A health insurance premium fund: who needs it and why

This article shows you a better alternative to paying premiums every month or quarter as well as manage when premiums increase over time.

This article shows you a better alternative to paying premiums every month or quarter as well as manage when premiums increase over time.

This article is a part of our detailed health insurance article series. Ensure you have read the other parts here:

This article discusses how to plan early retirement in the face of lifestyle inflation and lack of health insurance for an investor in their 40s.

This article discusses the ICICI Lombard Elevate health insurance plan to understand whether it really offers unlimited claims.

This article discusses the latest Master Circular on Health Insurance Business, issued on 29/05/2024, which introduced significant changes aimed at enhancing policyholder protection and streamlining claim settlements.

This article gives you a list of common questions and their answers on the concept of “Cashless Everywhere” introduced for health insurance.

This article talks about deductible-based health insurance plans like top-up and super-top-up and shows which one you should buy and why.

This article shows the steps to correctly file a health insurance claim so that it gets processed quickly and you get back as much as possible.

This article explains why health insurance is important, how to choose one that suits your needs, the tax benefits and where to buy it from.

While most insurance premiums offer a monthly or quarterly payment plan, here is why you should avoid them and choose the annual plan:

Here the basic premise is that the more times you pay, the more is the risk of a payment failure or other problems which might lead to the policy lapsing. A policy in force for 30 years has

If the chance of failure is say 1% per payment, a failure is least likely to happen once in 30 payments. However, at the same time, it is virtually inevitable at least once with 360 payments.

The insurance company extends courtesy to you by providing reminders to renew the policy, but that is not guaranteed. So do not count on getting a reminder to renew.

However, it may be difficult to cough up a large sum of money once a year on a specific date since that will likely strain the monthly budget. The following section shows a solution where you pay the premium monthly without straining the budget. This is especially important if the income is irregular.

Health insurance premiums go up due to two main reasons:

We will use a modified version of the sinking fund to help you save for increasing health insurance premiums.

To recap, a sinking fund is a place where you save money every month to save for a significant expense that occurs once a year. An excellent example of using a sinking fund is a building fund that pools contributions from society members to spend on various maintenance activities. Read more about sinking funds here: Budget 101: How to save for periodic expenses: the sinking fund.

A recurring deposit is one way of saving money monthly. However, a debt mutual fund offers a more straightforward alternative since you can take out as much as you need whenever you need it.

Steps to follow:

Let’s say your insurance premium is 60,000/year, payable in June. Start a SIP of 5000/month in the fund of your choice. Every 12 months, you will have 60,000 plus some returns from the fund. Redeem the 60,000 to pay your premium. Let the SIP run continuously.

The plan described above works fine if the premium is constant, like a life insurance premium. However, we use a slightly modified plan for a health insurance premium that may increase.

It is difficult to predict how much a health insurance premium will increase. Due to the COVID-19 pandemic, many health insurance providers have increased their premiums. Also, there is always a 10-30% jump in premiums whenever age increases into higher premium bands, like moving from the 35-40 band to the 41-45 band.

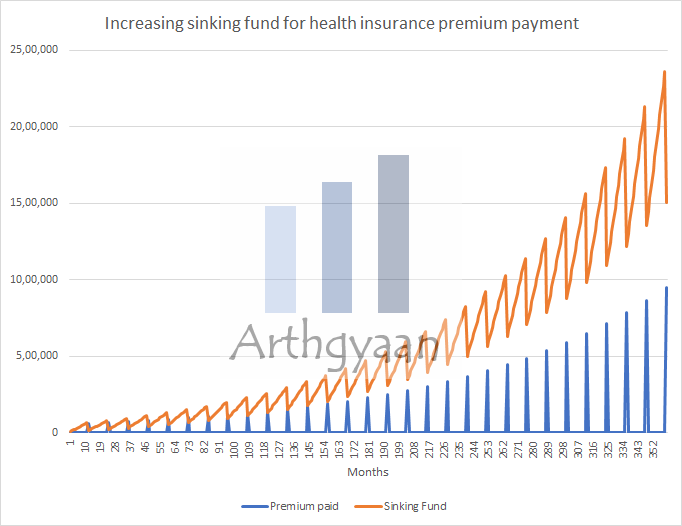

We will save more than 1/12th of the yearly premium to counter this increase. We will try to save 1/10th or 1/9th, budget permitting, every month. With the 1/10th plan, we will have saved the entire premium in 10 months, and the extra two months of saving will take care of a future increase.

For example, if the current premium is 60,000, then as per the 1/10th rule, start a SIP of 6,000/month. This account will have 72000 in 12 months (plus interest), and this 12,000 will be accumulated until the premium increases. Once the premium increases in the future, adjust the SIP amount again to make it 1/10th of the new premium.

Once retirement starts, any remaining balance in the health insurance premium fund will be used to pay the premiums in the first few years of retirement. Given the high costs of health insurance above 60, premium cost should be a prominent part of the expense planning in retirement. This article shows you how to estimate retirement costs: How can you figure out your expenses in retirement/FIRE?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled A health insurance premium fund: who needs it and why first appeared on 01 Jun 2022 at https://arthgyaan.com