Do you want to create wealth? This is how you should proceed step by step

This article discusses a no-shortcuts, step-by-step guide for investors who want to create wealth.

This article discusses a no-shortcuts, step-by-step guide for investors who want to create wealth.

Everybody wants to go to heaven, but nobody wants to die. - Unknown

In the same way, we all want to be wealthy. We wish to know that name of the one investment scheme, mutual fund or future multibagger stock that will make us not only wealthy, but do it at low risk or worse allow some sort of risk since the investor “can take risk”.

Real-life, unfortunately, does not work this way. However, a step-by-step plan can set you on the right path on the journey towards building wealth.

This article is the prelude to our previous article on How compounding works: the journey to a ten crore portfolio.

Here is the 10-sec version for those who do not wish to spend time reading the rest of the article: Invest 50:50 in an equity and debt mutual fund using some pointers from here. The result will be unpredictable, which should be acceptable since no planning is being done.

What does being wealthy mean to us is the first question that needs answering. Depending on where you are at your stage of life, this definition will evolve. An initial definition can be “have more money than I have today”. The end goal can be freedom, as described by Morgan Housel:

Money’s greatest intrinsic value-and this can’t be overstated-is its ability to give you control over your time.

Some alternative definitions can be:

Whichever definition you subscribe to, ultimately, it comes down to numbers, aspirations and planning.

Inflation is a silent killer and is often missed when planning what kind of wealth you aspire to have. Ignoring inflation also aids in misselling of products like insurance policies that offer you 10,000/month 10 years later. Alternatively, if a degree in the IITs cost ten lakhs today, and your child will go to college after 15 years, that ten lakhs has the potential of becoming a lot more. Similarly, a standard retirement planning starting point is to look for ₹1 lakh/month in retirement. However, if retirement can start 30 years later for someone just beginning to earn and will last 30-40 years or more for someone just retired. The value of ₹1 lakh will fall a lot over these many decades.

Inflation: the impact on your goals and how to choose assets that beat it

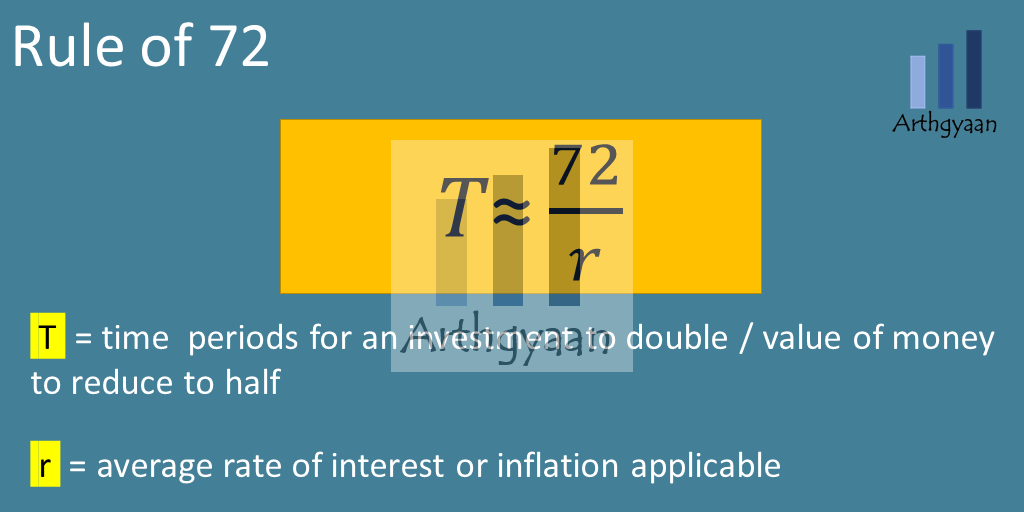

We use the rule of 72 to estimate the effect of inflation quickly. 7% inflation of goods and services shows that the cost will double in 10 years, approximately or the purchasing power of money will be cut by half over this period. Using the same examples above,

We cover the importance of planning for inflation in these posts:

It is important to understand under which circumstances different asset classes handle inflation:

