How much time and interest do you save if you pay off your home loan using a step-up EMI?

This article shows how quickly you can pay off your home loan, and even save a lot of interest, by increasing your EMI steadily year-on-year.

This article shows how quickly you can pay off your home loan, and even save a lot of interest, by increasing your EMI steadily year-on-year.

This article is a part of our detailed article series on the concept of home loans. Ensure you have read the other parts here:

This article breaks down the benefits of prepaying your home loan and how it impacts both your interest payments and tax savings.

This article tells you why it is a good idea to buy a home jointly as a couple and it is not only the tax benefits you get.

This article shows you an easy way to calculate how big a house you can buy based on your family’s combined monthly salary.

Home loan rate hike? You can prepay to keep EMI and tenor same. This post shows how.

This article shows how paying a small fee to your bank to reduce your home loan rate can save you lakhs in interest over the life of your loan.

This article shows you the benefits due to interest saving when you make a part-payment to your home loan. Your loan duration also reduces due to the pre-payment.

This article shows a handy ready reckoner for home loan EMI amounts for all tenures and interest rates along with the amount of principal and interest to be paid.

This article helps you decide when to prepay your home loan - at the beginning, middle or end of the total loan period.

This articles describes overdraft home loans like SBI Maxgain and BOB Home Loan Advantage.

This post discusses managing when interest rates go up increasing your home loan EMI.

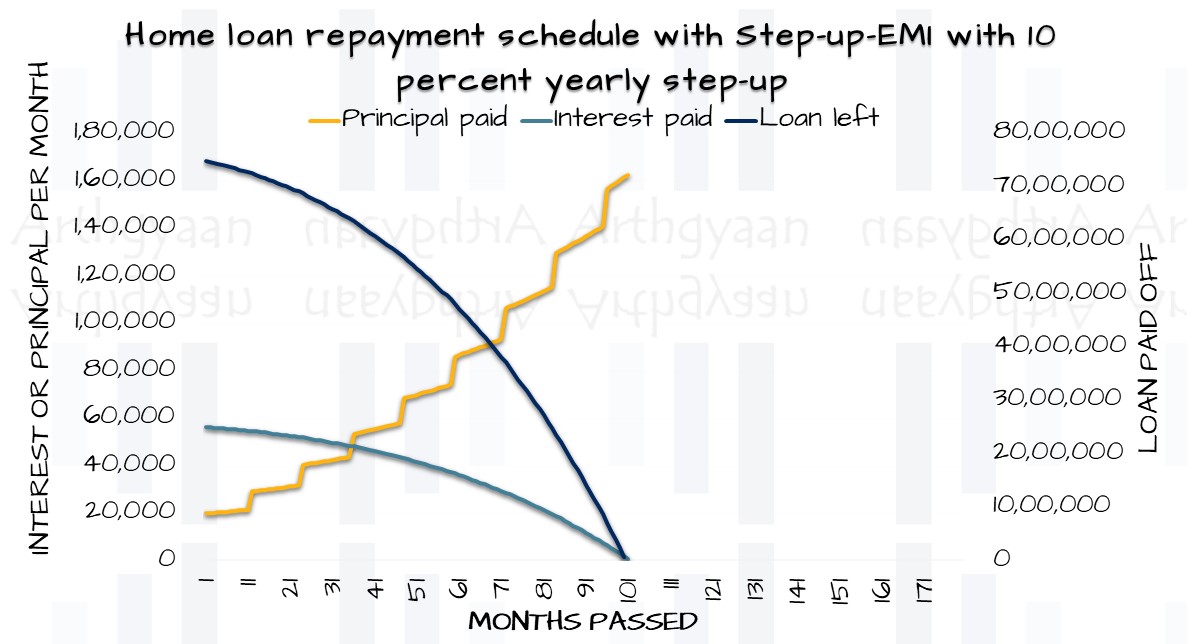

A step-up EMI, just like the step-up-SIP that amplifies your wealth, is a way to quickly pay off your home loan so that you save both interest and time. If your home loan is paid off quickly, thanks to salary and income increases, it will likely increase the value of your retirement portfolio: How much lower portfolio value do you end up with if you do not invest for a few years in between?

