How to get guaranteed income in retirement by combining dividends and pension?

This article shows how to combine dividends from an equity portfolio with pension plans to get guaranteed income for life.

This article shows how to combine dividends from an equity portfolio with pension plans to get guaranteed income for life.

This article is a part of our detailed article series on Dividend investing. Ensure you have read the other parts here:

This article explains the concept of dividends and shows which option is better for dividend income: stocks or mutual funds.

How to get inflation-indexed income in retirement using dividends.

A pension plan gives guaranteed income till death for the person buying the plan. On death, some plans provide some amount of regular payout to the surviving spouse. However, a pension plan does not beat inflation.

A mutual fund, vary rarely offers any regular or guaranteed returns. Instead, the returns fluctuate depending on the type of fund. For example, equity funds generally move up and down more than other categories like debt funds. But on the other hand, equity mutual funds have beaten inflation in India and major global markets over long periods.

This article combines the best features of both products to create a retirement plan that gives guaranteed returns via pension plans every year. Still, the additional yearly return fluctuates like an equity fund to allow for beating inflation.

Before understanding how to combine mutual funds with pension plans, we must understand how returns come from equity mutual funds.

Equity mutual fund returns come from two sources:

We are interested in the dividends of the stocks here. As per historical data, dividends are relatively stable, as shown below, unlike the price of individual stocks.

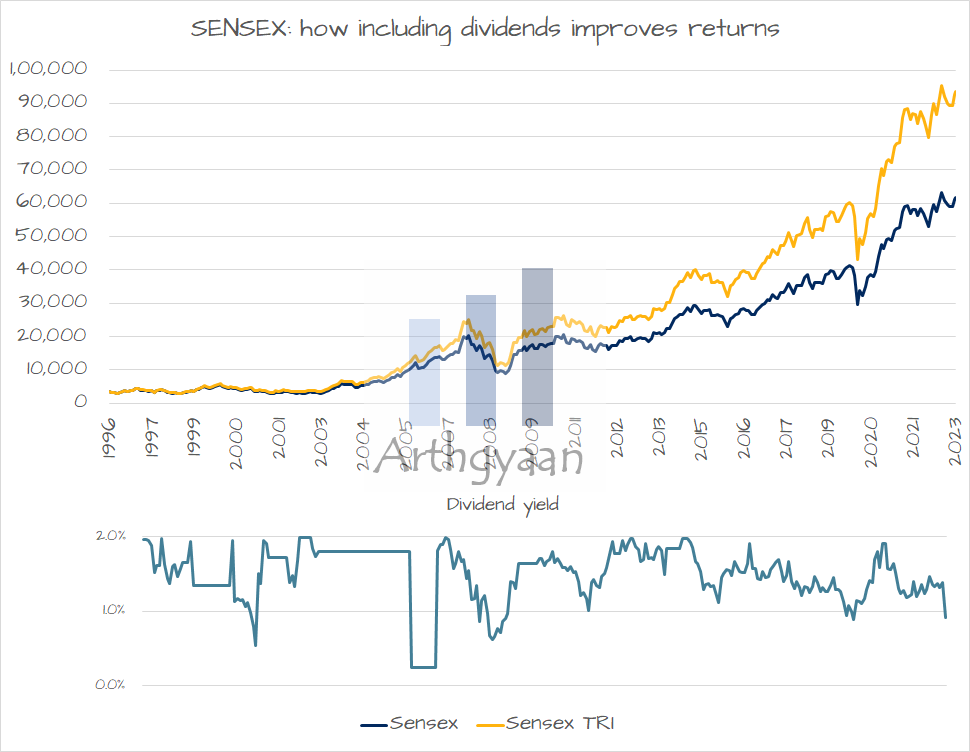

We will consider the BSE SENSEX as a representative of Indian stocks and compare the return of the SENSEX vs that of the SENSEX Total Return Index (SENSEX TRI). In the TRI version of any index, the stock dividends are immediately reinvested into the portfolio.

We have limited data since historical TRI index data was available only since 1996 and therefore restricted ourselves to only 20-year windows for rolling period analysis.

As the chart shows, including the 1-2% dividend yield has drastically improved the value of the SENSEX from 60,000 for the PRI version to more than 90,000 for the TRI version.

