Can you retire by keeping money only in FD or pension?

This post explores the pros and cons of keeping money only in fixed income throughout retirement

This post explores the pros and cons of keeping money only in fixed income throughout retirement

Many investors wish to know if they can retire solely by keeping money in either FD or a pension plan. This method allows them to avoid growth assets like equity altogether.

As we discussed earlier in this post about post-retirement portfolio construction, a retirement portfolio has three parts or buckets:

Read more on inflation-beating assets: Inflation: the impact on your goals and how to choose assets that beat it

This post will address various scenarios of a portfolio created only using buckets 1 and 2 which is cash and fixed income, and optionally some amount invested in a pension plan. Before proceeding further, it will be good to review the following since this post will assume familiarity with:

The wish of avoiding equity assets in retirement is common among investors

In this post, we will club all the usual post-retirement debt investments (see this post for the list) like SCSS, Post Office schemes and bank FD etc. under the same bucket we will call “FD”. We need to keep in mind that interest rates in India have been falling for the last 10+ years and as the country becomes developed, rates will fall further thereby reducing the returns from FD and other debt schemes.

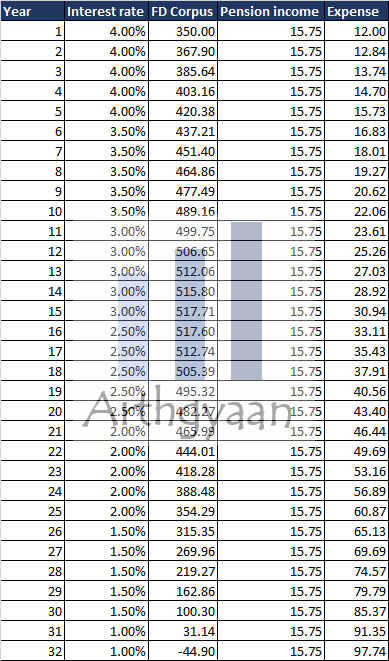

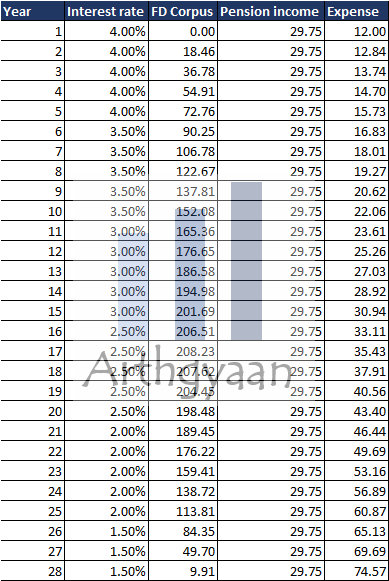

This corpus lasts 30 years since after that the FD corpus drops to 0 and the pension payout continues. Due to inflation, the purchasing power of the pension is now ₹ 15.75/(1.07)^30 = ₹ 2 lakhs/year which is 1/6th of the requirement of ₹12 lakhs/year. This is the risk of keeping money only in FD and pension. Post the death of the retirees, the pension investment amount of ₹ 3.5 crore goes to the heirs.

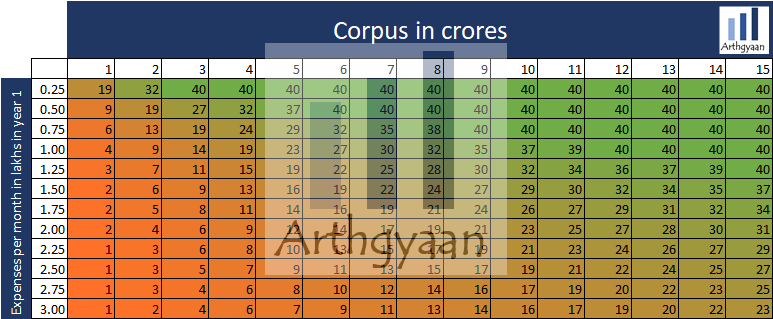

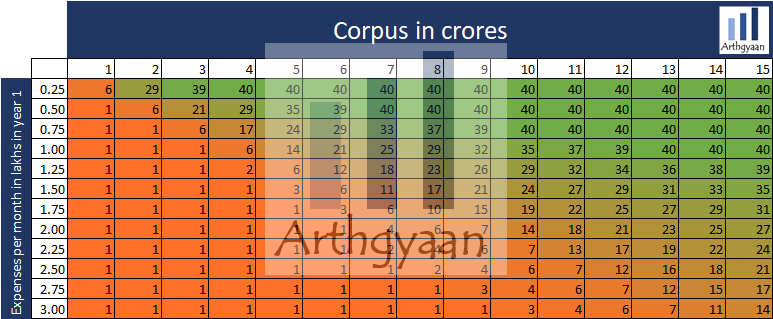

Here are some sensitivities between corpus in crores and the number of years in retirement it can support with multiple levels of monthly income with 50% in FD and the rest in pension:

