Which debt to pay off when you have more than one loan?

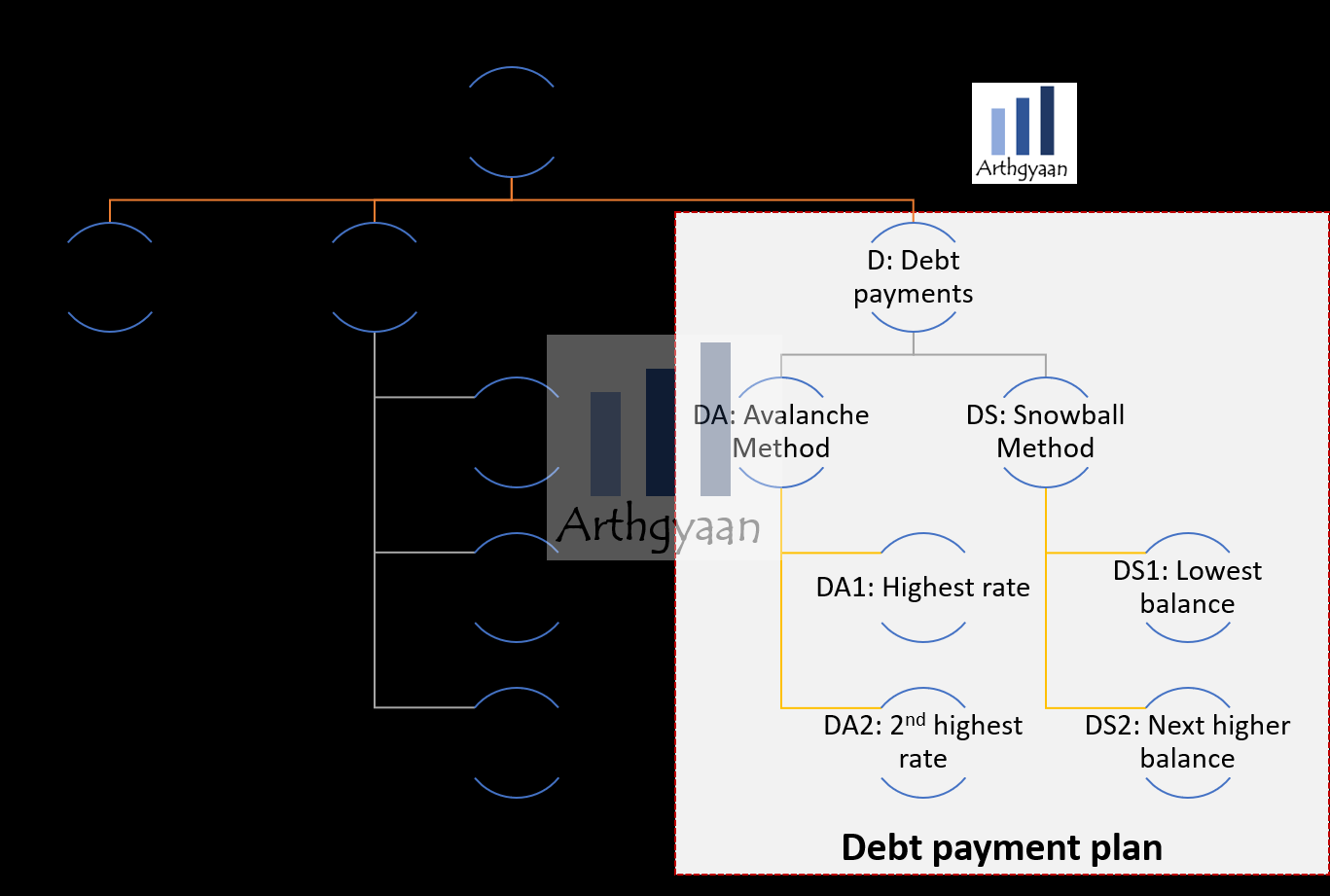

We discuss the two common debt payment methods that exist which can be used to easily pay off multiple loans: the avalanche and snowball methods.

