Are Your MF Investments Do it Yourself? Make Plan it Yourself Your New Mantra for Success

This article explains how DIY investors can move from a shoot & aim to aim & shoot approach towards their investments.

This article explains how DIY investors can move from a shoot & aim to aim & shoot approach towards their investments.

This article is a Guest Post from one of Arthgyaan’s earliest readers, a fellow blogger & knowledge sharer believing in helping the investor community.

About the author: Ashwin Sivakumar, is an IT professional experienced in retail & eCommerce. He is also a financial blogger by passion.

He was originally intrigued by the stock market as any other layman would, a decade back punching in trades in cash & derivative segments. His habit of asking why and how, lead him into the world of finance through explorative learning. He now follows and opines on Macros, Global Markets, Personal Finance, Crystal-balling Equities, Bonds, Gold through Technical Analysis & Market Sentiment. He believes instilling Goal Based Investing will benefit the investor community.

Readers of Arthgyaan may be interested in his blog posts about personal finance. Links to his other work and social media handles are on his home page Get Finsight.

Now over to Ashwin Sivakumar.

Mutual fund investments are increasingly becoming DIY and it’s heartening to see the democratisation of an investment vehicle that has seen low penetration for so long. But there are pitfalls in it, due to the lack of planning.

Newbie investors when introduced into MF, are not introduced to asset type as a means to a goal, rather they are introduced to “XYZ funds” by friends, family & influencers based on whichever is the best-performing fund set then.

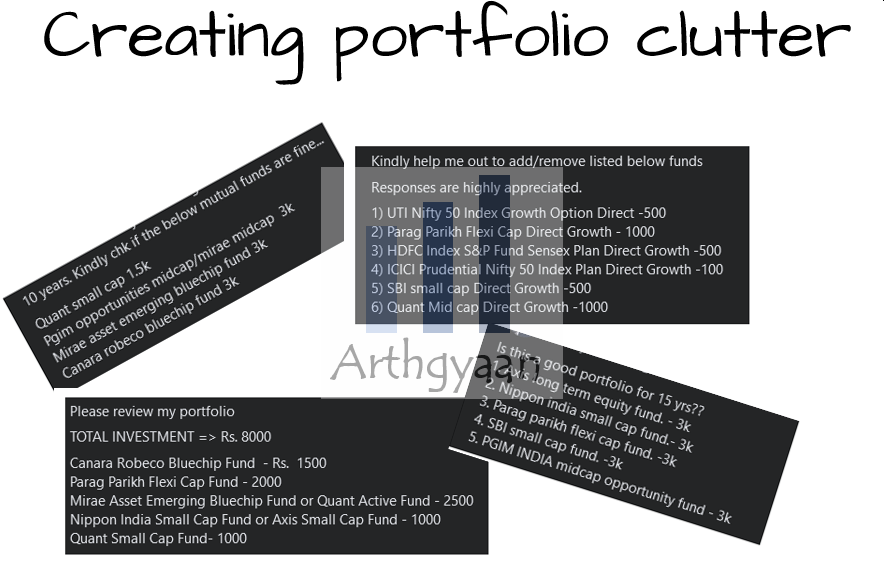

Before long, the investors seek suggestions on a portfolio built on hearsay & get queries about their unorganised portfolio.

More often than not, the goal, tenure, risk profile & expected returns are never mentioned & are ignored. Without these, it is indicative that the funds were built just by the literal meaning of Do It Yourself with a special emphasis on “Do” instead of “Plan”.

Perhaps, the investment community needs to evolve from DIY to PIY, Plan It Yourself. The drawback of lack of planning is that the investor would have miscalculated either their target or their risk capacity.

For instance, most people starting investment towards retirement would have identified the tenure and SIP amount based on their income but would have dived straight into an equity fund, because his profitable friend suggested so. Fund selection should only be an outcome of a planning process, however funds are selected beforehand. Before fund selection, investors need to start by calculating the corpus needed, after adjusting for inflation over the entire tenure. Only when the target corpus is known, the person can calculate the required rate of return which will, in turn, help in identifying proper asset allocation between debt & equity and finally choosing the right funds having the least possible risk.

A common mistake is not adding inflation to the calculations or keeping the inflation rate too low. Underestimating the effect of inflation leads to an insufficient target corpus. This also can lead to taking undue risk with funds such as small caps, thematic funds etc, while all they might have required is just a debt fund to achieve the target corpus.

For example, if your current monthly expense is 50k, people extrapolate that directly into several years, say 25 years to arrive at an arbitrary target corpus of 1.5-2Cr. But considering inflation and setting reasonable pre-retirement returns of inflation rate + 1%, you would need about 55X of the yearly expense, which comes to 3.3Cr. Even then, the additional expenses incurred due to lifestyle inflation are rarely considered. Lifestyle inflation is the increase in your expenses that happens due to better income and changing preferences.

As people’s income increases, people increase their lifestyle as well and this is on top of the regular cost inflation. So, a miscalculation in the target corpus leads to a significant shortage of funds later in one’s career, and by the time we realise that we are running short, it becomes too late to do anything.

Constructing a portfolio is like constructing a building. Unless you have a floor plan and the foundation is strong, a building won’t last long. The same applies while constructing your portfolio, with no goal or plan either the funds get redeemed prematurely or risk undershooting the target. So identify all the prerequisites and plan properly. PIY before DIY. This is a template I provide for anyone who asks for portfolio validation/construction. It might be basic, but that’s all we need. This could apply to you as well.

Pre-requisite: Get your BASICS such as emergency fund, term insurance, and health insurance covered.

Note: Use only the benchmark returns of the past 10 years for calculating the expected return of the portfolio you constructed. Don’t use the returns generated by the funds itself for the calculation. Some bit of work in Excel is required to find the right asset allocation. Hope it’s clear how fund selection comes at the very last step of the planning process, but most of us do it the opposite way. We select funds first and then ask for suggestions, validations & modifications. Such an approach will leave us further behind on our target. Ultimately, If you can do all the above steps, PIY & DIY.

If all this feels overwhelming or if you don’t have time or patience, please consult a financial advisor who can plan it for you & then implement it.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Are Your MF Investments Do it Yourself? Make Plan it Yourself Your New Mantra for Success first appeared on 28 Jan 2024 at https://arthgyaan.com