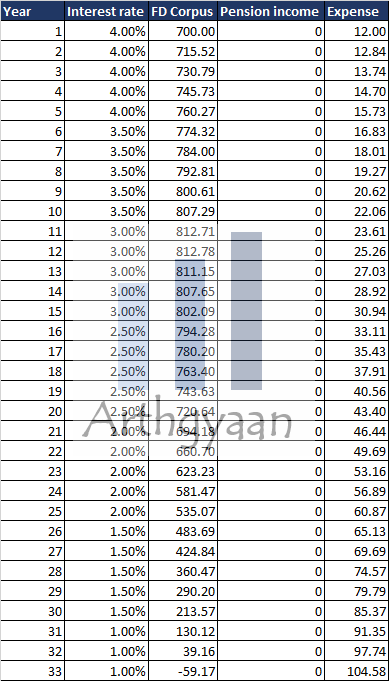

This corpus lasts a bit longer this time i.e. 31 years but there is no cushion of pension this time. The heirs do not get anything in this example.

Here are some sensitivities between corpus in crores and the number of years in retirement it can support with multiple levels of monthly income with 100% in FD:

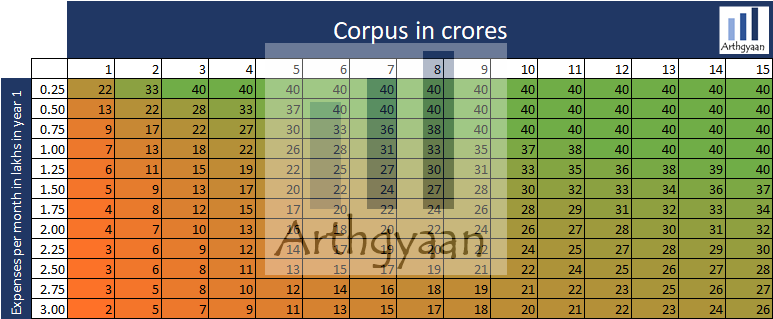

Here we keep the entire ₹ 7 crore in pension at 5% pre-tax which gives a payout of ₹ 700 * 5% * (1-15%) = ₹ 29.75 lakhs/year. In this case, we keep the excess above ₹ 12 lakhs in FD and use that when the pension amount falls short. Post the death of the retirees, the pension investment amount of ₹ 7 crore goes to the heirs. Unlike FD, the return of the pension is fixed for life. The plan lasts for 25 years post which only the pension plan continues. Note that due to the higher income, in this case, the tax rate is increased to 15%.

Here are some sensitivities between corpus in crores and the number of years in retirement it can support with multiple levels of monthly income with 100% in pension:

If you are using pension and FD interest for your retirement portfolio, you can see how the portfolio changes with different FD and pension income values: How can you add multiple income streams to your portfolio for retirement?.

We have covered this in detail in this post. For 40 years in retirement, you can get ₹ 1 lakh/month inflation-adjusted income with a corpus of ₹ 5.25 crore which is expected to last for 40 years. However, unlike the FD/pension combinations above, this is not guaranteed and is more suitable for retirees with

