How your term insurance coverage changes with time?

Term insurance coverage needs to be reviewed as per life stages. This post shows how to do that.

Term insurance coverage needs to be reviewed as per life stages. This post shows how to do that.

This post assumes that you are aware of the concept of a term insurance policy. If not i.e. if you wish to understand who should purchase a term insurance policy and why along with FAQs, please refer to this post: Term life insurance: what, why, how much to get and from where?.

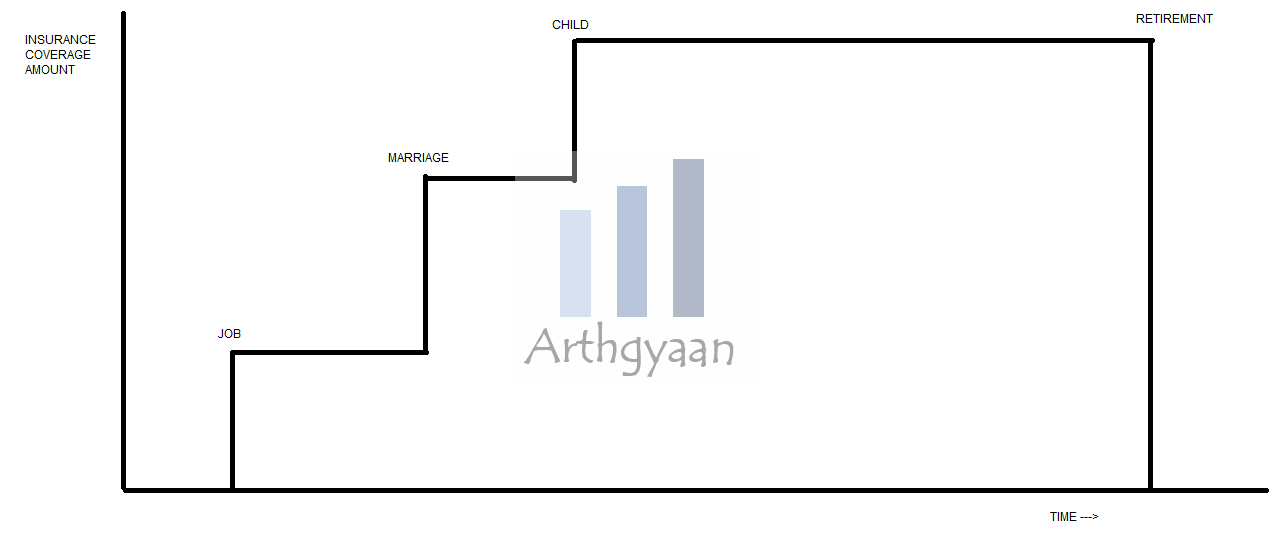

This article will analyse how term insurance coverage changes at various life stages. For example, simply because you get a job, start a family, have children, and buy a house, your life situations change, and you need more coverage.

The concept of term insurance is covered here: Term life insurance: what, why, how much to get and from where?

