Inflation: the impact on your goals and how to choose assets that beat it

This article talks about the impact of inflation on your goals and shows which assets have beaten inflation over time in India.

This article talks about the impact of inflation on your goals and shows which assets have beaten inflation over time in India.

Inflation is one of the axioms of personal finance and enjoys the same permanence as death and taxes.

Investors who are looking for safety in debt as an asset class would have a perpetual worry as to whether debt products beat inflation or not. Given the downtrend in interest rates in the last decade, anyone dependent on debt as an asset class, pensioners, and general investors allocating a part of their portfolio to debt products have a cause for concern. On the other hand, investors with an equity-heavy portfolio should have fared better vs inflation over time.

Chart: Arthgyaan • Source: RBI • Get the data

Falling interest rates have led to two effects on portfolio valuation and income. First, long-duration bonds have risen in price over this period while interest income from fixed deposits, small saving schemes (like provident fund, NSC) and annuities have gradually come down. Similarly, falling rates positively impact equity valuation since the cost of capital reduces.

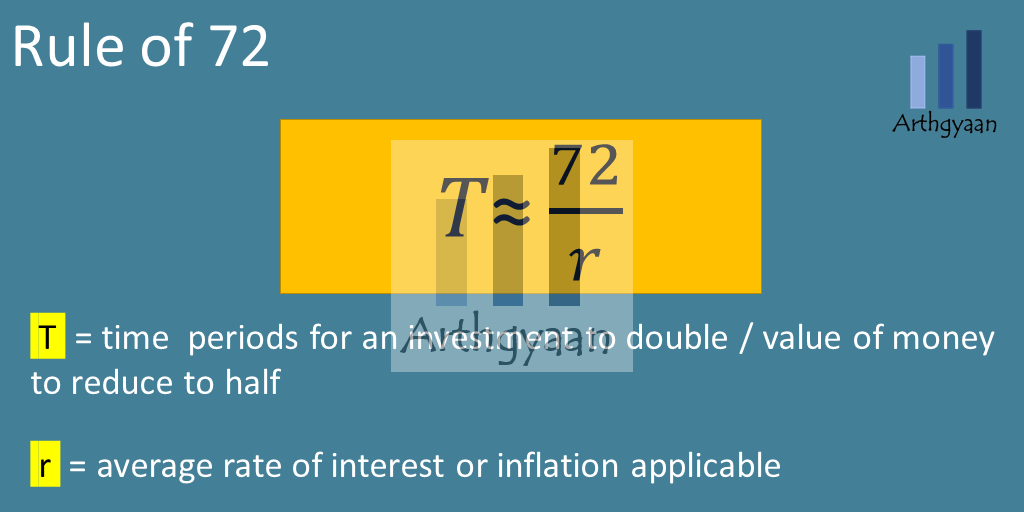

Inflation is essential to goal planning in an economy where prices are rising overall. We can use the rule of 72 as a convenient mental shortcut to understanding the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Rule of 72 lets us quickly calculate the impact of inflation over time. For example, using the rule, we can see that:

The above examples show the danger of linear thinking when money is involved. For example, any goal planning that ignores the effect of inflation will lead to inevitable failures when it is time to spend the money. Similarly, investing in insurance plans that give a fixed return over life will lead to getting smaller and smaller amounts in real terms that will be useless in the later years of retirement. The actual calculation is an application of the compounding formula like this:

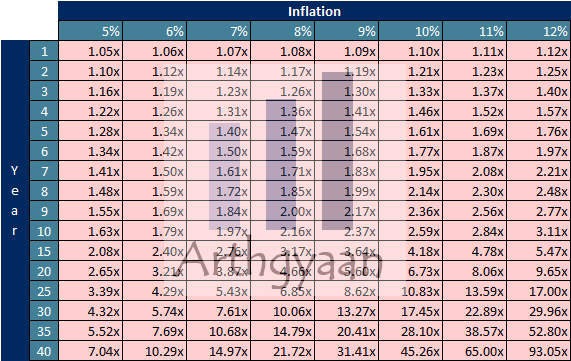

Cost after N years = Cost today * (1+Inflation) ^ Time

Here is a table that applies the above rule:

For example, at 9% inflation, a goal ten years away will increase by 2.37 times. If the cost today is ₹10 lakhs, after ten years, it will be ₹23.7 lakhs.

