How much will my child's college education cost?

This post shows a general method to work out the total cost of the degree with some examples.

This post shows a general method to work out the total cost of the degree with some examples.

Originally published: 28-Aug-2021

Updated: 24-Feb-2024 - Updated for 2023 fees

Watch this article as a video on Youtube:

This article extends our previous post on children’s college education, focusing on estimating the total expenditure over the entire duration it takes to get a degree.

While every child and family has unique dreams, however, the financial goal planning process is standard. The Goal-based investing strategy requires us to determine

Since getting a degree is a multi-year exercise, the expenditure follows the same pattern. For a typical undergraduate college degree, money is spent as per this schedule:

Since each of these requires money to be spent on dates that are years apart, it is better to model each of them as individual goals. This assumption allows better asset allocation as per the goal duration. For example, the money needed in the 4th year can stay in equity longer and have a higher chance of growing than the funds required for the first year.

Engineering, medical, and other similar entrance examinations will require a good amount of money for preparation. Typically for engineering and medical entrance examinations, the student will have to enroll for particular courses or a coaching institute. In addition, the institute may require staying in a different city with its associated costs (rent, food, books, etc.).

Admission costs are generally a large sum of money depending on which institute and type of course. Private colleges will have a much higher admission fee compared to government ones.

Apart from fees payable to the institute, we will have the hostel mess and other related costs typically per semester or annually. So if it is a 4-year course with two semesters per year, we will have to multiply the semester-wise expenses eight times to get the total cost. Depending on the institute, this fee may or may not increase during the duration of the course.

Training is something that happens in most courses, typically in the third or fourth year. Participation requires a little bit of extra money for preparation and any travel and living costs related to the training.

Once the course is over and the new job starts, there might be some setup costs. These costs relate to finding a house in a new city, like paying brokerage and buying everything needed to start living in that house, like utensils or mattresses. Some of these costs may be reimbursed by the company, but they might be required to be paid upfront, so it is good to provide these costs. An alternative for reducing these costs is starting in a fully furnished paying guest setup.

As discussed before in our goal-setting post, it is essential to know at what rate these costs will increase with time until the money is needed. Education inflation is much higher than other forms of inflation, and 10% is a good number to target. At a modest 7% inflation, the cost of a 25 lakhs college degree doubles in 10 years (to ₹50 lakhs) and quadruples in 20 (to a crore).

Inflation: the impact on your goals and how to choose assets that beat it

Depending on the college location, stream type (engineering vs medical) and country, inflation can vary as 6-12%. You have to keep tracking the current cost of the degree every year to follow the inflation rate.

For a 25 lakhs degree today, this is the final corpus due to inflation vs time. For example, a 25 lakhs degree is expected to cost ₹1.04 crores in 15 years at 10% inflation.

| Time vs Inflation | 6% | 7% | 8% | 10% | 12% |

|---|---|---|---|---|---|

| 5 years | 33 | 35 | 37 | 40 | 44 |

| 10 years | 45 | 49 | 54 | 65 | 78 |

| 15 years | 60 | 69 | 79 | 104 | 137 |

| 20 years | 80 | 97 | 117 | 168 | 241 |

| 25 years | 107 | 136 | 171 | 271 | 425 |

Inflation formula: Corpus needed = Cost today * (1 + Inflation) ^ Time

To implement all the steps related to investing for your child’s college goals in one easy-to-follow package, we have Arthgyaan Child Education goal packages. Choose the year closest to your desired college admission year to get started:

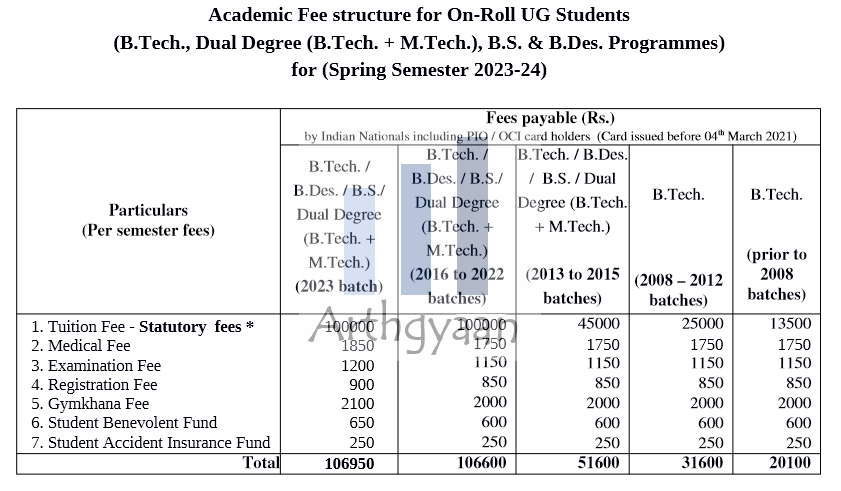

Here we will follow the simple method of using the website of IIT Bombay to estimate the various costs related to a 4-year engineering degree at IIT. The numbers are accurate as of February 2024.

We assume that the child is three years old, the degree starts at age 18, and the SIP is increased at 5% per year as a step-up SIP. The SIP amount comes to ₹ 19,536 per month, of which ₹ 11,408 should be invested in equity and the rest in debt. See this post for identifying equity and debt funds for investing. The assumptions are:

Below fifteen years of age, there is typically no clarity on where the child will end up for their UG and PG degrees. The way around this problem is to start with an aspirational goal like a premier engineering or medical degree in India and start on that basis. The objective of this is to have a target that is an order of magnitude correct. You also need to determine if you want to target India or abroad since the costs will drastically differ.

You need to sit down with the family and decide, post the money left for other long-term goals, what corpus you can reasonably reach: 10 lakhs, 50 lakhs, one crore or even higher. Our online Goal-based Investing calculator will show you how much you will end up with based on starting SIP amounts today. But, of course, the earlier you start, the lower will be the required monthly investment amount.

Since you will be reviewing your goals at least once a year, over time, you can fine-tune your cost and corpus target as the child grows up, and there is more clarity on what they intend to do. However, to help you with the numbers, here are some sensitivities for various amounts and time horizons:

This calculation shows that for a ₹30 lakhs cost spread out over four years for a 5-year-old, the SIP amount is ₹ 36,440 for a UG degree starting at the age of 18.

This calculation shows that for a ₹50 lakhs cost spread out over four years for an 18-year-old, the SIP amount is ₹ 106,039 for a PG degree starting at 23.

The assumptions for the above sensitivities are:

Based on the institute/course reputation (like IIT degrees), banks offer collateral-free education loans that are easy to get. Collateral-based loans are also available for education both in India and abroad. Another source for loans is alumni bodies of the institutes or new-age startups that specifically lend to premium college applicants with a joining offer.

Many of these loans offer no or simple interest during the course period and easy repayment terms. However, be mindful of balancing the loan amount vs the future salary potential.

In many cases, depending on the student’s temperament, taking an educational loan can instill discipline towards getting the degree. Otherwise, there might be a tendency of taking things easy because of free money.

Parents can prioritize funding for college like this

At all times, ensure that you have the following in place

and once you start investing,

We have prepared a simulation using 26 years of market data in India to show the effectiveness of the goal-based investing process that shows how effective the process is for reaching close to the target. You will find more details here: What is the best way to invest for your child’s college education?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much will my child's college education cost? first appeared on 28 Aug 2021 at https://arthgyaan.com