How does an overdraft loan like SBI Maxgain work?

This articles describes overdraft home loans like SBI Maxgain and BOB Home Loan Advantage.

This articles describes overdraft home loans like SBI Maxgain and BOB Home Loan Advantage.

This article is a part of our detailed article series on the concept of home loans. Ensure you have read the other parts here:

This article breaks down the benefits of prepaying your home loan and how it impacts both your interest payments and tax savings.

This article shows how quickly you can pay off your home loan, and even save a lot of interest, by increasing your EMI steadily year-on-year.

This article tells you why it is a good idea to buy a home jointly as a couple and it is not only the tax benefits you get.

This article shows you an easy way to calculate how big a house you can buy based on your family’s combined monthly salary.

Home loan rate hike? You can prepay to keep EMI and tenor same. This post shows how.

This article shows how paying a small fee to your bank to reduce your home loan rate can save you lakhs in interest over the life of your loan.

This article shows you the benefits due to interest saving when you make a part-payment to your home loan. Your loan duration also reduces due to the pre-payment.

This article shows a handy ready reckoner for home loan EMI amounts for all tenures and interest rates along with the amount of principal and interest to be paid.

This article helps you decide when to prepay your home loan - at the beginning, middle or end of the total loan period.

This post discusses managing when interest rates go up increasing your home loan EMI.

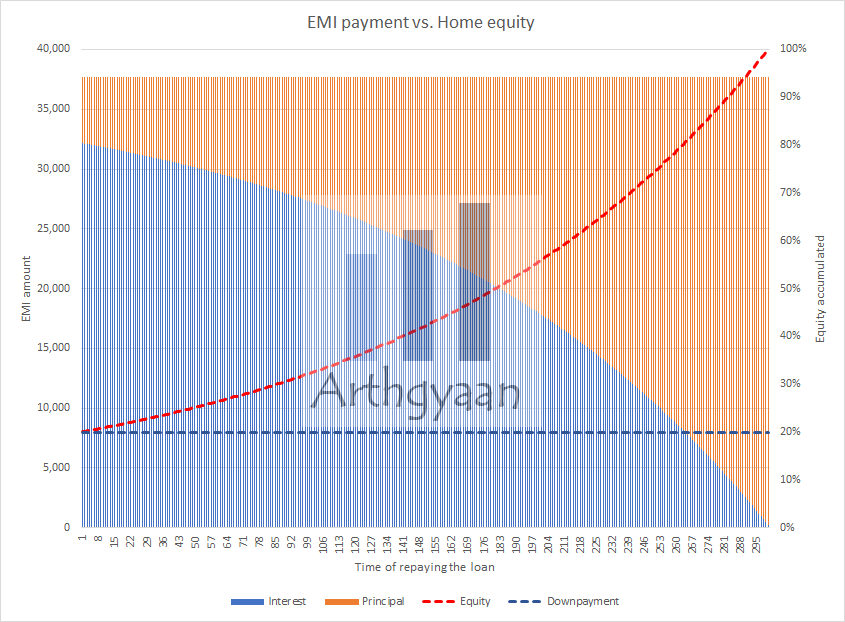

A home loan is a standard term loan where a fixed amount is taken as a loan, called the principal, and then paid back in installments, called EMI, every month. The EMI is designed to be fixed over the term of the loan. If the interest rate of the loan changes over time, the EMI will change. This point is the distinction between fixed and floating types of term loans.

The bank gives a home loan to own the property while using it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that has both interest and principal in the same amount.

