How paying a small fee to your bank can save you lakhs in home-loan interest?

This article shows how paying a small fee to your bank to reduce your home loan rate can save you lakhs in interest over the life of your loan.

This article shows how paying a small fee to your bank to reduce your home loan rate can save you lakhs in interest over the life of your loan.

This article is a part of our detailed article series on the concept of home loans. Ensure you have read the other parts here:

This article breaks down the benefits of prepaying your home loan and how it impacts both your interest payments and tax savings.

This article shows how quickly you can pay off your home loan, and even save a lot of interest, by increasing your EMI steadily year-on-year.

This article tells you why it is a good idea to buy a home jointly as a couple and it is not only the tax benefits you get.

This article shows you an easy way to calculate how big a house you can buy based on your family’s combined monthly salary.

Home loan rate hike? You can prepay to keep EMI and tenor same. This post shows how.

This article shows you the benefits due to interest saving when you make a part-payment to your home loan. Your loan duration also reduces due to the pre-payment.

This article shows a handy ready reckoner for home loan EMI amounts for all tenures and interest rates along with the amount of principal and interest to be paid.

This article helps you decide when to prepay your home loan - at the beginning, middle or end of the total loan period.

This articles describes overdraft home loans like SBI Maxgain and BOB Home Loan Advantage.

This post discusses managing when interest rates go up increasing your home loan EMI.

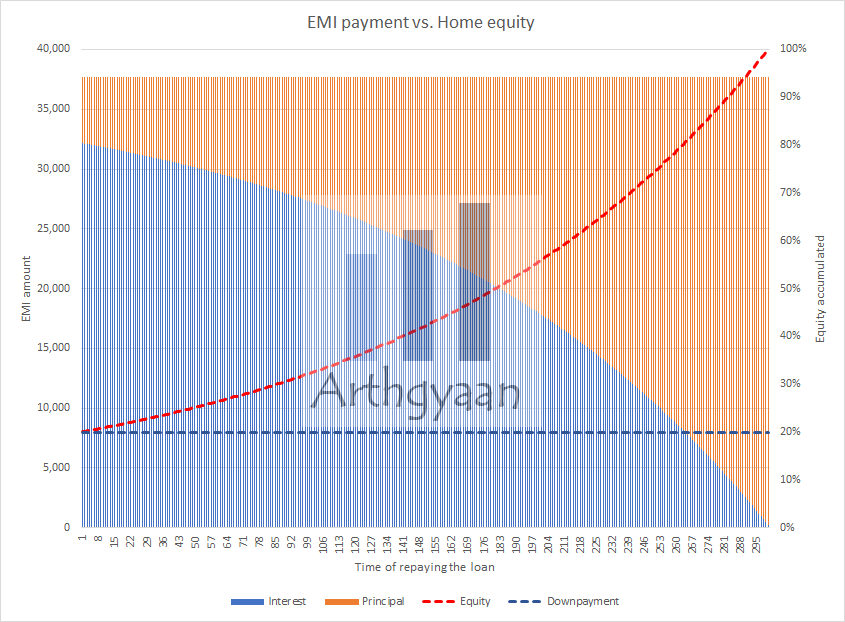

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that includes both interest and principal in the same amount.

EMI = Principal + Interest

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

As you pay back the loan, your ownership share in the house will increase in the same way. At the point of taking the loan, you own 20% of the house (12.5 out of 62.5, of which 50 is the loan). The bank owns 80%. As the loan is repaid, you own more and more of the house as the principal is paid off. This is the concept of building equity in an asset. Equity is the part of the asset you own after subtracting the part that the bank owns.

Home equity value = Current home value - Outstanding loan balance

Once you build equity in your home, that has additional benefits:

We break down the home loan rate into its major components to see where the fluctuations come from.

Repo linked home loan rate = Repo Rate + Spread + Premium

Repo rate: This rate is decided by the RBI. Home loan rates will move up and down as soon as the RBI revises the repo rate.

The latest repo rate is 5.25%. This rate was last reviewed by the RBI on 05 Dec 2025.

Spread: This is an additional rate on top of the repo rate that essentially captures the profit the bank can make off this loan relative to the deposits it offers to customers. This rate is generally revised every three years but will vary from bank to bank.

Premium: An extra value for some specific customers. For example, SBI adds another 15 bps for non-salaried customers or it will depend on the CIBIL score of the borrower. This value is also revised periodically, like every three years.

This article discusses the situation where new home loan customers are being offered much lower rates than existing customers. New customers have the options of reducing the loan after approaching their lender.