Since you must set goals using the SMART framework, building inflation into the target corpus amount calculation is crucial.

Read more here:

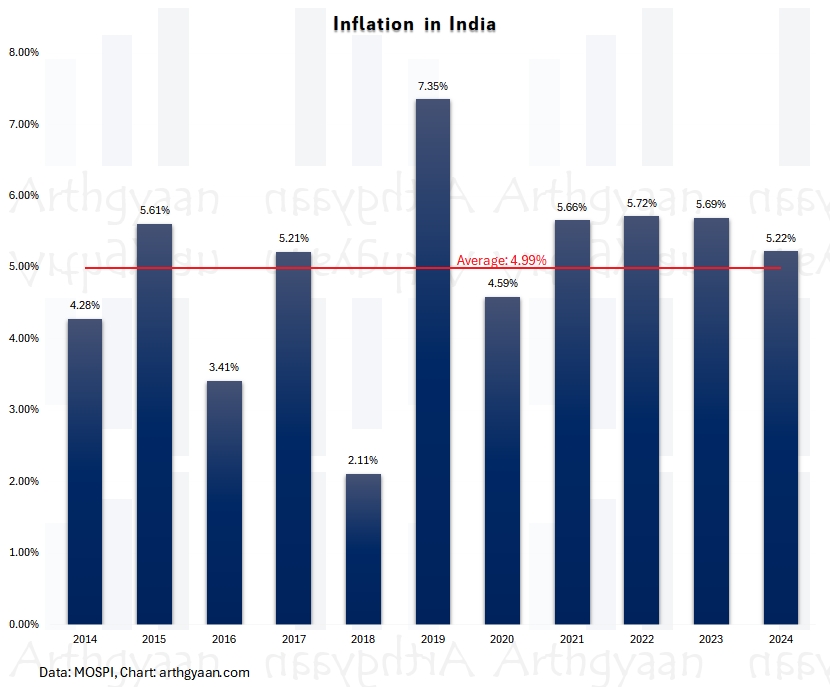

Before examining returns, we need to check what inflation data means. The government publishes multiple statistics using the MOSPI website that reflects a general basket of goods and services. While this is adequate for the country, individual investors should consider the following two points.

Personal inflation is associated with an investor’s lifestyle. Therefore, this figure will always be different from government figures. Accordingly, to estimate inflation for long-term goals like retirement, the investor must keep detailed year-to-year records of household expenses from which inflation can be calculated and will vary from family to family.

Goal-specific inflation is related to individual goals like houses, cars, college education, and vacations are different and likely higher than general inflation levels.

Read more on this topic here:

Using inflation data from MOSPI, SBI 10-year FD rates and mutual fund data from Valueresearchonline, we have created the following exhibit showing yearly inflation and category-wise returns (not that of an individual fund) of debt funds (regular plans until 2014, direct plan post that) and SBI 10-year FD. The inflation figures are from MOSPI and apply to the whole country, not an individual investor. The returns are also pre-tax.

We have also added Arbitrage funds to this list. Many investors prefer these funds because of their debt-like returns and equity-like taxation.

The diagram shows that no single category, including FD, has consistently beaten inflation over this period.

We again use Valueresearchonline data to show the returns of equity mutual funds vs inflation over the same period. Furthermore, we see that, as a whole, equity has beaten inflation in most cases.

We will use RBI House Price index data to show how aggregate real-estate prices all over India have fared against inflation. It is important to note that this is an average number for the entire country and will differ from anecdotal evidence.

We will use World Gold Council data to show how gold prices have fared against inflation. While gold is widely considered an inflation hedge, this is the only asset class in the list to have given negative returns over the period. However, the average returns vs inflation are slightly higher.

We will combine the asset classes’ data to prepare the table for equity, debt, estate, gold and SBI 10Y FD vs inflation.

In a future article, we will show how to combine these assets to create an all-weather inflation-beating portfolio.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Inflation: the impact on your goals and how to choose assets that beat it first appeared on 01 Sep 2022 at https://arthgyaan.com