Should you match debt portfolio duration with goal duration?

The standard advice given to investors is to match their goal duration with the portfolio duration in the case of the debt component. But, is that the right thing to do?

The standard advice given to investors is to match their goal duration with the portfolio duration in the case of the debt component. But, is that the right thing to do?

Debt as an asset class can behave differently to investor expectations. Debt is included in a portfolio with one of two purposes:

There are 16 categories of debt mutual funds in India which makes choosing one very difficult. The onus has been put on the investor to understand how these work and perform the very difficult task of choosing one suitable for the goal. In our previous article, we present an easy-to-follow 3-step framework to cut through the clutter and choose funds that meet the stated objective: How to choose a debt mutual fund?.

This article discusses a particular piece of advice that is often given to investors:

match your intended investment horizon with the portfolio duration

This means that if you are investing with a horizon of 5 years, your debt investments should mature in 5 years etc. We will consider all the common debt investments available to the average retail investors like Provident Fund, Debt Mutual Funds, Fixed Deposit and NPS.

We will understand and evaluate this suggestion to check whether and if at all, investors should follow this advice. We will start with debt mutual funds and NPS (which will have debt funds) first.

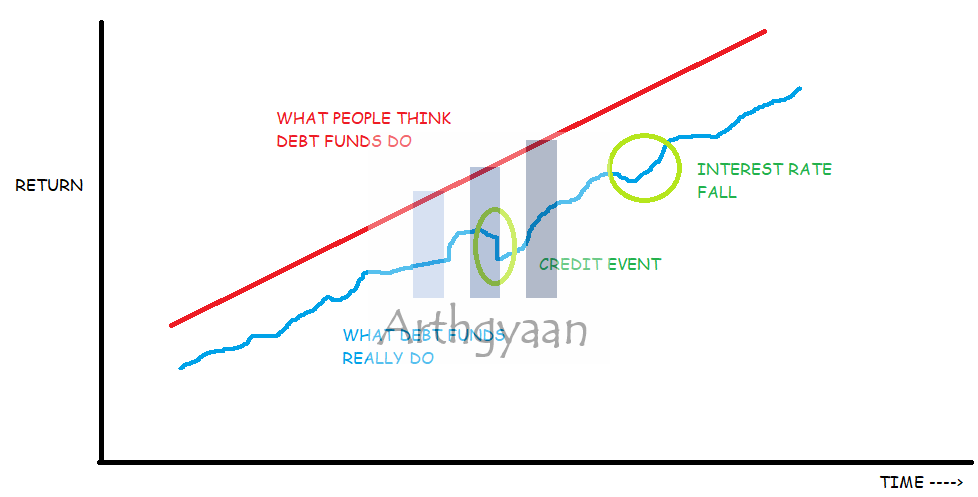

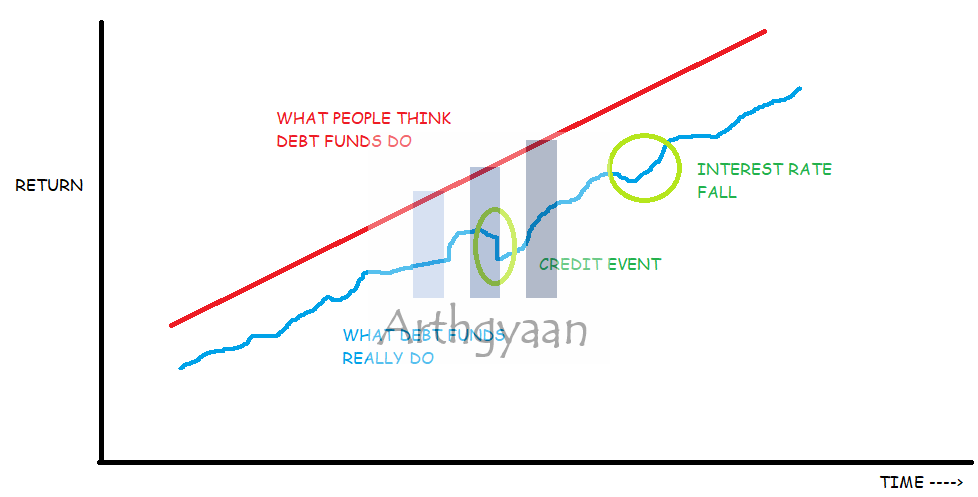

Like all mutual funds, and unlike Fixed Deposit (FD), debt fund returns (and the principal invested) are not guaranteed and returns can fluctuate continuously.

In a debt mutual fund, risk (and return) comes from two main sources:

This determines how good the underlying bond is in terms of the issuer’s capability of paying back the regular interest (called a coupon) and the money borrowed (the principal) of the bond.

Issuers are rated by Credit Rating agencies (like S&P, Moody’s, Fitch, CRISIL, Indiaratings, etc.) and given a scale like AAA (best quality), AA (lower than best), to D (worst quality - unable to pay back the money borrowed). The higher the credit rating (AAA or SOV - for the government), the lower the coupon and the lower the credit risk.

