What will create a higher corpus for children's marriage: buying physical gold vs SIP in stocks

The article shows you if you there is a better alternative to buying gold over time for your child’s marriage goals.

The article shows you if you there is a better alternative to buying gold over time for your child’s marriage goals.

This article is a part of our detailed article series on accumulating gold over time for a child's wedding in the future. Ensure you have read the other parts here:

This article gives the solution for buying small amounts of gold over the years in case buying SGB is not an option.

This article shows you how to buy gold in small amounts over years for a child’s wedding goal.

Originally published: 5-Jun-2022

Updated: 19-Nov-2023 - updated Sensex and gold prices to Nov 2023

Many parents wish to accumulate a certain amount of gold for their child’s marriage goal. Since this is their personal choice, we will look at the best ways to achieve this goal by presenting a case of buying gold versus investing in stocks for your child’s marriage. We will explicitly compare the following two cases:

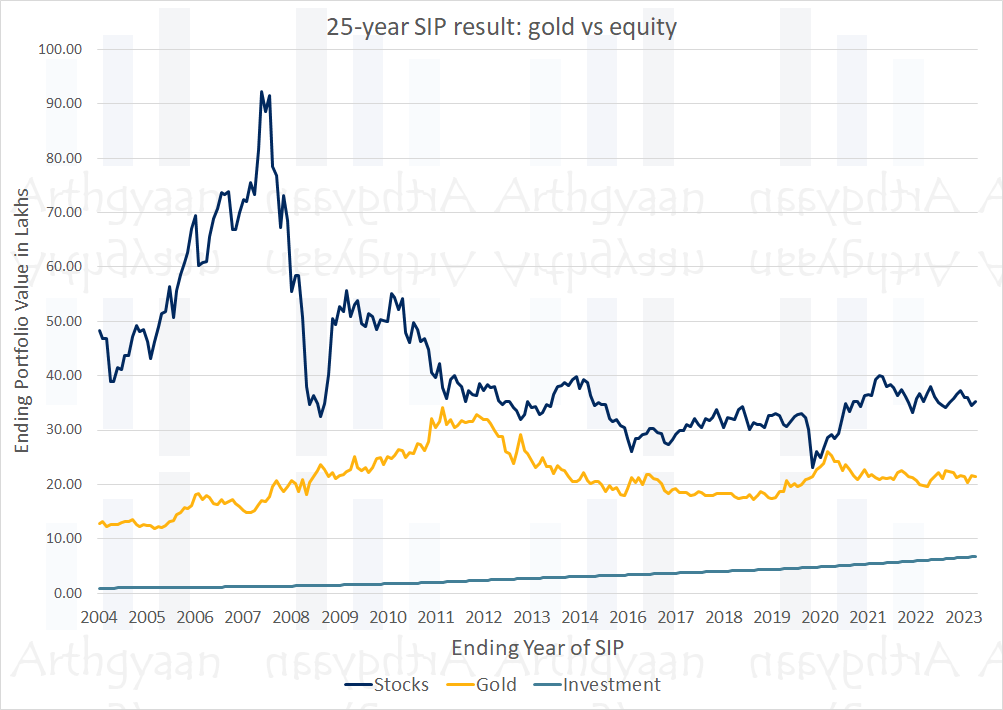

To perform this analysis, we will compare a 25-year SIP into stocks and gold, increasing by 10% a year, using Sensex Total Return Index (Sensex price movements plus dividends) to represent stocks and USD/ounce gold price, converted to rupees, to represent gold since Jan-1973. A practical comparison is a SIP in a Sensex/Nifty 50 mutual fund and any gold mutual fund. We did not have mutual funds in 1979, but we have today, and not having mutual funds in the 1970s does not invalidate the conclusion below.

This calculator helps you determine the total cost of gold jewellery, including making charges and GST.

Enter Today’s Gold Price

Input the current price of gold per gram in ₹.

Enter Grams of Gold

Input the weight of the jewellery in grams.

Enter Making Charge (%)

Input the percentage charged for making the jewellery.

Enter GST (%)

Input the applicable GST percentage.

Note: If you already own the gold as a bar or biscuit, GST is applied only the making charge.

The calculator will automatically display:

All calculations update in real-time as you change the inputs.

We start with ₹1,000/month at the beginning of the period and increase that amount by 10%/year for 25 years. We build in a 10% increment in the SIP since investors will invest more and more in real life as their income increases.

In the gold SIP case, we buy physical gold for that amount, and in the case of stocks, we invest the same amount in a hypothetical index fund that tracks the Sensex.

