How to manage a home loan if you are worried about job loss?

This article discusses the steps for investors in high-income brackets but hesitant to commit to a home loan due to the fear of job instability.

This article discusses the steps for investors in high-income brackets but hesitant to commit to a home loan due to the fear of job instability.

🎉 This is post number 400 in this blog

This post from Social Media got my attention:

Age 35, drawing 3.7L per month. Should I take 1CR home loan ? Very confused and scared if I should take the home loan of 1cr at the age of 35 or not. I will also have to invest 50% of my savings towards purchasing the home. Have a family of 4 dependent on me.

Let us break this down and discuss remediation.

There is a relationship between house price and monthly in-hand income based on the amount of down payment, the loan terms, and the percentage of monthly income paid as EMI and any existing loans.

As calculated in detail in this article, Home Loan Eligibility for Joint Applicants: how to buy a bigger house, if you make a 50% down-payment and the bank allows a maximum 30% EMI as a percentage of the take-home pay, then the house you can purchase is worth at most 70.4x your monthly in-hand salary.

In the example here, for ₹3.7 lakhs pretax salary, in the new tax regime, the in-hand is around ₹2.8 lakhs/month. The house they can afford, using the 70x multiplier costs almost ₹2 crores.

Since they are paying 50% as a down payment, their EMI, for ₹50 lakhs taken at 9% for 15 years is around ₹50,000/month. This figure is around 18% of the in-hand income.

Therefore, just by buying a much cheaper ₹1 crore house with a 50% down payment, the investor is well within the safety zone offered by their income.

There are multiple strategies to pay off a loan quickly:

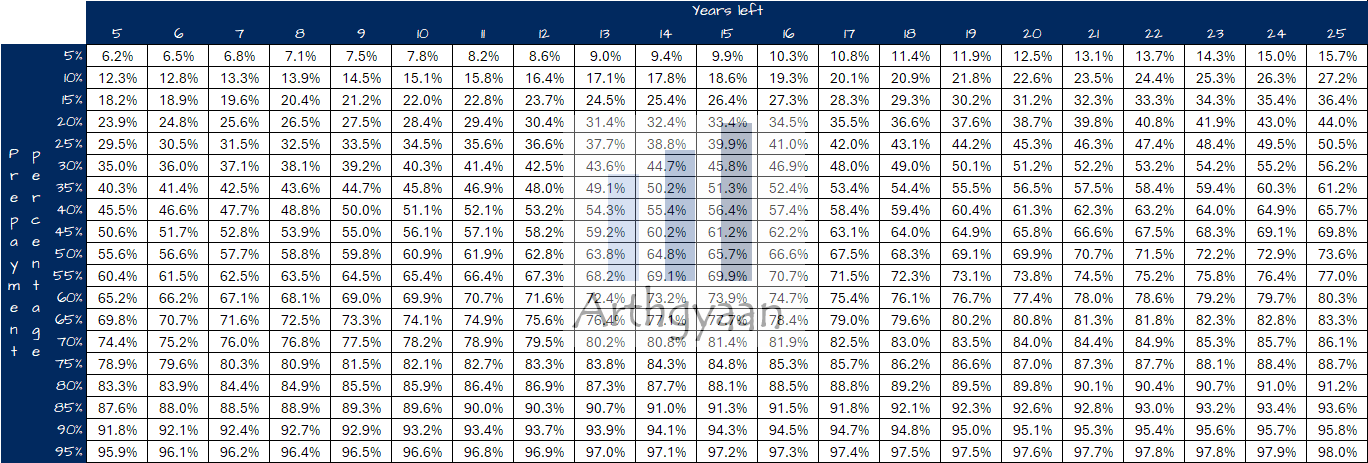

As we have discussed here, What benefit do you get if you make a one-time prepayment to your home loan?, every time you make a prepayment the time left in your home loan reduces since the principal gets repaid.

In the image above, every time the investor pays off 10%, which in this case is ₹5 lakhs or less, of the outstanding loan balance for a 15-year loan, the tenure reduces by 18.6% or 33 months. So just ploughing the annual bonus into the loan will massively reduce the amount of time left in the loan.

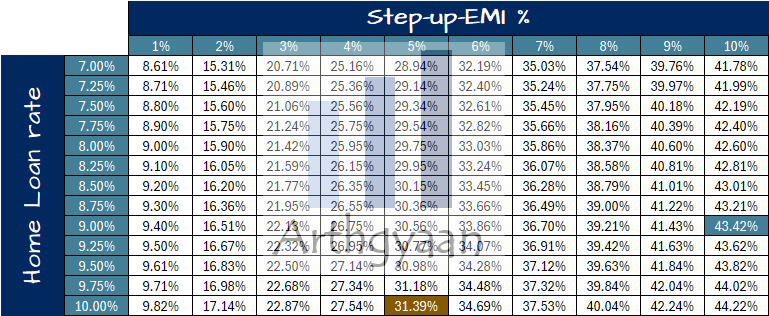

In the table above, for a 15-year loan, if you step up your EMI by 10% a year, you save 43.42% of the time. So if the investor just increases their EMI by 10% a year, their loan will be paid off in (1-43.42%) * 180 months = 102 months.

We have completed more such calculations here: How much time and interest do you save if you pay off your home loan using a step-up EMI?

As discussed in this post, the final impact on your mutual fund/stock portfolio, if you stop investing to pay off a home loan in 5 years is minimal: What happens to your mutual fund portfolio final value if you choose to buy a house?

What about starting with a higher EMI amount since there is likely room in the monthly budget?

There is always the option of pausing long-term investments and aggressively paying off the EMI from the beginning. Here we will keep the EMI constant which has multiple benefits:

We have discussed this point in detail here: Pay Off Your Home Loan Faster: How Extra EMI Payments Save Time and Money.

As discussed in this article, How much EMI do I have to pay for my home loan?, doubling the EMI/lakh from ₹1,014 to ₹2,076, for a 9% loan, drops the total loan duration from 15 years to 5 years. Banks, as per RBI directive, cannot charge extra for prepayments from the investor’s own funds.

To understand if now is the right time to take a home loan:

To reduce the risk of hardship in case there is a break in income, it is prudent to less as little loan as possible.

Lower the loan, the lower the EMI but higher the impact on the future portfolio

You can choose a higher down payment and end up with a lower EMI by:

You can of course execute any of these options in case your job is actually impacted anytime.

Do not tell anyone in the office that you have taken a home loan. The reasoning is obvious.

These are the standard prerequisites that must be completed before investing and taking new loans:

For a home loan, it is specifically important to:

If your loan is already running and if any of the checklist items above are incomplete, please pause your long-term investments (e.g. mutual fund SIPs) to:

Emergency fund will take care of dependents and EMI

Just because a risk exists, it might become true at some point. You lose your job and are put on notice period. The first order of business at this point will be not to panic. It is easier said than done but it is important to keep a calm head to follow the next steps:

In parallel to all of these, you should put in every effort in finding a new job.

Personal + Finance = Personal Finance

In the end, buying a home is a mix of financial and personal decision-making.

We have covered the financial decision-making here: Goal-based investing: how to purchase your dream home

But the personal part is a leap of faith:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to manage a home loan if you are worried about job loss? first appeared on 14 May 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.