Do not make these common mistakes while buying a term insurance policy

This article discusses some common mistakes people should avoid while buying term insurance.

This article discusses some common mistakes people should avoid while buying term insurance.

Term insurance is a type of life insurance that pays a benefit to the named beneficiaries in the event of the insured person’s death, as long as the policy is active. The purpose of term insurance is to provide financial protection for the policyholder’s loved ones in the event of their unexpected death, helping to cover daily expenses, future goals such as children’s education, and loans like home loans.

It is a straightforward insurance product, similar to car insurance, in that it only pays out in the event of a specific occurrence (death) and does not have a savings component like other types of life insurance. Term insurance offers high coverage at a low cost and is the cheapest insurance plan that you can purchase to protect your family’s lifestyle and financial goals in case you die.

Insurance spreads financial risk across a large pool of policyholders, reducing individual financial burden. Since many people buy insurance, only some are expected to die within the policy’s coverage time. However, it should be present at least for all earning members of the family before retirement age.

The concept of term insurance and why you need it has been covered in detail in this article: Term life insurance: what, why, how much to get and from where?.

This article discusses some common mistakes people should avoid while buying term insurance. These mistakes creep in primarily because the increasing popularity of term plans diverts customers from traditional investment-cum-insurance plans that provide most of the profits for the insurers. Insurance companies have therefore come up with innovations to complicate the term plan with riders that bring back investment features into the term plan.

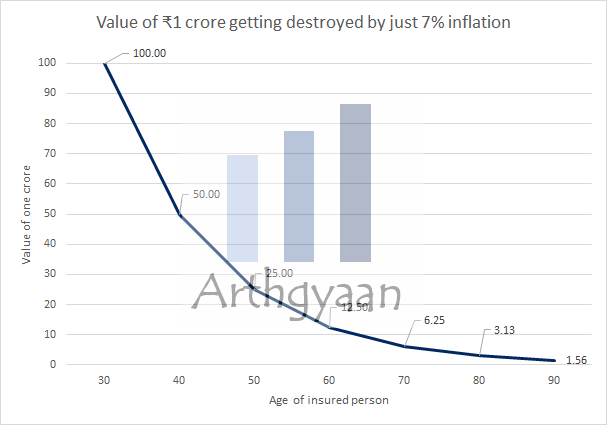

Most people, especially in their 20s and 30s, have not yet reached a corpus of one crore. While buying term insurance, they choose the default option of one crore coverage since the amount looks big and is a nice round figure. However, that might not be enough. Here’s why:

Suppose a claim is made decades after taking the policy. In that case, the money will not be enough to take care of the family and goals like children’s education and retirement for the spouse.

What should you do instead?

Two calculation methods, HLV Income and HLV expense (see this article for details), will show you the approximate coverage based on your income and expenses respectively.

Alternatively, if you are using the Arthgyaan goal-based investing tool, then you will get the exact term insurance coverage amount based on your income and goals like this:

Accelerated premium = Normal premium + Rider premium

A rider is an optional feature tagged onto the policy. Just like in supermarkets, items kept close to the checkout counter are high-profit but unnecessary impulse buys, so is the case with riders. The insurance company employs advanced-level statistics called actuarial science to calculate the premiums for these riders to ensure that the customer feels that they are getting a lot more benefits at just a little bit more premium. That is never the case. Riders make a lot of money for insurance companies and provide limited benefit to the customer.

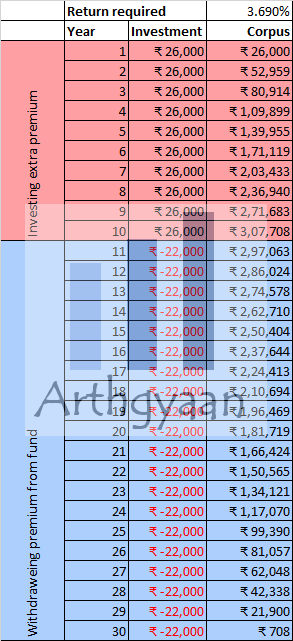

Accelerated premium rider is pitched as a way to get rid of the premium payment obligation quickly. However, what is not explicitly mentioned is that the insurer receives a much higher premium earlier in the cycle, which benefits the company.

If you are planning to take an accelerated premium plan (either a single period or the typical ten years reduced period payment plan), please note that:

An example below to clarify the last point:

What should you do instead?

You should pay your premium once a year, every year until the day your coverage ends or your policy lapses. The rider premium should be invested every year as per typical investments.

Term insurance protects your income stream. However, it is not an estate planning tool where your term insurance amount pays for your dependents’ expenses You may not die before the term coverage policy expires. This fact, coupled with how the value of money falls rapidly over time, your term insurance coverage amount at the age of 70 or 80 will be practically worthless for your dependents. Also, the premiums for long-dated policies are higher than those that end at age of 60.

We have covered this concept in some additional detail here: Why shouldn’t you buy term insurance up to age 80? Or 100?

What should you do instead?

Take coverage up to the target retirement date. For most people, this will be the age of 60. The saved premium should go into your retirement plan: Low-stress retirement planning calculations: worked out example.

The return of premium option has a simple pitch:

“In case you don’t die, you get some/all of the premium paid back at the end”.

The time value of money concept tells us, for example, that paying ₹100 for 30 years is not the same as getting ₹3,000 back in 30 years. The difference between the two cases, even after adjusting for the premium of the embedded policy, is in favour of the insurance company and not the customer.

Alternatively, just like a car insurance where you are happy to have paid the least amount of money to pay for damage for your car, in term plan you intend to pay the least possible money and hope no damage happens to your body. The successful scenario is that you did not die. In that case, why pay more to get back money from the insurance company since you can invest the rest.

The calculation is similar to the accelerated premium case and should be avoided for the same reason.

Here is a complete article on this topic: Term Insurance with Return of Premium: a Complete Waste of Money.

What should you do instead?

Avoid return of premium and take a simple term insurance plan.

Accidental death benefit rider pays out a higher coverage amount, say 50% more, in case the death is caused by accident. The complication here happens since an accidental death claim has stringent requirements for proving death. For example, a typical term claim requires a death certificate. In contrast, an accidental death claim requires FIR, autopsy and other documents that may be missed under the stressful situation for the family.

An accident is a sudden, unforeseen and involuntary event caused by external, visible and violent means - Source: IRDAI site

The definition of accident may not match what we think it should be while taking the policy. This concept is discussed in detail in this post: What is a Personal Accident Insurance policy: who needs it and why?.

What should you do instead?

Instead of a rider with your term insurance plan, take a separate accident insurance policy from a general insurance company. If you want a higher coverage for accidental death, take a higher coverage term policy.

The Married Women’s Property Act 1874 (MWP Act) ensures that upon the husband’s death, the insurance proceeds only go to the wife/children (if the wife/children are nominees) and not to any creditor in case loans are outstanding in the husband’s name. A wife can also take a policy in her name and invoke the MWP option to ensure her children (if they are the nominee) get the proceeds instead of any creditors.

What should you do instead?

If you have a wife, you must avail of the MWP option at the time of buying the policy since cannot be opted in once the policy has been issued. Opting into the MWP option does not materially change anything else in the policy terms.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do not make these common mistakes while buying a term insurance policy first appeared on 10 Aug 2022 at https://arthgyaan.com