Should you take a personal loan to invest in the stock market or mutual funds?

This article looks at the effects of leverage while investing in risky assets like the stock market by directly purchasing stocks or via mutual funds.

This article looks at the effects of leverage while investing in risky assets like the stock market by directly purchasing stocks or via mutual funds.

As the Indian stock markets are reaching new all-time highs, many investors are feeling the effect of FOMO (Fear Of Missing Out). A common question that comes is “What if I take a loan to buy shares or invest in mutual funds?”

The concept of taking a loan to invest is called leveraging. The basic premise here is that the risky asset that you invest in will grow at a faster rate than the interest on the loan. A good example of leveraging is buying a property to stay in it that most people end up doing: Should you sell your mutual funds to buy a house?

If that asset does not grow or falls in value, the investor loses both ways since the investor still needs to pay the EMI as the bank will want its money back anyway.

A personal loan is a common choice for getting money punting in the stock market since the lender does not pose restrictions for what you do with the money. However, taking a personal loan for speculative purposes like stock market investing is frowned upon by most lenders.

In this article, we will compare two cases:

Since individual stock returns have no pattern whatsoever, we will use the Nifty 50 (via a mutual fund) as the proxy for a risky investment in the stock market.

For case 1 (personal loan for investing), we will

For case 2, instead of the personal loan, we will invest the EMI of the personal loan in the same fund for the same period.

If you refer to our simple EMI calculator post, EMI Calculator: know your EMI per lakh to easily know how much total EMI you have to pay, the EMI/SIP amounts will be:

Therefore in each case, around ₹5000-6000 per month approximately is going towards interest. The total interest being paid over this period in the personal loan will be:

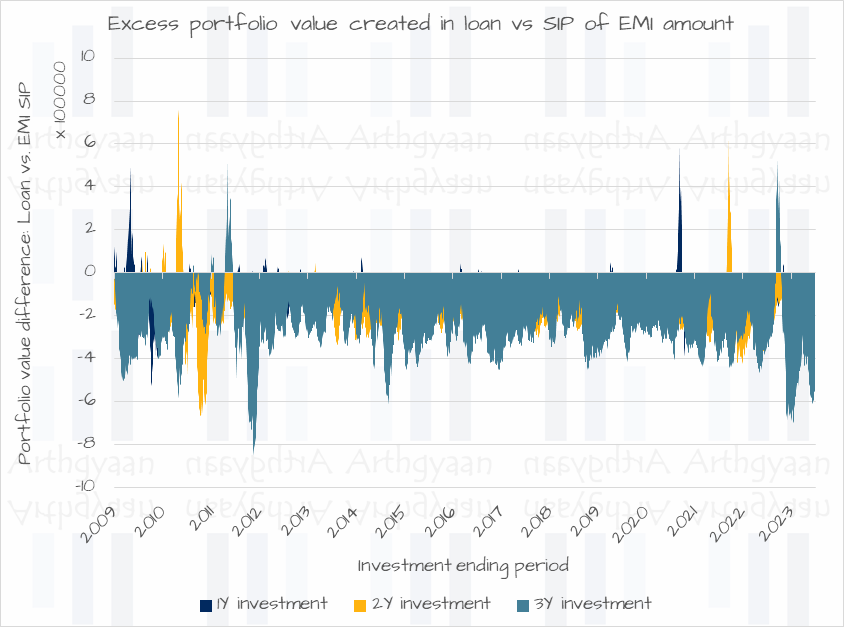

We will consider the investments using a rolling window or 1,2 and 3 years using data from 2006 till date.