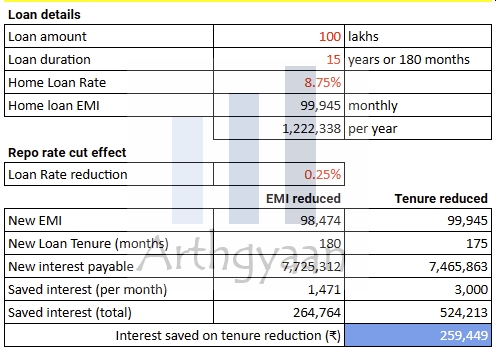

We will now look at the benefits of reducing your home loan from 9% to 8.5% after payment of a small reduction fee.

We will now use a sample home loan to see what happens when you get the rate reduced. If you are using Excel to calculate your home loan EMI, the formula to use is:

EMI = PMT(rate/12,time * 12,-principal,0,0)) where time = years left to pay the loan

Interest paid = EMI * Number_of_EMIs - Principal left

| Metric | Value |

|---|---|

| Loan balance (₹ lakhs) | 50 |

| Old rate of interest | 9.00% |

| Years left | 15 |

| Period left (months) | 180 |

| EMI | 50,713 |

| Total interest to be paid | 41,28,399 |

| New rate of interest | 8.50% |

| Conversion fee | 10,000 |

| ######## | ######## |

| Option 1: | Lower duration |

| EMI | 50,713 |

| New period left (months) | 170 |

| Period reduction (months) | 10 |

| Total interest to be paid | 36,21,266 |

| Interest saved | 5,07,133 |

| ######## | ######## |

| Option 2: | Lower EMI |

| EMI | 49,237 |

| Monthly EMI savings | 1,476 |

| Conversion fee recouped | 7 months |

| Total interest to be paid | 38,62,656 |

| Interest saved | 2,65,743 |

As we can see, lowering the EMI has an immediate benefit whichever option you take.

The lender, who gave you the home loan, benefits the higher the interest rate and the longer you keep paying the EMI. Banks will jack up the home loan rate as soon as the reference rate goes up.

As the borrower, your main incentive is to make the interest rate as low as possible, even after paying the conversion fee.

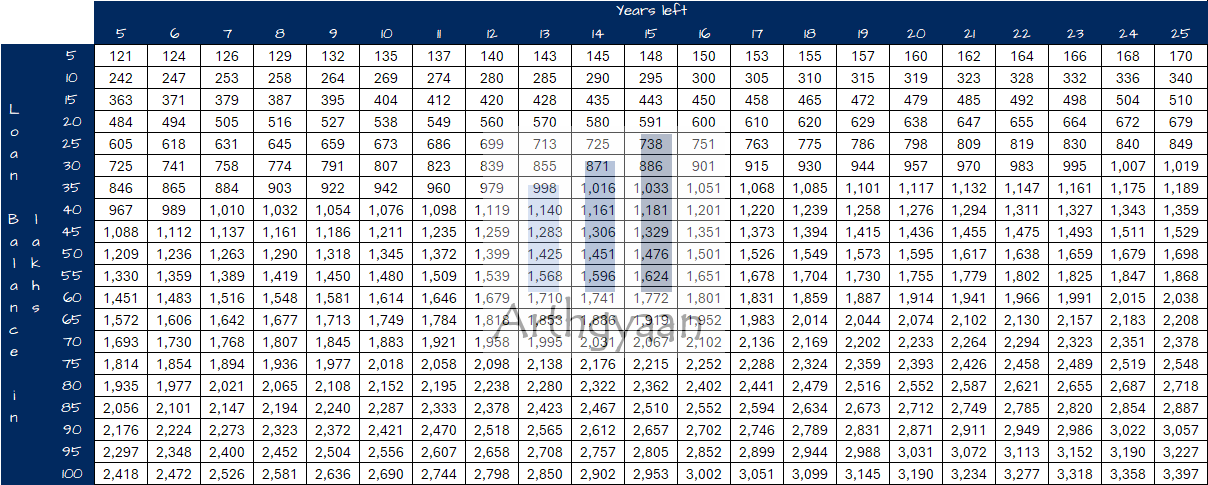

We will now look at various savings values for interest and time if you reduce the rate. These tables assume that the old rate is 9% and the new rate is 8.5%. The benefits of EMI reduction are shown below.

