Portfolio construction basics: sources of risk

Risk and return go hand in hand, and a portfolio requires a balanced representation from various sources of risk to generate returns.

Risk and return go hand in hand, and a portfolio requires a balanced representation from various sources of risk to generate returns.

In investing, risk is defined as the variability of returns with time. In simple words, it means that stock, bond, and real estate markets go up and down with time. These fluctuations, also known as volatility, provide the opportunity that returns will be high as well as low. Therefore, the more sources of risk you have in your portfolio, the more is the chance that all of them will not go up and down simultaneously.

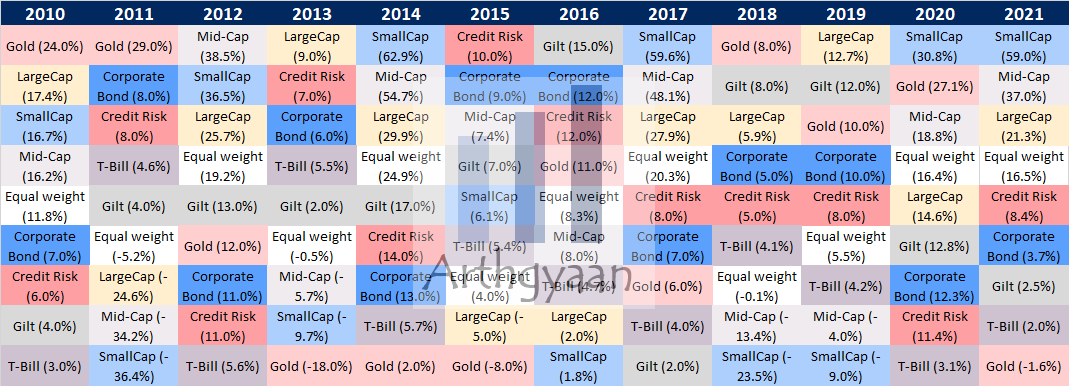

We show a chart based on the yearly return of assets classes from 2010 to 2021 using Valueresearchonline data.

This chart shows that:

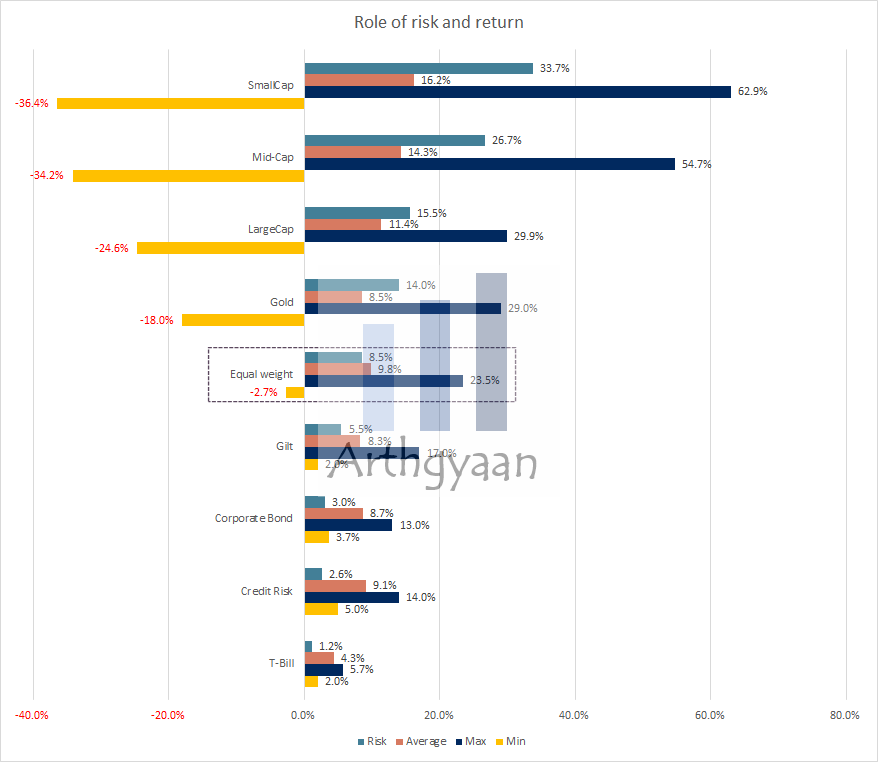

A common misconception amongst investors is that increased risk will increase returns. However, if the return is always high, the risk is low and not high since there is a low chance of variation. We use the same data as the chart above to show the impact on returns on taking more or less risk.

Some points to be noted here:

Investors who specifically load up on small and mid-cap funds to get higher returns should spend some time consulting this chart and be comfortable with the 30%+ falls that come along with the 60%+ gains. A strategic asset allocation plan with a diversified mix of multiple asset classes has a better potential to reach financial goals than one that is overexposed to any one of these factors.