EMI = Principal + Interest

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point, and the rest of the EMI is the principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

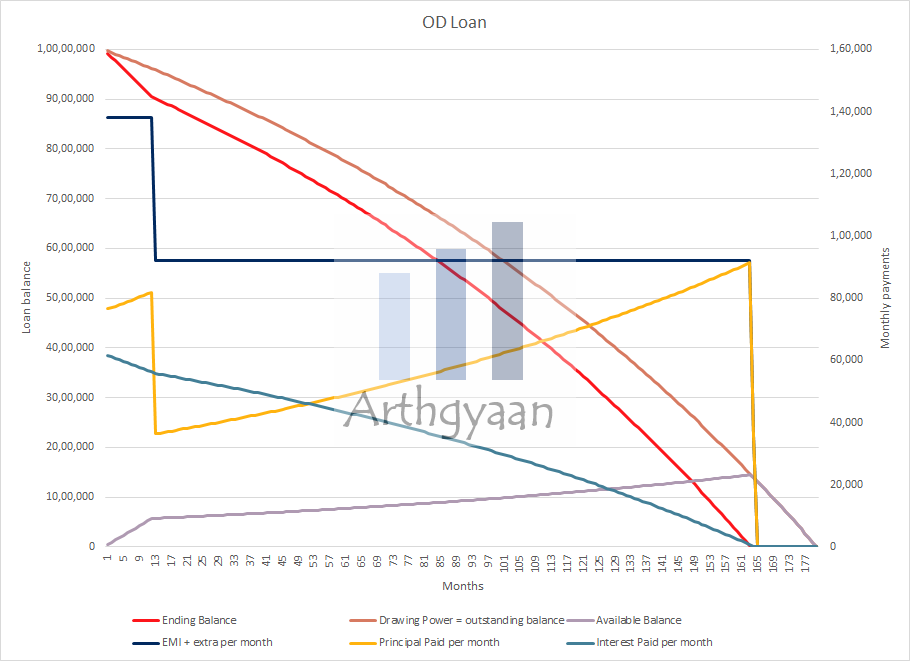

An overdraft (OD) loan is a secured loan that is offered against collateral like FD (very typical), home or other assets. The key feature of an OD loan is that interest is charged only on the amount you borrow and not on the amount sanctioned. We can extend this concept to a home loan as well and create a special home loan using the same mechanics as an OD account.

An overdraft home loan, like SBI Maxgain or Bank of Baroda Home Loan Advantage, is a special case of the standard floating rate loan. The OD facility allows you to park excess cash in the OD account with three main features:

There will be a time when the ending balance will become zero due to the fact that the entire principal, less the surplus parked in the OD account, has been paid. At this point, if you do not need the money in the OD account, you can simply prepay the loan using the surplus and close the loan.

If your loan is taken for under-construction property using something like a Construction Linked Plan (CLP), the undisbursed loan amount is a part of the Available Balance. You need to know that in the case of a CLP, you cannot take out the surplus amount from the OD account. You can do so only once the undisbursed amount becomes zero.

If you are paying the complete EMI on such a loan that has been partially disbursed, the interest part of the EMI is calculated on the book balance which is now lower than the sanctioned amount. For example, for a 50L sanctioned amount and 15-year outstanding loan, the EMI is ₹44,941. If the disbursement is only 20L, then the EMI is same but the EMI of a ₹20L loan is only ₹17,977. Hence the difference of ₹44,941-17,977 will go as an extra payment to the principal reducing both the tenure and the interest. Therefore if you have taken a CLP loan with OD facility, always pay the full EMI from the beginning instead of the pre-EMI interest option where you pay only interest.

All home loans have the following tax benefits:

For an OD loan, the amount parked in the OD account is not eligible for either Section 80C or 24 deduction. The actual principal and interest repaid in the EMI are eligible. The bank will provide an interest certificate that will capture this interest and principal repaid information that will help you in tax filing.

Parking any amount of cash in the OD account, even for a day, will reduce the total interest you need to pay over the loan’s lifetime. This benefit has to be balanced vs the higher interest rate of the OD loan against the interest saving using the methods below.

A sinking fund is used to save for periodic expenses. These are known costs that are usually mandatory (insurance payments), but a few can be discretionary (like mobile phone replacement). The key here is that the expense is periodic at a frequency lower than once a month. Periodic expenses can be once a quarter, once every six months, annually or once every 2 to 3 years. You could park the sinking fund in the OD account and fund your periodic expenses from there.

