How to choose debt instruments for retirement?

This post describes suitable debt instruments for both pre and post-retirement investing: Provident fund, PPF, Sukanya Samriddhi, FD/RD, NCD, pension plans, RBI bonds, post office and SCSS.

This post describes suitable debt instruments for both pre and post-retirement investing: Provident fund, PPF, Sukanya Samriddhi, FD/RD, NCD, pension plans, RBI bonds, post office and SCSS.

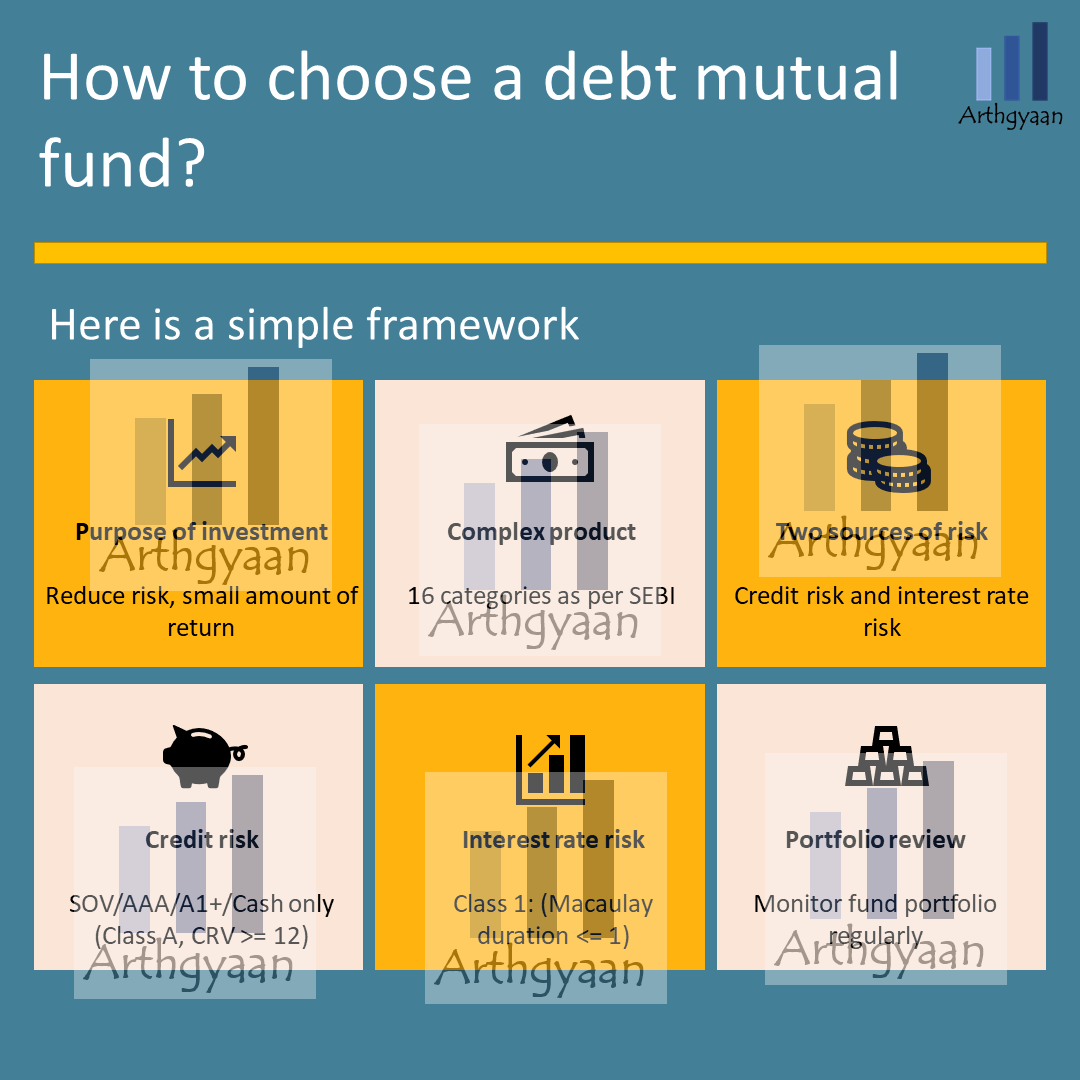

This article builds on the debt selection framework discussed in this post to focus on the retirement portfolio specifically. To recap, a debt fund has a single purpose in a portfolio: reduce the overall risk and provide a small return. The purpose of having debt as a part of the general asset allocation of a goal is to stabilise the portfolio risk. It is extremely risky for DIY investors to chase returns from debt in their overall portfolio since debt funds can crash drastically like this.

