Why shouldn't you buy term insurance up to age 80? Or 100?

This article explains why it is a waste of money to buy a term insurance policy beyond the usual retirement age of 60.

This article explains why it is a waste of money to buy a term insurance policy beyond the usual retirement age of 60.

Term insurance is a type of life insurance that pays a benefit to the named beneficiaries in the event of the insured person’s death, as long as the policy is active. The purpose of term insurance is to provide financial protection for the policyholder’s loved ones in the event of their unexpected death, helping to cover daily expenses, future goals such as children’s education, and loans like home loans.

It is a straightforward insurance product, similar to car insurance, in that it only pays out in the event of a specific occurrence (death) and does not have a savings component like other types of life insurance. Term insurance offers high coverage at a low cost and is the cheapest insurance plan that you can purchase to protect your family’s lifestyle and financial goals in case you die.

Insurance spreads financial risk across a large pool of policyholders, reducing individual financial burden. Since many people buy insurance, only some are expected to die within the policy’s coverage time. However, it should be present at least for all earning members of the family before retirement age.

The concept of term insurance and why you need it has been covered in detail in this article: Term life insurance: what, why, how much to get and from where?.

This article discusses one common mistake people must avoid while buying term insurance. These mistakes creep in primarily because the increasing popularity of term plans diverts customers from traditional investment-cum-insurance plans that provide most of the profits for the insurers. Insurance companies have therefore come up with innovations to complicate the term plan with riders that bring back investment features into the term plan.

We have the complete list of common mistakes to avoid here: Do not make these common mistakes while buying a term insurance policy

Term insurance is not an estate planning tool.

It would be best if you took term insurance for a duration up to retirement, typically around 58-60 years. This convention is because the need for income protection ends at retirement, and plans that extend beyond that age are generally more expensive.

Alternatively, suppose the policy is held for a more extended period, such as 20-40 years beyond 60. In that case, the difference in cost between a policy that extends to age 70 or 80 versus one that ends at 60 can create a corpus higher than the sum assured amount of the term policy.

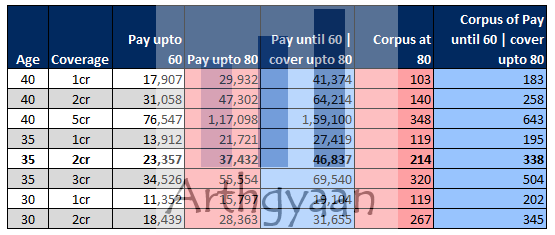

We will use actual policy premium numbers to explore these points to check whether it makes sense to take up to 80 (or 100). Our premium numbers are taken from the website of Max Life on 24-Jan-2023 for a non-smoker male with a salary income and above 12th pass educational qualifications. Some of the premiums incorporate a 5% discount for the first year.

Explaining the 2cr coverage at age 35 case:

We will first compare Option 1 and Option 2:

The point here is that if you live beyond 80, the insurance policy does not pay anything. But you still have a corpus (₹24L to ₹2.14cr) that you accumulated just by saving premium.

But what if you die before that?

Say you took the option of paying up to 60 with coverage up to 60, and then you die at 65. Then, if you had taken the option of coverage up to 80, your nominee would have got ₹2 crores at that point. In contrast, the saved-premium-fund would have around ₹10-38 lakhs, depending on the returns you got.

We now compare Option 1 and Option 3:

Therefore it comes down to your perception of when you think you will die. If you are convinced that you will live long, based on your current lifestyle and family health history, take the term plan until 60. If not, you can explore taking the more extended coverage options.

One thing that you need to keep in mind is that just because you have a term plan up to 80 or longer, it does not indicate to you or your family that your death before the policy lapse date is beneficial to the nominees.

We maintain that there is no need for insurance coverage if income is not there

The purpose of insurance is not to leave a legacy for retirement since you are expected to do that while you have income. But we realise that some investors wish to have extended coverage duration. The next section is for them.

If you are convinced that coverage up to 80 is what you want, then which option is better?

In either case, the benefit is the same: life is protected until 80. But the premiums are more in option 3 while option 2 makes you pay when you do not have income in retirement. Depending on the coverage amount and age at which the policy has been taken, the difference between the two might be substantial.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Why shouldn't you buy term insurance up to age 80? Or 100? first appeared on 25 Jan 2023 at https://arthgyaan.com