In the example below, we will show the monthly EMIs of a normal loan for a ₹1 crore house (₹75 lakhs loan at 9% for 15 years, ₹25 lakhs down-payment) vs the same loan being paid off with a 10% step-up EMI like this:

| Year | Normal EMI | 10% Step-up EMI |

|---|---|---|

| 1 | ₹77,537 | ₹77,537 |

| 2 | ₹77,537 | ₹85,290 |

| 3 | ₹77,537 | ₹93,820 |

| 4 | ₹77,537 | ₹1,03,201 |

| 5 | ₹77,537 | ₹1,13,522 |

| 6 | and | so on |

Before we get into the details of how the Step-up EMI is beneficial, we will recap how a home loan works.

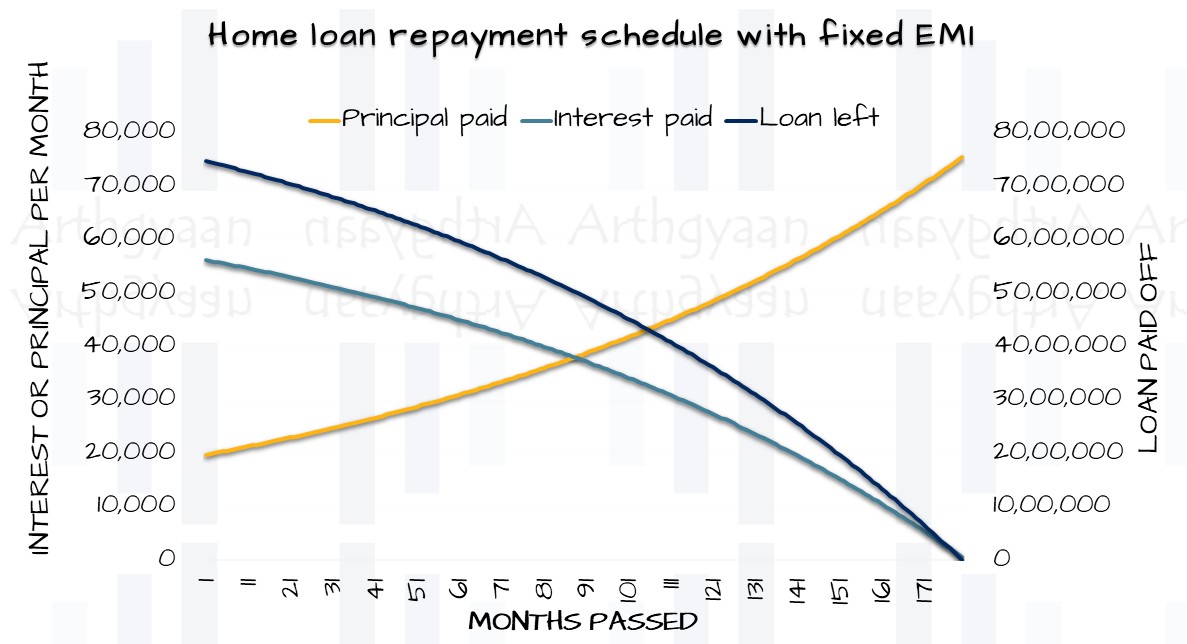

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that includes both interest and principal in the same amount.

