What do you need to make money when the stock market suddenly drops like 4th June 2024?

This article discusses the strategies needed to profit off sudden market falls like that happened on election results day on 4th June 2024.

This article discusses the strategies needed to profit off sudden market falls like that happened on election results day on 4th June 2024.

Disclaimer: It takes considerable effort to make a quick buck by investing in a stock market that has just fallen

This article is a part of our detailed article series on Election 2024 and the following market gyrations. Ensure you have read the other parts here:

This article uses historical data to estimate returns expected from the stock market post-election.

This article talks about the volatility in the stock market on 4th June 2024, which was the day of election results.

This article shows you the pros and cons of each approach you can take between today and the General Election Results next week regarding your portfolio.

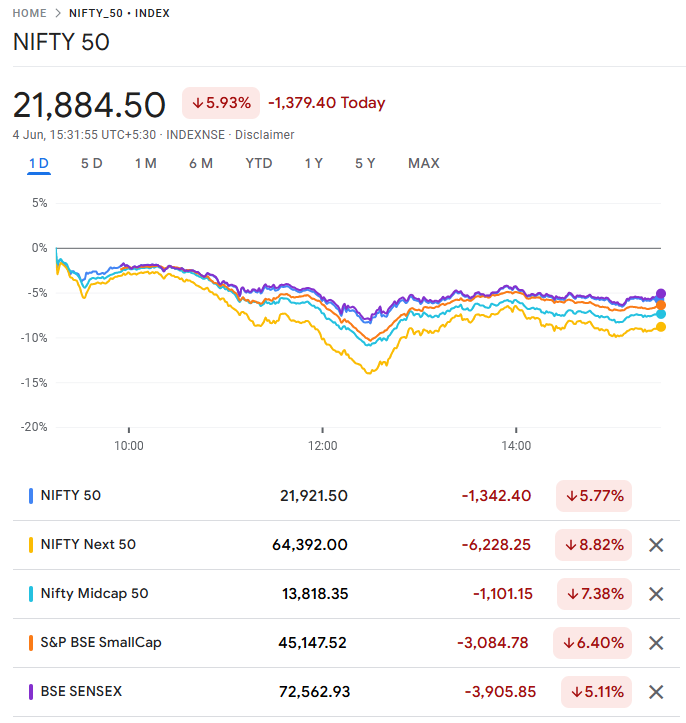

On 4th June 2024, we saw volatility that we had not seen since the wild fluctuations in March 2020 (12.98% fall in the Nifty 50 on 23-Mar-2020) during the COVID-19 crisis.

Such volatility inspires a lot of investors to attempt to make profit in such a falling market. So do this effectively, you need four things:

This strategy has multiple names:

We will now cover the special case of buying the dip when markets fall suddenly due to events like election day uncertainty.

We will focus on quickly investing in three common assets:

To get NAV of the same business date, there is a specific SEBI-mandated guideline shown here from AMFI website:

Where the purchase transaction is received upto cut-off time of 3.00 p.m. on a business day at the official point(s) of acceptance and funds for the entire amount of subscription/purchase are available for utilization upto 3.00 p.m. on the same Business Day.

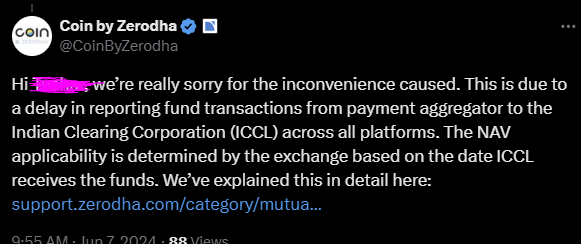

In easier language, units get allocated once the AMC (or more specifically the clearing house) receives the money before 3 pm. Otherwise, the NAV of the next business day applies.

There are typically multiple parties in the chain:

Reducing the number of parties in the chain (using the AMC website or RTA sites directly) and using fast payment mechanisms (UPI, RTGS, or NEFT into a virtual account linked to your folio) are some measures that you can take to get the same-day NAV.

However, no measure is fool-proof for getting the same-day NAV.

Specifically, 4th June 2024 saw an unexpectedly large number of pre-3 pm orders allocated with 5th June NAV. Many investors were admittedly upset though unless their portfolios were small relative to the amount invested on 4th June, this delay would have no impact in the long run on their portfolio value.