The result shows that both gold and stocks have been highly volatile even with a 25-year time horizon. The choice of 25 years is arbitrary, and we do not expect the results to materially change for a 20 or 30-year SIP. Also, given that the data has been only available since 1973, we will have fewer data points if the SIP interval is increased.

The ending portfolio value will depend a lot on the performance of the investment in the latter part of the period, given that the invested amount increases over time. For example, if the underlying stock or gold changes by 5%, a 10 lakh portfolio changes by 50,000 while a one crore portfolio changes by five lakhs. The result is evident in two places for stocks: 2008 and 2020, due to the Global Financial Crisis and the COVID-19 pandemic. In both cases, gold gave closer return than in previous periods relative to stocks due to stocks falling.

Most importantly, the result shows that out of the 238 periods in the result, only 2 periods saw the gold investment end closer to the value of the stock investment. This result effectively means that if you started a SIP anytime between 1973 and 2004, you would have a higher return in stocks in all cases.

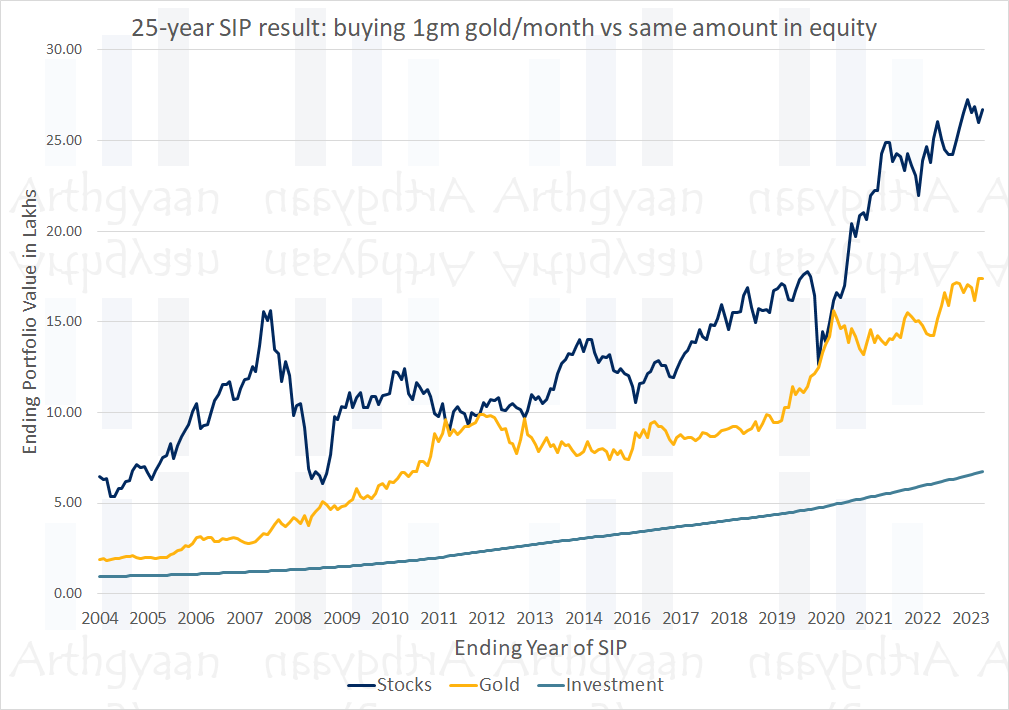

We now compare the performance of buying 1 gram of gold every month vs investing the exact same amount in Sensex over 25 years in the same way. This means that if gold is ₹550/gm today, then in one case, we buy 1 gram of gold, and in the other, we invest ₹550 in the Sensex. If the gold price rises to ₹580 in the following month, we do the same but end up spending ₹580 now. Since we are running a 300-month SIP, in one case, we have 300gm of gold, and in the other, an investment in Sensex stocks. We now compare and plot the ending values of the two cases: the value of 300gm gold when the SIP ends and the value of the stock portfolio. If the stock portfolio is higher, it can buy more than 300gm of gold at that point in time.

We see a repetition of the previous result with 236 of 238 cases having a higher ending value in stocks than the other of just 2 cases. The result is not materially different from the previous case. Once more, buying stocks is better than buying gold over 25 years, as per the historical data.

We should keep in mind the following points while concluding anything from this analysis:

We have a complete guide for you here: What is the best way to accumulate gold for your child’s wedding?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What will create a higher corpus for children's marriage: buying physical gold vs SIP in stocks first appeared on 05 Jun 2022 at https://arthgyaan.com