocks. In such a case, the investor may wait a few months and see if the performance and TER are acceptable.

All other NFOs (especially index fund NFOs tracking indices that already have enough funds tracking them) must be avoided until at least one year of trading data is available to make a reasonable tracking error calculation.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which index funds to invest in and why? first appeared on 12 May 2021 at https://arthgyaan.com