For our framework for selecting debt mutual funds, we stick to a mix of SOV/AAA/A1+/Cash only (same as SEBI’s new Class A, i.e., CRV >= 12 categorization).

This affects the prices of bonds already in the market.

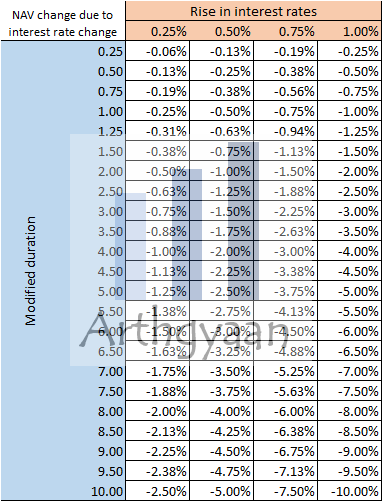

If an existing bond offering a 7% coupon is pitted against a new bond that offers a lower coupon of 6% (interest rates are falling), then the existing bond is more desirable and so is a debt fund holding these older 7% bonds. The reverse happens if interest rates rise in the economy - debt fund NAVs fall. This metric, for measuring interest rate risk, is called Modified Duration, and is available for all debt funds. It measures the rate of change of the portfolio NAV due to changes in interest rates.

For our framework for selecting debt mutual funds, we will stick to a duration of up to 1, which effectively means that for every 1% rise (fall) in interest rates, the fund NAV will fall (rise) by 1%. The debt fund categories that satisfy this criterion are overnight, liquid, ultra-short, low duration, and money market funds. This is the full list from SEBI. The new June 2021 debt fund classification by SEBI defines Macaulay Duration of less than or equal to 1 year as Class 1. This recommendation is in line with the SEBI definition since Duration < Macaulay Duration for all debt funds.

In general, funds with large AuM increase diversification. There is no role of star ratings or past performance in choosing a debt fund.

Debt fund investors should be wary that, unlike western countries, there is no bond market in India for corporate bonds. There is a market for government bonds, but mostly banks and other institutions participate in that market with deals happening in crores.

Credit and interest risk manifest as liquidity risk. Liquidity risk means that the bond cannot be sold without incurring a substantial loss since there would not be any buyers. The lack of buyers could be due to:

There are three terms that can be used to measure interest rate risk and are loosely similar as in for each term, higher the value, higher is the interest rate risk. With that knowledge you can skim this section with the takeway: higher the duration, higher the risk.

