Will NPS Vatsalya Give Your Child Eleven Crores When They Retire?

This article discusses the corpus projections shared officially when launching the NPS Vatsalya scheme and how parents should be aware of the danger of ignoring inflation.

This article discusses the corpus projections shared officially when launching the NPS Vatsalya scheme and how parents should be aware of the danger of ignoring inflation.

This article is a part of our detailed article series on avoidable investment plans for your children. Ensure you have read the other parts here:

This article discusses the NPS Vatsalya scheme that does not really offer any greate benefits over simply investing in mutual funds.

This article discusses the NPS Vatsalya scheme that does not make any sense as a product for anyone even if you plan to invest for your children’s retirement.

We review the new LIC Amritbaal insurance cum investment plan so that parents are aware that the plan is not good for most people. We will also show what to do instead for your kid’s goals.

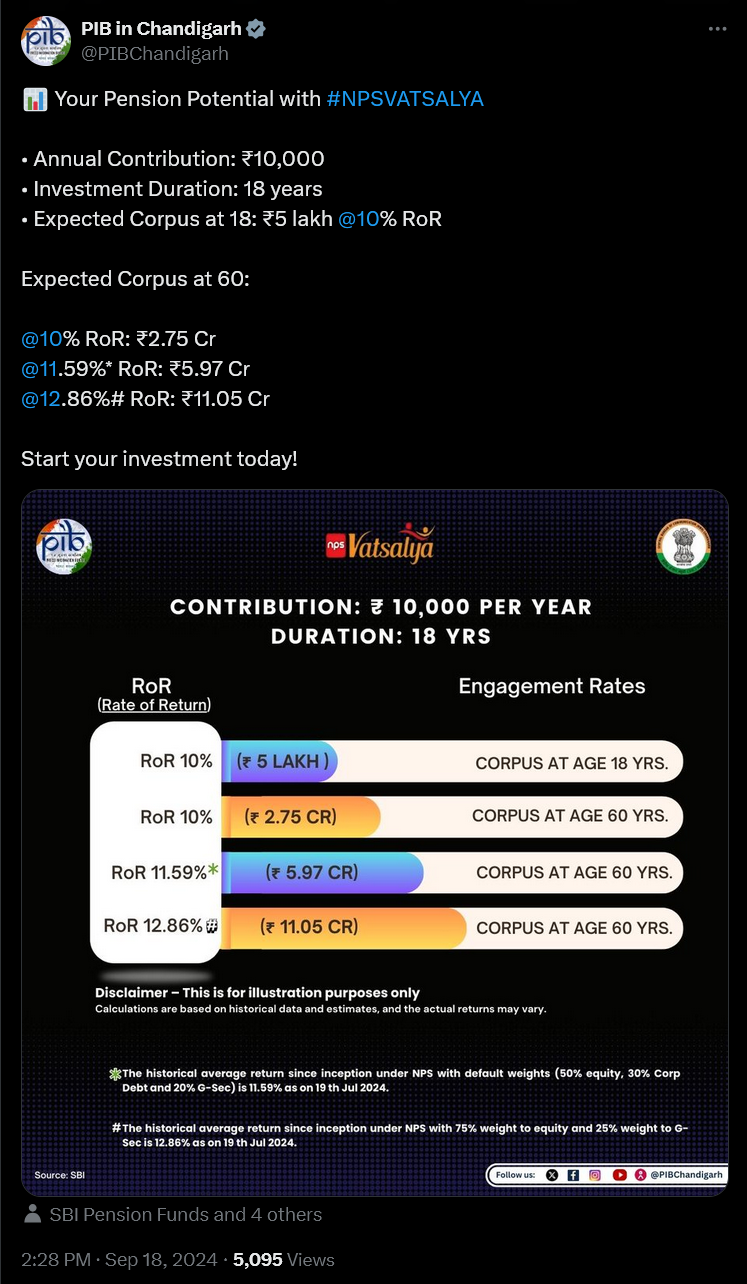

We saw this tweet when analysing the NPS Vatsalya launch on 18 September 2024. The source is the official Twitter account of the Press Information Bureau (Chandigarh office):

© X / https://x.com/PIBChandigarh/status/1836329030695391394

What does the Tweet (X?) say?

Then, your child will get ₹11.05 crores when they reach the age of 60.

This article is a part of our detailed article series on the NPS Vatsalya scheme. Ensure you have read the other parts here:

This article describes the tax benefits announced in Budget 2025 for the NPS Vatsalya Scheme to understand if these benefits make NPS Vatsalya a good scheme for children’s future.