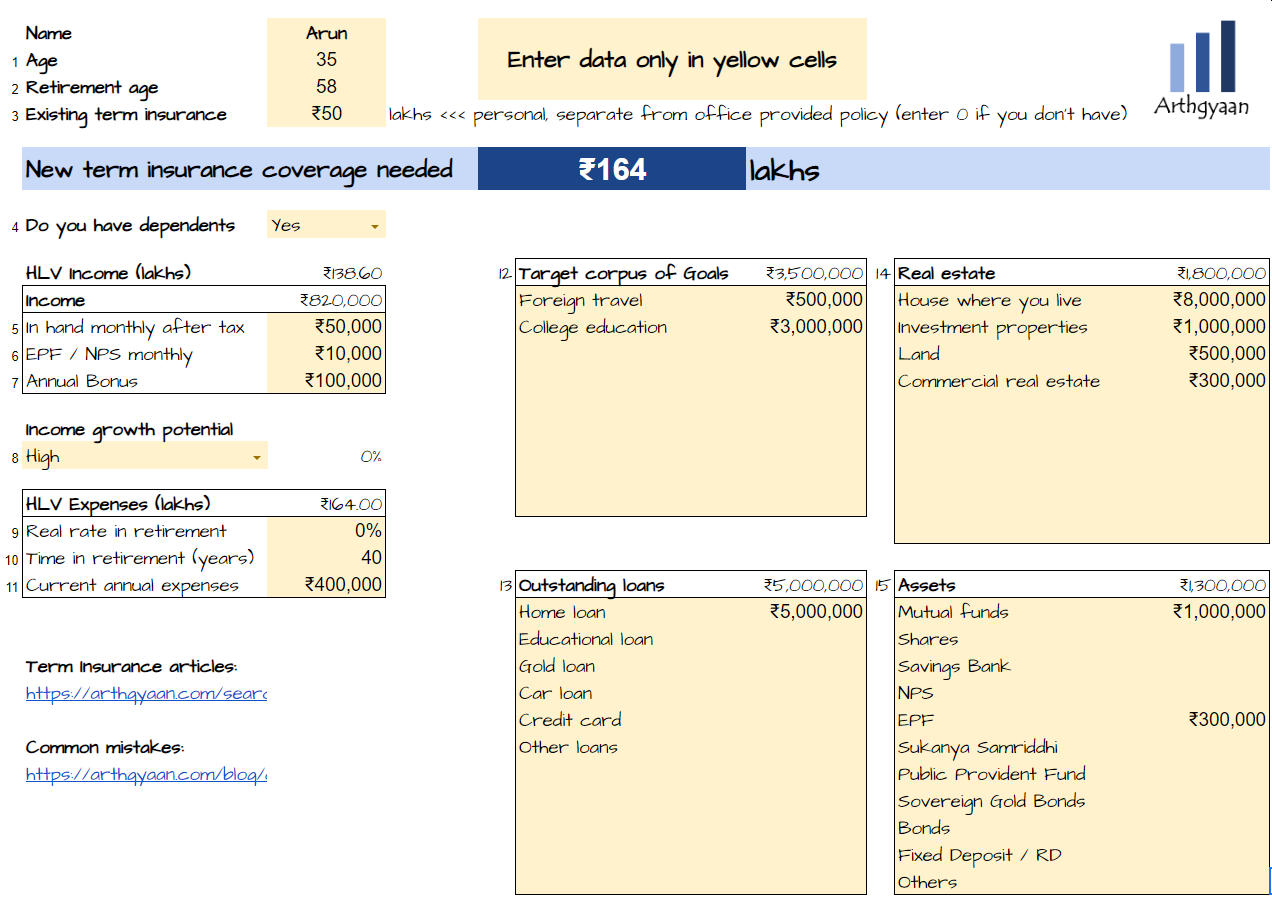

We will end this article with a calculator that will show the exact term insurance coverage you need at any point in life.

We will first cover two methods to calculate the term insurance coverage amount. We have explained the concept in detail here: How to calculate term insurance coverage amount?.

You can use a tool like Excel (free on office.com) or Google Sheets to calculate using the following formula:

Coverage needed = PV(RealRate,Years_to_retire,-AfterTaxAnnualIncome,0,1)

Coverage needed = PV(Real_Rate_In_Retirement,Years_In_Retirement,-Current_Annual_Expenses,0,1) + LoansOutstanding - Current_Investments - Existing_Term_Insurance

If you are using the Arthgyaan Google sheets-based goal planner then you will see the minimum term insurance you need to have based on:

We also have a simpler term insurance calculator built into the Arthgyaan Google sheets-based goal planner that can be used for free.

You can access the calculator and get instructions regarding how to use the calculator here: How to calculate term insurance coverage amount?.

We will now cover how term-insurance coverage changes across multiple life stages. The basic premise here is that income, dependents, and financial goals change at every life-stage transition.

A child does not have income and hence does not need any insurance coverage, term plan or otherwise. However, the parents and guardians should have sufficient term and health insurance.

This stage is that of the typical undergraduate/post-graduate college student with negligible income (maybe from an internship) but otherwise does not require term insurance. Of course, there might be an educational loan involved. Still, until the student starts earning, the onus will be on the parents who have co-signed that loan and should have insurance of their own.

