Gold touched ₹75,000 per 10 gm. Should you buy gold or sell gold at this point?

This article explores the probabilities of gold price movement, both up and down, from current price levels.

This article explores the probabilities of gold price movement, both up and down, from current price levels.

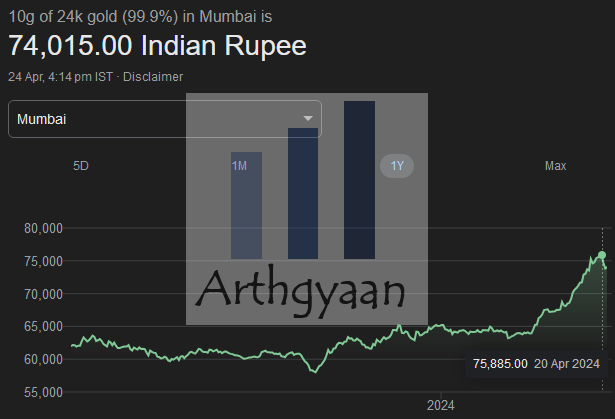

The price of 99.9% purity gold recently (20-Apr-2024) reached a lifetime high of more than ₹75,000/10gm on the back of news of the Iran-Israel conflict. Gold prices, always track the risk of geopolitical risks, and have reached today’s level after a 52-week low of ₹58,000/10gm in October 2023.

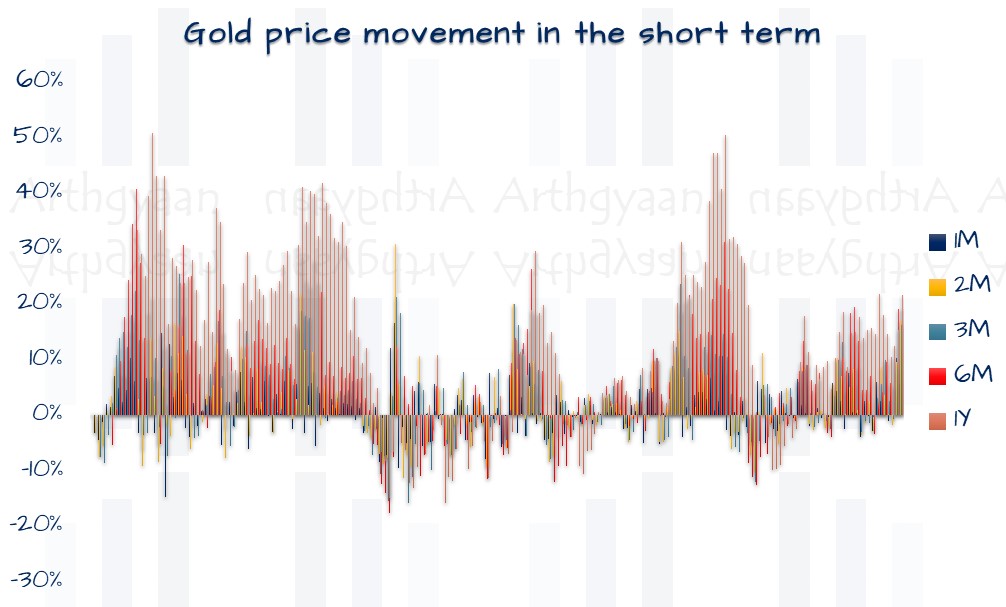

This article explores how gold prices have moved in price bands like -5% to 5%, -10% to 10% etc. in India in the short-term (1-month, 2-month up to 1 year) so that investors looking to enter or exit gold can make an informed decision.

The chart above shows rolling gold price returns for various short-term periods (up to a year) since 2007. We have used the beginning of month 24CT gold prices since March 2007.

| Range | 1M | 2M | 3M | 6M | 1Y |

|---|---|---|---|---|---|

| -5% to 5% | 74% | 59% | 53% | 35% | 22% |

| -10% to 10% | 94% | 88% | 78% | 65% | 42% |

| -15% to 15% | 99% | 96% | 91% | 82% | 56% |

| -20% to 20% | 100% | 99% | 98% | 90% | 66% |

| -25% to 25% | 100% | 100% | 100% | 96% | 76% |

| -30% to 30% | 100% | 100% | 100% | 98% | 85% |

The table above shows that historically

There is no chance that anyone can predict actual price movements. The best we can do is look at the historical probabilities and extrapolate the trend to short periods only.

| Probability | 1M | 2M | 3M | 6M | 1Y |

|---|---|---|---|---|---|

| Rise | 59% | 60% | 64% | 74% | 77% |

| Fall | 41% | 40% | 36% | 26% | 23% |

If we ignore the amount of change and just look at the direction, there is more chance, historically, that gold will rise in the short term. However, these are probabilities. Just like a coin toss does not guarantee either a head or tail, the table does not guarantee any particular direction of movement.

To understand whether to purchase gold now or later:

If you must buy gold soon, say for a wedding, you should consider what happens if the gold price actually moves between now and the wedding.

If your target is to buy 100gm of gold (around ₹7.5 lakhs at current prices), as per the data below:

| In grams | 1M | 2M | 3M | 6M | 1Y |

|---|---|---|---|---|---|

| 95 to 105 gm | 74% | 59% | 53% | 35% | 22% |

| 90 to 110 gm | 94% | 88% | 78% | 65% | 42% |

| 85 to 115 gm | 99% | 96% | 91% | 82% | 56% |

| 80 to 120 gm | 100% | 99% | 98% | 90% | 66% |

| 75 to 125 gm | 100% | 100% | 100% | 96% | 76% |

| 70 to 130 gm | 100% | 100% | 100% | 98% | 85% |

There is an 88% chance, for example, that the gold you will end up buying in the next 2 months will be within 90-110gm for the same amount of money. It may not be possible to distinguish, without using a jeweller’s scale, if a piece of jewellery has 90 vs 110 gm of gold. Of course, the best way to accumulate gold for a wedding in the far future is slightly different: What is the best way to accumulate gold for your child’s wedding?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Gold touched ₹75,000 per 10 gm. Should you buy gold or sell gold at this point? first appeared on 28 Apr 2024 at https://arthgyaan.com