Should you prepay your home loan or invest instead?

Quickly figure out if you should prepay your home loan vs investing in the stock market?

Quickly figure out if you should prepay your home loan vs investing in the stock market?

You have a home loan for which you pay EMI monthly. You have extra money every month that you need to utilize: typically invest as per your goals or prepay the loan. Maybe you even got some extra cash as a bonus or maturity of FD or insurance. Read on to find out what you should do next.

This article is the next part of our guide to purchasing your dream home. Read the other parts here:

Personal finance is more personal than finance. - Tim Maurer

Home loan prepayment is a classic example of this adage being true. There are two parts to the definition of personal finance that leads to this quote.

The first, the Finance part, is pure mathematics and has to be proved or acted upon based on a mathematical calculation. A good example is that paying off a credit card balance (at a 36% interest rate) is better than buying stocks whose returns are uncertain.

The second, the Personal part, is tied to the investor’s behaviour. It, therefore, causes all sorts of issues in implementing something that should have been straightforward mathematics, both good and bad. An example of personal behaviour is the willingness to let investments rise higher and higher in a bull market rather than book profits via rebalancing.

Sometimes, these behavioural biases can become extremely powerful to overcome the rational answers provided by the formulaic part of personal finance. Therefore, we will tackle the current point at hand - prepayment of a home loan - from both aspects - the mathematical and the emotional. For many people, the peace of mind that comes with being debt-free cannot be counted in money terms.

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that includes both interest and principal in the same amount.

EMI = Principal + Interest

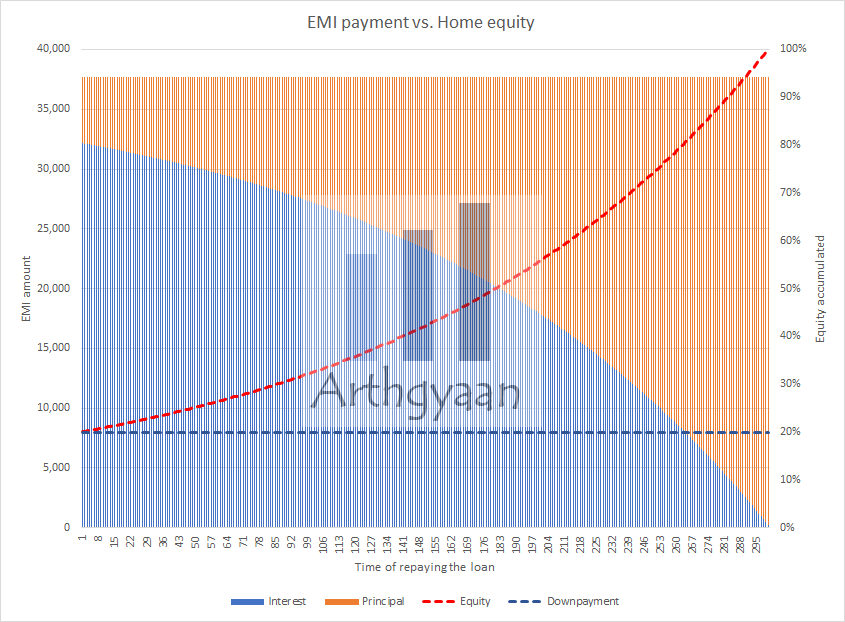

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

As you pay back the loan, your ownership share in the house will increase in the same way. At the point of taking the loan, you own 20% of the house (12.5 out of 62.5, of which 50 is the loan). The bank owns 80%. As the loan is repaid, you own more and more of the house as the principal is paid off. This is the concept of building equity in an asset. Equity is the part of the asset you own after subtracting the part that the bank owns.

Home equity value = Current home value - Outstanding loan balance

Once you build equity in your home, that has additional benefits:

When you prepay a loan, the principal immediately reduces by the amount you prepaid. This payment directly shortens the loan tenure if EMI remains the same. You can also ask to switch to a smaller EMI, keeping the same loan tenure. Ideally, you shouldn’t reduce EMI unless you cannot manage monthly expenses. If your loan tenure comes down, the interest you pay reduces. This interest savings due to principal reduction leads to a return on the amount you just prepaid equal to the (after-tax) rate of the loan. So for a home loan at 8% (after-tax savings on principal + interest, say 6-7%), this is a return that is guaranteed. Additionally, you end up owning more and more equity in your home more quickly.

Generally, goal-based investments assume an overall return (usually from equity) higher than the loan’s effective rate. This is true, at least historically and but is not guaranteed. If we assume this to be accurate, paying only the EMI is better since the extra money can be invested for long-term goals in equity markets to get more returns.

There is a small caveat here regarding opportunity cost. Suppose you do not have a loan. In that case, your opportunity cost of investing in equity is a debt fund that returns lower than the cost of the loan itself. So you take some risk or uncertainty to hopefully get returns higher than a debt fund by investing in equity. On the other hand, your opportunity cost is lower with a loan since the loan rate is more. So essentially, you take the same risk while the opportunity cost is lower.

In either case, you should perform a recalculation of your entire portfolio using a comprehensive planner (like this) to see where this allocation should be made to debt or equity. If the allocation comes to debt, prepay the loan with that amount. Keep in mind that unless you have a home loan like SBI Maxgain, you cannot bring out the money you have invested into the loan. It is generally a one-way transfer.

You should not prepay the home loan if your asset allocation does not allow it. For example, this may happen if the portfolio is already debt-heavy or the goals are such that you cannot rebalance the portfolio further into debt.

Read more on asset allocation and rebalancing here:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you prepay your home loan or invest instead? first appeared on 23 Mar 2021 at https://arthgyaan.com