Who should invest in target maturity debt funds?

There are multiple target maturity debt funds in the market with gilt, SDL, PSU and CPSE bond exposures. Who should invest?

There are multiple target maturity debt funds in the market with gilt, SDL, PSU and CPSE bond exposures. Who should invest?

Target maturity debt fund (TMDF) is a debt mutual fund that matures, like an FD, on a particular date. The portfolio of these funds, based on the fund mandate, is a mix of one or more of the following types of bonds:

In most cases, the funds are benchmarked against a bond index launched by an index provider like Crisil, NSE or others and are run in a passive fashion. These funds are launched in three formats:

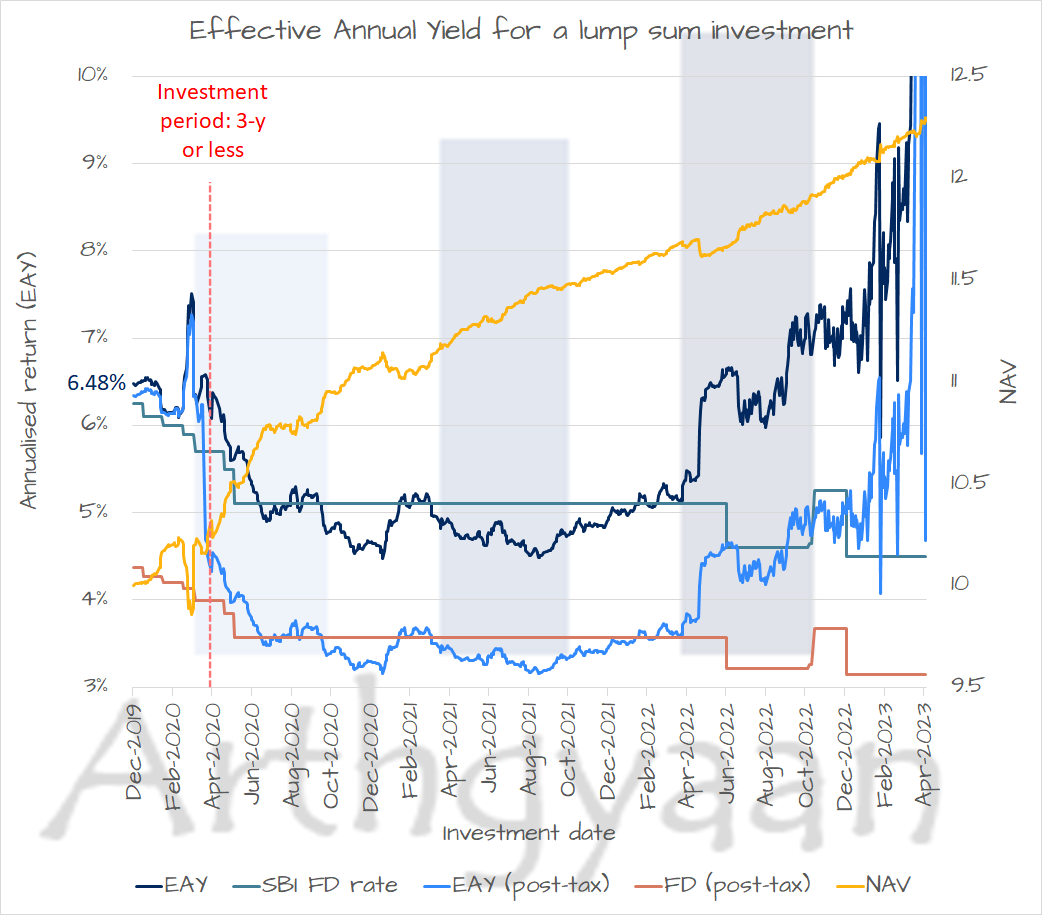

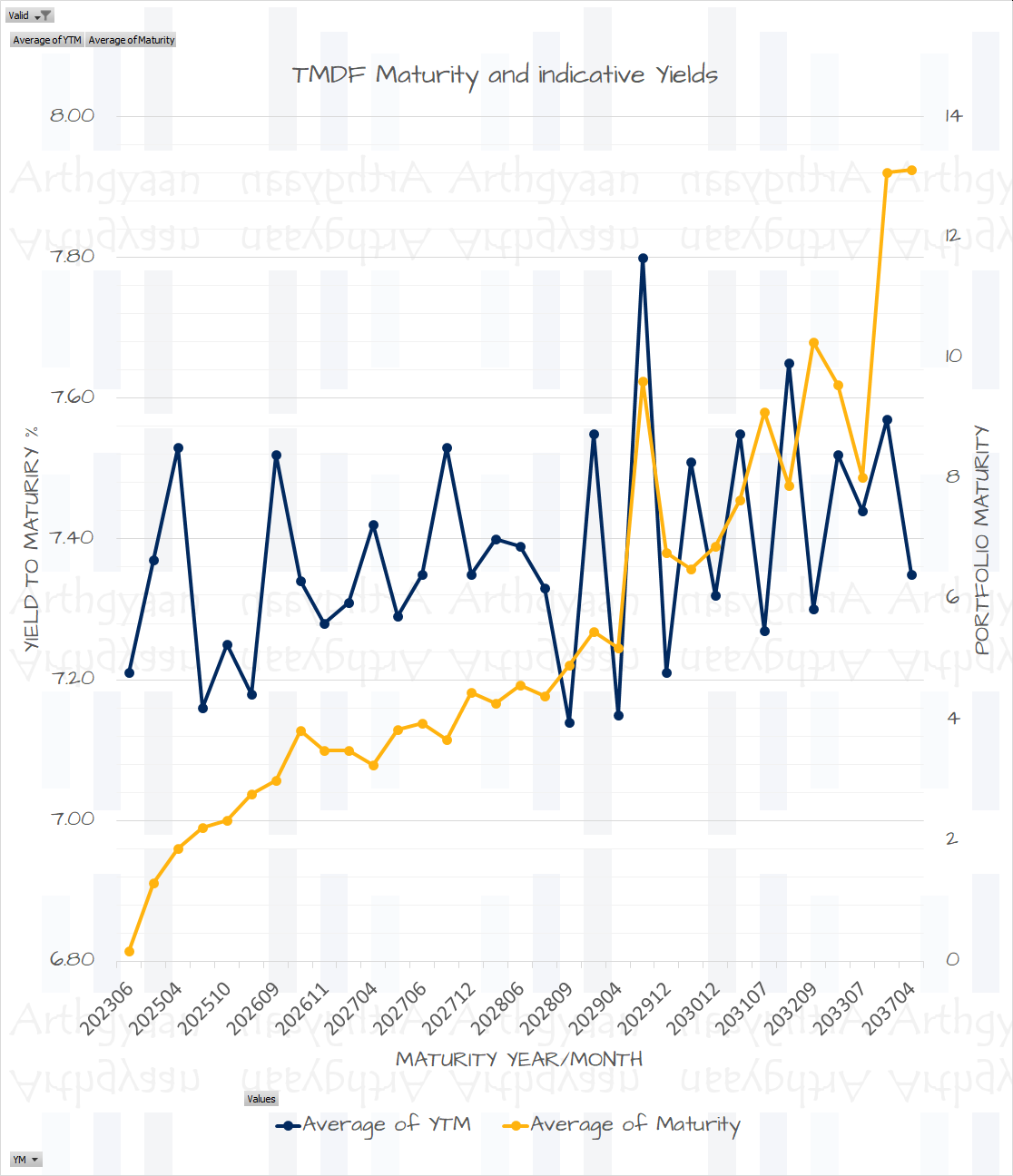

Using data from Valueresearchonline and AMC websites, we see that the average maturity of the bonds in the portfolio is very close to the residual time to maturity of the bonds. This is by design since the TMDF buys bonds that mature just before the fund’s maturity date. Therefore, this portfolio structure clarifies the actual yield (measured by Yield To Maturity or YTM minus the expenses TER) the investor is expected to get for every investment made in the fund, given that the bonds are held until maturity.

We will use the RRTTLLU framework to evaluate these funds and their suitability for investors.

