How did the Indian stock market perform in 2022?

This article shows the report card for the Indian stock market for 2022 vs the last 25 years.

This article shows the report card for the Indian stock market for 2022 vs the last 25 years.

This article is a part of our detailed article series on the yearly stock market performance in India. Ensure you have read the other parts here:

This article shows the report card for the Indian stock market for 2023 vs the last 25 years.

This article shows the report card for the Indian stock market for 2021 vs the last 25 years.

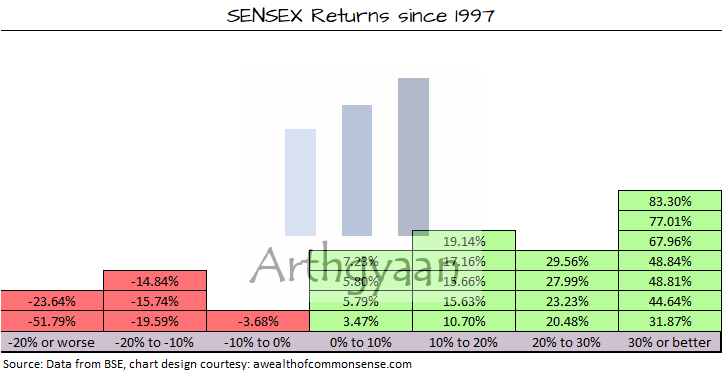

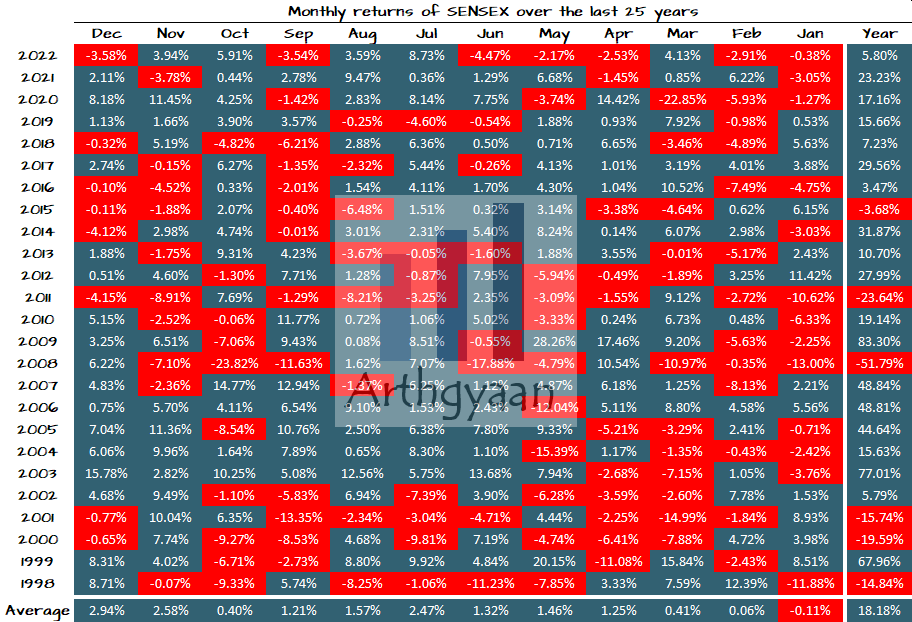

But there has been a lot of fluctuation over the years.

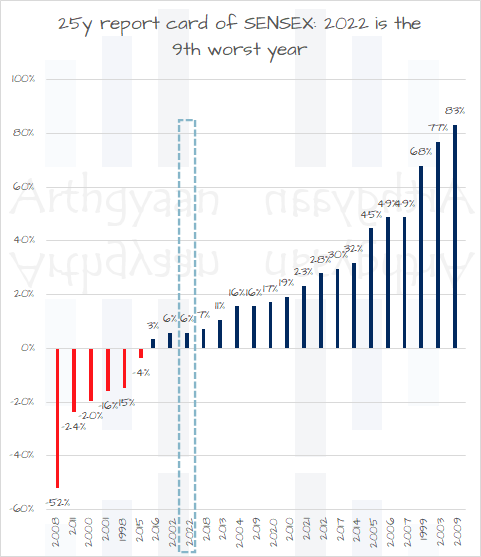

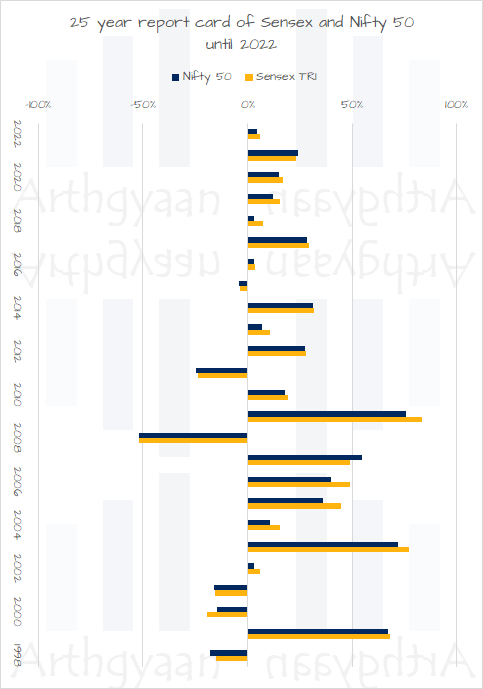

2022 was a rare year in which stock markets overall fell in India. If we look at the last 25 years, since 1998, the Sensex and Nifty 50 have given negative returns only 6 times. 2022 returns were the 3rd lowest but positive return in these 25 years.

This article uses the SENSEX Total Returns Index and the Nifty 50 price index to show a report card for the Indian stock markets.

Note: The Nifty 50 has not regularly underperformed the SENSEX. The Nifty 50 data in the chart uses the price returns, while the SENSEX data includes price returns and reinvested dividends.

The average return of the SENSEX with reinvested dividends is 18% over these 25 years. So ₹1 lakh invested in the beginning would have become ₹25 lakhs today. But that journey was not smooth, with a 52% drop in 2008 due to the global financial crisis and more minor falls along the way.

Investors should be prepared for both rises and falls along the way when investing in equity. This concept is called the sequence of returns. The unpredictability of this sequence causes sequence of return risk that we have discussed here: How does sequence of return risk affect your goals?.

In the Indian equity market, there is limited evidence of flat stock market returns over long periods, like a decade. Hence, investors, especially new ones, will face a test of conviction in equity investing if such a situation arises.

In the Arthgyaan goal-based investing framework, we assume a positive premium over inflation for equity and zero real returns for an investor’s lifetime retirement portfolio: How much returns should you expect from your retirement portfolio?.

Investors must create their investment plan without worrying about such fluctuations in the equity markets since they would be safe by implementing risk management by reducing their allocation to equity as their goal comes closer: Your portfolio needs a glide path: what, why and how?.

We have evidence here that goal-based investing works for long-term goals in India: Goal-based investing: does it work in India? which you can implement for yourself using the Arthgyaan goal-based investing tool.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How did the Indian stock market perform in 2022? first appeared on 22 Jan 2023 at https://arthgyaan.com