How to clean up your mutual fund portfolio?

This article shows you various strategies to clean up your mutual fund portfolio.

This article shows you various strategies to clean up your mutual fund portfolio.

Disclaimer: Fund names in the article are not recommendations for investing in those funds.

Clutter: a collection of things lying about in an untidy state – Oxford English Dictionary

Portfolio clutter, especially with investments in mutual funds, happens due to these reasons:

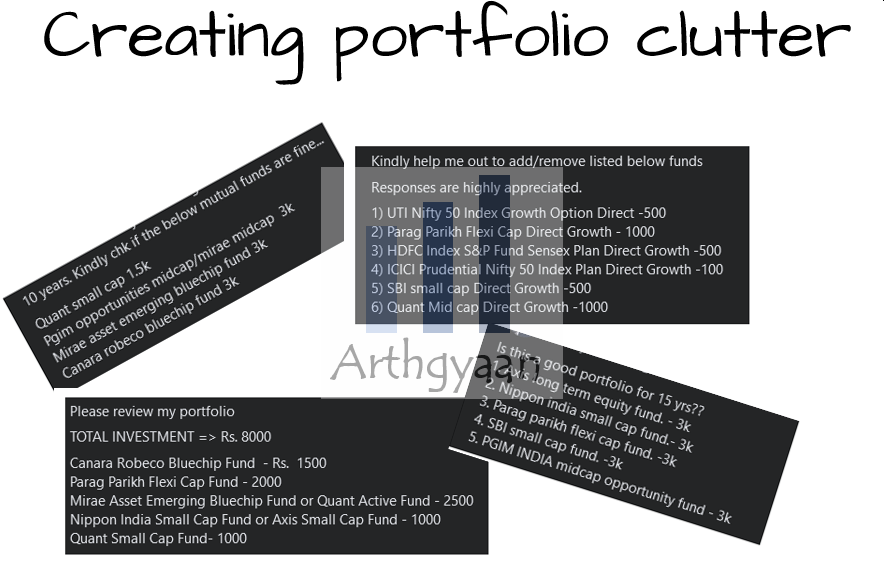

We will now take live examples from Social media to understand how clutter happens in a mutual fund portfolio.

The collage above is from a Facebook group where members ask for suggestions for investing in mutual funds. We will quickly review the common themes in the questions that lead to portfolio clutter:

Another reason for clutter is the investor’s penchant for adding the newest fund offer (NFO or New Fund Offering) into their portfolio. NFOs are a common way to offer something new and innovative to investors, like a theme like EVs or a factor like low-volatility or products like silver.

Given that, in such situations, fear of missing out or FOMO makes investors invest a small and usually insignificant amount in such new investments leading to more clutter.

Long-term readers of this site know that choosing where to invest comes only at step #5 of the Arthgyaan goal-based investing process. A clutter-free portfolio will make goal-based investing easier to implement.

We will discuss these problems that are caused by portfolio clutter.

Adding too many funds in the same category, e.g. large, mid or small caps, even from different AMCs, reduces portfolio returns. Since funds from the same type will have overlaps in the portfolio, one of two things happen:

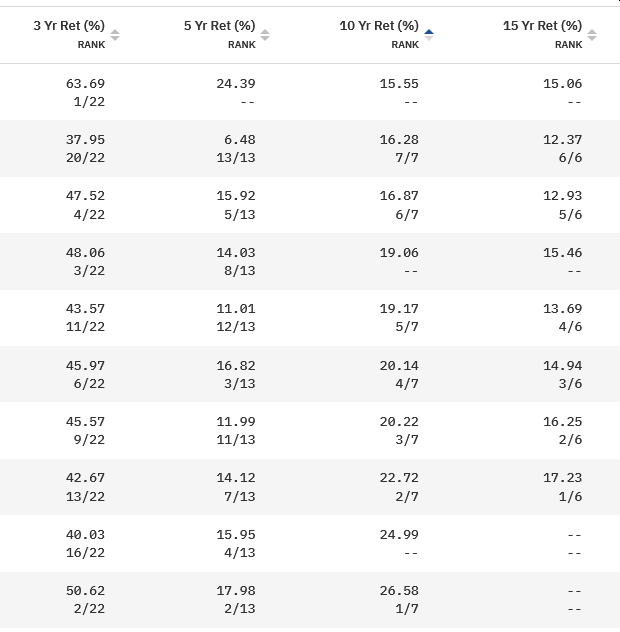

There is well-documented proof, for example, in the latest SPIVA report that active funds routinely underperform passive index funds. This fact, coupled with the observation that the same fund does not outperform or underperform its benchmark consistently yearly, means that choosing a “winning” active fund requires luck, not foresight.