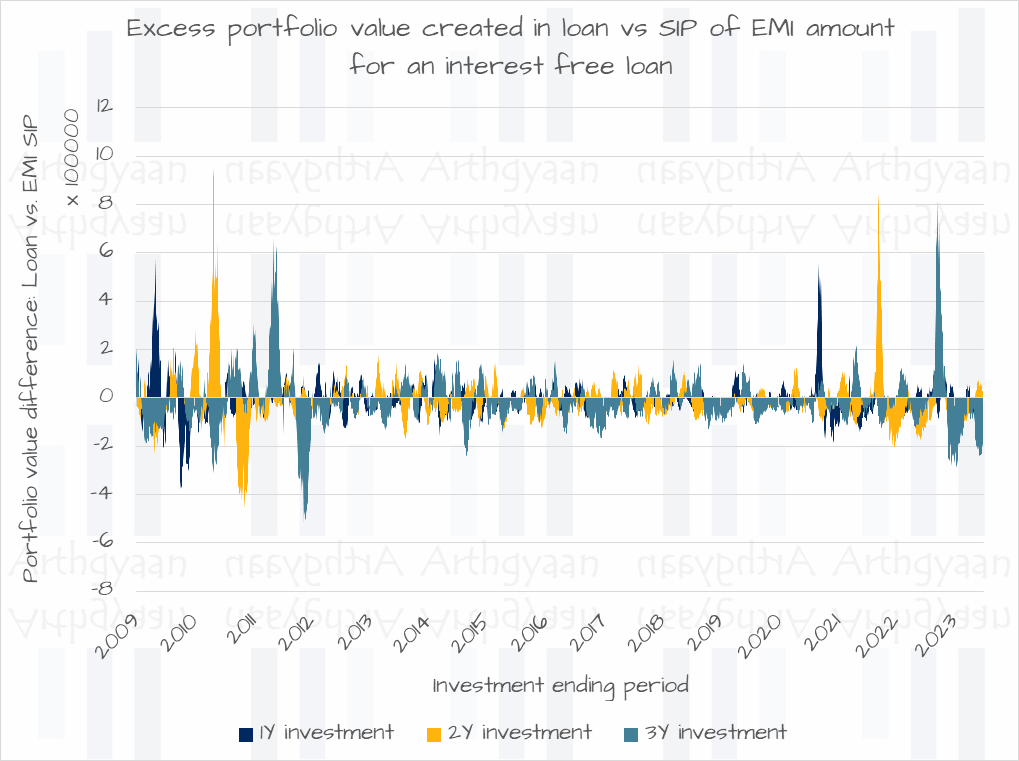

The above chart plots excess returns made when the loan amount was invested at one go vs an SIP made of the EMI amount in a Nifty 50 index fund for every 1,2 and 3-year period since 2006. As the chart shows very clearly, in most of the cases, very little extra money has been created by taking a loan to invest as a lump sum vs investing the EMI every month instead. The difference is entirely because you need to pay interest on that loan. If we make the interest to be zero, this becomes a simple SIP vs lump sum comparison:

In the chart above, the amounts invested were:

which is the same as ₹10 lakhs spread out over that many number of months. Here the results vary considerably without any noticeable tilt towards either option.

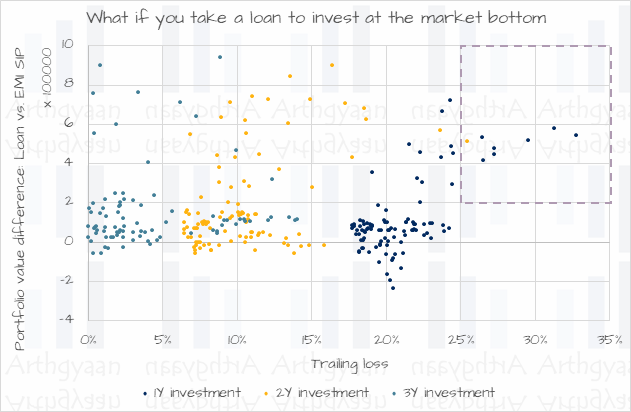

The results become considerably more interesting if we look only at the cases where the market fell from a recent peak. In the scatter chart above, we have plotted the worst 100 1-year, 2-year and 3-year returns and looked at the same two cases, loan vs SIP, whenever the market fell.

The results in this case favour lump sum investing a bit more although nothing is sure shot unless the loss exceeds 25%. To understand if you should be taking a loan to invest at all:

| Best excess returns | 1 year | 2 year | 3 year |

|---|---|---|---|

| 1 | ₹ 7,19,928 | ₹ 9,01,484 | ₹ 9,40,812 |

| 2 | ₹ 6,67,853 | ₹ 8,44,508 | ₹ 8,97,486 |

| 3 | ₹ 5,77,995 | ₹ 7,42,355 | ₹ 7,59,781 |

| 4 | ₹ 5,45,503 | ₹ 7,27,126 | ₹ 7,57,255 |

| 5 | ₹ 5,32,593 | ₹ 7,26,812 | ₹ 7,08,664 |

| 6 | ₹ 5,19,576 | ₹ 7,12,024 | ₹ 6,41,075 |

| 7 | ₹ 4,98,230 | ₹ 7,07,324 | ₹ 5,98,847 |

| 8 | ₹ 4,86,914 | ₹ 6,79,515 | ₹ 5,51,363 |

| 9 | ₹ 4,78,282 | ₹ 6,37,028 | ₹ 4,66,997 |

| 10 | ₹ 4,56,996 | ₹ 6,22,446 | ₹ 4,03,507 |

This table shows the 10 best cases of more money being made via leverage than by investing the EMI as SIP. However, these peaks do not have any correlation, as per the scatter chart, with the amount the market has fallen. Therefore there is still no sure-shot way to say that investing after taking a loan makes more money.

Now comes the sad truth:

The average of all of the cases since 2006 comes to:

While the average was still positive because there were a few good years, like the table above, there were plenty of bad ones too. After doing all of these steps: tasking a personal loan, dealing with paperwork, paying processing charges, monitoring the EMI payment, closing formalities, change in credit score etc, the potential reward is not that big in absolute terms:

| Excess returns | 1Y investment | 2Y investment | 3Y investment |

|---|---|---|---|

| Minimum | ₹ -2,34,026 | ₹ -1,33,675 | ₹ -1,63,858 |

| Average | ₹ 14,322 | ₹ 37,090 | ₹ 66,015 |

| Maximum | ₹ 7,19,928 | ₹ 9,01,484 | ₹ 9,40,812 |

| EMI | ₹ 88,849 | ₹ 47,073 | ₹ 33,214 |

Even if you consider the best-case scenario, you are making free money of ₹7-9 lakhs over ₹10 lakhs of investment. In the worst case, you are making ₹1.3-₹2.3 lakhs less via loan. At the end of the day, it is not a lot of money being made. We can put this into perspective by looking at the EMI amount.

There are a lot of permutations and combinations of course:

These decisions cannot be modelled since their investors will take them once they see the actual market movement.

Our conclusion will be that based on this analysis, any investor thinking of taking a loan to invest will be better off by investing the loan EMI amount every month in SIP form. When the market does fall, rebalancing from debt to equity, is the right course of action to take based on the target asset allocation of the investor.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you take a personal loan to invest in the stock market or mutual funds? first appeared on 21 Jan 2024 at https://arthgyaan.com