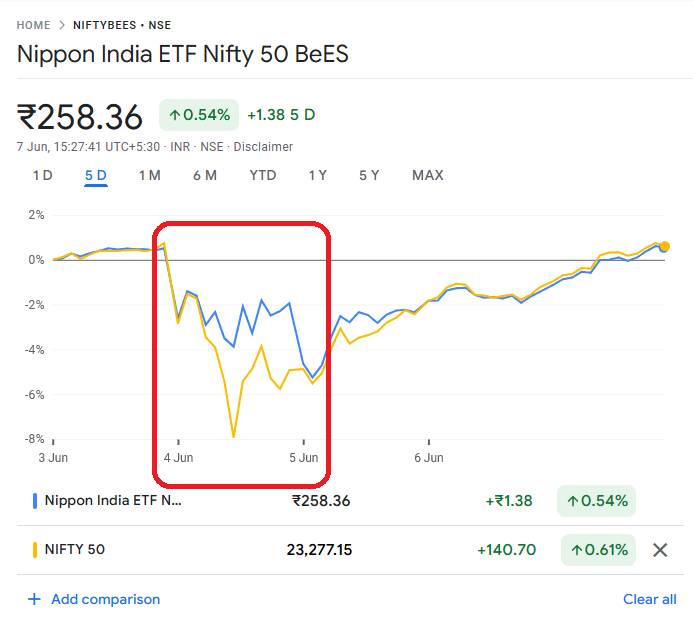

ETFs are the same product as mutual funds with the added feature of buying and selling like a share from the stock market. However, on days like this, the market making that keeps ETF prices close to the intraday NAV (iNAV) fails. The ETF no longer tracks the index accurately during the day.

| Nifty Index Name | ETF Fall | Index fall | Gap |

|---|---|---|---|

| PSU BANK | -17.82% | -19.51% | 1.70% |

| CPSE | -15.37% | -19.55% | 4.18% |

| 200 ALPHA 30 | -11.91% | -16.24% | 4.33% |

| 200 MOMENTUM 30 | -11.28% | -14.50% | 3.22% |

| NEXT 50 | -10.36% | -14.10% | 3.74% |

| BANK | -8.72% | -9.62% | 0.89% |

| 500 | -8.47% | -9.97% | 1.50% |

| MIDCAP 150 | -8.31% | -10.78% | 2.48% |

| 100 ESG SECTOR LEADERS | -8.13% | -8.48% | 0.35% |

| SMALLCAP 250 | -8.10% | -11.31% | 3.21% |

| MIDCAP 100 | -6.21% | -11.45% | 5.23% |

| Nifty 50 | -6.08% | -8.52% | 2.44% |

| 100 | -5.68% | -9.61% | 3.93% |

| ALPHA LOW-VOLATILITY 30 | -5.21% | -8.77% | 3.56% |

| MIDCAP 50 | -5.17% | -10.96% | 5.79% |

| 50 EQUAL WEIGHT | -5.14% | -8.65% | 3.51% |

| 200 QUALITY 30 | -5.13% | -7.15% | 2.03% |

| 100 LOW VOLATILITY 30 | -4.87% | -5.29% | 0.43% |

| MIDCAP150 QUALITY 50 | -4.82% | -8.91% | 4.09% |

| 50 VALUE 20 | -4.05% | -8.86% | 4.81% |

| HEALTHCARE INDEX | -3.65% | -4.41% | 0.76% |

| IT | -2.91% | -3.66% | 0.76% |

As the table above shows, for each of the ETFs in the market, the average intraday lowest point (lowest price compared to the previous day’s close) was above that of the index.

For example, for the ETFs tracking the Nifty 50, the average lowest fall, relative to the 3rd June closing price, was 6.08%, while the Nifty 50 fell 8.52% at some point. There is no point in buying the ETF if the index, which you can trade using futures, is cheaper than the ETF tracking it.

Each company that trades has its own risk over and above that of the overall stock market called unsystematic or stock-specific risk. On days like 4th Jun 2024, some stocks fall more and some fall less compared to the index they belong to.

Here we show the average sector-wise worst intraday fall (compared to previous close) for the Nifty 50 stocks.

| Nifty 50 Sector | Average Intraday fall |

|---|---|

| Services | -25.00% |

| Power | -18.51% |

| Oil Gas & Consumable Fuels | -16.56% |

| Metals & Mining | -16.15% |

| Construction | -14.81% |

| Telecommunication | -12.37% |

| Financial Services | -9.72% |

| Construction Materials | -8.63% |

| Nifty 50 index | -8.52% |

| Automobile and Auto Components | -7.27% |

| Consumer Durables | -4.73% |

| Information Technology | -4.27% |

| Healthcare | -3.34% |

| Fast Moving Consumer Goods | -2.54% |

Here lies the actual opportunity to make money if you put in the effort to:

If you have put in the effort of creating a watch list, studied the stocks and have the capital available, then such volatile markets are the best times to invest with the conviction of making money in the long run.