As the Indian economy matures, interest rates will keep falling, impacting the steady returns of savings schemes (Fixed deposits, provident fund, senior citizen savings schemes, annuities, Sukanya Samriddhi Yojana) KVP, NSC etc.) as well as bonds and debt mutual funds. While inflation is also expected to fall over time, debt usually gives a lower return than inflation at any time. Therefore, the investor needs to accept this as a fact of life and build a portfolio with suitable asset allocation to both reach the target retirement corpus and then beat inflation post retirement.

We deal with choosing suitable debt instruments for both planning retirement and those entering / already in retirement.

Inflation: the impact on your goals and how to choose assets that beat it

As discussed in this post, we choose mutual funds using these criteria:

Provident funds (PPF, EPF and VPF) are typical products chosen for retirement. They have guaranteed returns and no taxes on maturity. However, there are two considerations:

While bank deposits give you predictable returns, there are two things you need to keep in mind

This post discusses FD vs mutual funds in more detail.

NCDs are very attractive to yield-chasing investors, given offers as high as 10% (as of July 2021), which doubles the investment in around seven years. There is no free lunch. However, to offer such high returns, these NCDs have AA or similarly low credit rating with a higher risk of default than lower-yielding AAA-rated investments. Only investors with very high risk-taking ability (not risk-taking willingness) should choose such NCDs with the understanding that an NCD default (like DHFL) should not derail their retirement. The proceeds are taxable at the marginal tax rate on maturity.

Arbitrage funds are hybrid mutual funds that try to profit from pricing discrepancies in the equity cash and futures markets. They have equity-like taxation (10% tax over 1 lakh of LTCG), which makes them reasonably popular for short holding periods. There are two things that investors need to keep in mind:

This is a recent offering in the debt mutual fund space that “mature” like an FD on a particular date but allow new investments via lump sum and SIP (or exits) anytime before maturity. These funds typically have the maturity year in their name and invest in RBI / Government bonds or bonds issued by state governments and generally do not have a default, i.e. credit risk. These funds hold the bonds until maturity (chosen to be the same time as the fund maturity) and offer a roll-down holding strategy. Investors need to keep in mind that:

Read more on this topic here: Who should invest in target maturity debt funds?

Apart from all the instruments mentioned above, there are a few additional ones suitable for the retirement phase when

Pensions offer a fixed payment throughout the life of the investor with a few caveats

This concept is covered in more detail in this article.

This is a new facility via the NSE goBID platform or the new RBI retail direct scheme where retail investors can directly buy RBI, i.e. government bonds for up to two crores. This allows sovereign guaranteed coupon payments every six months and gets the principal, i.e. face value of the bond, back after maturity. This replicates a pension plan with the option of getting a part of the bond purchase amount on maturity.

Investors should know that:

This same discussion applies to RBI Floating rate bonds as well, which mature after seven years.

More details: How to use the RBI Retail Direct Scheme to get guaranteed income?

There are a few schemes with minimal risk that you can consider:

The latest (as on 30-Sep-2025) rates are:

| Instrument | Rates of interest from 01-Oct-2025 to 31-Dec-2025 |

|---|---|

| Saving Deposit | 4.0% |

| 1 Year Time Deposit | 6.90% |

| 2 Year Time Deposit | 7.00% |

| 3 Year Time Deposit | 7.10% |

| 5 Year Time Deposit | 7.50% |

| 5 Year Recurring Deposit | 6.70% |

| Senior Citizen Savings Scheme (SCSS) | 8.20% |

| Monthly Income Account Scheme (MIS) | 7.40% |

| National Savings Certificate (NSC) | 7.70% |

| Public Provident Fund (PPF) scheme | 7.10% |

| Kisan Vikas Patra (KVP) | 7.50% (will mature in 115 months) |

| Sukanya Samriddhi Account (SSA) | 8.20% |

Source:: https://dea.gov.in/index.php/documents-orders-notices-dea

Investing in dividend-paying stocks is a common strategy for generating income in retirement. This is mentioned under the “debt investment” category as a footnote because if chosen well, dividends offer a reasonably stable income stream and can be considered by understanding the impact of adding such stocks to the retirement portfolio. However, due to taxation at the marginal rate, dividend-paying stocks should not be a part of the portfolio during the accumulation phase.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to choose debt instruments for retirement? first appeared on 29 Jul 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.