A low-stress step-by-step guide to creating a retirement portfolio

This article shows you an easy step-by-step way to start retirement planning.

This article shows you an easy step-by-step way to start retirement planning.

“nastiest, hardest problem in finance.” - William Sharpe, Nobel Prize winner, regarding the withdrawal stage of retirement

Retirement planning can be daunting for those who have either not started planning for retirement or are having difficulty choosing from the multitude of investment options available in the market today. There would also be investors who have already started investing but require guidance regarding reviewing their portfolios. There are multiple general challenges in investing:

However, with retirement, there are a few unique risks:

The way to handle these risks is to acknowledge that they exist, take steps today that allow you to create a portfolio that fulfils your retirement goal and create a review process to manage these risks.

In this article, we will cover the steps to construct and maintain a retirement portfolio in the easiest possible way. An even simpler way to create a retirement portfolio is described here: Retirement Planning: Simple Steps for a Secure Future in Your 40s and 50s

A journey of a thousand miles begins with a single step - sourced from sage Laozi’s Tao Te Ching

The first thing to figure out regarding your retirement portfolio is the type of lifestyle you wish to have in retirement relative to your present lifestyle. You need to decide that in retirement, do you wish to have a lifestyle which is:

You should be able to figure out in general how much you spend today on expenses in the following buckets:

The first two will survive in retirement since most people should not have the other two in retirement. Once you add up the total for the whole year, you will end up with today’s expenses. Let’s say that this is ₹10 lakhs/year. Now, based on the lifestyle target, you wish to have a slightly more extravagant lifestyle due to regular travel so that the total expenses in retirement is ₹12 lakhs/year.

Estimation of the expenses in retirement is covered here How can you figure out your expenses in retirement/FIRE?.

Other goals like a house purchase, children’s college/marriage or any other large goals have to be planned and managed separately:

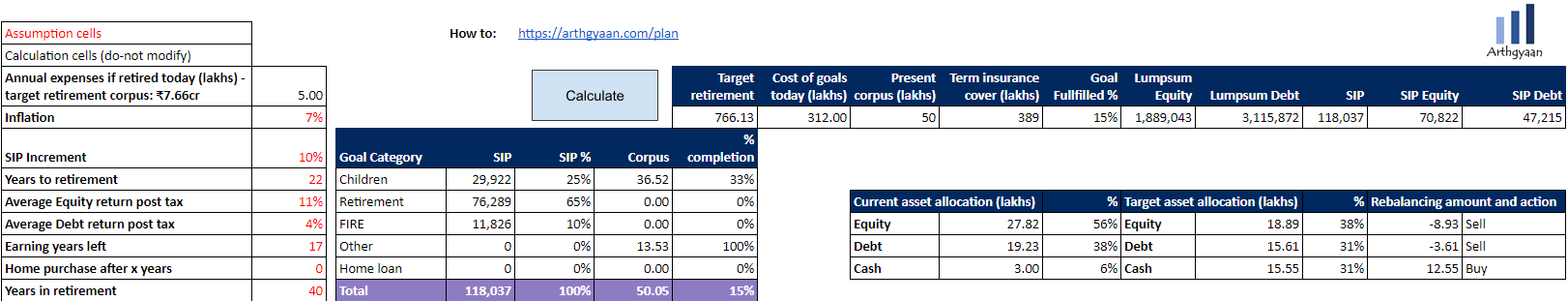

You can use the comprehensive goal-based investing planner to plan for these items together.

We will need to construct a retirement portfolio that:

Before touching on the investment options, let us understand the basic premise of retirement savings from the perspective of the need to beat inflation. We will consider the following numbers:

Let’s assume a world where prices do not increase i.e. inflation is zero. In such a world, if your target lifestyle costs 12L/year today, it will cost the same when you retire as well and for the next 40 years in retirement. This means you need 12 times 40 = 4.8 crore as a retirement corpus to be accumulated by the time retirement starts. This means that if 25 years is left say from today and until retirement starts, then every year you need to accumulate 480/25 or almost 20 lakhs in your retirement corpus starting at zero corpus. The formula for the amount you need to invest/year is:

Yearly investments = (Desired_Lifestyle_Expenses * Years_in_retirement - Corpus_you_already_have) / Years_left_to_retire

In the above case, we get

Yearly investments = (12 * 40 - 0) / 25 = 480 / 25 = 19.2L/year

Inflation adds another level of complexity to this. If inflation is 7%, then prices double in 10 years since 1.07^10 = 2. This means that the 12L that you are targeting in retirement becomes

To ensure that this 5x bigger corpus is reached, we need to invest in a manner where we stay on top of inflation for the next 25+40 i.e. 65 years. If we look for assets that have historically beaten inflation over such long periods of time, there are very few options that satisfy both the inflation-beating and small ticket size requirements: market-linked assets like equities meet both the criteria while real-estate does not meet the ticket size requirement. You can invest/redeem as low as ₹1000 in equity mutual funds but cannot build a real estate portfolio for ₹5000/month.

In the rest of the article, we will focus on mutual funds (including NPS), RBI bonds, and provident fund (PPF/EPF/VPF/Sukanya Samriddhi) for creating and managing a retirement portfolio. We will exclude FD, direct stocks, gold and real estate for taxation, risk/return and ticket-size considerations.

If substantial assets already exist in real estate or others from the second list, you need to get started first and consider liquidating if you are unable to make progress with market-linked assets.

Since we have done the heavy lifting in the previous sections, we will now use the information we have to construct the retirement portfolio.

Using the following numbers, we will use the comprehensive goal-based investing calculator to find out the SIP amount:

The calculator will also show where to invest both the lump sum and SIP amounts in equity and debt asset classes using funds from this guide: Which funds should I invest in?. At any point, you can find out how much progress you have made using this post: How long will your money last if you retire today?.

Here is a simple way to estimate the retirement corpus: How much money do you need for retirement?

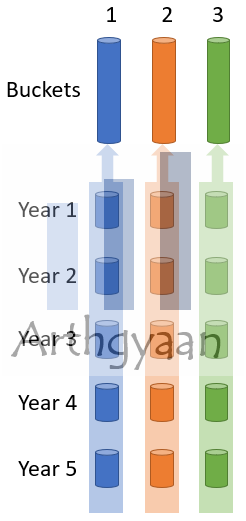

If you are already in retirement, we will create a very simple portfolio that is easy to manage and is expected to meet both the inflation and longevity risks by creating three buckets of assets:

Read more here: How to plan for retirement using the bucket approach?

At all times ensure that you have the following in place

and once you start investing,

Please refer through this follow-up article to check how to do retirement planning for yourself:

Low-stress retirement planning calculations: worked out example

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled A low-stress step-by-step guide to creating a retirement portfolio first appeared on 13 Apr 2022 at https://arthgyaan.com