Are index funds less risky than active funds?

Understanding the risk of every asset class in our portfolio is essential. This article talks about the risk in index funds.

Understanding the risk of every asset class in our portfolio is essential. This article talks about the risk in index funds.

This article is a part of our detailed article series on the concept of index funds in India. Ensure you have read the other parts here:

This article gives an easy to use Excel list of Index Funds in India for you to know which ones to avoid and which ones can be considered for investing.

This article shows the steps that a new index fund investor can follow to shortlist an index fund for investing

What are index funds, why invest in them and how to choose one?

Index funds are created using a written down formula or method that does not involve any active decision making by the fund manager. Many investors interpret this as index funds are lower risk than active funds. We will examine if that belief is true.

An investor looking for a primer on index fund investing should read this post first: Which index funds to invest in and why?

Risk comes from multiple sources when investing in the stock markets. These are:

Stock-specific risk or unsystematic risk is inherent to a single company. Decisions taken by the management, perception of customers and shareholders and overall market sentiment contribute to stock-specific risk. For example, the ethical perception of the Tata Group, the premium perception of Apple products and the rocket-like trajectory of Tesla are all examples of stock-specific sentiment or risk. In addition, stock-specific risk affects a single company in a sector. For instance, the Satyam scandal led to the stock price crash of Satyam but not that of other IT companies at the same time. Similarly, there is sector-specific unsystematic risk. For example, COVID impacted the hospitality and travel sectors badly, but the technology sector benefited greatly.

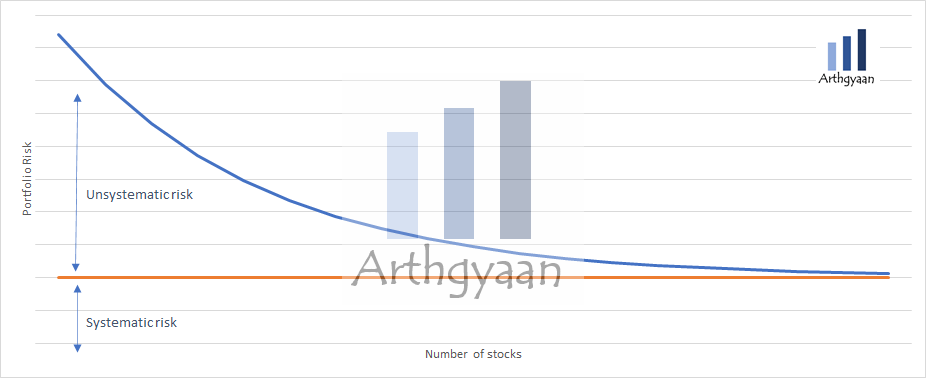

To lower the impact of unsystematic risk, the investor must invest both in multiple stocks in the same sector and different sectors in the same economy.

However, you cannot lower total portfolio risk indefinitely by adding more and more stocks. This is because some factors impact the overall country’s stock market that moves all stocks. After all stock-specific risk is eliminated, the residual risk is systematic risk. Examples of systematic risks are global fund flows, GDP growth rate, inflation and interest rates.

Inflation: the impact on your goals and how to choose assets that beat it

For example, fund flows from foreign investors are an essential factor that affects the entire Indian stock market and events like the 2008 Global Financial Crisis and the 2020 COVID Pandemic led to falls in stock markets globally.

To lower the impact of country-specific risk, investors should diversify their portfolios by investing in global stocks.

Related reading: Should you invest in international stocks?

Source of risk in mutual fund portfolios:

Mutual funds are a portfolio of multiple stocks and have lower unsystematic risk than individual stocks.

An active fund manager is supposed to beat the index by:

By replicating a rule-based index, index funds take the diversification benefits of active funds and remove fund manager risk altogether.