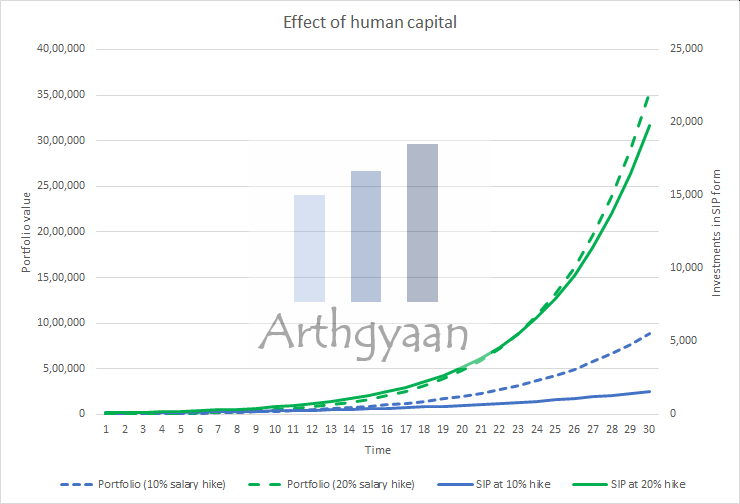

Growing wealth depends on both income and investments and is one of the axioms of personal finance. There is an intrinsic limit to the amount of time you can spend per day or week in your primary profession. If you know your hourly wage, and you should like this, you should also be aware that you cannot scale the denominator i.e. hours/day indefinitely. This leads to the concept of increasing human capital, where you are enhancing your skills and knowledge to increase your income - both active income from your profession and passive income from other sources.

Here we see two investors getting the same average return from their investments over 30 years. One of them gets salary hikes of 10% a year while the other gets 20% hikes. Over time, their portfolios diverge, and the second portfolio ends at a value that is 4x higher than the first.

Human capital is covered in more detail here: Your human capital, not investment returns, is your biggest wealth creator.

Being wealthy means that you have money to spend when you need it. If you have a lot of assets tied up in real estate or jewellery having poor returns, that will impact your goals. If you have earmarked a plot of land for your child’s education/marriage, will you be able to sell it at the desired price when the money is needed?

Similarly, if you are retiring with multiple rental properties, see if the yield vs the effort it takes to maintain the properties and get tenants are working out for you. If the effort is fine at the age of 60, will it still be fine at the age of 75 or when only one spouse is there to manage the properties? Can a simplified portfolio which is managed by a competent advisor or family member, be more desirable?

Another good example is a heavy allocation to locked in assets like provident fund (EPF, PPF), Sukanya Samriddhi, insurance policies with investment components and NPS. Both EPF and NPS are locked until retirement with extremely onerous exit clauses. If you have a considerable amount of assets in such investments, and face a liquidity crunch like a job loss or medical emergency, getting hold of required funds can become problematic. Some of these assets, like provident fund and insurance policies, allow loans to be taken against them, to partially offset the liquidity constraint. Except NPS investments with a high allocation to equity, all of these schemes are primarily debt schemes and will impact the asset allocation of the portfolio.

Whenever an investor is looking for an investment option, risk must be a serious consideration at that point. Often, when we think that we can take a moderate amount of risk, or high risk, or no risk at all, it points to our risk-taking willingness. Willingness is a subjective metric that deals with behavioural aspects driven by the level of knowledge about personal finance and experience in capital markets.

How the investor actually reacts in situations like the March 2020 COVID crash, or the 2008 Global Financial Crisis cannot be predicted in advance. Therefore, it is essential to know both the risk implied in the type of investment being considered and the investor’s own risk profile.

A few risky behaviours that many investors have are:

Therefore, investors should perform a risk profiling before investing using a tool like this: Do not invest in mutual funds before doing this.

A common requirement of new investors is: “I need to invest ₹ 10,000/month for ten years. The purpose is to grow wealth”. Readers of this blog will understand that the immediate question that would follow is: “Grow wealth to do what?” and “Is that all that you are investing for?”. Both of these questions are answered here:

The related question is, “Is your retirement covered?”. This question comes because

Here lies an essential concept of prioritization. Your monthly income is finite, but your goals and aspirations are not. You also need to balance spending money today vs investing for the future. The concept of prioritization is handled in these posts:

No one likes paying taxes. However, just like death, it is an inevitable part of life. When building and preserving wealth, planning for taxes is extremely important. Some investments are highly tax efficient (like capital gains), while others like interest, coupons, annuity payments, and dividends are taxed at the highest slab rate. You should not also assume that

These posts cover tax-related considerations when planning investments

The wealth ladder applies geometric progression, human behaviour and life goals in one easy to understand construct. If you follow the rules of the wealth ladder, you can climb the rungs quickly.

| Level | Wealth | Can / Should Buy | Stretch / Loan | Decision-making level |

|---|---|---|---|---|

| Level 1 | 10,000 or less | Insurance (monthly premium) | Emergency fund | ₹ 100 |

| Level 2 | 1 lakh | Emergency fund | Groceries, Restaurant of choice, White goods | ₹ 1,000 |

| Level 3 | 10 lakhs | Groceries, Restaurant of choice, White goods | Car, Foreign Vacations | ₹ 10,000 |

| Level 4 | 1 crore | Car, Foreign Vacations | House | ₹ 1 lakh |

| Level 5 | 10 crores+ | House | Luxuries | ₹ 10 lakhs |

How to understand this?

Read more here: How to climb the wealth ladder in India?

For someone who wants to get started, the next step is learning about and following goal-based investing. This process will take considerable time and effort but the result will be worth it: I have just started earning and do not know a lot of finance. What now?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do you want to create wealth? This is how you should proceed step by step first appeared on 22 Jan 2022 at https://arthgyaan.com