Do you need a pension plan during retirement?

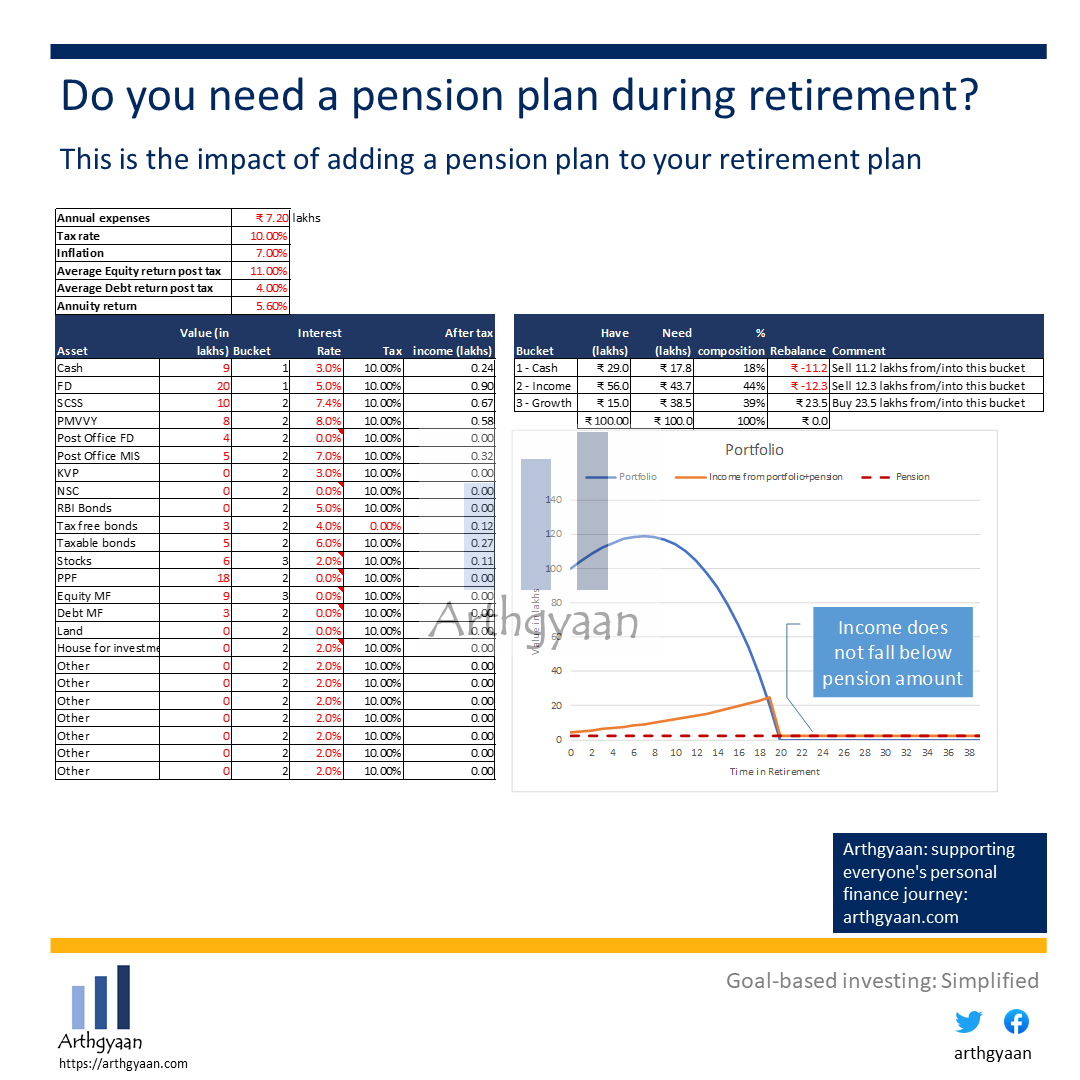

This is the impact of adding a pension plan to your retirement plan.

This is the impact of adding a pension plan to your retirement plan.

We build on the retirement with buckets post to handle retirement calculation with the addition of a pension plan (also called an annuity). A pension plan is a financial product that gives you a fixed amount of money called a pension throughout your life. This allows you to have an assured minimum income throughout your retirement.

There are many types of pension plans. Most of them do not give any money back and the money that you get is also taxable. There are two main types of pension plans that we are going to mention here. The first type gives the money immediately every year while the other, called deferred plan, starts five or ten years later. If you are purchasing it a few years before retirement then you need the deferred type else if you are retiring now then get the immediate type.

