Don't Get Caught in the Credit Card Debt Trap: Unmasking Interest Calculation & GST Charges

This article unveils the secrets of credit card interest, from EMIs to GST impact. Stay informed to avoid financial traps!.

This article unveils the secrets of credit card interest, from EMIs to GST impact. Stay informed to avoid financial traps!.

A credit card is a short-term loan that banks like to give people in the hope that they will not be able to pay back the complete balance. Credit cards charge interest in the range of 18-54% a year which are amongst the most expensive form of loans.

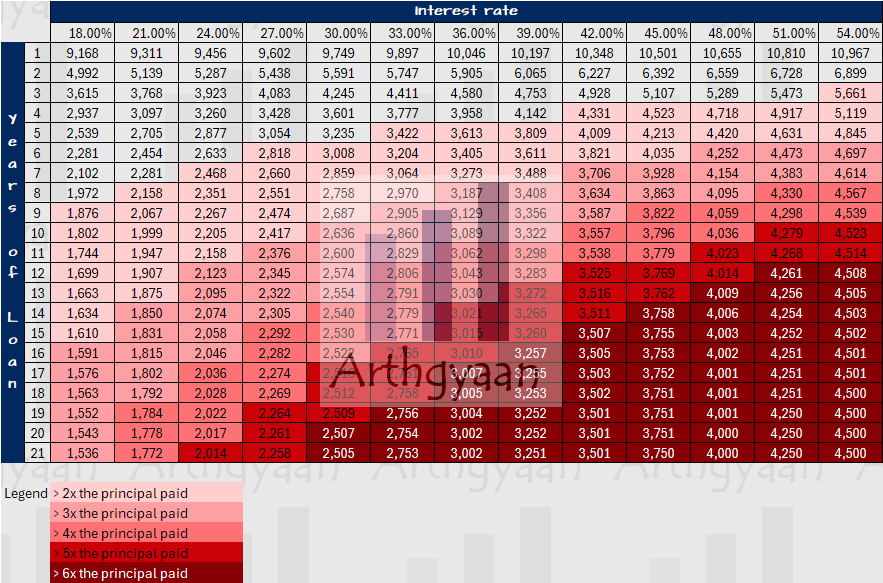

The EMI amount does not seem too bad until you realise that for each deepening of the shade of red, the amount of principal repaid increases by 100%. The numbers in the table exclude GST on interest.

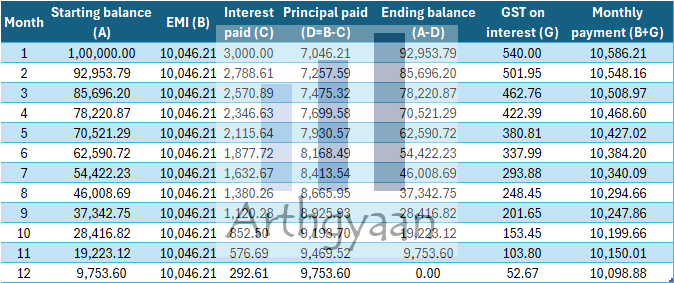

The interest calculation works in the same way as any reducing balance loan, for example, a home loan, where:

EMI = Principal + Interest (stays constant)

with some important points to be noted:

We will cover these points one by one.

18% GST is charged on the interest. Since the interest component of the EMI changes with every EMI, the GST charge also changes and therefore the total payment (EMI plus GST) also changes.

Many cards also charge 18% GST on the processing fee for EMI conversion.

Interest = (Days since the date of transaction/365) x outstanding amount x Monthly Interest rate x 12

The financing charge on the outstanding balance is calculated at the monthly interest rate (typically 1.5-4.5% a month equivalent to more than 18-54% a year) based on the age of the transaction.

For example, you made a transaction of ₹1 lakh on the 1st of the month and the bill was generated on the 10th. The monthly interest rate is 3%.

The due date was the 15th and only the minimum amount of ₹5,000 was paid. The interest now charged, on the 10th of the next month will be:

Interest = (40/365) x 95000 x 3% x 12 = ₹3,748 (for the unpaid 95k balance for 40 days

plus

Interest = (15/365) x 5000 x 3% x 12 = ₹74 (for the paid 5k balance for 15 days)

Miss the fact? Even the paid-off balance attracts interest until the payment day. The entire interest is then added to the next bill. To understand how to better plan a large purchase via a credit card:

If you convert a large purchase to EMI, your interest rate will reduce to a figure of 12-18%. The bank will charge a processing fee, which will also have a GST of 18%, and then you need to pay this amount monthly. While not ideal, EMI conversion might help you to avoid the EMI trap: My EMIs take up all my salary. How do I start investing?.

Miss the EMI conversion for a hefty amount? Be ready for some serious interest charges at the full 18-54% rate of the card.

You can use the calendar app on your smartphone (either iPhone or Android) to create a recurring reminder to go off before the credit card due date. This app is built into all smartphones. You do not need third-party apps like CRED or PayTM for something so basic.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Don't Get Caught in the Credit Card Debt Trap: Unmasking Interest Calculation & GST Charges first appeared on 24 Jan 2024 at https://arthgyaan.com