How can you pay the least interest and get the most tax deduction on your home loan?

This article breaks down the benefits of prepaying your home loan and how it impacts both your interest payments and tax savings.

This article breaks down the benefits of prepaying your home loan and how it impacts both your interest payments and tax savings.

This article is a part of our detailed article series on the concept of home loans. Ensure you have read the other parts here:

This article shows how quickly you can pay off your home loan, and even save a lot of interest, by increasing your EMI steadily year-on-year.

This article tells you why it is a good idea to buy a home jointly as a couple and it is not only the tax benefits you get.

This article shows you an easy way to calculate how big a house you can buy based on your family’s combined monthly salary.

Home loan rate hike? You can prepay to keep EMI and tenor same. This post shows how.

This article shows how paying a small fee to your bank to reduce your home loan rate can save you lakhs in interest over the life of your loan.

This article shows you the benefits due to interest saving when you make a part-payment to your home loan. Your loan duration also reduces due to the pre-payment.

This article shows a handy ready reckoner for home loan EMI amounts for all tenures and interest rates along with the amount of principal and interest to be paid.

This article helps you decide when to prepay your home loan - at the beginning, middle or end of the total loan period.

This articles describes overdraft home loans like SBI Maxgain and BOB Home Loan Advantage.

This post discusses managing when interest rates go up increasing your home loan EMI.

There is only one lever to pull when paying off a home loan to reduce the interest you pay and the tax deduction you receive. This lever is the amount you decide to prepay at any time to pay off the loan more quickly.

There is nothing else you can do regarding the home loan since:

The right answer is Neither.

The best thing to do, when paying off your home loan, is to choose a prepayment plan that maximises the Net Present Value of your net loan cash flows: How Net Present Value (NPV) Can Help You Make Smarter Financial Decisions

Net Cash Flow = EMI + Prepayment - Tax Savings

Net Present Value = NPV( rate, [ -loan amount , net cash flows …] )

🤖 Explainer: What is Net Present Value?

We will now try to explain a few bits intuitively without mathematics.

If the NPV discount rate is equal to the loan rate, NPV = 0

For convenience, we set the NPV discount rate (minimal acceptable rate of return) equal to the loan interest rate. This result holds because the EMI is calculated at the same rate as the loan rate, giving a zero NPV.

After-tax loan rate = Loan rate * (1 - marginal tax rate)

| Loan rate | New tax regime | 10% slab | 20% slab | 30% slab |

|---|---|---|---|---|

| 7.00% | 7.00% | 6.30% | 5.60% | 4.90% |

| 7.25% | 7.25% | 6.53% | 5.80% | 5.08% |

| 7.50% | 7.50% | 6.75% | 6.00% | 5.25% |

| 7.75% | 7.75% | 6.98% | 6.20% | 5.43% |

| 8.00% | 8.00% | 7.20% | 6.40% | 5.60% |

| 8.25% | 8.25% | 7.43% | 6.60% | 5.78% |

| 8.50% | 8.50% | 7.65% | 6.80% | 5.95% |

| 8.75% | 8.75% | 7.88% | 7.00% | 6.13% |

| 9.00% | 9.00% | 8.10% | 7.20% | 6.30% |

| 9.25% | 9.25% | 8.33% | 7.40% | 6.48% |

| 9.50% | 9.50% | 8.55% | 7.60% | 6.65% |

| 9.75% | 9.75% | 8.78% | 7.80% | 6.83% |

| 10.00% | 10.00% | 9.00% | 8.00% | 7.00% |

Some investors may prefer to set the discount rate equal to the after-tax rate of the loan due to the tax deduction on interest, as per the table above.

If you are in the old tax regime, you can deduct up to ₹200,000/year of home loan interest from your taxable income. This way, depending on your tax slab, you can get tax savings per financial year as follows:

| Tax bracket | Tax Savings upto |

|---|---|

| 0% | 0 |

| 10% | ₹20,000 |

| 20% | ₹40,000 |

| 30% | ₹60,000 |

| New tax regime | 0 |

Related: Which is the best tax regime: old or new?

Since the discount rate used in NPV is the same as the loan rate, any tax savings during the repayment period give a positive NPV. This NPV cannot increase further unless the borrower moves into a higher tax bracket during the loan’s lifetime.

Therefore, any prepayment will only reduce the NPV of the loan.

When you prepay a loan:

The NPV calculation lets us know whether prepayment is beneficial based on these rules:

The Arthgyaan goal-based investing calculator shows you this impact on interest paid and tax savings due to loan prepayment. We have a tab “loan-calculation” that allows you to see these changes.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