When you buy a pension plan you may get tax benefits under section 80C. Pension plans can be taken singly or jointly with the spouse. In a joint pension plan, the remaining spouse will get 50 or a hundred percent of the pension upon the death of the original purchaser.

The most important factor that you need to consider when buying a pension plan is how much money you have for retirement purposes and how much income you need every year. It might be possible that you do not need a pension plan at all especially if your corpus is very high compared to the amount you need every year. However, for those with a small amount of corpus relative to the amount they need, it will be good to have a pension plan for them.

You need to keep in mind that a pension plan cannot be exited. This means that after some time if you change your mind, you cannot get your money back. Some pension plans have the return of premium option which can be used to leave an inheritance for the nominee. These plans give lower returns than the plans that do not give the premium amount back.

Pension plans have an option to pay out money monthly, quarterly or yearly. However, the monthly options have the least return compared to the yearly one. In some pension plans, the amount paid out every year increases by a small amount, like 3%, which does not beat inflation but is still better than the other pension plans where the payment does not increase at all and will have a very low return compared to inflation.

Inflation: the impact on your goals and how to choose assets that beat it

There is also the concept of vesting age which is the time at which you start receiving the pension. You need to make sure that the vesting of the policy matches the time that you need the money from. You need to provide yearly proof of life to continue receiving the pension.

Pension plans can be purchased from insurers like LIC and private insurers. It is worthwhile to mention that there was a specific LIC-provided annuity scheme offering around 7% (7.4% as of July 2021) called Pradhan Mantri Vaya Vandana Yojana (PMVVY) that offers a pension for 10 years (and not life). PMVVY has been discontinued after 31-Mar-2023.

It is possible, for knowledgeable investors, to replicate a pension plan somewhat by buying RBI bonds where the bond coupon gives the pension and the maturity amount of the bond returns money to the nominee. We will discuss this in a future post.

Investors have an option of buying additional annuity plans in case there is an excess corpus accumulated due to a market rally or reduction in projected expenses (maybe due to the death of a spouse) in order to lock in a guaranteed income stream at different points of the retirement journey.

Due to the inability to beat inflation, you need equity in the retirement portfolio to beat inflation. Current (July 2021) pension plans are offering around 5% pre-tax returns which are lower than the 8%+ inflation in the country. There is a trade-off between having the best of having the longest time the corpus can last vs. the mental peace of knowing that you will have some amount of income till death even when the main portfolio is gone.

If you are using a pension plan for your retirement portfolio, you can see how the portfolio changes with different pension income values: How can you add multiple income streams to your portfolio for retirement?.

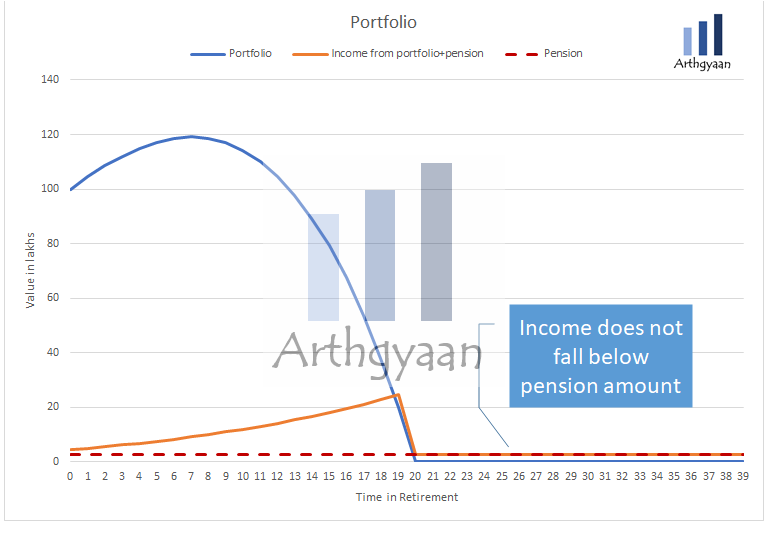

We buy a lifetime annuity (joint, 100% for spouse post death of purchaser) of 50 lakhs while keeping more or less the same asset allocation with the rest of the 1 crore of the assets. The chart below shows a zoomed version of how the portfolio behaves post-retirement:

Compared to the example without the pension plan, the corpus lasts 3 years less (due to the returns from the annuity from the rest of the portfolio) but it does provide 2.8 lakhs of income (pre-tax) for the rest of the life. This makes a pension plan invaluable from a psychological point of view.

We give a walk-through of the worked-out example in this Excel workbook.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do you need a pension plan during retirement? first appeared on 01 Jul 2021 at https://arthgyaan.com