How to calculate term insurance coverage amount?

This article gives you an easy-to-use calculator to know your term insurance coverage amount.

This article gives you an easy-to-use calculator to know your term insurance coverage amount.

Note: This is post #200 on this blog. This milestone has been reached in 21 months since the day of starting this blog in March 2021. I wish to thank all my readers for their continued support.

Term insurance is a type of life insurance that pays a benefit to the named beneficiaries in the event of the insured person’s death, as long as the policy is active. The purpose of term insurance is to provide financial protection for the policyholder’s loved ones in the event of their unexpected death, helping to cover daily expenses, future goals such as children’s education, and loans like home loans.

It is a straightforward insurance product, similar to car insurance, in that it only pays out in the event of a specific occurrence (death) and does not have a savings component like other types of life insurance. Term insurance offers high coverage at a low cost and is the cheapest insurance plan that you can purchase to protect your family’s lifestyle and financial goals in case you die.

Insurance spreads financial risk across a large pool of policyholders, reducing individual financial burden. Since many people buy insurance, only some are expected to die within the policy’s coverage time. However, it should be present at least for all earning members of the family before retirement age.

The concept of term insurance and why you need it has been covered in detail in this article: Term life insurance: what, why, how much to get and from where?.

This article shows you how to calculate the coverage amount that you need.

As a thumb rule, typically, coverage will be 15-25x current annual income after tax.

There are two ways of calculating insurance coverage/sum assured needed. The coverage required typically changes every few years since financial goals and life events (like marriage, the birth of a child etc. happen) change the requirement. Please review the term coverage needed every 3-4 years. The method of calculation of coverage required is called Human Life Value (HLV) method.

Use a tool like Excel or Google Sheets to calculate using the following formula:

Coverage needed = PV(RealRate,Years_to_retire,-AfterTaxAnnualIncome,0,1)

Explanation:

Example:

Someone currently 32 years old in a high growth industry expecting to retire at 55 and having an after-tax annual income of 20 lakhs needs coverage of

PV(0%,55-32,-20,0,1) = 4.6cr.

If they already have a 1cr term plan, then you should take additional 3.5cr coverage.

Here are some lookup tables that can help you:

Case 1: Real rate = 0%

Case 2: Real rate = 1%

Case 3: Real rate = 2%

Coverage needed = PV(Real_Rate_In_Retirement,Years_In_Retirement,-Current_Annual_Expenses,0,1) + LoansOutstanding - Current_Investments - Existing_Term_Insurance where

Current_Annual_Expenses =

Salary credited to the bank

Example: (using the exact figures from above)

If a spouse spends 30 years in retirement where the real rate of return is 0% (a reasonable assumption), 33 lakhs in home loan outstanding, 80 lakhs in investments (stocks/mutual funds/FD etc. but not house) having 1cr current term insurance will need

Current_Annual_Expenses =

In hand salary less personal needs of the person being insured (20 lakhs salary less two lakhs personal expenses) less any EMI being paid (25k/month, i.e. three lakhs/year for a home loan) less any insurance premiums being paid (11k/year for 1cr term plan)

= (20-2) - 3 - 0.11 = 14.89 lakhs.

Coverage needed = PV(0%,30,-14.89,0,1) + 0.33 - 0.80 - 1.00

= 4.47 + 0.33 - 0.80 - 1.0

= 3cr

If you are using the comprehensive Google sheets-based goal planner then you will see the minimum term insurance you need to have based on:

This figure is the minimum since you need to add any ongoing outstanding secured loans (like home or car loans) or loans where family members may be co-borrowers to this coverage amount. This means that if you have 30 lakhs in an outstanding home/car loan or an educational loan of 10 lakhs with parents as co-borrowers, add those amounts to the term insurance coverage.

