How to prepare today in case you are forced to retire in the next five years?

This post deals with a situation where a middle aged salaried employee is forced to retire due to changing workplace situations.

This post deals with a situation where a middle aged salaried employee is forced to retire due to changing workplace situations.

We have discussed multiple ways of calculating your FIRE corpus in previous posts, considering early retirement is a life goal. However, you need to know if early retirement is thrust upon you; is that something you can handle? There is an urgent need to evaluate your financial position to perform a health check and take remedial actions. This post is a thought experiment considering a hypothetical 40-year-old looking at his career and preparing for the worst five years from now.

This post does not deal with options to delay the impact of forced retirement or possibilities for developing a secondary income source. Those will be considered on a future date.

At all times, ensure that you have the following in place

We are increasing the emergency fund requirement to 12 months to tide over the initial hit to finances. Unless done already, health insurance should be separated from the employer’s, and a super-top-up policy needs to be in place.

These four measures will ensure that investments made for long term goals can continue and compounding is not interrupted.

After securing your financial defences, the next priority will be retirement corpus starting at age 45. We will consider two cases:

As described in this post, many investors have not seriously invested for their retirement goals up to their forties. If you are in this category, you need to reevaluate your assets and see which can be helpful during retirement and which will require to be converted into inflation beating assets. For example, a second or third investment house earning a 3% return as rent should be sold and invested in a proper retirement plan.

Inflation: the impact on your goals and how to choose assets that beat it

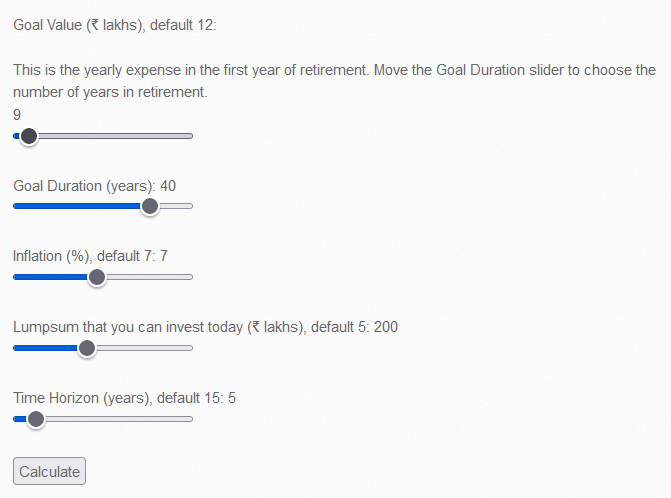

If you are already investing and have a retirement corpus ready, here is a quick way to know where you stand. We will use the simple goal calculator to check if you have enough retirement corpus already accumulated and how much SIP is needed over the next five years to have a 40-year retirement (up to age 85 starting at 45). The first year of expense in retirement (as explained in this post) is ₹ nine lakhs/year. We will use the default options in the calculator and assume that there is already ₹ two crores saved as the retirement corpus, including mutual funds and provident funds.

Here are some sensitivities based on the time left, corpus saved and expenses in the first year of retirement:

As the example shows, with five years left for retirement and ₹ two crores saved, a SIP of ₹ 1.4 lakhs/month is needed to sustain a lifestyle worth ₹ nine lakhs/year. However, the table also shows that if you can reduce the expenses in retirement, then the required amount for SIP drops dramatically and vice versa. The SIP amount is expected to increase by 5% a year.

At any point you can find out how much progresss you have made using this post: How long will your money last if you retire today?.

Unless there is already a financial emergency, there should be no loans like credit cards and personal loans. The car loan needs to be paid off as quickly as possible since a vehicle is a depreciating asset, and paying a car loan when you don’t have income does not make sense.

If there is a home loan, then you need to evaluate options like

Depending upon the result in the previous steps, there are now several options left. This post discussed that children’s education and marriage could be de-prioritized based on immediate priorities.

If there is enough monthly surplus available, you can continue investing in children’s education and marriage. The objective should be to completely fund those goals in a short amount of time while you have income.

We have dealt with goals like multiple goals like regular vacations, but if you cannot fund such goals, for the time being, you should put them on hold. The same applies to car upgrades and similar optional expenses.

The worst-case scenario will come if the SIP amount for retirement goals after mandatory expenses and EMIs is less than the required amount. It is critical to reevaluate how the household spends money and the other goals in such a case.

Upskilling and making career changes is the option you should do to stay relevant in your current role. But, of course, this might be easier said than done, depending on unique career situations.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to prepare today in case you are forced to retire in the next five years? first appeared on 06 Sep 2021 at https://arthgyaan.com