Navigating Election Uncertainty: Should You Sell, Hold, or Buy More Stocks?

This article shows you the pros and cons of each approach you can take between today and the General Election Results next week regarding your portfolio.

This article shows you the pros and cons of each approach you can take between today and the General Election Results next week regarding your portfolio.

This article is a part of our detailed article series on Election 2024 and the following market gyrations. Ensure you have read the other parts here:

This article uses historical data to estimate returns expected from the stock market post-election.

This article discusses the strategies needed to profit off sudden market falls like that happened on election results day on 4th June 2024.

This article talks about the volatility in the stock market on 4th June 2024, which was the day of election results.

No one knows. (We do know now on 4th June: What does the election day teach us about risk in our portfolio?)

Everyone however has an opinion and acts (or does not act) on that opinion. The sum total of all of these actions and inactions will drive the overall market.

In the run-up to a major event like election results, the stock markets have already acted on what the majority think the result will be and then move slightly from that level due to others thinking what happens if the opposite result comes.

In such an uncertain situation, what should you do as a retail investor? There are three potential decisions:

For simplicity, we will assume that you as the investor are mostly concerned with the short-term (1 week to 1 month) movement of the equity market. We will use the Nifty 50 (Price) stock index, investible via index funds, as a proxy for stock markets.

Doing nothing is one of the hardest decisions to take especially for investors who actively follow capital markets news or are active consumers of market sentiment from social media.

Only those investors who have a rock-solid investment plan in place will actually wait until the election results are out and then act in one of two basic ways:

For the record, we will note down the market prices of these asset classes for now vs. the evening of election results (4-Jun) and the 1-week and 2-week periods after that date.

| Asset class | Investment | 28May | 04Jun | 11Jun |

|---|---|---|---|---|

| Equity | Nifty 50 | 22,888.15 | 21,884.50 (-4.4%) | 23,264.15 (+1.6%) |

| Debt | CCIL All Sov TRI | 3,891.93 | 3,885.57 (-0.02%) | 3,904.91 (+0.03%) |

| Gold | Gold (999 closing) | 72,291 | 71,969 (-0.04%) | 71,445 (-1.17%) |

Buying more now before the market pops is a classic Fear of Missing Out (FOMO) reaction.

If you have FOMO, you need to answer one basic question:

If you are buying more stocks now, where is the money coming from?

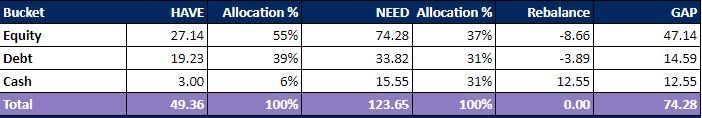

If you plan to rotate from debt investments (like debt mutual funds) within your portfolio, you need to be conscious that you are deliberately buying more equity (as a percentage of the total) than your asset allocation allows.

If you are holding cash due for whatever reason, then you need to

Touching your emergency fund, or taking a loan to invest, are terrible ideas at any point in time.

The sell-now-buy-later-at-low levels plan sounds great on paper. However, you need to make two decisions correctly:

Since you are selling stocks or mutual funds in this approach, you will of course pay capital gains tax.

There are a few things that must go right with this plan

The compounding effect of an investing decision is permanent

What this means in simple words is that:

Decisions can go right when

Decisions can go wrong when

You need to predict three things:

Therefore the probability of correctly calling a

If you are doing a Case 3 (sell now and buy later) move, you need to be sure of calling the bottom as well once the markets start recovering. This is not easy.

The last bit that you need to decide is how much capital, either as a percentage of your total portfolio you will move based on all this decision-making.

If it is a small amount, say 5-10% then the impact, whether you are right or not, will not be substantial.

If it is a big amount, say 20-50% then the potential impact, both for the right and wrong call, will be large. Do you feel confident about that?

Ultimately it comes to the individual investor and their mental makeup:

There is a lot of academic literature out there with studies showing that market timing is something that retail investors, you and me basically, should not do. There is a high chance of the decision going wrong.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Navigating Election Uncertainty: Should You Sell, Hold, or Buy More Stocks? first appeared on 29 May 2024 at https://arthgyaan.com