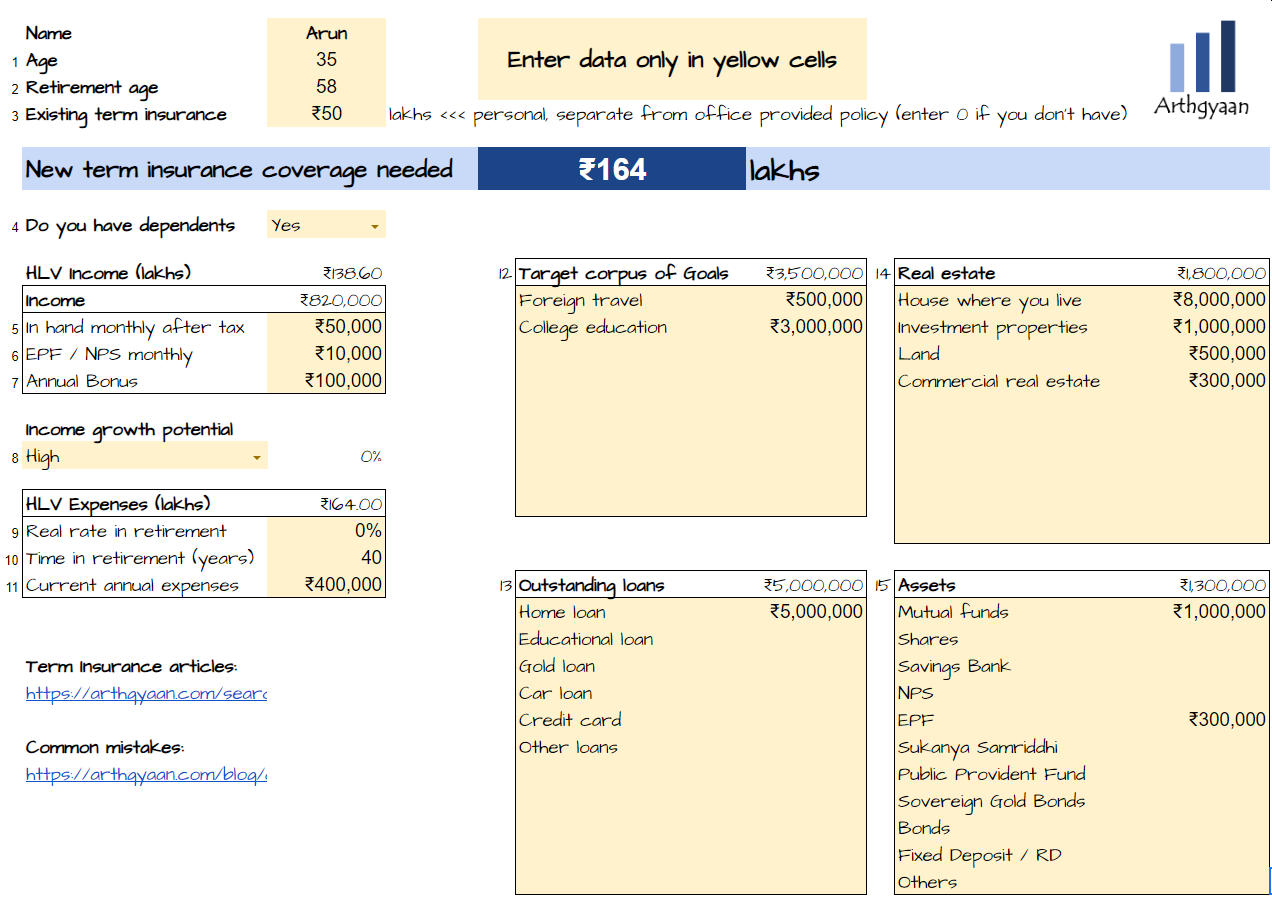

We have put together an easy-to-use calculator to calculate the coverage amount. The number will be approximate and will depend on the quality of the inputs that you enter into the calculator.

Important: You should enter data only in the yellow cells. If any cell is not relevant to you, please enter 0 to erase the number in the cell.

Box 4: This is a Yes/No choice. Generally, if you do not have dependents, you do not need term insurance unless you have loans.

This is for Box 12 and is an important section. If you do not fill this out correctly, you will underestimate the amount of insurance coverage needed. The value should be the target corpus of future financial goals, projected to the present. For example, if you need 10 lakhs in 5 years and can invest at 5% post-tax returns, the value will be ₹10/(1.05)^5 = ₹7.8 lakhs.

You can enter goals in the table one after the other. The total will be added and fed into the calculation.

Similarly, you need to enter the current outstanding amounts of all loans. For example, if you have a ₹70 lakhs home loan and have already paid off ₹20 lakhs, then enter 50 here.

This is for boxes 14 and 15. You need to enter the market value of all your assets. For real estate, the market value of your primary residence is not included in the calculation since you do not expect your family to sell their home since you died.

The result will be calculated and shown to you in the middle of the page. The number you see, in lakhs, is the additional coverage amount. If you are buying a new policy today, the coverage should be around this number. If the number comes to be very low or zero, you do not need term insurance coverage as explained here: How your term insurance coverage changes with time.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the term-insurance tab of the sheet once you open it.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to calculate term insurance coverage amount? first appeared on 13 Nov 2022 at https://arthgyaan.com