How to map your mutual funds to your investment goals?

This article shows how investors can map their various investments, like mutual funds, FDs, NPS, stocks etc., to different goals.

This article shows how investors can map their various investments, like mutual funds, FDs, NPS, stocks etc., to different goals.

This article continues our previous post How to clean up your mutual fund portfolio?. The plan here is to help investors map their existing investments in mutual funds, shares, FD, real estate (plots/houses etc.) and gold, among others, to their goals.

Goal setting helps you understand the priorities of your life, set the future of you and your family, understand the various money-related challenges that come and be best prepared for the future financially. Goals give direction and momentum to your financial life:

You will hurt your chances of creating wealth via compounding if goals are not set.

You need to answer three main questions regarding your portfolio, which will be helpful once you complete the investment-to-goal mapping.

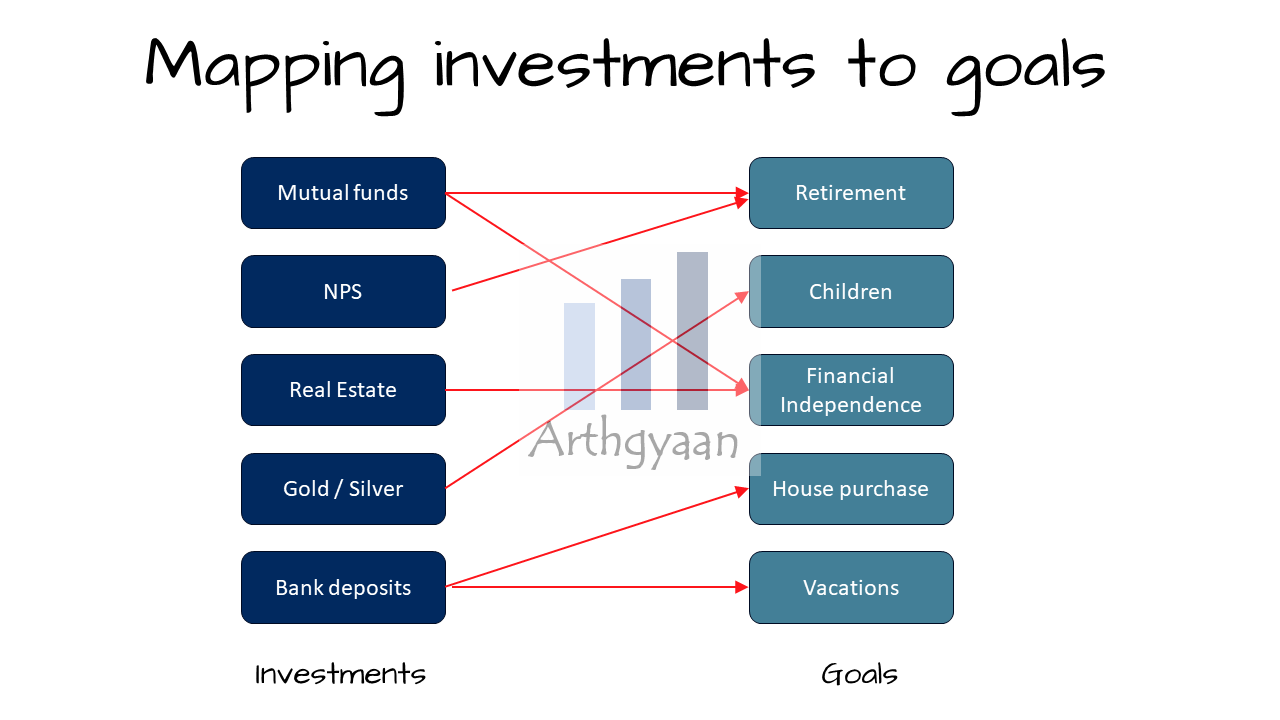

Investors need to be sure that their current investments suit what they are trying to achieve with their money. A few examples are:

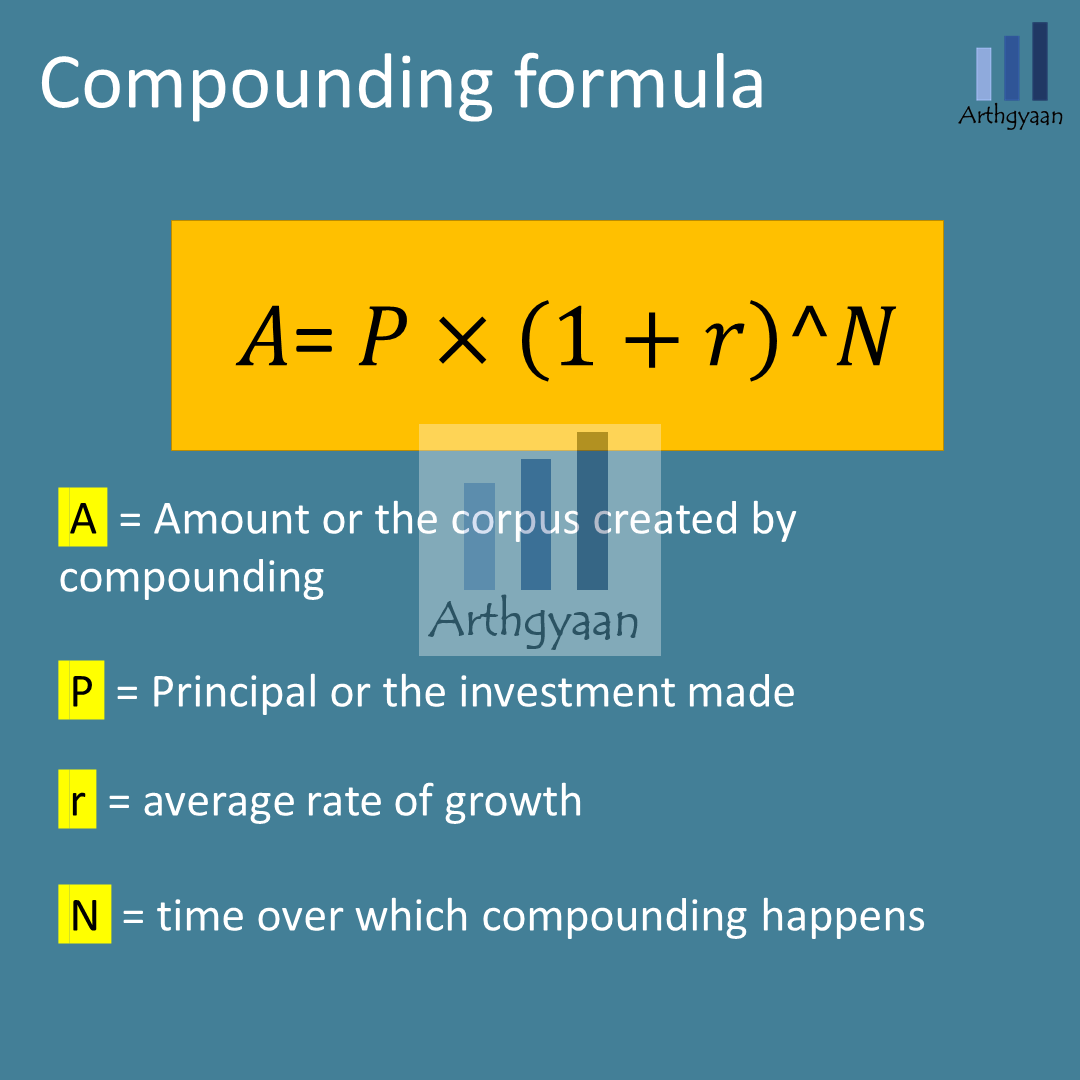

A common mistake many investors make is that they assume that investing in risky products like mutual funds will create enough wealth via compounding. We have already shown that wealth-creation via SIP in mutual funds does not happen as most of us think it does. The only way out is to follow goal-based investing like here:

But to reach that stage, you need to understand the purpose of each of your investments.

Investors often club every investment under the garb of “wealth creation”. Much of this happens if you have

We have given a theoretical example in our previous article on How should couples invest for their goals?, which we show here:

| Goal name | AMC / Bank | Investor | Folio / Account | Type |

|---|---|---|---|---|

| Car | ABC Mutual fund | Spouse 1 | 1111 | Money Market |

| House | PQR Mutual fund | Spouse 2 | 2222 | Liquid |

| Vacations | EFG Bank | Spouse 1 | 3333 | Recurring deposit |

| Child College | XYZ Mutual fund | Spouse 1 | 4444 | Equity Index, Money Market |

| Child College | PQR Mutual fund | Spouse 2 | 5555 | Equity Index, Gilt |

| Retirement | PQR Mutual fund | Spouse 1 | 6666 | Gilt, Equity Index |

| Retirement | XYZ Mutual fund | Spouse 2 | 7777 | Gilt, Equity Index |

Having multiple funds from the same AMC for a single goal (e.g. Equity Index and Money Market funds from XYZ Mutual Fund for Child goal) allows for one-click rebalancing via switches. The above approach also allows investors to easily diversify across AMCs: Do you need multiple mutual funds to keep your money safe?.

Once the mapping is complete, the next step would be to feed the assets into a goal-based investing tool to understand the next steps to take:

The playlist to complete the mapping of your goals and use our goal-based investing tool is here:

A worked out example for using this framework for an investor is here: Where to invest your monthly income if you spend only 45% a month?. Additional examples are in our case studies linked below.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to map your mutual funds to your investment goals? first appeared on 25 Jun 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.