This article explores using the NPS Vatsalya scheme for grandparents to transfer wealth to their grandchildren by gifting them a large corpus to be used to create a pension income stream.

This article discusses the NPS Vatsalya scheme that does not really offer any greate benefits over simply investing in mutual funds.

This article discusses the NPS Vatsalya scheme that does not make any sense as a product for anyone even if you plan to invest for your children’s retirement.

There is nothing wrong with the projection mathematically. After all,

Corpus = FV(return,years,annual_contribution,0,0)

Corpus = FV(0.1286,60,-10000,0,0) = ₹11.03 crores

Using Excel / Google Sheets, you can type in this formula “=FV(0.1286,60,-10000,0,0)” and get the same result.

We will also make the, albeit ludicrous, assumption that the underlying NPS Vatsalya portfolio with equity and debt in a pre-defined proportion behaves like an FD and gives a fixed 12.86% a year.

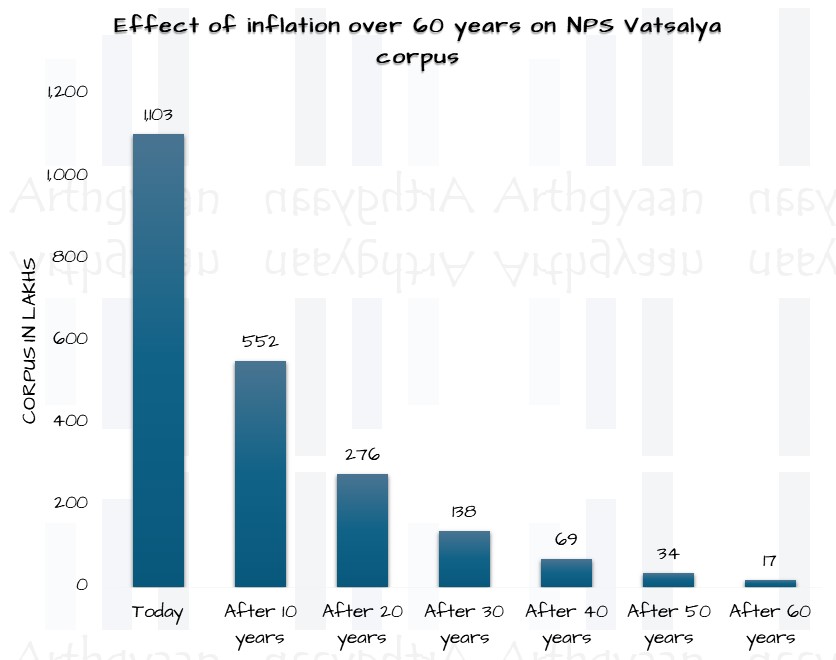

The bigger problem, for those who have not come across the nuance, is that the ₹11 crores is not after inflation. Let us not ignore that this corpus was created after 60 years.

We use the rule of 72 to estimate the effect of inflation quickly. 7% inflation of goods and services shows that the cost will double in approximately 10 years or the purchasing power of money will be cut by half. So if you have 8 crores today, somehow, then the

Applying the same logic to the ₹11 crore corpus, we see that after 60 years, the accumulated ₹11 crores will have the same worth as ₹34 lakhs today.

A quick mental maths shortcut to calculate this is:

This is where the absurdity of ignoring inflation in making a 60-year projection hits.

Let’s assume that the entire NPS corpus at retirement is invested into a pension plan at the age of 60.

Let’s also assume, that 60 years later, Indian annuities are still offering a 7% return.

What is the pension per year?

₹11 crores at 7% gives ₹77 lakhs/year or ₹6.43 lakhs/month pension

After 60 years of inflation, these numbers were reduced by 64 times

₹17 lakhs at 7% gives ₹1.2 lakhs/year or ₹10,000/month pension

Let’s not forget that this ₹10,000 stays fixed for life and loses 50% value every decade. You need to understand what exactly your child will do with ₹10,000/month where on paper, they are sitting on ₹11 crores of corpus.

That is not the point of this article. We can always plug in numbers in Excel and make assumptions to get any number after 60 years.

However, the point of this article is not to discuss the alternatives to NPS but to complete the picture when rosy scenarios like the PIB tweet are shown.

We anyway strongly believe that NPS Vatsalya is a gimmicky product that is best avoided. There are much better options to create a huge, inflation-adjusted corpus for your children: NPS Vatsalya details revealed: is it good for your children’s future or avoidable?.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Will NPS Vatsalya Give Your Child Eleven Crores When They Retire? first appeared on 20 Sep 2024 at https://arthgyaan.com