How Net Present Value (NPV) Can Help You Make Smarter Financial Decisions

This article explains the concept of NPV - a financial tool that helps you compare investment options to use in buying insurance, home loan prepayment and in many other cases.

This article explains the concept of NPV - a financial tool that helps you compare investment options to use in buying insurance, home loan prepayment and in many other cases.

Net Present Value (NPV) is a finance concept that will change how you decide between different financial decisions like:

We will cover the concept of NPV in this article and then cover the above use cases one by one in a future article(s).

To understand NPV, we need to understand two concepts:

A cashflow is money spent or received sometime in the future. Some examples can be:

The present value (PV) of any future cashflow is what you will be willing to accept today instead of receiving the same cashflow in the future.

For example, if you are expecting to receive ₹10,000 from a friend a year from now, you would also be willing to receive ₹9500 from that same friend today if you keep that ₹9500 in an FD today that gives interest of ₹500 in one year. Here PV of the ₹10,000 cashflow due in one year is ₹9500 discounted at a rate of 10000/9500 -1 = 5.2%. To understand more about this concept of discounting to the present, we need to understand the next concept.

Time Value of Money simply says that money is worth more today than in the future. The simplest reason is that we can keep money in a risk-free SBI FD and get more money in the future. Conversely, receiving ₹10,000 today is better than receiving ₹10,000 a year from now. Since prices of things go up with time due to inflation, the ₹10,000 received in the future will be worth less in the future than today. We will quickly cover two examples of TVM:

The rate at which we will value future money vs. the money in hand today is the discount rate.

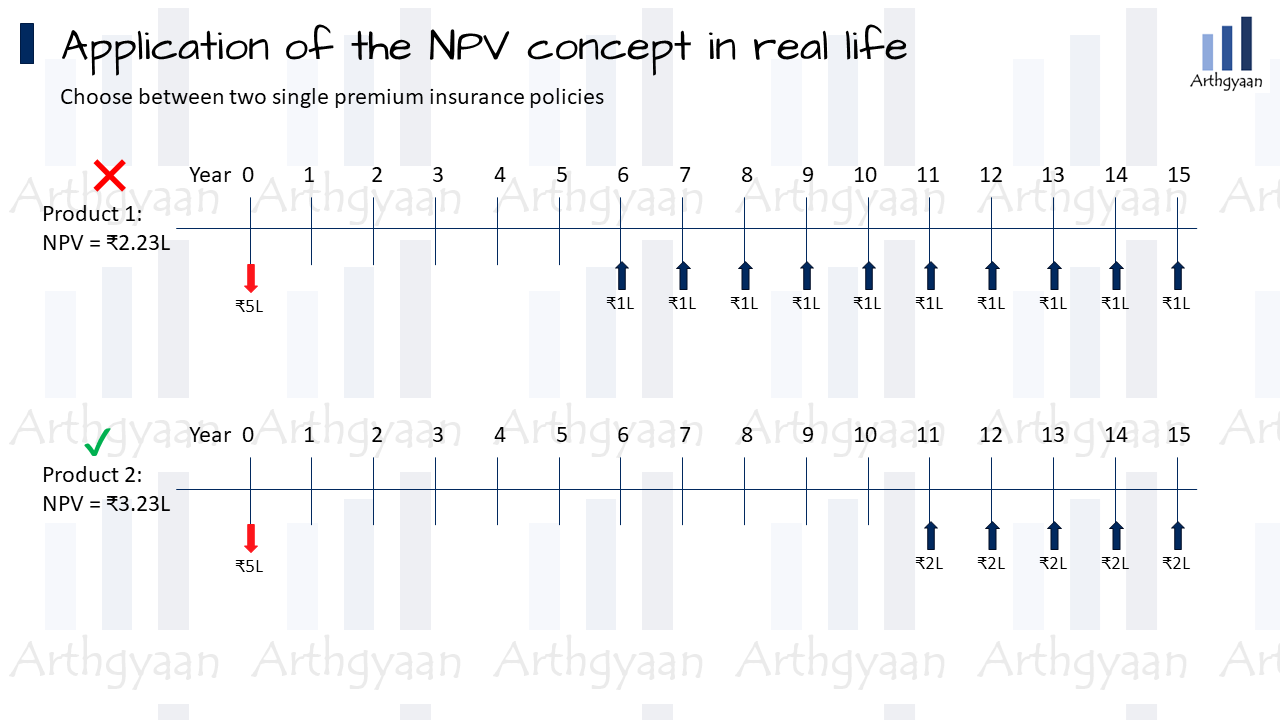

To calculate NPV, we calculate the future cashflows first, discount them to the present, add them and subtract the amount of money we are paying today. NPV does not have any utility by itself but is instead used to compare two or more financial products. Let us take one case study of purchasing a single premium insurance:

We will assume a discounting rate of 6%, say that of a FD or debt mutual fund.

The NPV calculation is shown below:

For option 1

| Year | Cashflow (lakhs) | PV (lakhs) |

|---|---|---|

| 0 | -5 | -5.00 |

| 1 | 0.00 | |

| 2 | 0.00 | |

| 3 | 0.00 | |

| 4 | 0.00 | |

| 5 | 0.00 | |

| 6 | 1 | 0.70 |

| 7 | 1 | 0.67 |

| 8 | 1 | 0.63 |

| 9 | 1 | 0.59 |

| 10 | 1 | 0.56 |

| 11 | 1 | 0.53 |

| 12 | 1 | 0.50 |

| 13 | 1 | 0.47 |

| 14 | 1 | 0.44 |

| 15 | 1 | 0.42 |

| NPV | - | ₹2.23 |

For option 2

| Year | Cashflow (lakhs) | PV (lakhs) |

|---|---|---|

| 0 | -5 | -5.00 |

| 1 | 0.00 | |

| 2 | 0.00 | |

| 3 | 0.00 | |

| 4 | 0.00 | |

| 5 | 0.00 | |

| 6 | 0.00 | |

| 7 | 0.00 | |

| 8 | 0.00 | |

| 9 | 0.00 | |

| 10 | 0.00 | |

| 11 | 2 | 1.05 |

| 12 | 2 | 0.99 |

| 13 | 2 | 0.94 |

| 14 | 2 | 0.88 |

| 15 | 2 | 0.83 |

| NPV | - | ₹3.23 |

Here option 2 is a better choice between the two since the NPV is higher. The keyword here is between the two. There might be other better investment options with better NPVs.

Readers should note that in both cases the insurance company is paying the same notional amount of money (₹10 lakhs) but since they occur at different time periods, the present values are different.

Our home loan prepayment vs investment decision calculator uses NPV to help you decide which option is better:

Click "Calculate & Compare" to see the results.

| Year | Loan Left | Principal Repaid | Interest Paid | Tax Savings | MF Corpus |

|---|

NPV is calculated over the full original term of the loan, using the Expected MF Return as the discount rate. A higher (less negative) NPV is better.

| Scenario | Net Present Value (₹) | Optimal Decision |

|---|

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How Net Present Value (NPV) Can Help You Make Smarter Financial Decisions first appeared on 20 Aug 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.