How much retirement corpus is enough?

This post stress-tests the corpus accumulated to support your desired post-retirement expenses

This post stress-tests the corpus accumulated to support your desired post-retirement expenses

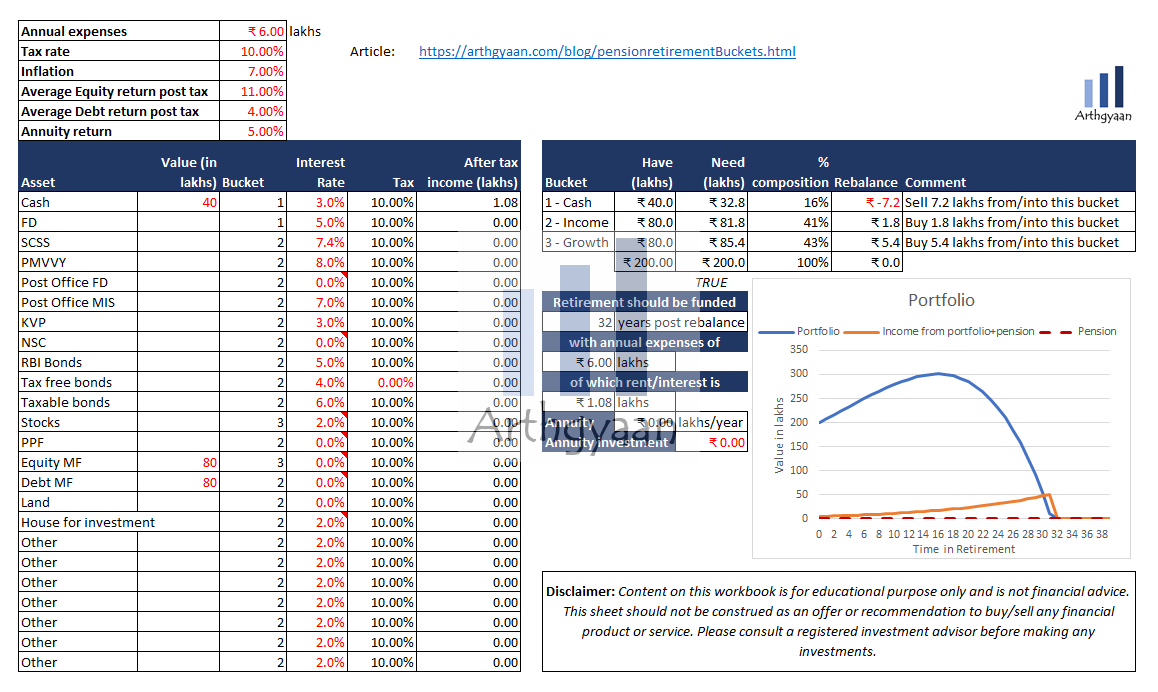

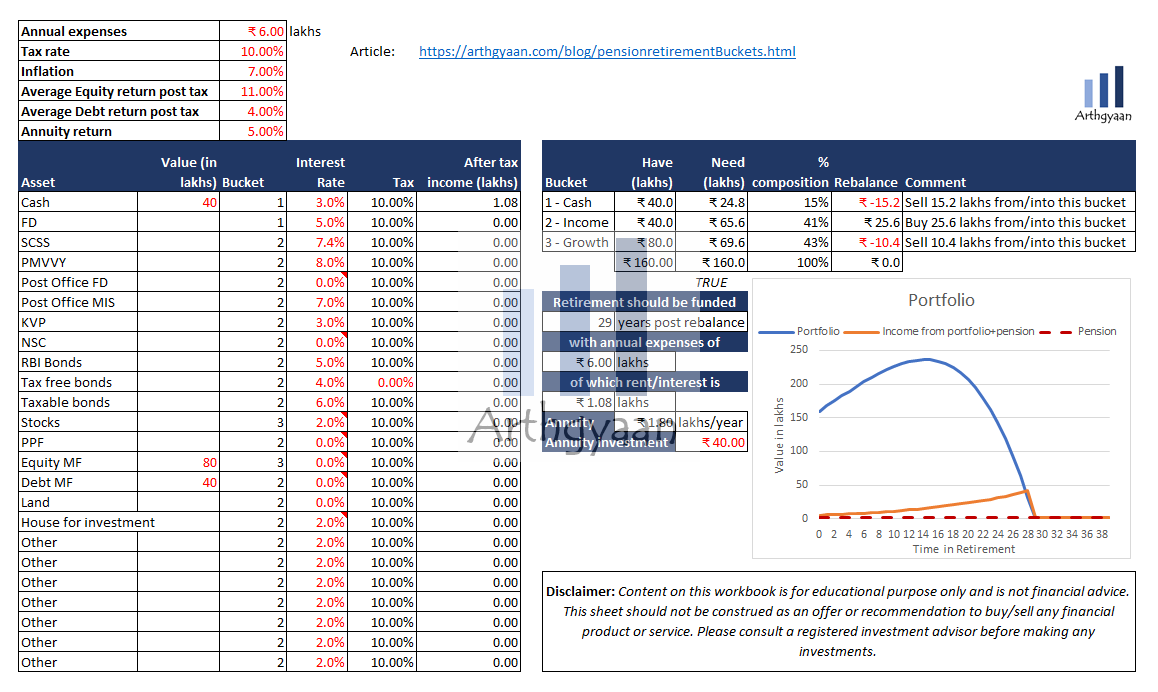

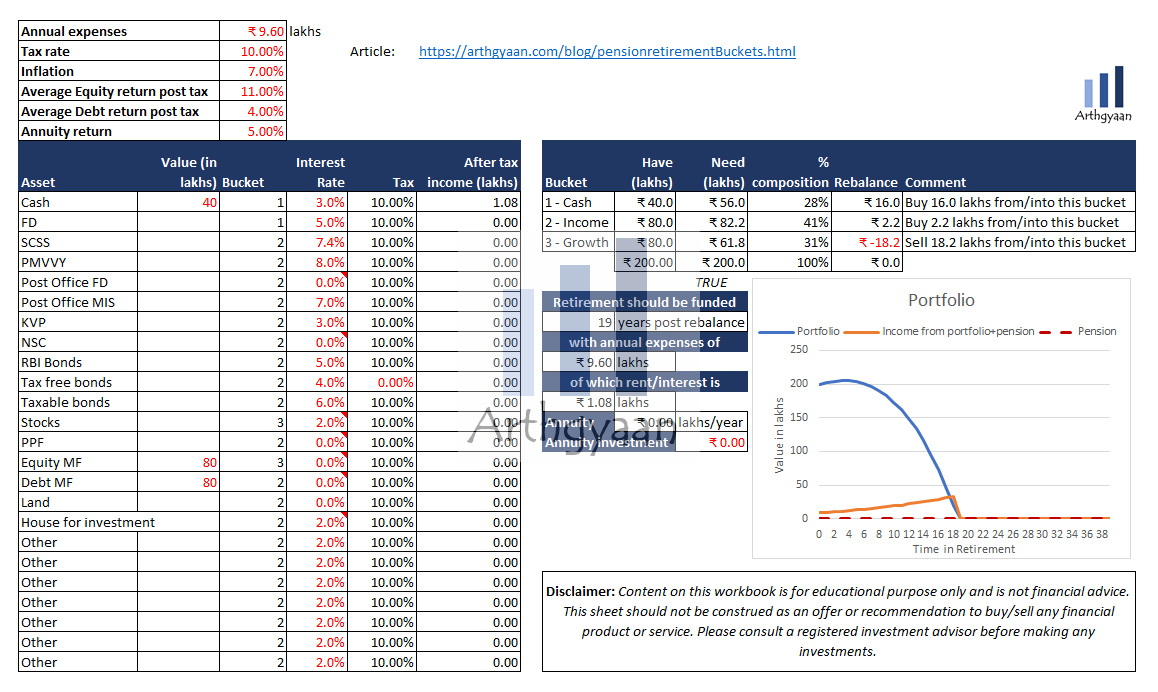

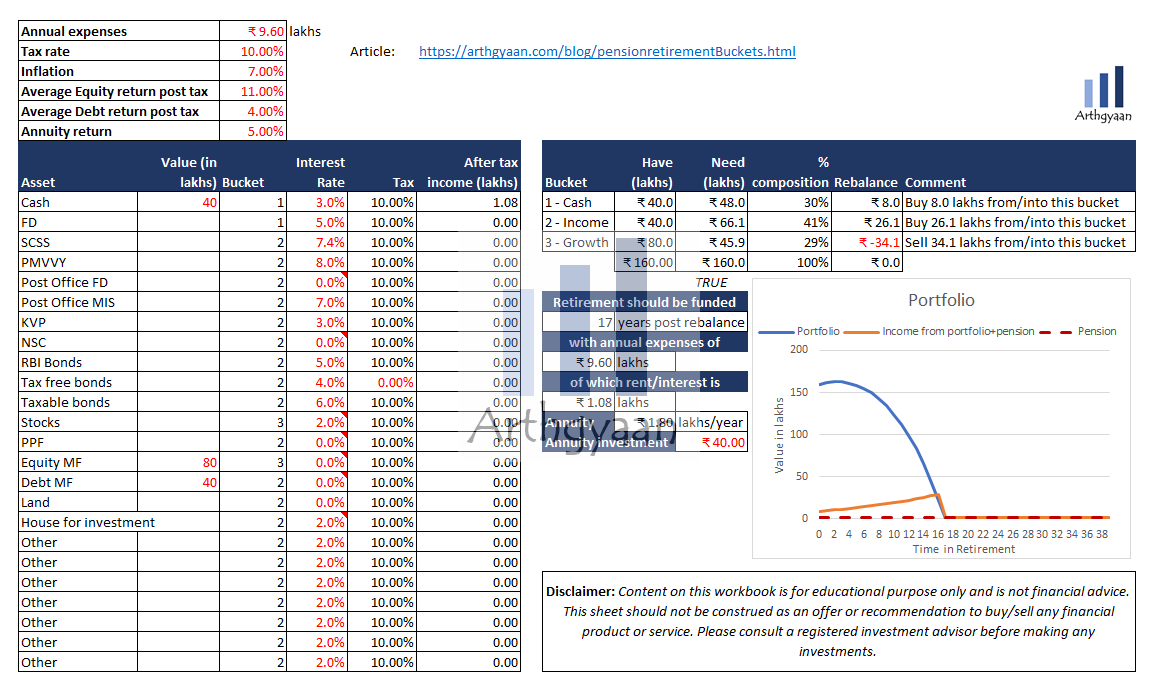

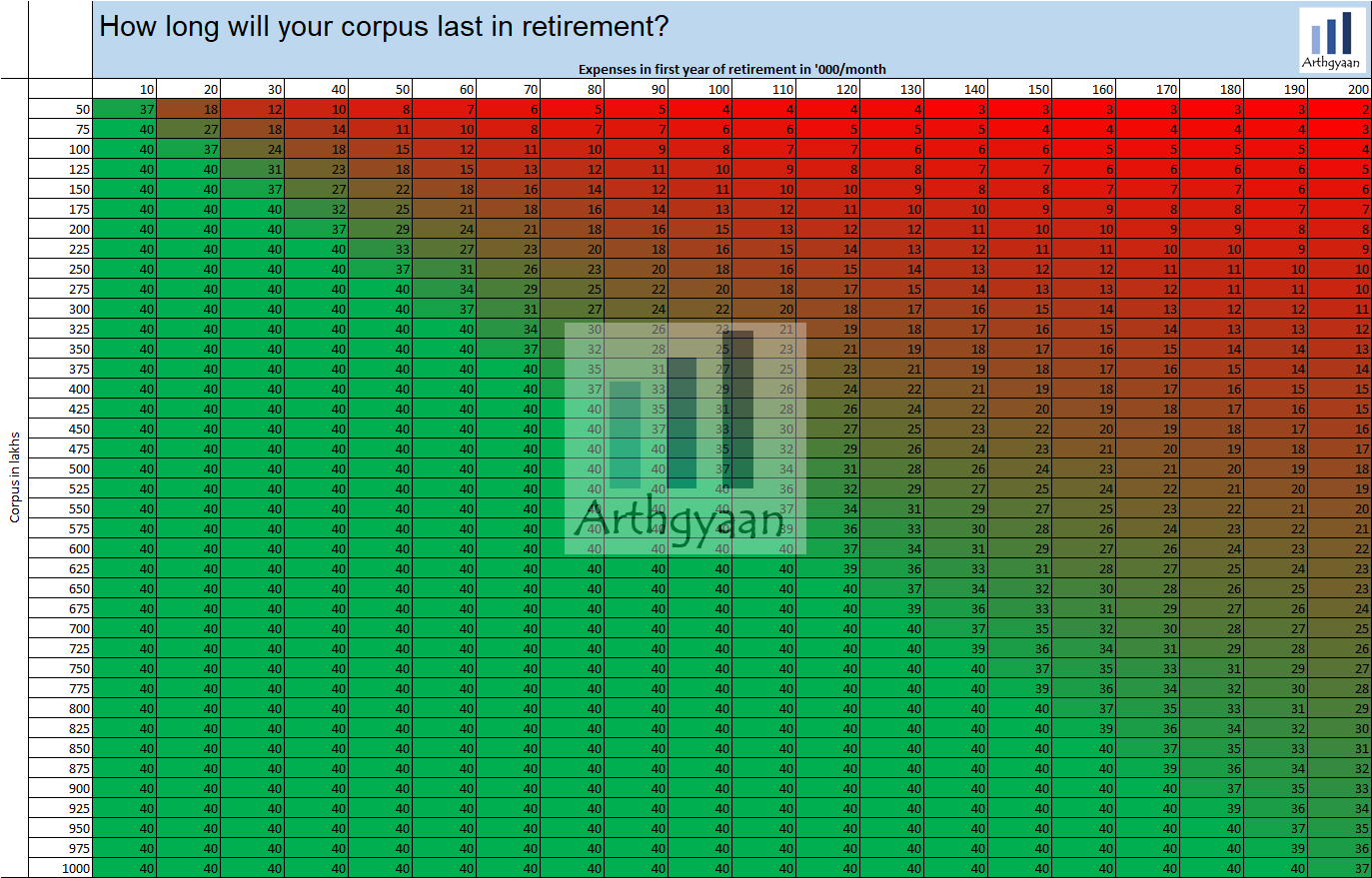

We use the retirement bucket calculator to see how long a certain corpus like ₹2 crores can support inflation-indexed drawdown of ₹ 10,000 to ₹2 lakhs/month.

We will invest in 3 buckets:

Inflation: the impact on your goals and how to choose assets that beat it