We discuss the two common debt payment methods that exist which can be used to easily pay off multiple loans: the avalanche and snowball methods.

This article is a part of our detailed article series on the concept of paying off loans. Ensure you have read the other parts here:

This article gives the list of people to whom you can give or receive gifts like cash, property, stocks, mutual funds or any other assets without paying tax.

This article shows a few ways to avoid and escape from EMI traps to be able to invest via goal-based investing.

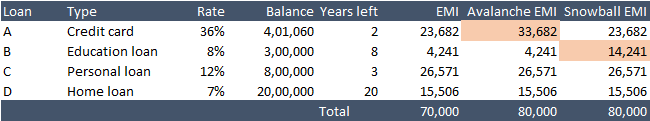

If you have two or more loans, there are two strategies to pay them off. In general, all loans require a minimum payment every month called EMI. This article deals with what to do with any extra cash available every month for loan payments. The methods below differ regarding the choice of the loan for that additional payment. Once one loan is closed, the entire EMI gets split among the remaining loans.

Debt payment is part of handling overall budgeting that should be read together with

For example, if the minimum EMI is 70,000 and the extra cash is 10,000/month, then every month 80,000 will be paid until all the loans are closed. If extra cash is not available, even then use the same concepts with 70,000/month once the first loan is paid off.

The strategy is to take the loan with the highest interest rate, like a credit card balance or personal loan, and pay it off as much as possible every month while making standard EMI payments on the rest.

This strategy minimizes the interest being paid and also leads to the least time to pay off all loans. It is suitable if you can be patient with the repayment plan knowing that you will be paying lesser interest overall.

Using the example above, the interest paid is 7.5 lakhs over 57 months.

The debts are paid off in this sequence:

This strategy exists so that the borrower can feel a sense of accomplishment and relief by getting rid of the loan with the lowest outstanding balance first while making standard EMI payments on the rest. The extra payment goes to the loan with the smallest balance without regard to the interest rate.

Once that loan is closed then the process is repeated with the rest of the loans. This strategy gives relief to the borrower struggling with a lot of loans. This method will lead to higher interest payments and a slightly longer overall payment period compared to the avalanche one. This method works if you like to see results earlier than the other plan and can get a psychological boost to see the count of loans reducing.

Using the example above, the interest paid is 8.2 lakhs over 58 months.

The debts are paid off in this sequence:

Like everything else, there is a middle path between these two extremes:

Here you pay off the highest-interest loan first and this is best if it is something like a credit card balance with high interest rates.

For the rest, approach a loan consolidation agency to combine the loans into one single loan with one EMI. If consolidation is not possible, then choose between the avalanche and snowball methods as per your personal choice.

If you have multiple credit cards with rotating balances, then it will be better to pay off the one with the least balance first in case you need to use credit cards in the future for any emergency. This works since the freed-up card will not charge interest from day one for the older debt.

Apart from emergency funds, any investment or asset like stocks, mutual funds etc can be considered to pay off the loan especially if it is a high-interest one like a credit card. Typically stocks and mutual funds will not give a guaranteed 40% return which is the typical rate of credit card loans

Approach your home loan provider (if you have one) for a top-up loan. This will be at a rate lower than the credit card and personal loan and good for those with some history of paying off home loan EMI on time. Alternatively, a personal loan can also be taken to pay off the higher-interest loans.

If you are helping out a relative or child with debt payments, offer to match their debt payment in the same amount. If they are paying ₹ 5,000/month, then you can also pay the same amount. If, however you offer to pay off the whole debt, it creates a situation where you will be considered a source of future bailouts also.

Divert any available income from expense cuts, selling off unnecessary stuff or even a bonus at work towards an emergency fund. This builds a cushion to avoid future high-interest debt like credit cards used for emergencies.

Note: We have already covered home loan pre-payment here separately since the loan is of long tenure, it might be prudent to weigh the concept of pre-payment against investing for long-term goals.

Debt payment is one of the axioms of personal finance?

References:

Further reading:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which debt to pay off when you have more than one loan? first appeared on 19 Jun 2021 at https://arthgyaan.com