EMI = Principal + Interest

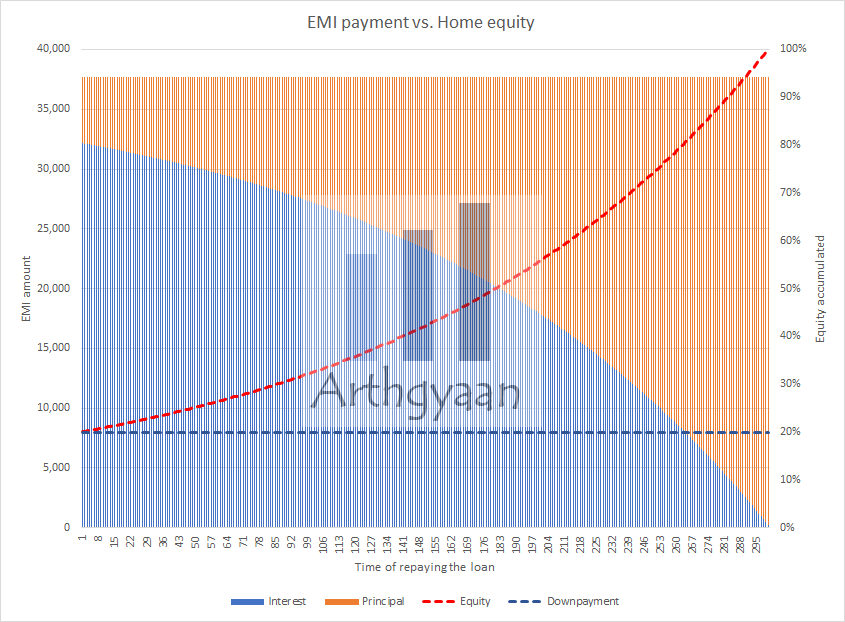

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

As you pay back the loan, your ownership share in the house will increase in the same way. At the point of taking the loan, you own 20% of the house (12.5 out of 62.5, of which 50 is the loan). The bank owns 80%. As the loan is repaid, you own more and more of the house as the principal is paid off. This is the concept of building equity in an asset. Equity is the part of the asset you own after subtracting the part that the bank owns.

Home equity value = Current home value - Outstanding loan balance

Once you build equity in your home, that has additional benefits:

We break down the home loan rate into its major components to see where the fluctuations come from.

Repo linked home loan rate = Repo Rate + Spread + Premium

Repo rate: This rate is decided by the RBI. Home loan rates will move up and down as soon as the RBI revises the repo rate.

The latest repo rate is 5.25%. This rate was last reviewed by the RBI on 05 Dec 2025.

Spread: This is an additional rate on top of the repo rate that essentially captures the profit the bank can make off this loan relative to the deposits it offers to customers. This rate is generally revised every three years but will vary from bank to bank.

Premium: An extra value for some specific customers. For example, SBI adds another 15 bps for non-salaried customers or it will depend on the CIBIL score of the borrower. This value is also revised periodically, like every three years.

If instead of a step-up EMI, you are looking at a fixed higher amount as the EMI, read this: Pay Off Your Home Loan Faster: How Extra EMI Payments Save Time and Money.

Continuing the ₹75 lakhs 15-year home loan at 9% example, the normal EMI looks like this:

In contrast, the 10% step-up EMI pays off the loan in 43% less time (and saves 36% of the interest).

We will now quantify the savings involved via a step-up EMI for your home loan.

To understand how to choose a suitable step-up EMI amount:

Our home loan prepayment vs investment decision calculator uses the concept of NPV to help you decide which option is better:

Click "Calculate & Compare" to see the results.

| Year | Loan Left | Principal Repaid | Interest Paid | Tax Savings | MF Corpus |

|---|

NPV is calculated over the full original term of the loan, using the Expected MF Return as the discount rate. A higher (less negative) NPV is better.

