Understanding dividend investing: should you invest in stocks or mutual funds for dividend income?

This article explains the concept of dividends and shows which option is better for dividend income: stocks or mutual funds.

This article explains the concept of dividends and shows which option is better for dividend income: stocks or mutual funds.

This article is a part of our detailed article series on Dividend investing. Ensure you have read the other parts here:

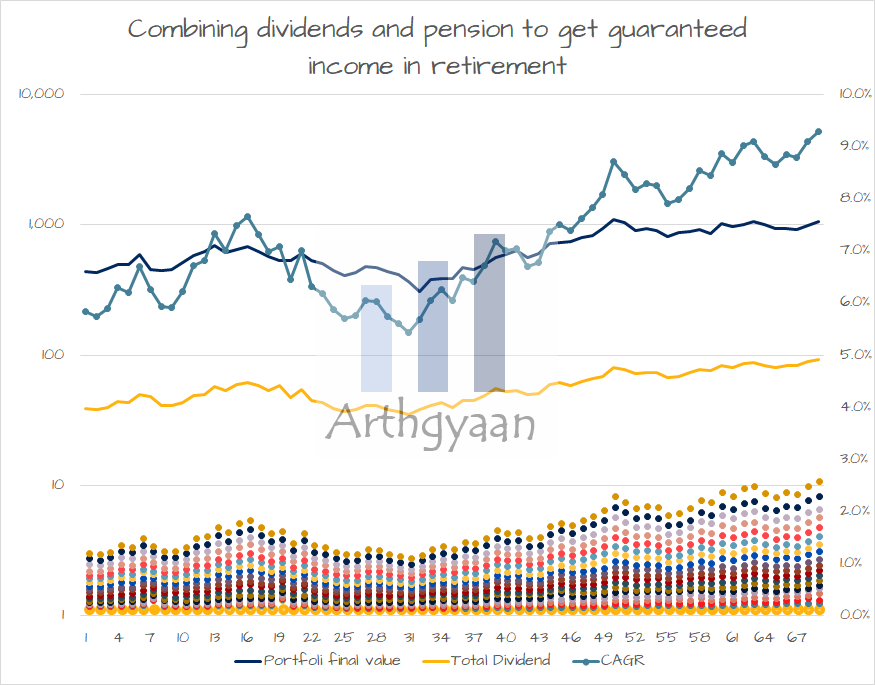

This article shows how to combine dividends from an equity portfolio with pension plans to get guaranteed income for life.

How to get inflation-indexed income in retirement using dividends.

A dividend is a share of the profit of a company given to the owners of the company. For example, if the company is a shop, the shopkeeper can use say 30% of the monthly profits for household expenses. The remaining 70% of profit is used to grow his shop and is called retained earnings.

If there are two shop owners, say two siblings, they will share the profits from the shop in proportion to their ownership. Any amount not taken by the owners becomes retained earnings.

A loss-making company cannot pay dividends.

Dividends allow company owners to take part in a company’s profits.

Stock dividends operate in the same way as the shop example. Here is a quick explainer of the concept:

🤖 Explainer: Dividends from shares

Mutual fund assets before dividend = Stocks + Cash

Mutual fund assets after dividend = Stocks + Cash - Dividend

Since NAV = Fund Assets / Units, NAV falls after dividend payout.

Mutual funds do not provide dividends in the way stocks do. Mutual funds do have a dividend plan called Income Distribution cum Capital Withdrawal (IDCW), but that is just returning a part of the cash balance of the fund to the investor. As a result, the NAV falls by the declared dividend amount. In addition, mutual fund dividends are taxable at the investor’s slab rate, like stock dividends.