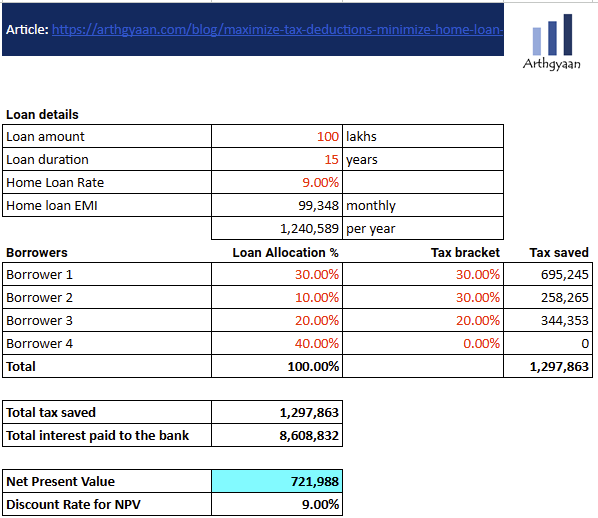

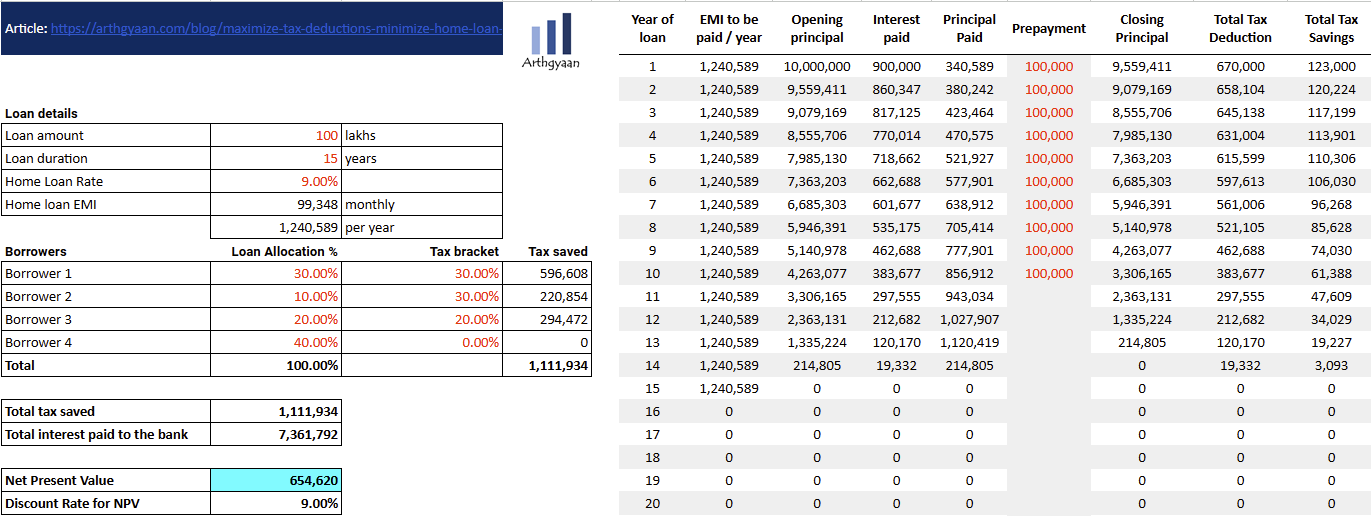

We will assume an outstanding loan balance of ₹1 crore borrowed for 15 years at 9%. The calculator allows you to calculate the total tax deduction for up to four borrowers on the loan, each with their tax rate. If any borrower is on the new tax regime, you can set their tax rate to zero which effectively zeroes out any tax benefits on the home loan.

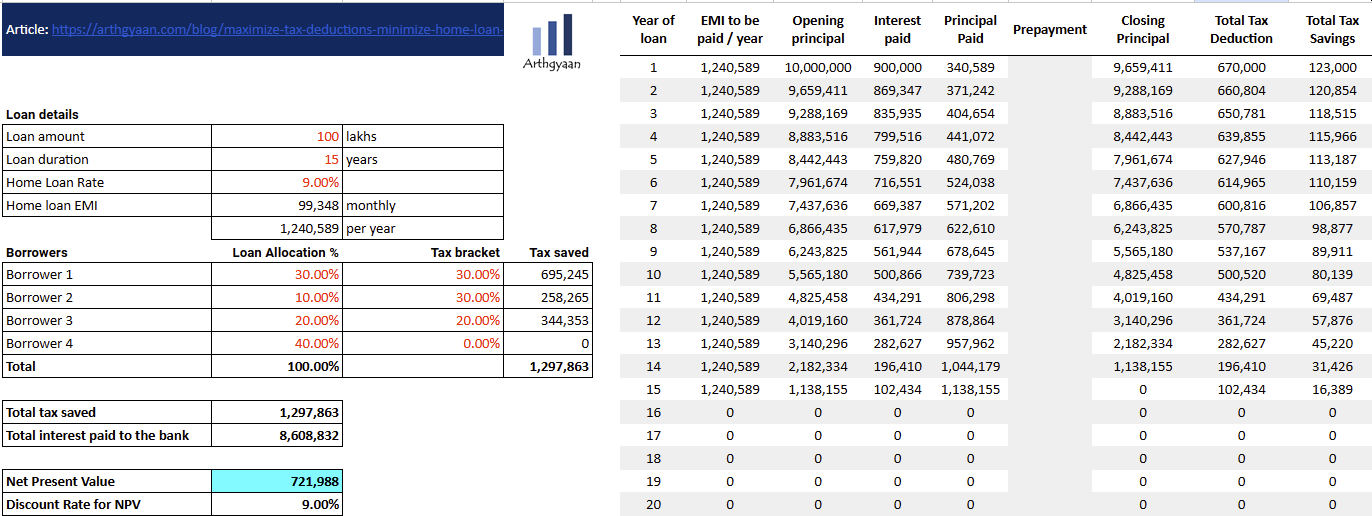

Here we make a single ₹10 lakhs prepayment in the second year.

