Should you consider paying off your home loan faster in your 40s or 50s?

This article gives you practical tips to pay off your home loan in case you are in your 40s and are concerned about potential income stability impacting your home loan.

This article gives you practical tips to pay off your home loan in case you are in your 40s and are concerned about potential income stability impacting your home loan.

Ideally, if you have a home loan, you should not prepay it at all.

Houses are the only asset that can be purchased with a loan and this concept of leverage does not apply to any asset. You can of course take a personal loan to invest in the stock market but that is not a good idea: Should you take a personal loan to invest in the stock market or mutual funds?.

We have shown before that investing in riskier assets like mutual funds to make potentially higher returns than the home loan interest savings is possible: How can you pay the least interest and get the most tax deduction on your home loan?

The only caveat here is income stability.

As long you think your job will be there.

Now subtract 5 years from that.

This is when you need to pay off the home loan.

For many readers, that five-year figure will vary but it is best to be prepared: How to prepare today in case you are forced to retire in the next five years?

Of course, you are bound by both:

Of course, if you prepay the home loan, the saved EMI in the future can be used to invest for goals like college education since your monthly in-hand income is now effectively higher.

Once you know when to pay off the loan, there are two approaches to take on the prepayment:

We will explore both options below.

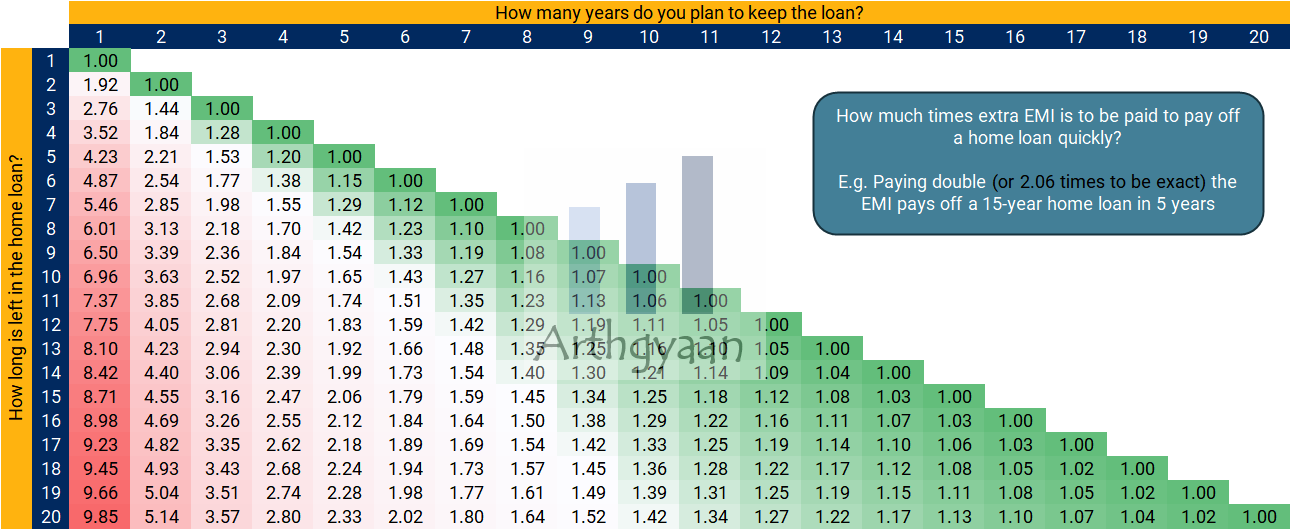

Paying double (or 2.06 times to be exact) the EMI pays off a 15-year home loan in 5 years.

Here we have assumed that the loan interest rate is 8.8% which is applicable for loans above ₹1 crore. Lowering the interest rate to say 8.5% does not materially impact the numbers in the table below.

Read the above table as :

where the table gives the values of x for various combinations of home loan tenure left and the desired time to pay off the loan.

We have discussed this option in detail here: Pay Off Your Home Loan Faster: How Extra EMI Payments Save Time and Money

Our home loan prepayment vs investment decision calculator uses the concept of NPV to help you decide which option is better:

Click "Calculate & Compare" to see the results.

| Year | Loan Left | Principal Repaid | Interest Paid | Tax Savings | MF Corpus |

|---|

NPV is calculated over the full original term of the loan, using the Expected MF Return as the discount rate. A higher (less negative) NPV is better.

| Scenario | Net Present Value (₹) | Optimal Decision |

|---|

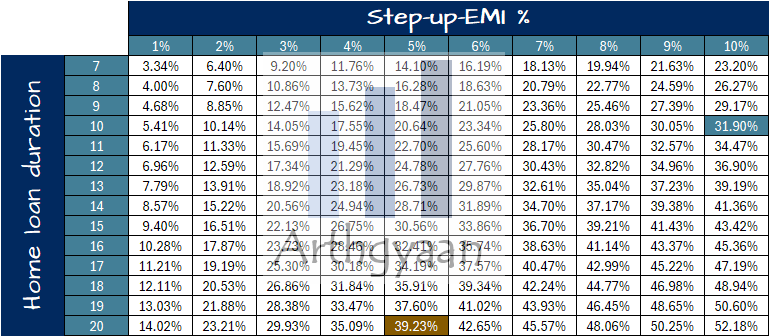

A step-up EMI, just like the step-up-SIP that amplifies your wealth, is a way to quickly pay off your home loan so that you save both interest and time.

In the example below, we will show the monthly EMIs of a normal loan for a ₹1 crore house (₹75 lakhs loan at 9% for 15 years, ₹25 lakhs down-payment) vs the same loan being paid off with a 10% step-up EMI like this:

| Year | Normal EMI | 10% Step-up EMI |

|---|---|---|

| This year | ₹77,537 | ₹77,537 |

| Next year | ₹77,537 | ₹85,290 |

| The year after that | ₹77,537 | ₹93,820 |

| … | and | so on |

To understand what the right option is to pay off your home loan:

This table shows the impact of a small step-up on the time it takes to pay off the loan.

In the table above, at a 9% loan interest rate:

We have discussed this option in detail here: How much time and interest do you save if you pay off your home loan using a step-up EMI?.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you consider paying off your home loan faster in your 40s or 50s? first appeared on 04 Dec 2024 at https://arthgyaan.com