You do not need insurance if you have just joined a job and do not have dependents. However, suppose you have an education loan. In that case, you should consider taking term insurance to avoid your co-borrowers having to pay the loan if something happens to you. You should also consider the following steps to set up your finances now that you have an income source: Life stage investing: how to manage finances when joining your first job.

Once you have identified dependents like parents and siblings, you should consider taking term insurance. You can calculate the term insurance amount applicable to you based on any of the methods above. A quick thumb rule to use at this stage is to take an insurance cover for whichever is the higher of these two:

A thumb rule like the above helps get you started and across the analysis-paralysis phase. When you apply, the life insurance company will require you to produce income proof (latest ITR or salary slips or joining letter) to decide your eligibility.

Once you get married, you need to sit down with your spouse and decide on your joint family goals. At this point, a few big goals will be the type of retirement targeted (traditional at 60 or earlier), whether to have children and their goals, whether to purchase a house, and the kind of lifestyle being aspired. Naturally, these goals will impact the amount spent on lifestyle expenses and planned investments. As an example, you never considered buying a house until now, but now you do. This new goal requires investments, and that will have to come from insurance if you die before enough has been accumulated to buy the house.

Your objective of taking term insurance will now be to ensure that the lifestyle your family is now used to is not impacted on your death. You should also take additional term insurance if you take a home loan:

This stage will require bumping up the term insurance coverage for two reasons:

At this stage, it is important to have reached a point of accumulated assets to last throughout retirement. The utility of term insurance at this point is minimal. Your retirement and other goals like children’s education and marriage should be almost funded. There is no need to have term coverage any more. You should stop paying the premium and let it lapse if there is still some coverage period left.

Once you no longer have active income or very minimal income from consultancy etc., there is no utility of term insurance. Either the policy has already lapsed, or if it has been taken for age beyond retirement, just let it expire. A term insurance policy is not a replacement for a retirement plan.

There are insurers offering term plans for ages like 70-100. They prey on the investor’s sentiment that since they will anyway die of old age, their families will get something. There are two problems with such policies:

When you take a home loan or a large loan like for foreign education, it is essential to get extra coverage. The bank will insist on having home loan insurance added to the loan. This policy will ensure that the loan will be paid off if you die. If you already have enough term coverage, that will cover your goals and the home loan’s outstanding balance.

Over the years, as you keep investing and your portfolio value increases, your goal comes closer to the funded state. For example, if you need five lakhs in 5 years and have already reached four lakhs, then a simple five-year FD at 4% will get you to your goal without any additional investment. This example shows that the goal is already 100% funded.

However, if you have three lakh instead of four, you need to invest more every month since your goal is only 75% (=3/4) funded.

The gap of 1 lakh has to come from both returns on the three lakhs and the investments you need to make for a few more months. Term insurance plugs that gap if you die and cannot make those additional investments. This calculation is the premise of the “Calculator” section at the end.

We will consider a few options to tackle the additional term insurance coverage.

Once you have identified the gap amount, you can apply to any insurer with the additional amount covered by a new policy. You need to declare the old policy to the new insurance company, irrespective of whether you continue the old policy or not. You can choose the same insurance company as your old one here or go to another.

This option is generally not possible. The company will usually cancel the old policy and issue a new one but the premium rate will increase since your age has increased.

Once you have a new policy, you can discontinue the old one in case the premium is high. For example, one crore coverage term plans from LIC sold before 2010 cost around ₹25000-30000/year. If your total need is three crores today, and you can get a three crore plan for ₹40,000/year, you can discontinue the old policy after three more years.

You can explore the LIC Tech term policy as an option: My experience with the LIC Tech Term life insurance policy

If you are using the comprehensive goal-based investing planner, then you will see the minimum term insurance you need to have based on:

This figure is the minimum since you need to add any ongoing outstanding secured loans (like home/car loans) or loans where family members may be co-borrowers. If you have a 30 lakhs balance, say, in a home loan or an educational loan of 10 lakhs with parents as co-borrowers, add those amounts to the term insurance coverage.

This post on term insurance covers these calculations in more detail.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How your term insurance coverage changes with time? first appeared on 23 Mar 2022 at https://arthgyaan.com