Term Insurance with Return of Premium: a Complete Waste of Money

This article explains why Term insurance with return of premium (TROP) is more expensive and wastes money that you should invest instead.

This article explains why Term insurance with return of premium (TROP) is more expensive and wastes money that you should invest instead.

Term insurance with return of premium (TROP) is a trap that wastes money. Insurance companies and their agents make the least amount of money from selling term insurance plans. Therefore, the TROP is an “innovation” that answers the fear of the insurance buyer that “I will not get any returns if I don’t die”. The return of premium policy has a simple pitch:

“In case you don’t die, you get some/all of the premium paid back at the end”.

We will first address this part: getting returns from insurance. Insurance is a pure risk transfer mechanism. Everyone dies but few people die while they are still working before the age of 60. The insurance company collects say ₹10,000/year premiums from everyone and pays the coverage amount of ₹1 crore to the few people who die that year. The cheapest product that can do this is term insurance.

Every other life insurance product, whether TROP, endowment, whole life or ULIP takes this basic core term plan and adds an investment component on top of it. Unfortunately, this investment part of the policy generally has too low returns and are mis-sold to customers who do not know better.

We have covered a few such mistakes in buying term insurance here: Do not make these common mistakes while buying a term insurance policy.

Would you eat Ghasitaram’s chocolate? — my MBA marketing professor

Ghasitaram is a placeholder for a quintessential Indian confectioner whose speciality is Indian sweets. In a world where Hershey’s, Toblerone, and Cadbury exists, would you walk into a Ghasitaram outlet specifically to buy chocolate?

Similarly, would you hire your night watchman to be your personal chef during the day since thieves are expected to come only at night?

Then why invest through insurance companies if banks, mutual funds, PPF, real estate, gold and other investment options exist? After all, though you are getting returns from your non-term life insurance policy, the premium is higher than a pure term policy. The difference of the premium is therefore invested and there is nothing stopping you to take a term plan and invest on your own in any investment of your choice.

Also, would you, and this is the main argument against TROP, pay 40-50% extra salary to your security guard and ask him to return the money after a year if no thieves come?

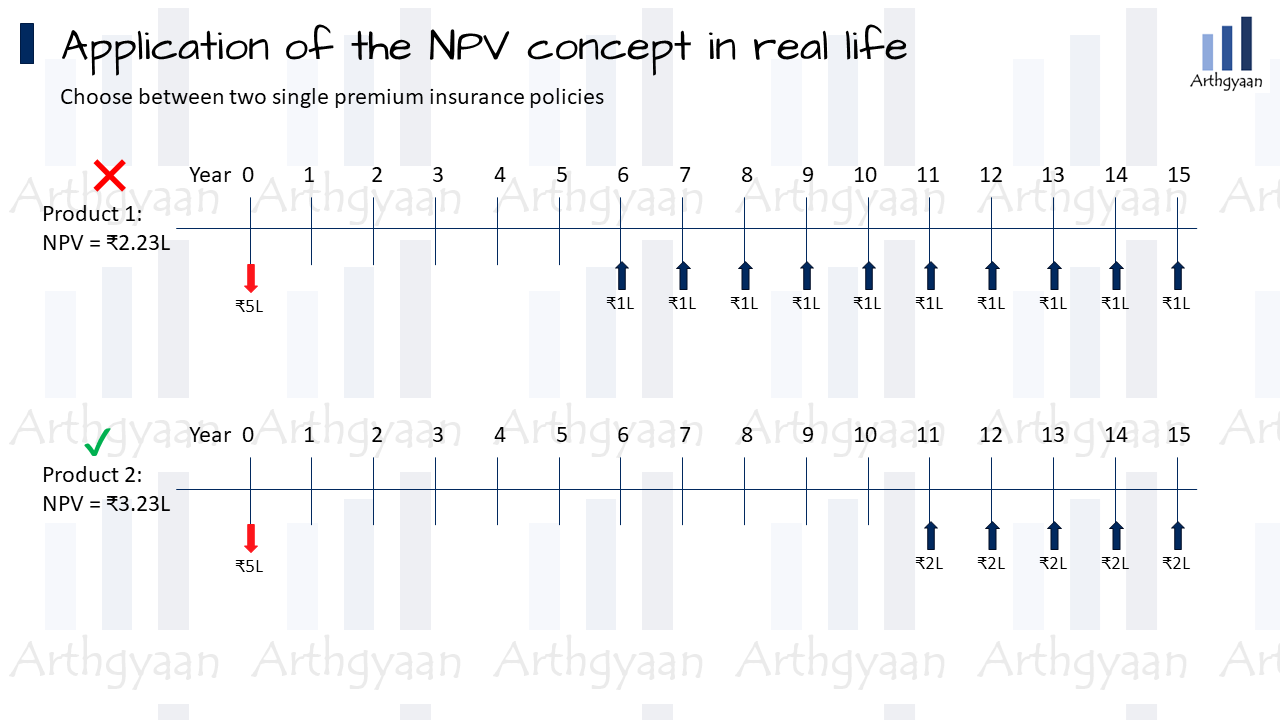

To understand why TROP is a wastage of money, we will utilise the concept of NPV and compare TROP with pure term policies using NPV.