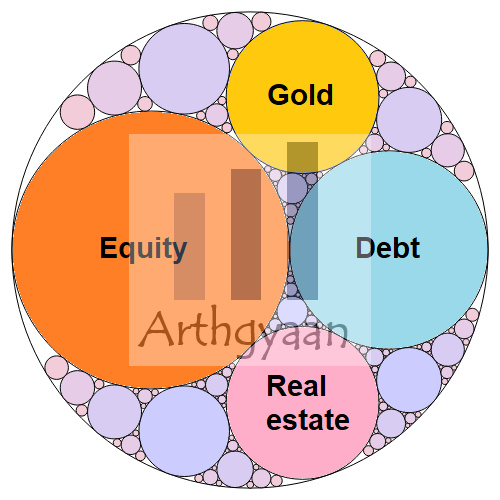

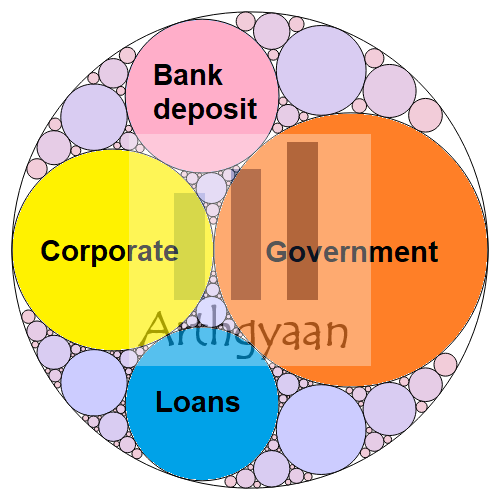

We can use a diagram like this to visualize the universe of investible asset classes, which you can use to create a portfolio. Typically we will have:

Related articles:

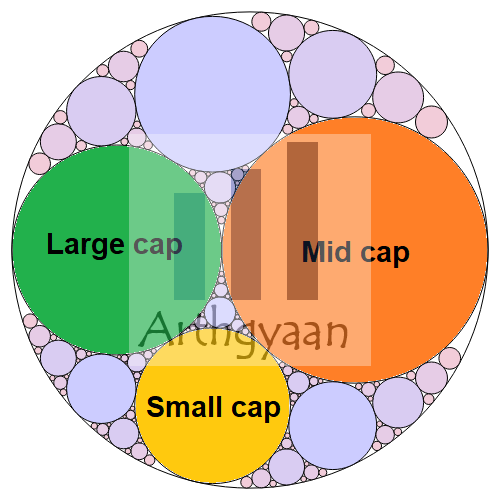

In the equity bucket, we have large, mid and small-cap stocks based on the market capitalization of the stocks. In India, we have six categories of funds based on various combinations of stock sizes in the portfolio. In addition, we have a large number of additional types like factor-based (like Momentum, Low Volatility), Sectors (like Auto, Pharma) and Thematic (like Consumption, MNC) funds.

In debt, we have various categories of investments:

Related reading:

Gold is an interesting asset since gold does not generate any income. This behaviour is unlike assets like stocks (via dividends), bonds (via coupons), real estate (via rent) or fixed deposits (via interest). Given how recurring cash flows like in the cases above are used to value assets like stocks, bonds and real estate, there is no way to value gold beyond hoping for a buyer to buy it at a higher price in the future.

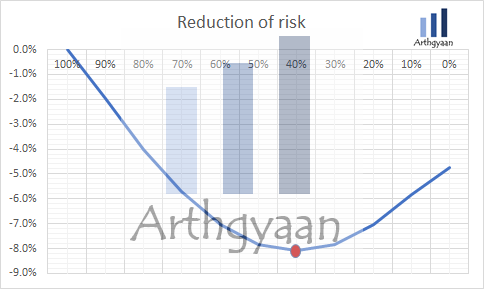

Gold can be used to diversify a portfolio of stocks and bonds, as shown below by slowly adding gold to a stock portfolio. As the proportion of gold increases, the portfolio risk decreases up to a limit and then increases again. We have covered the topic of gold investing in detail in this post: What is the best way to invest in gold?

Real estate is an attractive investment option for many people because of rental income, price appreciation and the feel-good factor of owning a tangible asset. We exclude the primary residence here since it is a part of the net worth but does not belong to the investment portfolio.

The flip side, apart from the illiquid nature and lack of regulation, is the ticket size. While you can purchase financial assets like stocks and mutual funds starting at a few hundreds, real estate is priced at ticket sizes starting at multiple lakhs. Basically, if you are starting with a ₹10,000/month SIP, it is not possible to get exposure to real estate directly at say ₹2,000/month. REITs, fractional commercial real estate, and REIT based FoFs (see Should you invest in PGIM Real Estate fund NFO?) are now available in India. Investors should perform thorough due diligence in case they are investing in products that are not SEBI regulated.

Art, wine, precious metals, structured products, P2P lending and commodities are just some of the alternative investments available to investors based on their status as retail, HNI or accredited investors.

In a future article, we will cover how to combine these asset classes to create a portfolio for long- and short-term goals.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Portfolio construction basics: sources of risk first appeared on 20 Mar 2022 at https://arthgyaan.com