How much money do you need for retirement?

This article discusses a quick thumb rule for retirement corpus estimation that you can do today.

This article discusses a quick thumb rule for retirement corpus estimation that you can do today.

“nastiest, hardest problem in finance.” - William Sharpe, Nobel Prize winner, regarding the withdrawal stage of retirement

Retirement planning can be daunting for those who have not started planning for retirement. Many are having difficulty choosing from the many investment options available today. There would also be investors who have already begun investing but require guidance regarding reviewing their portfolios. There are multiple general challenges in investing:

Often taking the first step, i.e. finding out the corpus needed, becomes very difficult for investors. This post will help you estimate this number.

Corpus (C) = Inflation factor (F) * Longevity (L) * Lifestyle Cost (E)

where

The thumb rule assumes that the real return (actual returns adjusted against inflation) on the post-retirement corpus is zero.

We can use this retirement expense estimation tool to calculate today’s expenses and determine how much to spend in retirement.

Since our calculation is back-of-the-envelop, we can use an estimate based on current lifestyle expenses and use it. The goal is to arrive at a good corpus number quickly to get started with planning instead of trying to perfect the numbers.

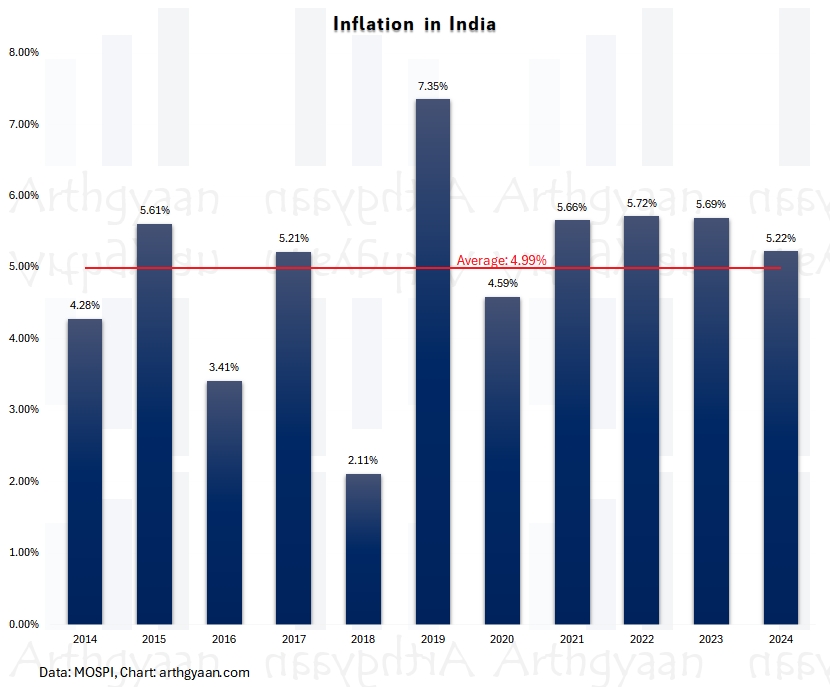

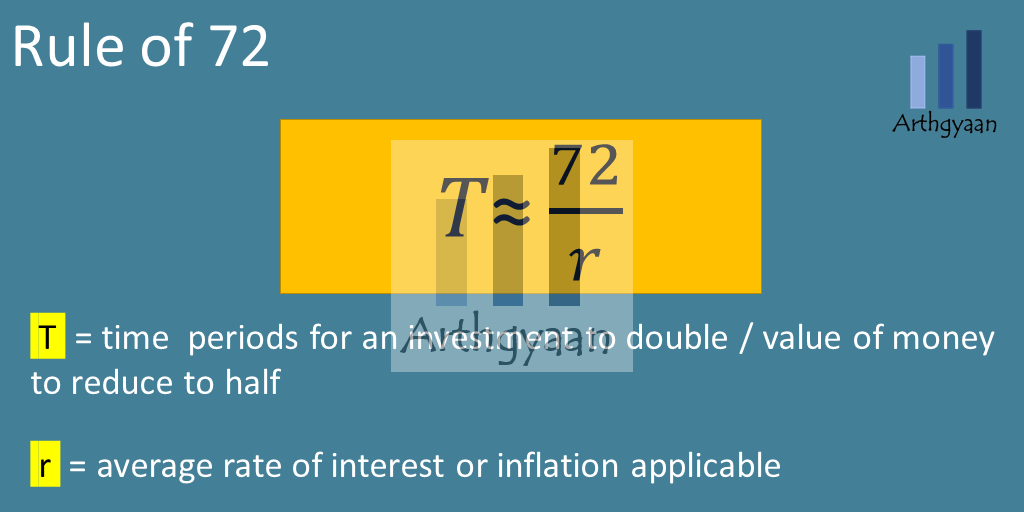

Given that inflation is an essential, but often overlooked factor in goal planning, we will explicitly call it out. We will use the Rule of 72 to calculate the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Rule of 72 lets us quickly calculate the impact of inflation over time. For example, using the rule, we can see that:

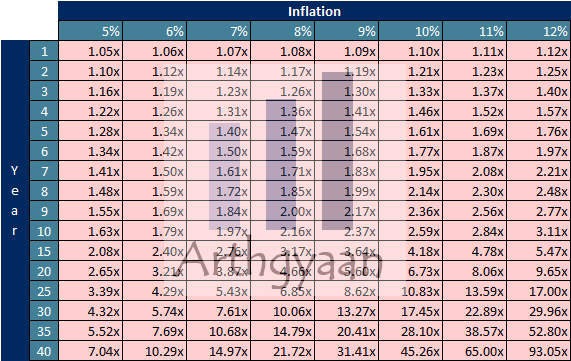

Cost after N years = Cost today * (1+Inflation) ^ Time

Here is a table that applies the above rule:

For example, at 7% inflation, a retirement goal ten years away will increase by 2 times. If the retirement corpus at today’s price level is ₹2 crores, then post inflation adjustment it will be ₹4 crores.

Longevity is difficult to assume since there are multiple factors:

Corpus (C) = Inflation factor (F) * Longevity (L) * Lifestyle Cost (E)

where

Corpus (C) = Inflation factor (4) * Longevity (40) * Lifestyle Cost (6)

or

C = 4 * 40 * 6 = 6.4 crore

or

C = 160x current expenses

We are deliberately taking out the current expenses (calling it x) so that:

Many investors miss out on inflation adjustment when applying SWR-based rules. A good example is thinking that say 40x of current expenses is sufficient for retirement. ‘ The above statement is technically true but only at the point of retirement. If the multiple is using today’s expense, then the inflation factor from the table above needs to be used to scale the multiple.

If 40x is the target and if retirement is 20 years away then at 7% inflation,

C = 4 * 40 = 160x

and not just 40x.

The rule described above (C = F * L * E) is a thumb rule only to get started based on rough estimates and assumptions. Please refer to the following articles to explore the retirement planning process in detail:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much money do you need for retirement? first appeared on 12 Oct 2022 at https://arthgyaan.com