We will use the retirement bucket Excel template to estimate this and consider the test to be successful if the corpus lasts at least 30 years in retirement i.e. after 30 years, money left should be non-zero.

which is expected to last around 32 years. The graph shows how the portfolio value (blue line) first increases with time, peaks after some time and then rapidly falls to zero in around 32 years. The orange line shows the yearly expense increasing at the rate of inflation over time.

We see that the total time drops to 29 years in retirement. However, given that there is a pension plan, we see that a fixed sum of ₹ 1.8 lakhs/year (pre-tax) will continue to be paid out till the death of the investor. This effectively puts a floor on the income even after the corpus drops to zero though due to inflation, the value of the annuity will have limited impact beyond a psychological benefit.

which is expected to last around 19 years. The blue line barely gets a chance to rise and falls to zero in just 19 years.

The pension lowers the period further to 17 years but gives ₹ 1.08 lakhs income (pre-tax) for life. This is recommended vs the without pension case since the number of years at full withdrawal is just 2 years less (17 vs. 19) but there is guaranteed income for life. This shows that if the corpus is low relative to the income needed, it will be prudent to take a pension plan.

Here we plot expenses in the first year of retirement (growing with inflation) vs. starting corpus in lakhs. The green zone is where you need to be by either having a high corpus or lower expenses. Since corpus will be fixed post-retirement and fluctuate due to market movement, the only variable under control is managing the lifestyle expenses.

At all times ensure that you have the following in place

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much retirement corpus is enough? first appeared on 06 Aug 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.