The terms used are:

If you do not understand what Macaulay duration is, please Tweet to SEBI as to why 6 of the 16 debt fund categories are based on a definition that requires an MBA in Finance or an equivalent degree to understand. A simpler definition, again from the same Investopedia article, is:

(Macaulay duration) is the weighted average number of years that an investor must maintain a position in the bond until the present value of the bond’s cash flows equals the amount paid for the bond

Modified (D) and Macaulay duration (MD) are related by this formula:

D = MD / (1+YTM/n)

where YTM is the yield to maturity of the portfolio (average return from the portfolio) and n is the number of times a year there is the coupon paid from the bond.

Estimated return from the debt fund in 1 year:

(YTM - TER) - D * ChangeInRates

where, ChangeInRates > 0 for increases in rates. The minus sign in front of D signifies that the return falls when rates rise and vice versa.

For some typical numbers,

YTM = 4%, TER = 0.2%, D = 0.16, Change = .5%,

expected return = 4 - 0.2 - 0.16 * .5 = 3.72% in 1 year before taxes.

We will examine the effect of duration in detail since that is the point of this article. However, many people inherently do not understand interest rate risk, and the fact that there are complex definitions in play does not help much. This is one of the reasons our Debt fund selection framework simplifies the task considerably: How to choose a debt mutual fund?.

Whichever metric you finally use, AM/D/MD, your portfolio risk increases with interest rate risk.

When interest rates rise, the NAV of a debt fund will fall and vice versa. Investors need to be comfortable with the concept of NAV of a debt fund falling if they take on interest rate risk by following the advice of matching fund duration with goal duration. For example, a goal that is 7-10 years away, if invested in a fund that has a modified duration of 7 will lose 3.5% value if rates rise by 0.5%. As an investor in such a fund, you need to then recover this fall which we will calculate in the next section.

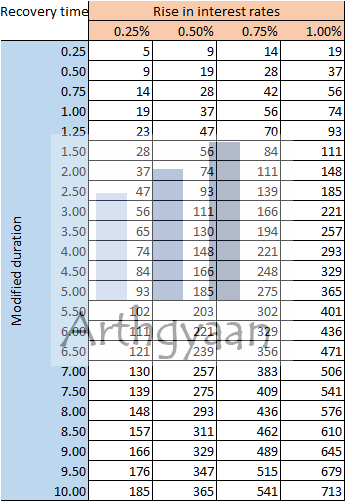

Once the debt fund NAV falls due to a rate rise, we can estimate how long it will take for the NAV to recover.

Assuming a YTM (less TER) of 5%, we can calculate how much time a portfolio with a certain modified duration takes to recover. If the YTM is 5%, then in 365 days, the portfolio rises by 5%, with everything else remaining the same. So this implies a daily return r which compounded over 365 days gives the 5% yearly return. Hence,

(1+r)^365 - 1 = 5%

which comes to r=0.0134% a day. This figure looks small, because it is, but compounding daily at this rate does get to:

We use this daily recovery rate to find out how long, in days, it takes to recover after a 0.25%, 0.50%, 0.75% and 1.00% rate rise.

We can look at interest rate risk in a different way. If you create a typical 60:40 equity and debt portfolio then depending you have the opportunity to rebalance between the two whenever one asset class outperforms the other over a period of time. This plan allows systematically buying low and selling high. If your portfolio is exposed to long duration debt for long term goals, you can utilize rebalancing opportunities whenever your asset allocation drifts by 5 or 10%. We have covered the concept of rebalancing in more detail in this post: Portfolio rebalancing during goal-based investing: why, when and how?.

The SEBI definitions of debt funds based on the portfolio duration are:

The investor does not control the duration of the fund as the fund manager can keep the duration within a wide range as defined by the SEBI definition of the category. As time passes and the goal comes closer, it will be difficult to keep shifting, due to taxes, to lower duration funds. Roll-down funds, which over time bring down the duration of the fund, do exist but those are difficult to identify and usually not a part of the overall investment objective of the fund.