Read more here: Budget 101: How to save for periodic expenses: the sinking fund

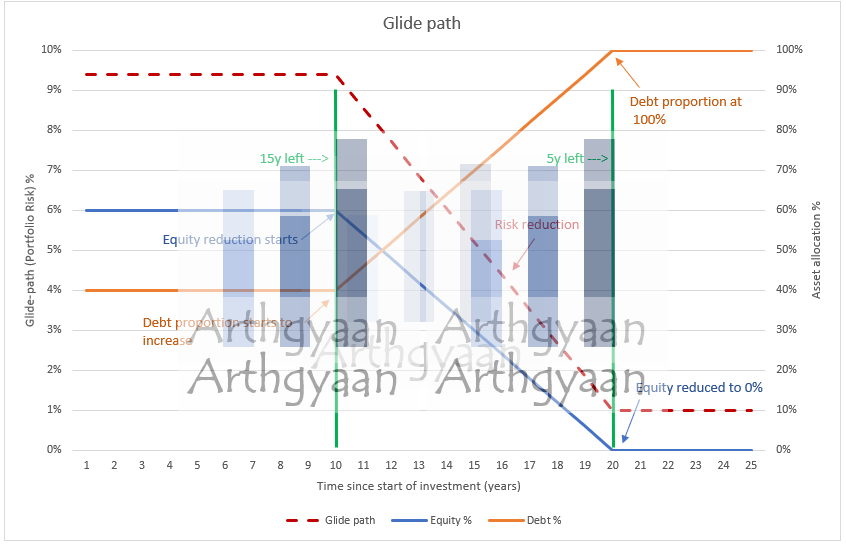

As per the asset allocation plan for goals based on the goal horizon (when the money is needed for the goal), we need to move the corpus to safe options as the goal comes closer. If we park this amount in the OD account, there will be significant interest savings if the goal amount is large. If you are using the Arthgyaan goal-based investing calculator, you can use to park the part of your debt SIP that is due for the next five years in this OD account. The cash allocation section in the bottom right of the image below from the calculator shows the amount that you can hold in the OD account.

Read more here: Budget 101: How to save for periodic expenses: the sinking fund

You can use the OD account as the everyday expenses account for running the monthly household expenses. However, please remember that ATM withdrawals are not free as it is an OD account. Hence you should use this account only for online payments.

In the next part of this article, we have covered how to choose between fixed, floating or overdraft home loans here:

First time home buyers: should you choose fixed, floating or overdraft type home loan?

An overdraft (OD) home loan, like SBI Maxgain or Bank of Baroda Home Loan Advantage, is a special case of the standard floating rate loan. The OD facility allows you to park excess cash in the OD account with three main features: (1) whatever cash amount you park in the OD account reduces the effective principal on which the interest is calculated, (2) the amount in the OD account is reasonably liquid and can be used for day-to-day expenses, savings for short term goals, keeping your sinking fund as well as the EMI buffer fund, and (3) the interest rate of the OD loan is slighty higher (e.g. for SBI as a lender) than term loans.

The OD loan terminologies are Drawing Power (DP), Surplus parked, Available Balance (AB), Book Balance (BB), EMI, Beginning and Ending Balance, and Interest part of EMI.

Drawing Power (DP) is the outstanding balance of the loan or simply the principal to be paid back.

Surplus parked is an extra amount kept in the OD account.

Available Balance (AB) is the surplus parked amount plus accrued interest savings.

Book Balance (BB) is the difference between Drawing Power (DP) and Available Balance (AB).

EMI is the Equated Monthly Instalment of the loan that consists of Principal and Interest. The EMI does not depend on any surplus parked amount and will remain constant throughout the loan tenure, assuming the interest rate does not change.

Beginning and Ending Balance are essentially the amounts you owe to the bank. As you pay, the principal reduces. The ending balance of the current period becomes the beginning balance of the next one. Ending balance = Beginning Balance - Principal Component of the EMI in this month.

Interest part of EMI is the interest component of the EMI. The calculation is against book balance on a daily basis.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How does an overdraft loan like SBI Maxgain work? first appeared on 22 May 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.