The returns of these funds are not guaranteed. Just like every other debt mutual fund, the return of these funds come from:

The expected return from these funds, provided you hold to maturity, should be understood in this way:

If you do not hold the investment to maturity, the returns will be unpredictable to the large interest rate risk in the portfolio.

These funds are suitable for investing as the debt component as per the asset allocation of goals. You can invest for goals whose maturity date aligns with the fund maturity date and will have to ignore fund volatility for already invested money. You need to see if the YTM aligns with your expectations for every new investment.

There are multiple risks in these funds related to interest rate movements, trading of these bonds and market sentiment related to bonds as a whole.

This determines how good the underlying bond is in terms of the issuer’s capability of paying back the regular interest (called a coupon) and the money borrowed (the principal) of the bond.

Issuers are rated by Credit Rating agencies (like S&P, Moody’s, Fitch, CRISIL, Indiaratings etc) and given a scale like AAA (best quality), AA (lower than best), to D (worst quality - unable to pay back the money borrowed). Higher the credit rating (AAA or SOV - for the government), the lower the coupon and also lower is the credit risk.

The credit risk of the bonds, from lowest risk to highest is this: Gilts (least) followed by SDL and PSU/CPSE. PSU/CPSE bonds may or may not be AAA rated (the highest rating).

SDL issuers are generally considered similar in credit quality as gilts. This article talks about the relative risk of SDLs vs gilts.

This risk affects the prices of bonds already in the market.

If an existing bond offering a 7% coupon is pitted against a new bond that got offered at a lower coupon of 6% (interest rates are falling) then the existing bond is more desirable and a debt fund holding these older 7% bonds. The reverse happens if interest rates rise in the economy - debt fund NAVs fall. This metric, for measuring interest rate risk is called Modified Duration, is available for all debt funds and measures the rate of change of the portfolio NAV due to changes in interest rates

The higher the portfolio’s average maturity, the higher the interest rate risk. One way to mitigate interest rate risk is to hold the investment until maturity.

There is no guarantee that the fund will provide returns close to the bond index if there are large inflows and outflows in the fund since some of these bonds can be illiquid. Also, if there are liquidity events in the bond market, like in March 2020, it might be difficult to exit these bonds to support redemptions.

Given the passive nature of these funds, there is limited fund manager risk in taking decisions that chase yield or invest in bonds that do not meet the fund maturity dates. The portfolio of these funds will be inline with that published by the index provider. A key issue with getting money back after the shutting down of six debt funds in 2020 was the AMC choosing long duration bonds that will mature in the far future.