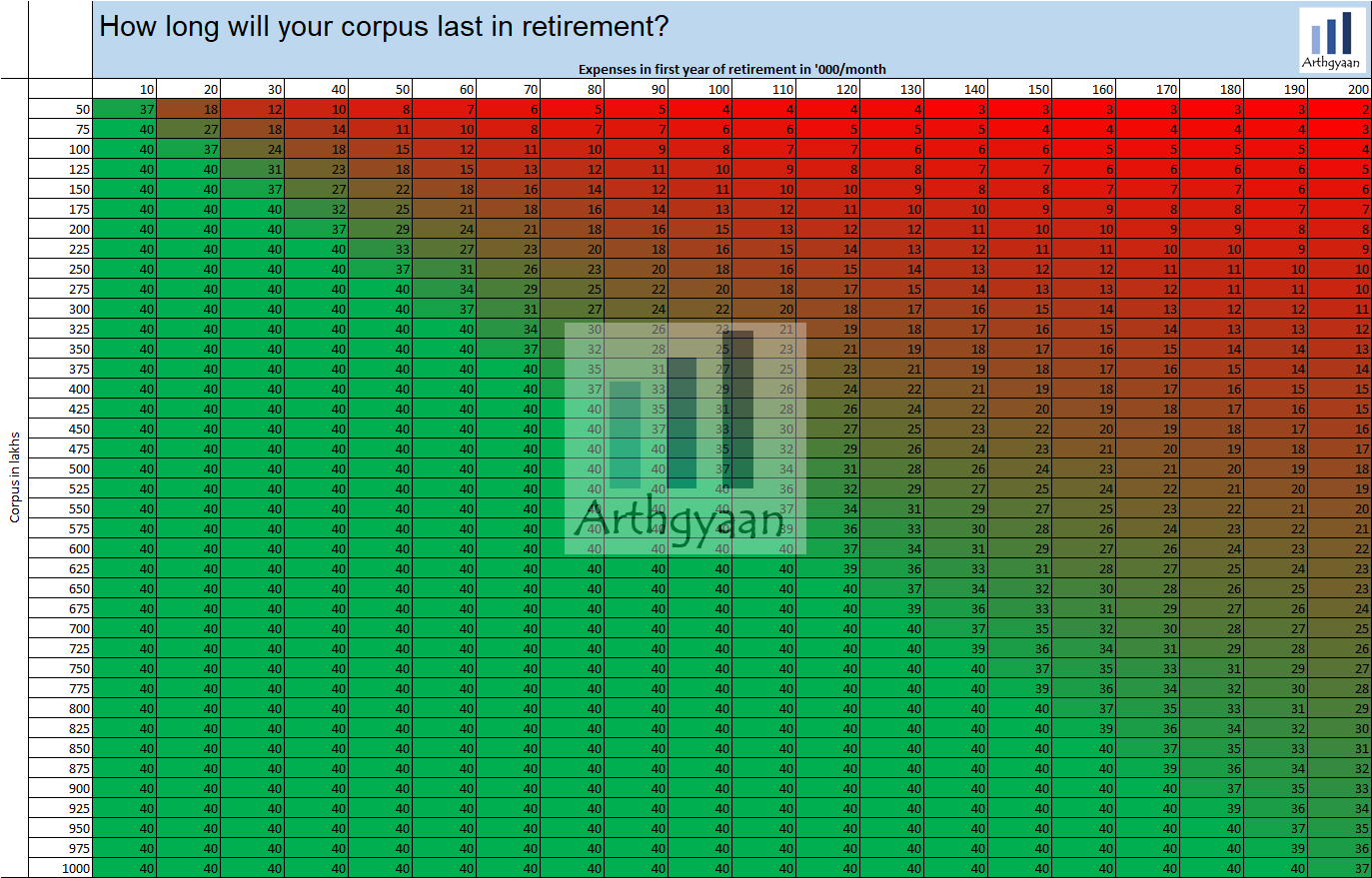

Here is the sensitivity table for retirement corpus with equity investment allowed:

Here we plot expenses in the first year of retirement (growing with inflation) vs. starting corpus in lakhs. The green zone is where you need to be by either having a high corpus or lower expenses. Since corpus will be fixed post-retirement and fluctuate due to market movement, the only variable under control is managing the lifestyle expenses.

We have covered this same point for NRIs retiring in India in this article: Can NRIs retire in India with only safe investment options like a fixed deposit?.

In this article on creating a dividend-only retirement portfolio, a question that came from a Twitter user on this topic is this:

If i have 7 crore then why will I invest in stock to get 14lakh dividends yearly that too post retirement.FD will give 26 lakh safe and secure post tax

The context is how much should be invested in dividend-paying stocks to get ₹ 12 lakhs/year as inflation-indexed income. Since this income is post-tax, we assume a 15% marginal tax rate to calculate. Yearly desired income, pre-tax is ₹ 1 * 12/(1-15%) = ₹ 14.18 lakhs. If the dividend yield is 2% at the time of purchasing the stocks then the corpus needed is ₹ 14.18 / 2% = ₹ 706 lakhs or ₹ 7 crores. This is where the 7 crore corpus target used above comes from.

The dividend portfolio is

There are two assumptions regarding inflation and capital growth in the points above and if both assumptions are valid, this is one portfolio that

Here is a worked out example for a 48 year old whose monthly investment and target corpus almost doubles if they choose only safe investment options: Late to plan retirement: how much money does this 48 year old investor need to invest per month to retire at 60?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Can you retire by keeping money only in FD or pension? first appeared on 18 Aug 2021 at https://arthgyaan.com