Net Present Value (NPV) is a finance concept that will change how you decide between different financial decisions. Since money is worth more today than in the future, a concept as the Time Value of Money, different amounts of money spent or received in the future in the case of two different financial decisions cannot be added and compared directly.

Instead we can use a discounting rate, like FD or PPF rate, to calculate the present value of such cashflows, add them up and calculate which option has the higher present value (NPV).

We have covered the concept of NPV in detail in this article: How Net Present Value (NPV) Can Help You Make Smarter Financial Decisions.

Here we have obtained insurance quotes for a 30-year old salaried male non-smoker with regular premium payment plan until the age of 60. The policy ends at 60.

The pure or normal term plan, for ₹1 crore coverage, is ₹10,593 with GST while the TROP version costs ₹18,880 with GST from the same insurance company. The difference of the premium is ₹8,287. These quotes are from Policybazaar website on the date of publishing this article from the same insurer.

In our NPV calculation we have assumed a discount rate of 7% which is similar to that of PPF. We are comparing two situations via NPV calculation:

Premium is paid for 30 years.

In case of the TROP, all the premiums, apart from the 18% GST, is returned after 30 years. This amount is 40 * ₹18,880 / 1.18 = ₹4.8 lakhs. The 1.18 factor adjusts for the GST which is not returned.

In case of the term + PPF option, the PPF corpus grows to ₹8.37 lakhs.

In both cases, the NPV comes as a negative number since the insurance company, and not you, benefit when you don’t die. However, with the normal + PPF case, the NPV is less negative and is therefore better.

| Year | TROP | Normal + PPF |

|---|---|---|

| 1 | ₹ -18,880 | ₹ -10,593 |

| 2 | ₹ -18,880 | ₹ -10,593 |

| 3 | ₹ -18,880 | ₹ -10,593 |

| 4 | ₹ -18,880 | ₹ -10,593 |

| 5 | ₹ -18,880 | ₹ -10,593 |

| 6 | ₹ -18,880 | ₹ -10,593 |

| 7 | ₹ -18,880 | ₹ -10,593 |

| 8 | ₹ -18,880 | ₹ -10,593 |

| 9 | ₹ -18,880 | ₹ -10,593 |

| 10 | ₹ -18,880 | ₹ -10,593 |

| 11 | ₹ -18,880 | ₹ -10,593 |

| 12 | ₹ -18,880 | ₹ -10,593 |

| 13 | ₹ -18,880 | ₹ -10,593 |

| 14 | ₹ -18,880 | ₹ -10,593 |

| 15 | ₹ -18,880 | ₹ -10,593 |

| 16 | ₹ -18,880 | ₹ -10,593 |

| 17 | ₹ -18,880 | ₹ -10,593 |

| 18 | ₹ -18,880 | ₹ -10,593 |

| 19 | ₹ -18,880 | ₹ -10,593 |

| 20 | ₹ -18,880 | ₹ -10,593 |

| 21 | ₹ -18,880 | ₹ -10,593 |

| 22 | ₹ -18,880 | ₹ -10,593 |

| 23 | ₹ -18,880 | ₹ -10,593 |

| 24 | ₹ -18,880 | ₹ -10,593 |

| 25 | ₹ -18,880 | ₹ -10,593 |

| 26 | ₹ -18,880 | ₹ -10,593 |

| 27 | ₹ -18,880 | ₹ -10,593 |

| 28 | ₹ -18,880 | ₹ -10,593 |

| 29 | ₹ -18,880 | ₹ -10,593 |

| 30 | ₹ -18,880 | ₹ -10,593 |

| Maturity | ₹ 4,80,000 | ₹ 8,37,592 |

| NPV | ₹ -1,75,352 | ₹ -28,615 |

In this case the TROP gives ₹1 crore but not the premiums back since premium is returned only if you do not die. Here the normal plan also gives ₹1 crore but there is an additional ₹3.63 lakhs balance in the PPF account. The NPV is again higher in the normal + PPF case.

