Investor behaviour: control what is possible

While investing, focus on those important things that you can control.

While investing, focus on those important things that you can control.

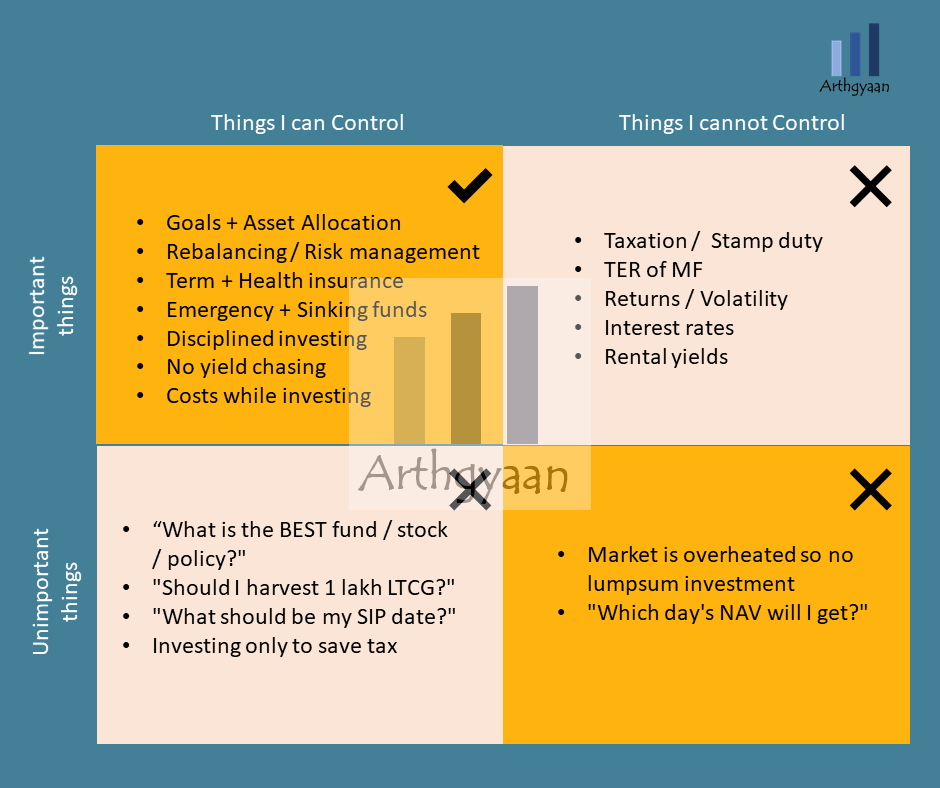

It is interesting to observe investor behaviour in the field of personal finance. People generally are focused on more minor, mainly operational aspects of investing. They give less attention to strategic actions that have more impact on achieving their investment goals.

Here is the view:

The diagram essentially means that there are important things and those we can control:

Contrast this with things that are easy to worry about but may not be as important:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Investor behaviour: control what is possible first appeared on 06 Mar 2021 at https://arthgyaan.com