Does this DISK family need to work longer even after reaching 45x FIRE corpus?

This article discusses how to plan early retirement in the face of lifestyle inflation and lack of health insurance for an investor in their 40s.

This article discusses how to plan early retirement in the face of lifestyle inflation and lack of health insurance for an investor in their 40s.

DISK = Double Income Single Kid

This article is a response to a Reddit post:

Source: https://redd.it/1h8klor

Source: https://redd.it/1h8klor

We will cover the points made by the Original Post author (OP) one by one.

Coming from a lower class, my current expenses are really shocking to me - OP

This is a problem that many of us face and there are many reasons for this.

The reason for this is that over the last 25+ years, OP has been earning and spending money due to which inflation of goods and services has been a silent factor that pushes up expenses without much warning. A basic Tier 1 city lifestyle with transportation (2-3L/year with car depreciation), good food (2-3L/year), school expenses (1-3L/year), entertainment (1-3L/year), travel (2-4L/year) and others (clothing, gifting, gadgets etc) can easily touch 15L without being considered lavish. That is just how it is.

I started tracking all my expenses(every single rupee) - OP

This approach is counterproductive and will lead to frustration and resentment. A much better approach can be one of two:

This doesn’t include the 40Lakhs I have set aside for my son’s education - OP

A kid’s college education can be a wildcard. There is no way to predict, until and unless the kid gets admission, at even the quantum of amount needed. A simple example, using UG MBBS degree costs based on NEET rank will make this point clear:

If you add 10% of inflation to education costs, then the problem becomes worse since in the short run, the education corpus must be kept safe (OP’s child is in Class X) and will need to be invested in safe investments like FD with low post-tax returns.

Why not take an educational loan?

If we think of OP and the kid as one economic unit, then whether 40 lakhs is enough is a moot point. If OP overspends on the degree, either they need to work longer or spend an extra part of their corpus on the degree. This will likely reduce the inheritance in the best case or the worst will make OP dependent on their kid 30 years from now for some expenses.

Alternatively, if OP’s kid takes a loan on the extra fee amount above 40L and creates lower wealth on their own due to loan EMI, they will then get a larger inheritance in the future. Therefore, the factor OP needs to control is the amount spent on the degree and not how much they have invested for that.

For health, currently depending on office cover. This is the biggest blunder I made in my life. I recently had some health issues and have to be dependent on corporate health coverage. I started looking for health insurance now and getting answers like, pre-existing disease cover will take at least 3 years. - OP

OP should go to a health insurance agent in their city and receive consultation on the best policies. 3 years of waiting is normal and unavoidable. There could be policies which have day-one coverage riders as well which the agent can provide guidance.

We are strongly of the opinion that health insurance policies should be purchased with agent involvement via a physical office. When a claim is to be made, the agent can provide invaluable service with claims so that you can focus on getting better.

A 20L base policy with a 1 crore super-top-up is the right combination of policies to get: What are top-up and super-top-up health insurance policies? Do you need either?

Another option that can be followed here is to take two sets of policies OP and wife/kid separately in case the premiums become too high for the floater. All of this can be discussed with the insurance agent.

I know I am financially independent. I want to retire now. - OP

We already know that:

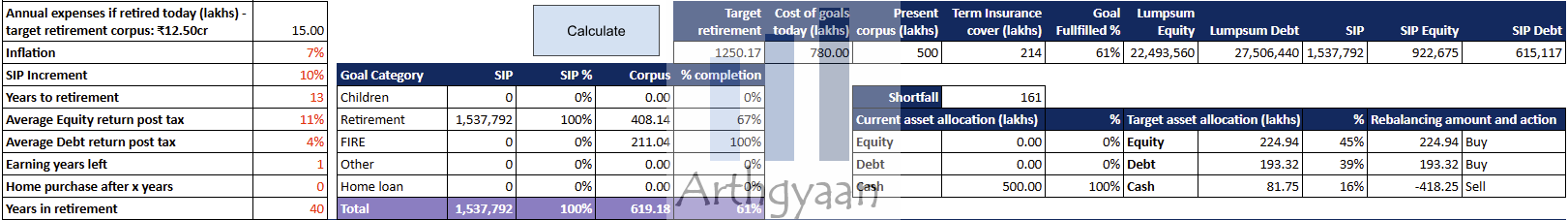

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

Here is the model output with these assumptions showing a deficit of ₹1.6 crore which will make immediate early retirement (RE in FIRE) not possible.