| Scenario | Net Present Value (₹) | Optimal Decision |

|---|

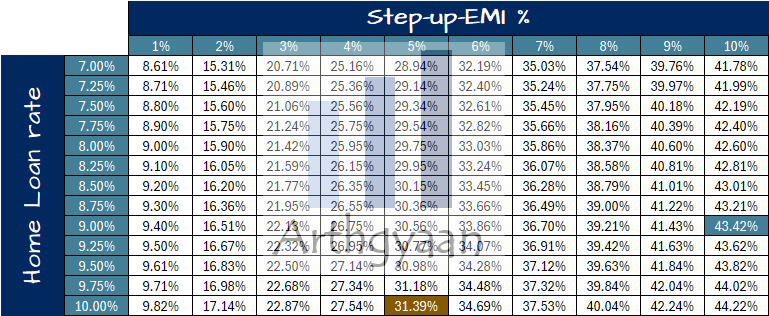

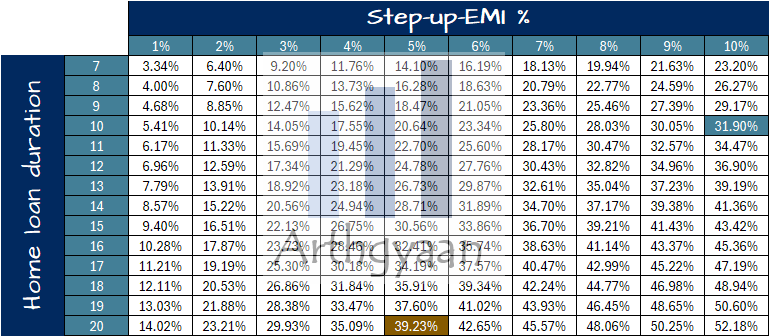

In the table above, for a 15-year loan:

In the table above, at a 9% loan interest rate:

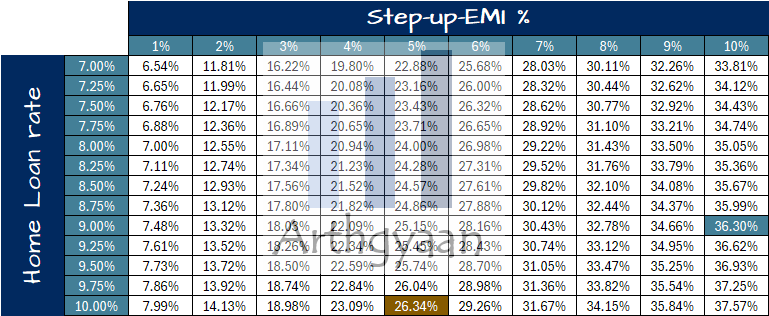

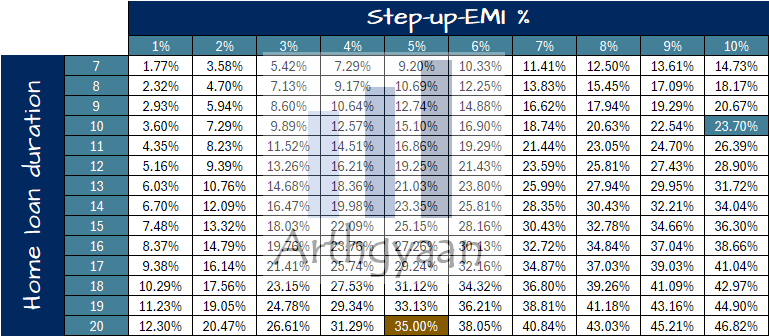

In the table above, for a 15 year loan:

In the table above, at a 9% loan interest rate:

| Year | Normal EMI | 10% Step-up EMI | Extra EMI |

|---|---|---|---|

| 1 | ₹77,537 | ₹77,537 | ₹0 |

| 2 | ₹77,537 | ₹85,290 | ₹7,754 |

| 3 | ₹77,537 | ₹93,820 | ₹16,283 |

| 4 | ₹77,537 | ₹1,03,201 | ₹25,665 |

| 5 | ₹77,537 | ₹1,13,522 | ₹35,985 |

| 6 | and | so | on |

Your loan-issuer bank will create an Electronic Clearing System (ECS) instruction to automatically debit your loan EMI. You should talk to your bank about getting the loan-account number and IFSC code of the servicing branch. Then you can map the account as a beneficiary in Net-banking and setup a NEFT standing instruction to automatically pay the step-up amount i.e. the extra EMI soon after you get salary every month. Some banks even offer UPI payments to the loan account. Once a year, login into Net-banking and increase the standing instruction amount. If the loan EMI changes due to repo rate change, adjust the step-up amount as well.

As per RBI circulars DBOD.No.Dir.BC.107/13.03.00/2011-12 dated June 5, 2012, and the subsequent circular DBOD.Dir.BC.No.110/13.03.00/2013-14 dated May 7, 2014, banks cannot charge pre-payment penalty any more on home loans.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much time and interest do you save if you pay off your home loan using a step-up EMI? first appeared on 01 May 2024 at https://arthgyaan.com