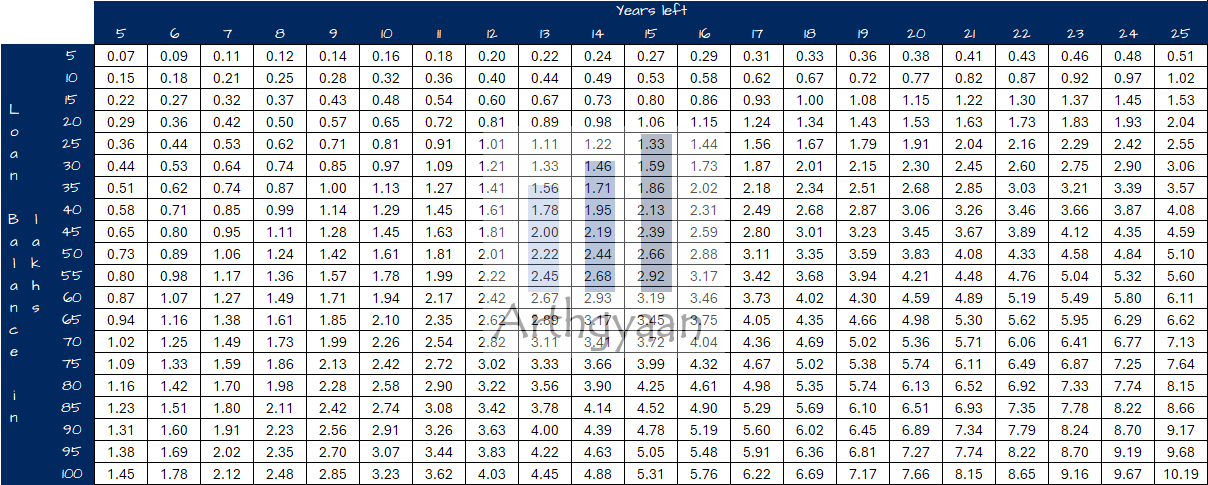

This table shows the monthly EMI reduction when your rate reduces for various combinations of outstanding amount and loan period left.

If you need a free calculator to understand the savings, as shown below, here is the free calculator to know the interest rate savings on repo rate reduction on home and other loans.

This table shows the reduction in total interest when your rate reduces for various combinations of outstanding amount and loan period left. Here you are reducing the EMI you are paying (maybe to invest for long-term goals) and keeping the tenure same.

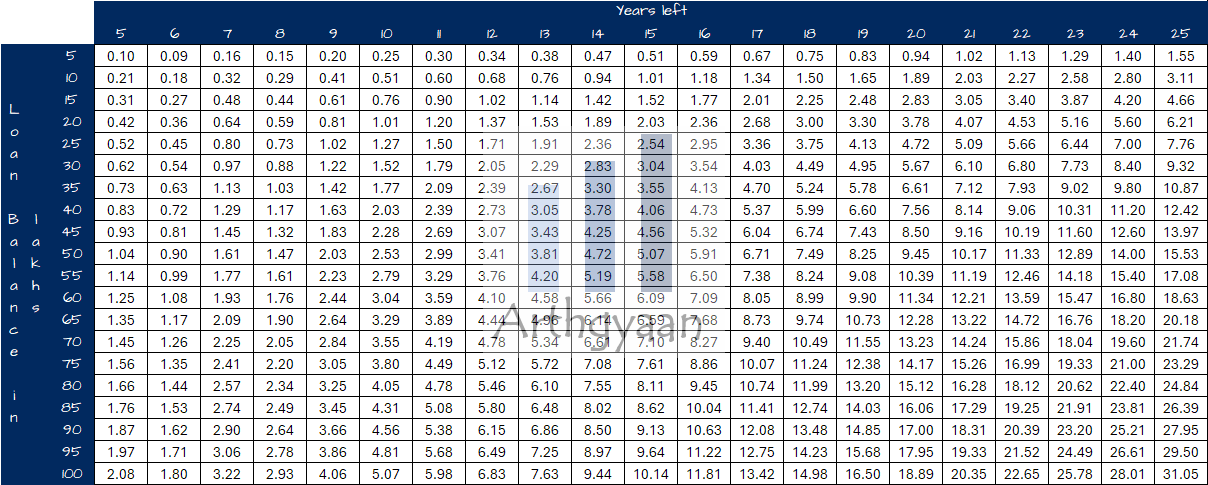

This table shows the reduction in total interest when your rate reduces for various combinations of outstanding amount and loan period left. Here you are reducing the tenure to get rid of the loan faster.

Your objective should be lower the interest rate as soon as possible unless the conversion fee is extremely high. In such cases porting the loan might be an option which we will cover in a future article.

This conversion fee (plus 18% GST) is not regulated by SEBI or RBI (they have no reason to) and serve as the mental block for borrowers not to reduce their interest rate. Hopefully after reading this article, you know the benefit of lowering the rate even after paying the conversion fee.

Lenders offer multiple channels for contacting them like physical branch (or loan processing centre) visits, via app, on phone or via email. It might be even possible to get different offers based on the channel you are checking (branch vs app) and in some cases the fee could be negotiable.

But surprisingly nowadays, the reduction of interest rate after repo rate cut is automatic and the interest rate savings are immediate: Repo Rate Cut leads to Banks Reducing Home Loan Rates Automatically: Find Out How Much Lower Interest You Need To Pay

RBI will raise repo rates as per its role as a central bank and home loan rates will follow. Even in such cases, a temporary reduction will be beneficial since the new increase in loan rate will be the same as the repo rate increase.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How paying a small fee to your bank can save you lakhs in home-loan interest? first appeared on 11 Oct 2023 at https://arthgyaan.com