Using average maturities and portfolio duration data from Valueresearchonline, we can estimate how long it will take, in days, for each of the debt fund categories to recover after a 0.25%, 0.50%, 0.75% and 1.00% rate increase at 5% yield of the portfolio.

| Category | Duration^ | 0.25% | 0.50% | 0.75% | 1.00% |

|---|---|---|---|---|---|

| Overnight | 0.00 | 0 | 0 | 0 | 0 |

| Liquid | 0.08 | 1 | 3 | 4 | 6 |

| Money Market | 0.22 | 4 | 8 | 13 | 17 |

| Ultra Short | 0.41 | 8 | 15 | 23 | 30 |

| Long Duration | 1.03 | 19 | 38 | 57 | 76 |

| Short Duration | 2.18 | 41 | 81 | 121 | 161 |

| Credit Risk | 2.60 | 48 | 97 | 145 | 192 |

| Corporate | 2.86 | 53 | 106 | 159 | 211 |

| Banking and PSU | 3.02 | 56 | 112 | 167 | 222 |

| Floater | 3.19 | 59 | 118 | 177 | 235 |

| Medium Duration | 3.63 | 68 | 135 | 201 | 267 |

| Dynamic | 4.39 | 82 | 162 | 242 | 321 |

| Medium to Long Duration | 4.57 | 85 | 169 | 252 | 334 |

| Gilt^ | 4.81 | 89 | 178 | 265 | 352 |

| 10Y constant maturity^ | 6.93 | 129 | 255 | 379 | 501 |

| Long Duration Roll-down^ | 7.78 | 144 | 285 | 424 | 560 |

Note: ^ items use modified duration; the rest are average maturities of the portfolio. The Long Duration Roll-down category refers to target maturity debt funds which are discussed in this post: Who should invest in target maturity debt funds?.

As we can see, the recovery time increases as duration increases which underscores the risk of each category. Therefore, when you rebalance after a rate rise, from equity to debt, you will need to wait as per the time in the table, for your rebalancing strategy to pay off.

In all of these cases, there is the option of matching the duration of the goal with the product duration. For example, if you have a goal in 7 years, you keep buying FDs or investing in Target Date Funds which mature on that particular date.

Read more here:

Small savings schemes include post office deposits, Monthly Income Account Scheme (MIS), Senior Citizen Savings Scheme (SCSS), National Savings Certificate (NSC), Public Provident Fund (PPF) scheme, Kisan Vikas Patra (KVP), and Sukanya Samriddhi Account (SSA) Scheme.

Rates updated on 30-Sep-2025

Starting date: 01-Oct-2025

Ending date: 31-Dec-2025

| Instrument | Rate of interest |

|---|---|

| Saving Deposit | 4.0% |

| 1 Year Time Deposit | 6.90% |

| 2 Year Time Deposit | 7.00% |

| 3 Year Time Deposit | 7.10% |

| 5 Year Time Deposit | 7.50% |

| 5 Year Recurring Deposit | 6.70% |

| Senior Citizen Savings (SCSS) | 8.20% |

| Monthly Income Scheme (MIS) | 7.40% |

| National Savings Certificate (NSC) | 7.70% |

| Public Provident Fund (PPF) | 7.10% |

| Kisan Vikas Patra (KVP) | 7.50% (will mature in 115 months) |

| Sukanya Samriddhi Account (SSA) | 8.20% |

Source:: https://dea.gov.in/index.php/documents-orders-notices-dea

Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY) and Employee Provident Fund (EPF) have different well-defined maturities and behave like a floating debt fund with interest rates moving as per government notifications. Therefore, investors should invest in these products by matching their requirements of using the money with the maturity date of the scheme.

Read more here: How to choose debt instruments for retirement?

If you are investing in debt mutual funds, you have two options:

For the others, i.e. if you are investing in a provident fund or target-date funds or FDs, you should match the duration of the product with that of the goal.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you match debt portfolio duration with goal duration? first appeared on 13 Feb 2022 at https://arthgyaan.com