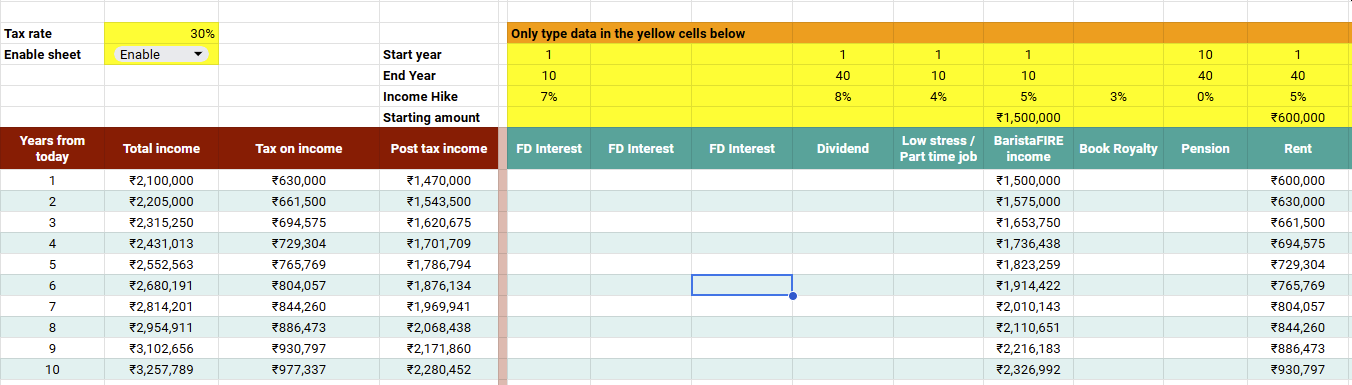

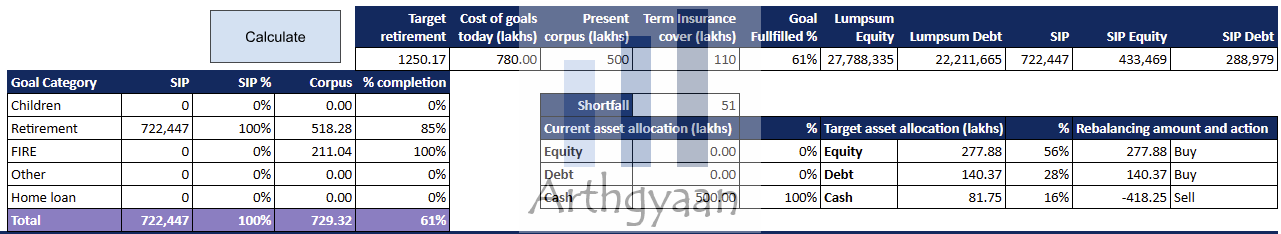

If we add in a modest ₹15L/year low-stress job (as shown above), essentially the so-called BaristaFIRE approach, to replace the primary income of OP, then the shortfall becomes more manageable to ₹51 lakhs.

If we add in a modest ₹15L/year low-stress job (as shown above), essentially the so-called BaristaFIRE approach, to replace the primary income of OP, then the shortfall becomes more manageable to ₹51 lakhs.

Lifestyle creep and the health cover are the two things which are holding me from retiring early - OP

My concern now is my cash flow. If I quit my job now, my cash flow will be reduced. So my goal is to try and increase my monthly cash flow in the next year or two - OP.

There are a few options here:

The most practical thing to do here will be to delay early retirement for around three years until the health cover fund is in place and the PED-exclusion period is over.

If you are planning your FIRE journey, then Arthgyaan packages can help you create and manage your FIRE portfolio effortlessly. Choose the year closest to your desired FIRE year to get started:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Does this DISK family need to work longer even after reaching 45x FIRE corpus? first appeared on 08 Dec 2024 at https://arthgyaan.com