NPS Vatsalya details revealed: is it good for your children's future or avoidable?

This article discusses the NPS Vatsalya scheme that does not really offer any greate benefits over simply investing in mutual funds.

This article discusses the NPS Vatsalya scheme that does not really offer any greate benefits over simply investing in mutual funds.

This article is a part of our detailed article series on avoidable investment plans for your children. Ensure you have read the other parts here:

This article discusses the corpus projections shared officially when launching the NPS Vatsalya scheme and how parents should be aware of the danger of ignoring inflation.

This article discusses the NPS Vatsalya scheme that does not make any sense as a product for anyone even if you plan to invest for your children’s retirement.

We review the new LIC Amritbaal insurance cum investment plan so that parents are aware that the plan is not good for most people. We will also show what to do instead for your kid’s goals.

Union Budget 2024 introduced the concept of the NPS Vatsalya Scheme. This scheme allows parents to open an NPS account for their child and contribute to it. When the child becomes an adult at 18, this NPS Vatsalya Scheme account will become the child’s own NPS account for their retirement at the age of 60. Budget 2025 has allowed up to ₹50,000/year tax deduction to the parent if they invest in the NPS Vatsalya Scheme as described here: Budget 2025: what income tax benefits are there for NPS Vatsalya? Is it good for children?.

This article is a part of our detailed article series on the NPS Vatsalya scheme. Ensure you have read the other parts here:

This article describes the tax benefits announced in Budget 2025 for the NPS Vatsalya Scheme to understand if these benefits make NPS Vatsalya a good scheme for children’s future.

This article explores using the NPS Vatsalya scheme for grandparents to transfer wealth to their grandchildren by gifting them a large corpus to be used to create a pension income stream.

This article discusses the corpus projections shared officially when launching the NPS Vatsalya scheme and how parents should be aware of the danger of ignoring inflation.

This article discusses the NPS Vatsalya scheme that does not make any sense as a product for anyone even if you plan to invest for your children’s retirement.

On 18th September 2024, the Finance Minister revealed these additional details:

The complete details of the scheme are in this thread from the PIB: https://x.com/PIBChandigarh/status/1836320481516855749

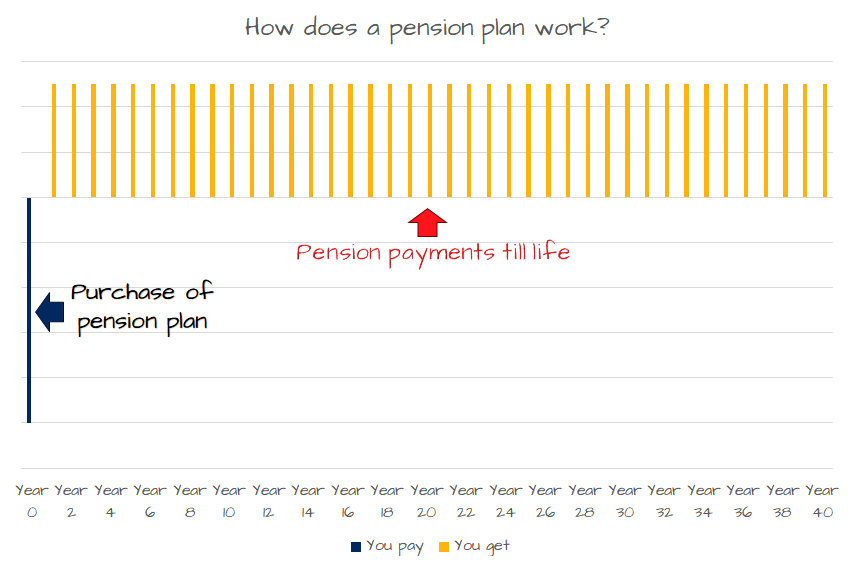

A pension plan gives you money every year until life. Pension is a fantastic product that made a lot of sense in the socialist world of the 1960s-2000s India but is meaningless today. Here are the reasons why we say so:

No, of course not.

A pension plan, very simply, is a deal between an insurance company and you to get regular sums of money until death in exchange for a large lump-sum payment today.

If you invest in NPS, the government makes it a rule to invest at least 40% of the corpus reached at the age of 60 into a pension plan while the rest is given to you tax-free. You can, of course, invest more than 40% also in the pension plan.

Here are two important points regarding the pension plan:

So while the pension payment is guaranteed to you for life, the amount you get as a pension depends on how much you invested into the pension plan.

Imagine two fathers, Ram and Shyam, who invested for their kids Raju and Sanju (respectively) into NPS Vatsalya Scheme. Both accounts were started on the same date when the kids, who were both born on the same date in 2015, turned 10:

8 years later the accounts become major NPS accounts when the kids turn 18. The same amounts keep getting invested. At the age of 25, on their birthday, Raju and Sanju start working. Their fathers stop investing and they start themselves:

They invest the same amount every month for the next 35 years and retire at the age of 60. They take the entire NPS corpus and purchase the pension plan.

Who gets more pension every month?

Obviously, the answer is Sanju since throughout the 50 years (age 10 to age 60) there was more invested in his NPS account. In fact, everything else was the same, except that Sanju’s account had 5 times the amount invested and therefore he gets 5 times the pension than Raju.

You can easily reach the same corpus without NPS by simply investing in mutual funds.

So, if you see a headline in news media that

NPS Vatsalya Scheme lets children receive pension

please understand the nuance that you do not really need NPS Vatsalya Scheme to get a pension for your child.

This is another flawed argument. Let’s say that lock-in up to 60 is a good thing that stops the withdrawal of the retirement corpus for “frivolous” things.

That is true.

However, retirement corpus, by its very nature, is a multi-crore and multi-decade journey. Since an NPS account can be kept active with just a ₹1,000/year investment, anyone with a tendency to take out retirement money for non-retirement uses, can simply stop investing in the retirement account and use the money not invested for whatever they feel like.

Unless the parents pump in a few crores into an NPS Vatsalya Scheme account and let the child continue that until 60, the lock-in will not help in securing retirement. Even then, once the child is an adult, they can take out the entire NPS corpus, put 80% into an annuity (as per NPS rules on premature withdrawal) and start having “fun” with 20% of the corpus. By the time they reach retirement age, that annuity they purchased when they were young will not even cover a basic sustainable lifestyle.

We are not saying that NPS Vatsalya Scheme is bad. We are saying that better alternatives with full flexibility and more options exist once you follow the process described below step-by-step:

Your child’s school and other regular expenses will come from monthly income. But you need to plan for bigger expenses in advance:

Which of these are you saving for:

To understand how to create a child’s education plan:

You need to ensure that an untimely death will not prevent your child from going to their future dream college. Term insurance is the right product here. Every earning member of the family must have adequate term insurance.

The whole family, i.e. child and parents should also have sufficient health insurance. This step prevents loss of income or a setback to investment goals due to illness.

Children’s education and other goals do not exist in isolation. They are a part of the comprehensive goal-based planning that parents need to do for their own retirement and everything else. The process is explained best with these examples:

There are more case studies here: Case Studies.

We have proven that the goal-based investing process works in most market conditions in this article: What is the best way to invest for your child’s college education?.

As time passes, things change:

Therefore the plan created in Step 3 has to be reviewed and rebalanced to check if you are still on track: Are your investments on track for your goals?.

To implement all of the above steps in one easy-to-follow bundle, we have Arthgyaan Child Education goal packages. Choose the year closest to your desired college admission year to get started:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled NPS Vatsalya details revealed: is it good for your children's future or avoidable? first appeared on 18 Sep 2024 at https://arthgyaan.com