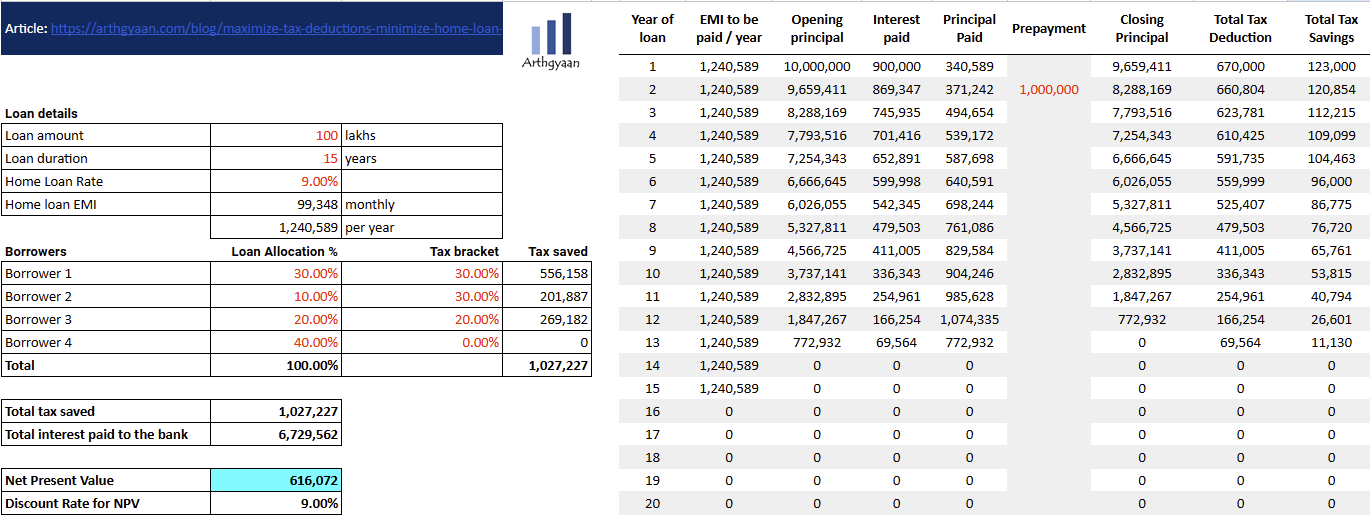

Here we make ten one lakh prepayments in the first ten years of the loan.

| Calculation | Base Case | Case 1 | Case 2 |

|---|---|---|---|

| Total tax saved | 12,97,863 | 10,27,227 | 11,11,934 |

| Total interest paid | 86,08,832 | 67,29,562 | 73,61,792 |

| Net Present Value | 7,21,988 | 6,16,072 | 6,54,620 |

Here it is interesting to see that paying smaller regular amounts via prepayment is better than one large prepayment at the beginning. This is due to time value of money and that ₹10 lakhs at the beginning of the loan does not earn a lot of interest outside the loan. The second case pays more interest but has a higher NPV.

You can use the calculator with various prepayment values and see which numbers you like to have. At the end of the day, it is not a case of simple prepayment but a case of investing a lump-sum amount in the loan or in your portfolio. We explain how to do that below.

Whenever you have some extra money available that you are not spending:

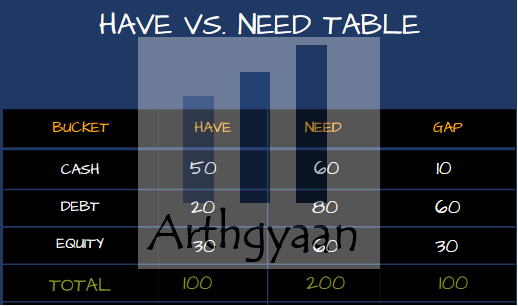

We extend the concept of the bucket theory of portfolio construction to create a framework to be used in the accumulation, i.e. the pre-retirement stage when the investor has active income and is investing for future goals.

The Arthgyaan Have vs Needs framework (HvN) is a simple tool to tell you how much money you need to invest:

We will now break this down in simple terms. There are two important questions that investors who are investing for their goals ask:

The Arthgyaan HvN framework needs you to make a very 4x4 simple table with three asset class buckets and for each bucket asks you to calculate three numbers: the amount you already have (the HAVE column), the amount you need to reach your goals (the NEED column) and the difference between the two (the GAP column).

The three buckets are:

The columns are:

We also have a TOTALs row to give a high-level view of the portfolio.

You can follow the complete guide here: How to invest a lump sum amount for your goals?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can you pay the least interest and get the most tax deduction on your home loan? first appeared on 22 Sep 2024 at https://arthgyaan.com