Using data from Valueresearchonline, this table shows no consistency in the ranking of active funds.

Portfolio sizing determines how much money to invest in each asset or security.

Portfolio sizing lines up very well with this Warren Buffet quote:

Diversification may preserve wealth, but concentration builds wealth.

A few concentrated bets will create outsized market-beating returns if they go right. However, the opposite, i.e., wealth destruction, is easier to achieve if those bets go wrong. Therefore, buying and holding the entire investible market via index funds is the right approach for most investors.

But newer investors, or those without the proper guidance, mistakenly follow this sequence of events:

This sequence of events increases clutter and lowers returns due to higher costs and taxes due to selling. Behaviourally there would be a constant source of stress due to looking at the portfolio and deciding what should be the next step.

While it is easy to create a cluttered portfolio, it is easier to clean it up by following the steps below. We will use the following hypothetical portfolio for cleanup.

| AMC | Fund category / name | Value today (lakhs) |

|---|---|---|

| XYZ | Large cap | 15 |

| PQR | Small Cap | 7 |

| ABC | Flexi Cap | 5 |

| EFG | Large cap Index | 2 |

| CDE | Small Cap | 1 |

We take the entire portfolio of funds and sort them by descending value of the position. The fund with the lowest holding is at the lowest end of the heap and the first on the chopping block. We will assume that you have already performed a fund-level review: Are you checking the performance of your funds regularly?.

We will only consider active funds since index funds from different AMCs offer AMC diversification and need not be removed.

In this example, we will declutter starting with the CDE Small Cap fund, which has just ₹1 lakh in a ₹30 lakh portfolio. Even if CDE gives outsized returns, it will not move the needle in the rest of the portfolio.

We will stop the SIP first so that more capital does not get invested into an undesirable fund.

We will log in to the AMC website using PAN and Folio number and do a switch transaction. The target scheme will be the index fund (say the Nifty 50 fund) of the AMC. If there is already an investment in the index fund of that AMC, the same may be chosen instead of a new fund.

The benefit of the switch transaction is that compounding is not affected as the money does not hit the bank account and gets into the target scheme in a short amount of time.

There might be a small amount of tax to be paid that you should calculate before transacting: Pay lower capital gains taxes for equity: understand how grandfathering works.

Once the new units are allocated and the switch is over, restart the SIP in the new fund.

Eagle-eyed readers will notice here that we are not reducing the number of funds unless there are already multiple funds with the same AMC. We are just replacing active funds with index funds in the same AMC. We will cover how best to deal with multiple index funds in the same portfolio in a future article.

The investor should repeat these decluttering steps every year until the portfolio is clean and is, therefore, easier to manage.

Couples should clean up their portfolios and map their existing and future investments to their common goals like this:

| Goal name | AMC / Bank | Investor | Folio / Account | Type |

|---|---|---|---|---|

| Car | ABC Mutual fund | Spouse 1 | 1111 | Money Market |

| House | PQR Mutual fund | Spouse 2 | 2222 | Liquid |

| Vacations | EFG Bank | Spouse 1 | 3333 | Recurring deposit |

| Child College | XYZ Mutual fund | Spouse 1 | 4444 | Equity Index, Money Market |

| Child College | PQR Mutual fund | Spouse 2 | 5555 | Equity Index, Gilt |

| Retirement | PQR Mutual fund | Spouse 1 | 6666 | Gilt, Equity Index |

| Retirement | XYZ Mutual fund | Spouse 2 | 7777 | Gilt, Equity Index |

Having multiple funds from the same AMC for a single goal (e.g. Equity Index and Money Market funds from XYZ Mutual Fund for Child goal) allows for one-click rebalancing via switches. The above approach also allows investors to easily diversify across AMCs: Do you need multiple mutual funds to keep your money safe?.

Read more here: How should couples invest for their goals?.

We have covered this topic here: Should you pay home loan EMI by SWP from mutual funds?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to clean up your mutual fund portfolio? first appeared on 18 Jun 2023 at https://arthgyaan.com