| Year | TROP | Normal + PPF |

|---|---|---|

| 1 | ₹ -18,880 | ₹ -10,593 |

| 2 | ₹ -18,880 | ₹ -10,593 |

| 3 | ₹ -18,880 | ₹ -10,593 |

| 4 | ₹ -18,880 | ₹ -10,593 |

| 5 | ₹ -18,880 | ₹ -10,593 |

| 6 | ₹ -18,880 | ₹ -10,593 |

| 7 | ₹ -18,880 | ₹ -10,593 |

| 8 | ₹ -18,880 | ₹ -10,593 |

| 9 | ₹ -18,880 | ₹ -10,593 |

| 10 | ₹ -18,880 | ₹ -10,593 |

| 11 | ₹ -18,880 | ₹ -10,593 |

| 12 | ₹ -18,880 | ₹ -10,593 |

| 13 | ₹ -18,880 | ₹ -10,593 |

| 14 | ₹ -18,880 | ₹ -10,593 |

| 15 | ₹ -18,880 | ₹ -10,593 |

| 16 | ₹ -18,880 | ₹ -10,593 |

| 17 | ₹ -18,880 | ₹ -10,593 |

| 18 | ₹ -18,880 | ₹ -10,593 |

| 19 | ₹ -18,880 | ₹ -10,593 |

| 20 | ₹ -18,880 | ₹ -10,593 |

| 21 | ₹ 1,00,00,000 | ₹ 1,03,63,511 |

| NPV | ₹ 22,15,116 | ₹ 23,90,701 |

We show some NPV values below for death from year 1 to year 30 of the death case and in all years, the normal + PPF option is better financially.

| Year | TROP | Normal + PPF | Normal has higher NPV |

|---|---|---|---|

| 1 | ₹ 87,16,742 | ₹ 87,32,232 | ₹ 15,490 |

| 2 | ₹ 81,28,843 | ₹ 81,58,809 | ₹ 29,966 |

| 3 | ₹ 75,79,405 | ₹ 76,22,900 | ₹ 43,495 |

| 4 | ₹ 70,65,911 | ₹ 71,22,051 | ₹ 56,140 |

| 5 | ₹ 65,86,011 | ₹ 66,53,967 | ₹ 67,957 |

| 6 | ₹ 61,37,505 | ₹ 62,16,506 | ₹ 79,001 |

| 7 | ₹ 57,18,341 | ₹ 58,07,663 | ₹ 89,322 |

| 8 | ₹ 53,26,599 | ₹ 54,25,568 | ₹ 98,968 |

| 9 | ₹ 49,60,485 | ₹ 50,68,469 | ₹ 1,07,983 |

| 10 | ₹ 46,18,323 | ₹ 47,34,732 | ₹ 1,16,409 |

| 11 | ₹ 42,98,545 | ₹ 44,22,828 | ₹ 1,24,283 |

| 12 | ₹ 39,99,687 | ₹ 41,31,329 | ₹ 1,31,642 |

| 13 | ₹ 37,20,380 | ₹ 38,58,900 | ₹ 1,38,520 |

| 14 | ₹ 34,59,346 | ₹ 36,04,293 | ₹ 1,44,947 |

| 15 | ₹ 32,15,389 | ₹ 33,66,343 | ₹ 1,50,955 |

| 16 | ₹ 29,87,391 | ₹ 31,43,960 | ₹ 1,56,569 |

| 17 | ₹ 27,74,310 | ₹ 29,36,125 | ₹ 1,61,816 |

| 18 | ₹ 25,75,168 | ₹ 27,41,887 | ₹ 1,66,719 |

| 19 | ₹ 23,89,054 | ₹ 25,60,356 | ₹ 1,71,302 |

| 20 | ₹ 22,15,116 | ₹ 23,90,701 | ₹ 1,75,585 |

| 21 | ₹ 20,52,557 | ₹ 22,32,145 | ₹ 1,79,588 |

| 22 | ₹ 19,00,633 | ₹ 20,83,962 | ₹ 1,83,329 |

| 23 | ₹ 17,58,647 | ₹ 19,45,473 | ₹ 1,86,825 |

| 24 | ₹ 16,25,951 | ₹ 18,16,043 | ₹ 1,90,093 |

| 25 | ₹ 15,01,935 | ₹ 16,95,082 | ₹ 1,93,146 |

| 26 | ₹ 13,86,033 | ₹ 15,82,033 | ₹ 1,96,000 |

| 27 | ₹ 12,77,713 | ₹ 14,76,381 | ₹ 1,98,668 |

| 28 | ₹ 11,76,479 | ₹ 13,77,640 | ₹ 2,01,160 |

| 29 | ₹ 10,81,869 | ₹ 12,85,359 | ₹ 2,03,490 |

| 30 | ₹ 9,93,447 | ₹ 11,99,115 | ₹ 2,05,667 |

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Term Insurance with Return of Premium: a Complete Waste of Money first appeared on 23 Aug 2023 at https://arthgyaan.com