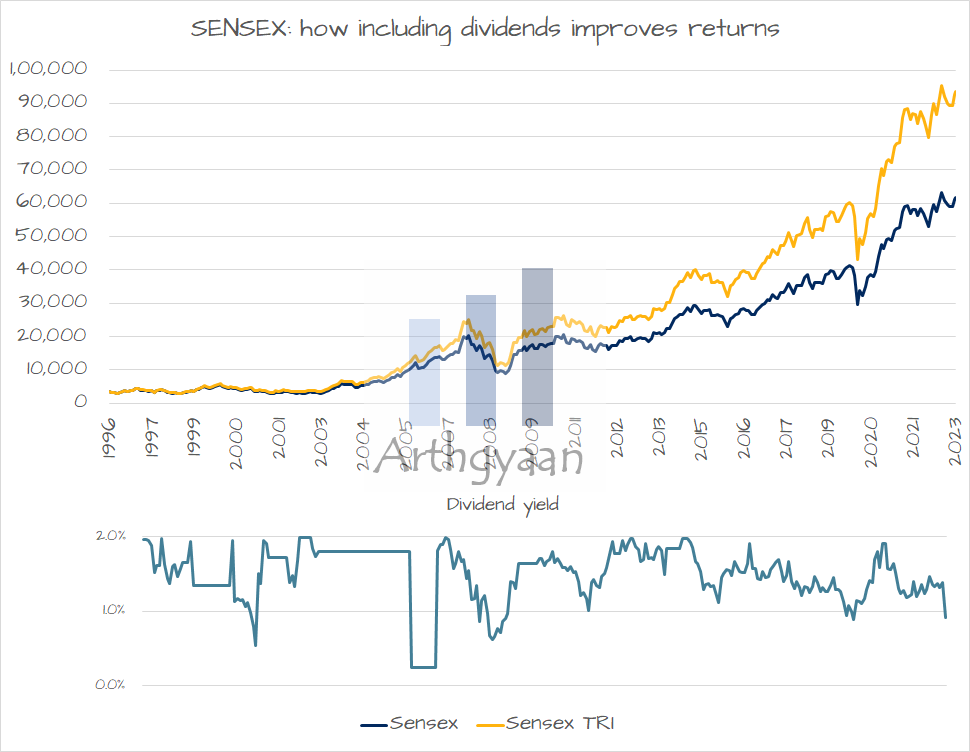

We will consider the BSE SENSEX as a representative of Indian stocks and compare the return of the SENSEX vs that of the SENSEX Total Return Index (SENSEX TRI). In the TRI version of any index, the stock dividends are immediately reinvested into the portfolio.

We have limited data since historical TRI index data was available only since 1996 and therefore restricted ourselves to only 20-year windows for rolling period analysis.

As the chart shows, including the 1-2% dividend yield has drastically improved the value of the SENSEX from 60,000 for the PRI version to more than 90,000 for the TRI version.

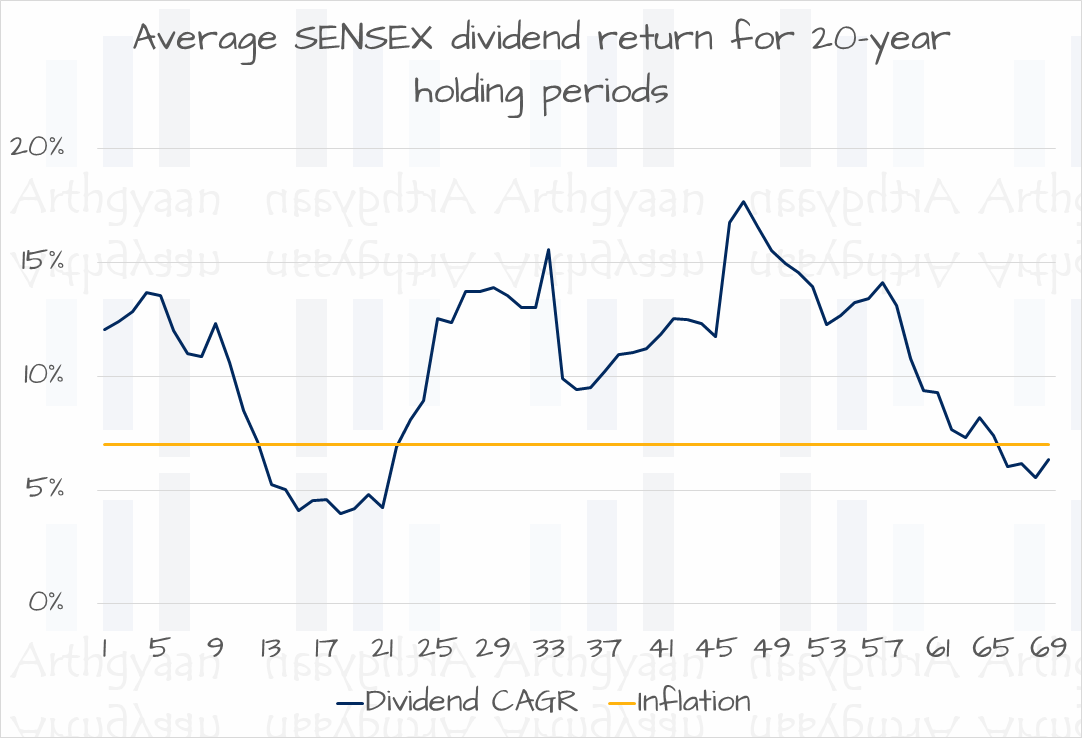

Suppose we plot the total dividends from a portfolio investing in the SENSEX TRI, via a mutual fund, for every period of 20 years and calculate the CAGR returns. In that case, we will get a chart like the above one. We have 69 periods, each 20-year long, from Aug-1996 till date. These periods are:

In most of these 20-year holding periods, the total amount received from dividends has grown faster than an inflation rate of 7%.

Investors should avoid investing in direct stocks, whether that of the SENSEX or by following any dividend strategy, because of the following reasons:

Currently, dividends in India are taxable at slab rates. This means that as per the RRTTLLU suitability framework, dividend-paying stocks are unsuitable for the accumulation stage, i.e. pre-retirement portfolio. In post-retirement, there is a possibility of taxes being lower, making dividends more tax-friendly. Even at the highest slab rates, the chance of stable income from dividends must be balanced against the lower taxation from stock and mutual fund capital gains.

Due to the reasons above, an investor, at higher slabs, looking to create a stream of dividend income should invest via a mutual fund and not via stocks.

Returns, including dividends, from mutual funds are not guaranteed.

Mutual funds come in two plans:

Irrespective of whether we need the dividend, we should only invest in the Growth plan of the mutual fund. Here are the supporting reasons:

As a simple rule, the investor can sell 1-2% of their mutual fund units every year since that amount is close to the historical dividend yield of the SENSEX. Therefore, in summary, to get dividends by investing in mutual funds, an investor should:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Understanding dividend investing: should you invest in stocks or mutual funds for dividend income? first appeared on 10 May 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.