How can you figure out your expenses in retirement/FIRE?

This post shows an easy way to estimate your expenses in retirement/FIRE as the first step in knowing how much you need to target as a retirement corpus.

This post shows an easy way to estimate your expenses in retirement/FIRE as the first step in knowing how much you need to target as a retirement corpus.

Knowing how much money you need to spend in retirement is the first step in estimating how much money you need to save for retirement. Many retirement corpus calculators like this online Goal-based Investing calculator and this Excel-based calculator start with this step asking you to “enter the expenses in retirement”, typically in the first year in today’s money.

There are a lot of assumptions that go into estimating retirement expenses, including

All of these make it overwhelming for the investor. This post will provide some direction regarding the solution so that the investor can move forward instead of being perennially bogged down with minutiae.

The output of this expense estimation exercise is the figure that you will be spending in the first year of retirement at today’s price levels. The calculator you should be using (like this and this) will automatically project that into the future at the actual point of retirement.

Expenses in retirement will vary from family to family, but the typical list can be:

There can be exceptions to this like:

Expenses with known end date:

You can plan for these using the recurring goal model shown in this post.

Expenses with unknown end date:

These have to be a part of the monthly expense in retirement and should be modeled to continue.

The impact of location (High Cost of Living - HCOL vs Low Cost of Living - LCOL) may be significant on these estimates. You should err on the side of caution and assume HCOL-level expenses when projecting future costs. If the cost reduces in the future after shifting to an LCOL location, then that is a more desirable situation.

If you have a way to earn extra income for the first few years in retirement, that can be adjusted against the initial expenses and will be dealt with in a future post.

This is tricky to estimate since the consumption basket before and after retirement changes. For example, before retirement, the most significant expenses are housing and children’s education, while post-retirement, healthcare and to some extent, travel become the most important line items. Therefore, post-retirement inflation needs to be estimated depending on the mix of expenses and the inflation applicable to each.

Inflation: the impact on your goals and how to choose assets that beat it

Currently, our models assume 7% (or the same) inflation for both before and after retirement periods. Our retirement bucket calculator allows you to choose your inflation post-retirement.

Choosing 7% as the inflation figure allows an easy mental shortcut to estimate the future value of money using the Rule of 72. At 7%, the cost of a goal doubles every ten years or the purchasing power of a corpus halves every ten years. As India matures into a developed economy, inflation is expected to reduce, but private healthcare inflation will be high. The way to mitigate this is to maintain good health starting today and provide high healthcare insurance premiums in retirement.

Please keep in mind that inflation, as mentioned in Government published WPI/CPI figures, will be different from your lifestyle inflation. To estimate inflation, you need to keep a budget for several years and see how your own basket of goods and services increases in value.

Both level of expenses and inflation is impacted by the location chosen for retirement. Thus, a quick shortcut to cut through the analysis-paralysis phase is to assume retirement in one of the metros with the highest expenses and revise that closer to actual retirement. This is one of the reasons to review all goals at least yearly.

Depending on when retirement happens and whether it is planned, i.e. voluntary or unplanned, i.e. involuntary, there could be other goals that need to be prepared for. It is up to the investor to closely examine their career and skillset to understand if involuntary retirement applies to their case.

Expenses that should be planned using the single/multiple-goal model

Most investors, especially FIRE candidates, will need to prioritize these goals vs saving for retirement since you may not have enough in the initial years of investment. This post shows you how to do that.

Just like all other goals, this expense estimation has to be repeated at least once a year. Please involve the whole family to work out the priority expense heads:

The replacement rate (RR) is a simple concept that says how different the lifestyle will be post-retirement. RR is helpful when there are too many variables and assumptions that make estimating retirement expenses complex or less robust. RR of 100% assumes the same lifestyle, more or less as today. For example, if you are already staying in your own house, have 1-2 vehicles and take one primary and one minor vacation a year, then you can assume this:

This means that the expenses during retirement will be the same after adjusting for inflation. We use the concept of RR in this post on calculating the minimum investment level for retirement.

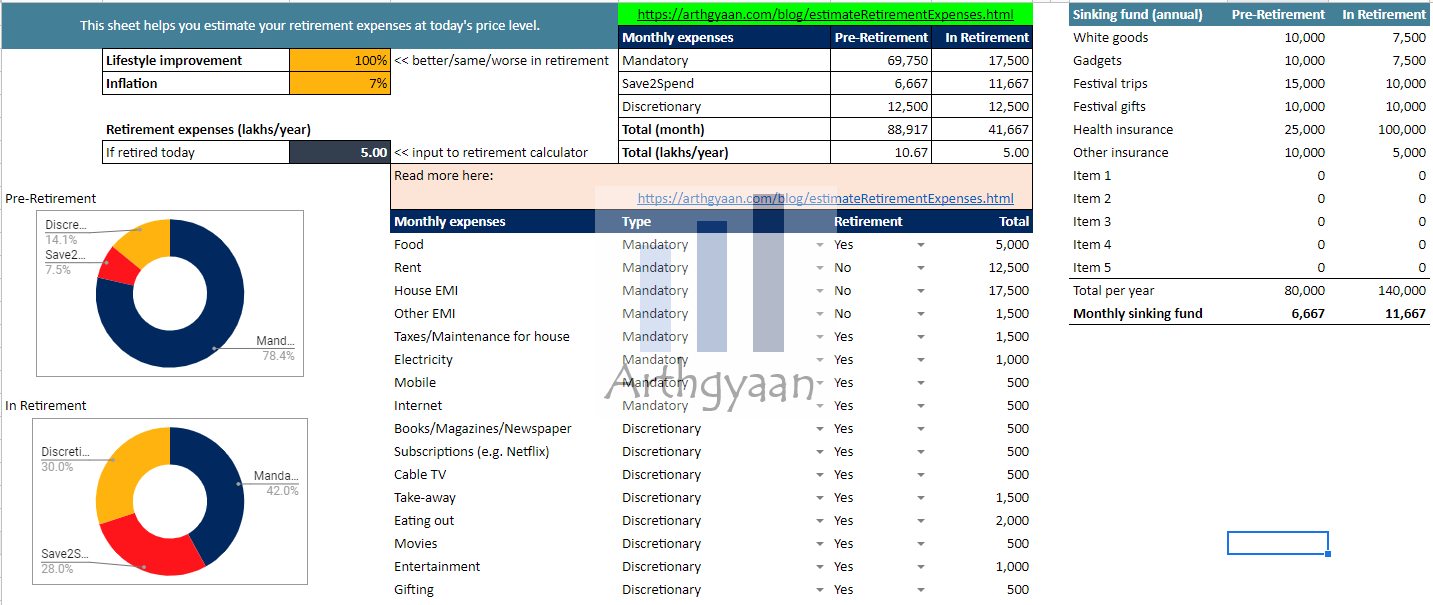

Here we provide a simple expense calculator to find out your before and after retirement expenses. The calculator breaks down each expense category into two parts:

Note: There is a line item in the list that is called a sinking fund. This is for payment of items like insurance premiums and festival gifting that are known in advance but occur once a year. The total yearly expense, which will cover things like fridge/TV/washing machine purchase and replacement, will be saved monthly and spent when needed. This line needs to be carefully calculated since it contains the health insurance premium. You can find more details on the concept here.

The Google Sheets workbook (see the free-to-use expenses-in-retirement sheet) will add up the figures and show you the expense in retirement in the first year, which you need to feed into the retirement calculators here or here.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can you figure out your expenses in retirement/FIRE? first appeared on 23 Aug 2021 at https://arthgyaan.com