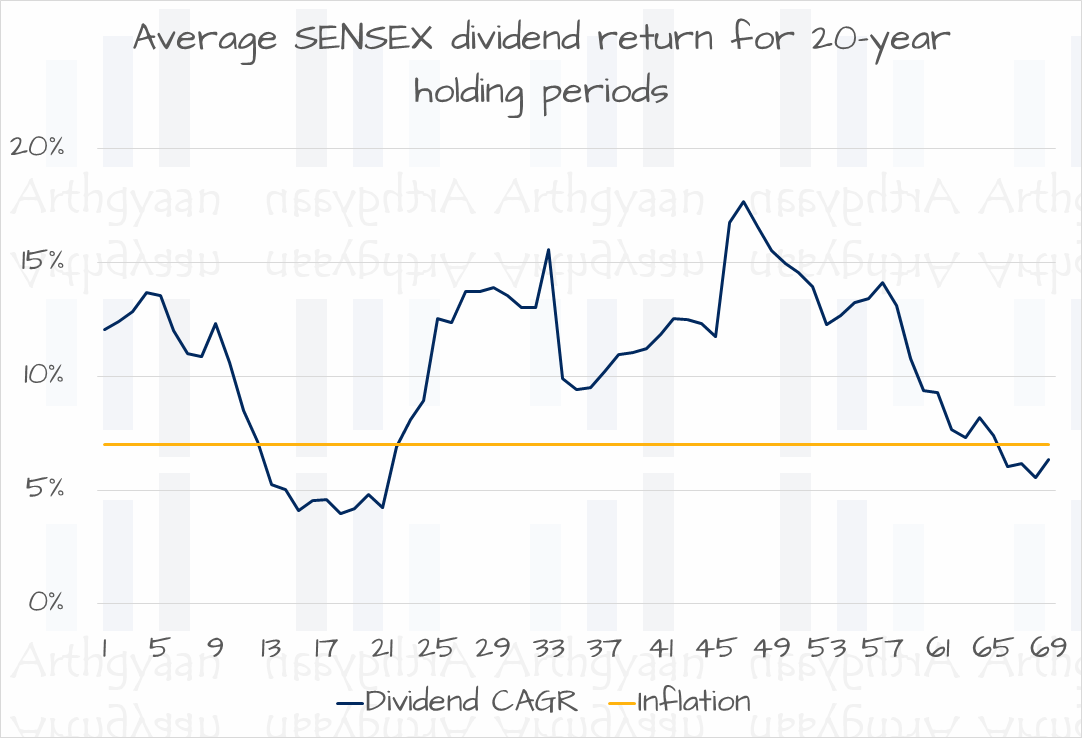

Suppose we plot the total dividends from a portfolio investing in the SENSEX TRI, via a mutual fund, for every period of 20 years and calculate the CAGR returns. In that case, we will get a chart like the above one. We have 69 periods, each 20-year long, from Aug-1996 till date. These periods are:

In most of these 20-year holding periods, the total amount received from dividends has grown faster than an inflation rate of 7%.

Here, we cover the best option to create a dividend income stream: Understanding dividend investing: should you invest in stocks or mutual funds for dividend income?.

We have discussed pension plans in retirement that you should cover before proceeding further:

Our plan is straightforward:

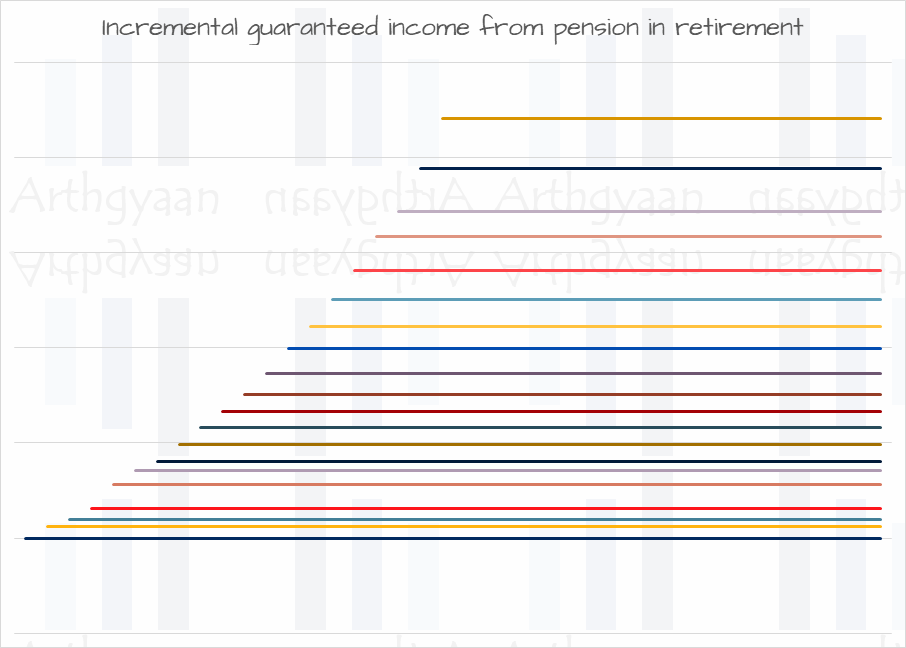

The diagram above shows this plan implemented in practice. There are 20 different pension plans purchased once a year for 20 years, and each produces guaranteed income for life. A few assumptions have gone into the plan above:

Here we see a sample retirement plan using data for the 20 years ending April 2023

We have assumed a flat 5% return from each pension plan to simplify the calculations. In reality, pension plans in this period offered higher returns, which would have led to higher monthly income. Also, as each pension plan is purchased as an immediate annuity, the return increases as the age of the investor increases.

To implement this scheme of getting guaranteed income from pension purchased from dividends, the starting corpus, as a multiple of first-year’s expense in retirement, is very high.

We can thus see the trade-off between a secure cash flow from pension and the need to provide inflation indexing on that. Our previous article on combining a pension plan with an SWP from equity also had a similar conclusion. Still, the starting corpus requirement was less demanding: How to mix an SWP from an equity mutual fund with a pension plan in retirement?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to get guaranteed income in retirement by combining dividends and pension? first appeared on 14 May 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.