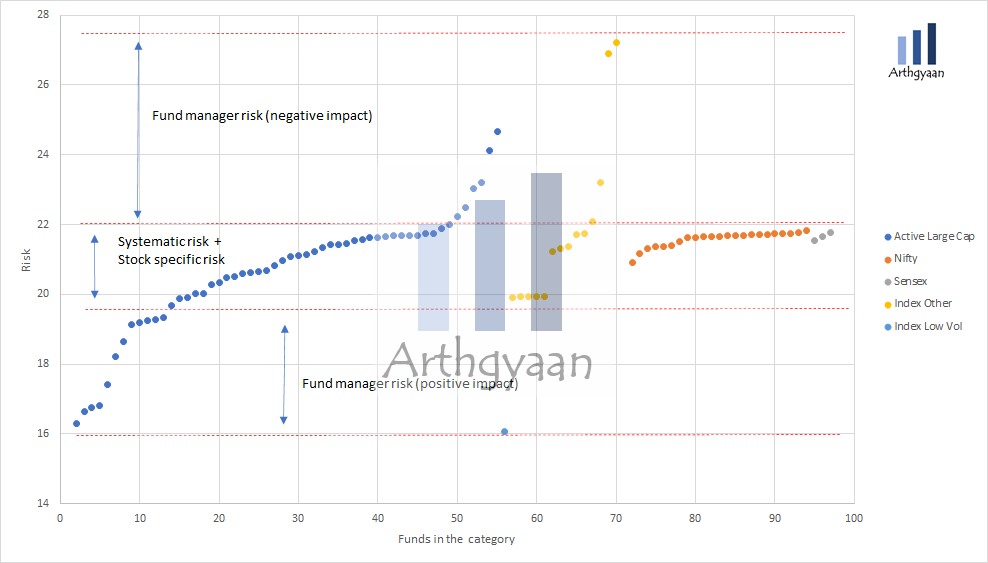

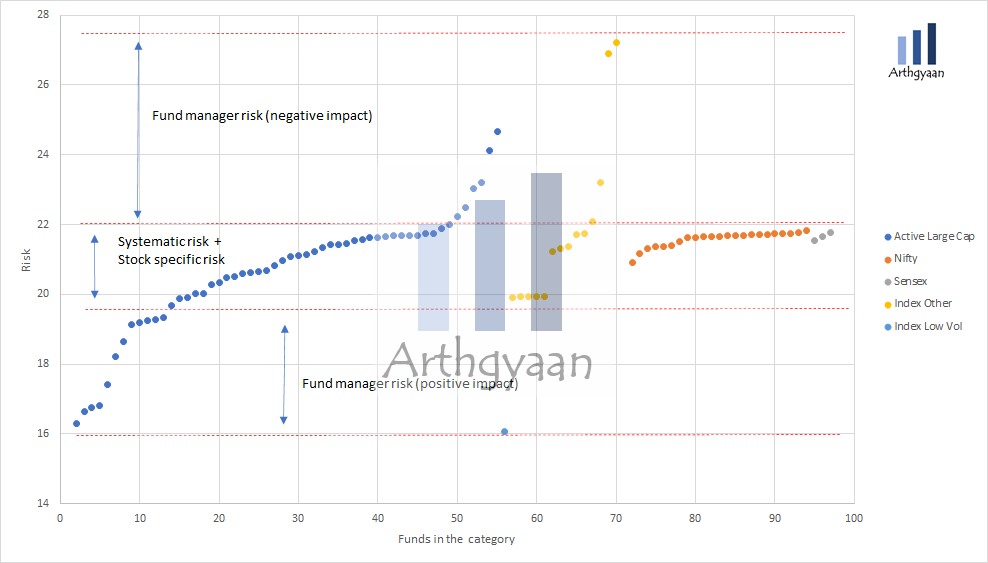

The impact of fund manager risk is shown in the figure above. This is a snapshot of active large-cap mutual fund and index fund risk from Valueresearchonline. We see that risk in index funds is in a narrow band and is not necessarily lower than that of active funds. On the other hand, active funds have managed to have total risk lower and higher than index funds. The the diagram, we have singled out large-cap market capitalization weighted Index funds tracking the Nifty 50 and Sensex specifically under the index fund definition.

Another interpretation of this diagram strengthens the premise of index funds having lower risk than active funds. The risk of index funds is within a narrow band, which is predictable, unlike active funds.

We have described active decision making by fund managers for their funds as a source of risk. Similarly, investors introduce an element of active risk in creating and managing their portfolios by

On a portfolio level, active decision-making can be curtailed if there are only index funds. In such a portfolio, the only decision to be made is when to rebalance. All other times, the investment can continue into equity funds as per the asset allocation. In addition, active fund investors have an additional step of evaluating the performance of each active fund in their portfolio.

Factor based index funds like funds tracking the Nifty Next 50 index or other value, volatility or alpha based indices are not considered in the diagram to be index funds due to their risk profile being influenced by the factor used in the construction. An investor who is investing in such funds will have to keep in mind that the risk profile, though different from active fund manager risk, will be different. The tracking needed to manage this risk profile will fall under the investor’s own tracking risk.

In summary,

Related reading:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Are index funds less risky than active funds? first appeared on 10 Dec 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.