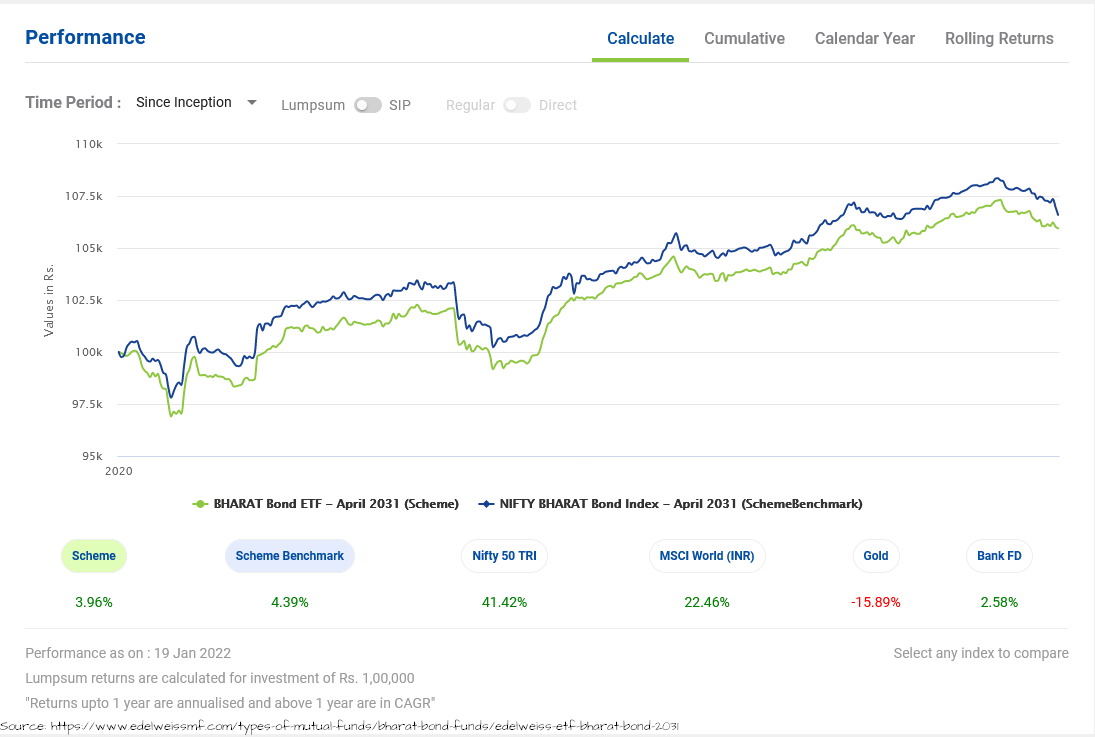

There are challenges in tracking a bond index given liquidity of the underlying bonds in the index. As the diagram above shows, for the Bharatbond 2031 ETF since inception, there are considerable differences in the way the ETF is tracking the performance of the underlying index.

These funds are suitable for investment where you need the money just after the fund matures. If the goal is further away, by more than six months to a year, you need to invest in a different fund. You should not invest in this fund if your goal comes before the fund maturity. The fund documents will have the maturity specified.

Taxation for these funds is identical to other debt funds:

Read more on mutual fund taxation: How is tax calculated on selling shares/MFs and how do to do tax harvesting?

SEBI like all other mutual funds regulates these funds. There is no special regulatory specific feature or restriction.

Typically, compared to closed-ended Fixed Maturity Plan (FMP) debt funds in the market, these funds are open-ended like most common mutual funds allowing entry and exit any time. The usual transactions like lump-sum, SIP, STP, SWP etc. are allowed. The open-ended nature also allows easy rebalancing.

Investors should, in general, avoid ETFs if there are consistent price/NAV variations i.e. the ETF keep trading away from the NAV. When buying or selling ETFs, check the iNAV from the AMC website before investing.

Read more here: Portfolio rebalancing during goal-based investing: why, when and how?

These funds are unique as they are the only target-date funds (TDF) available in India. TDFs are common in other countries and have both equity and debt for purposes like retirement and college education.

BHARAT Bond - April 2023 was a mutual fund and ETF launched by Edelweiss AMC in December 2019 with maturity in April 2023. This fund, a Fund of Fund (FoF), invested in the BHARAT Bond - April 2023 ETF, which invested in Central and State Government bonds maturing in April 2023.

We have a detailed report card of the first ever TMDF here: Mutual fund report card: Edelweiss BHARAT Bond FoF - April 2023

These funds can be a part of goal-based investing as per the asset allocation of the goal. However, given the nature of the investment, the goal horizon, i.e. when you need to spend the money, should be fixed and not change over time.

Read more: What should be the Asset Allocation for your goals?

Since we have funds maturing every year, we can create a bond ladder using current yields to create regular income. The corpus will be fully invested in these funds, and we will have to allocate a certain amount to each fund so that, post-tax, we get the amount we need. This may be useful for conservative investors since this method is more efficient since the taxation for debt funds is better than FD or interest from bonds. This method also requires less capital upfront than investing in RBI Bonds and getting income from that.

Read more: How to use the RBI Retail Direct Scheme to get guaranteed income?

These funds are suitable for investors under certain conditions and investors need to be extremely clear on their requirements and expectations.

A general primer on choosing debt mutual funds is provided here: How to choose a debt mutual fund?.

Investors should invest if:

Investors should not invest if:

As per the new tax law change, units purchased in these funds, along with several other categories of non-Indian-equity funds, after 1st-Apr-2023 are no longer eligible for 20%-post-indexation benefit. You can read more here: What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?.

Here is our latest guide for investing in target maturity debt funds: What are the best target maturity debt funds?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Who should invest in target maturity debt funds? first appeared on 20 Jan 2022 at https://arthgyaan.com