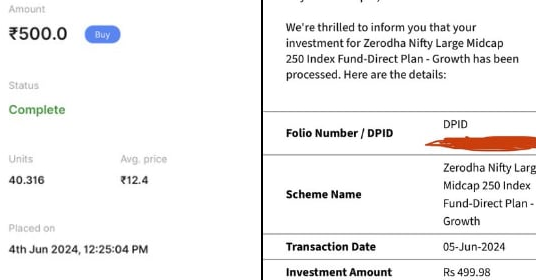

If you don’t have the conviction, you waste time doing activities like this investor who complained on social media that their ₹500 order placed on 4th June got 5th June NAV:

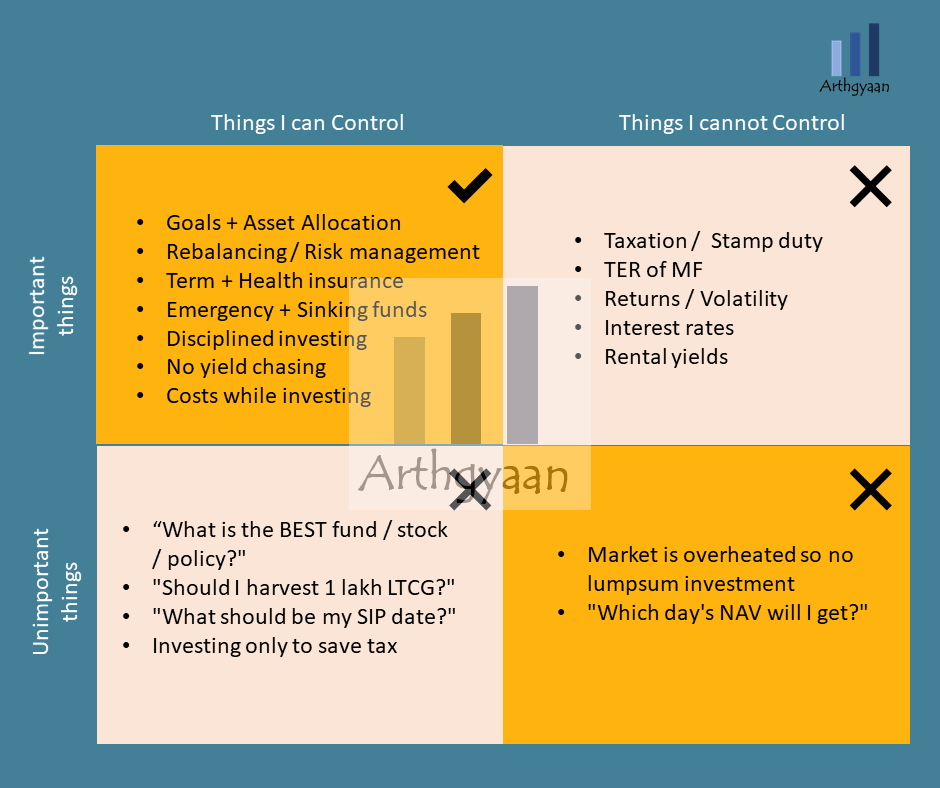

What do we mean by this point?

While there is nothing wrong in investing ₹500/day, the fact that the order got filled at ₹12.40 (5th Jun NAV) and not at ₹11.96 (4th June NAV) and resulted in 3.67% fewer units (₹18 worth of loss) is an extreme example of focusing on things that are not under our control though we feel that they might matter a lot.

Read more here: Investor behaviour: control what is possible

Let’s take the case of an investor with 10 lakhs of capital investing 3 months’ worth of SIP at one shot on volatile markets and missing a 5% NAV movement due to getting the next day’s NAV. If their monthly investment is 1% of their portfolio (₹1.2 lakhs/year on the 10 lakh/portfolio i.e. ₹10,000/month), they invested ₹30,000 and got 5% higher NAV.

5% on ₹30,000 is ₹1,500 which is 0.015% of their portfolio

For bigger portfolios, the impact will be minuscule. This brings us back to the first point made at the beginning of this article:

To make money in a volatile market you need cash to deploy

Without the effort of screening and analysing stocks and also holding a large sum of capital just for this purpose, you cannot make money from volatile markets.

Investors should therefore put in the effort of staying invested at all times as per their investment plan and not spend time timing the market. Or if they do wish to, they need to both put in the efforts required before buying the dip as well as arrange for a good chunk of ready cash.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What do you need to make money when the stock market suddenly drops like 4th June 2024? first appeared on 09 Jun 2024 at https://arthgyaan.com