PPF vs. mutual funds: which is better?

The article presents a historical analysis of investing in stocks vs. PPF since 1979.

The article presents a historical analysis of investing in stocks vs. PPF since 1979.

Many investors wonder which is a better option for long-term investment: Public Provident Fund or investing in the stock market via mutual funds.

An updated version of this article for the latest year is presented here: The latest result of PPF vs. SENSEX.

This article is a part of our detailed article series on Public Provident Fund (PPF). Ensure you have read the other parts here:

Many investors wonder which is a better option for long-term investment: Public Provident Fund or investing in the stock market via mutual funds. Given that PPF returns more the earlier you make the investment, many investors also try to target investing the maximum in PPF as early as possible, preferably in April.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2024.

This article shows the maturity amount of investing in the Public Provident Fund (PPF) for 15 years as per historical interest rates.

This article explains how PPF interest calculation works so that you can invest in the best month to get the maximum interest.

This article compares the various ways of investing in PPF to show which gives the most interest.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2023.

This article gives you the current and historical interest rates for PPF so that you can decide if investing in PPF is the right option for your portfolio.

This article shows you a quick way to know when your PPF account will mature depending on the date you opened the account.

This article compiles an exhaustive list of FAQs on the Public Provident fund (PPF).

A Step-by-step guide for PPF account holders approaching maturity in April. This post shows how to decide between extension vs. withdrawal.

We run a simulation using historical data to check which option has been better. The simulation takes the case of two individuals

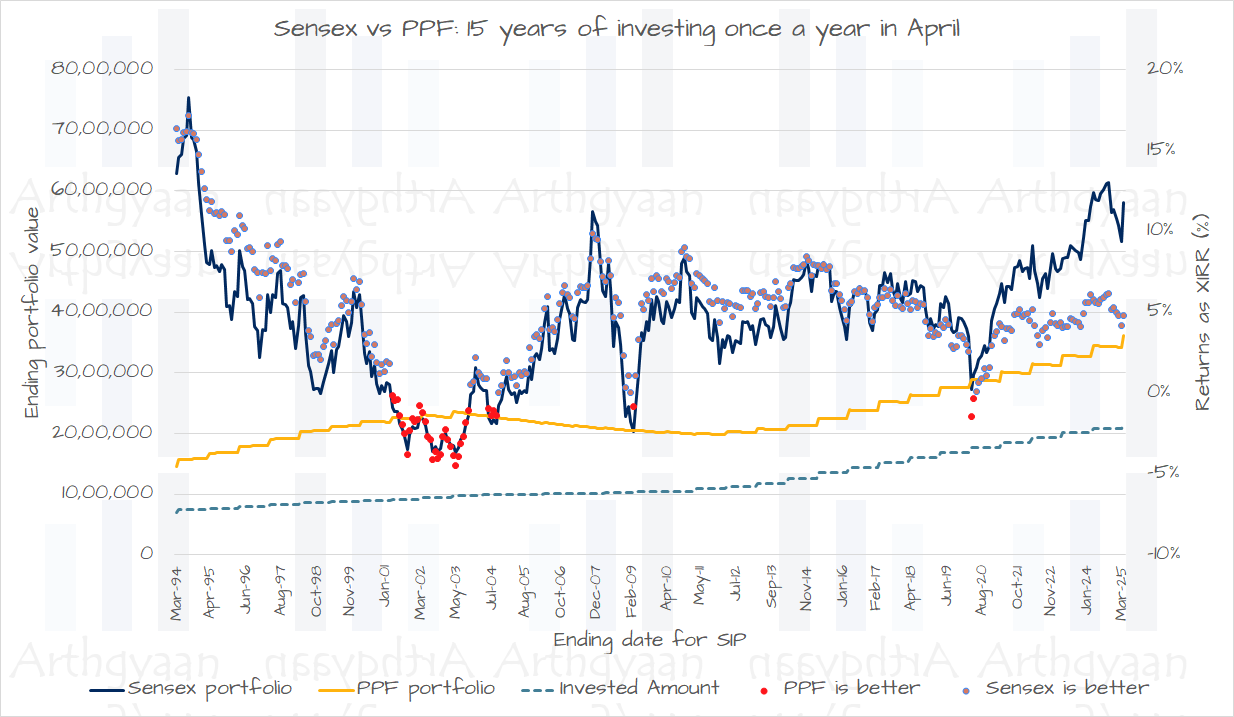

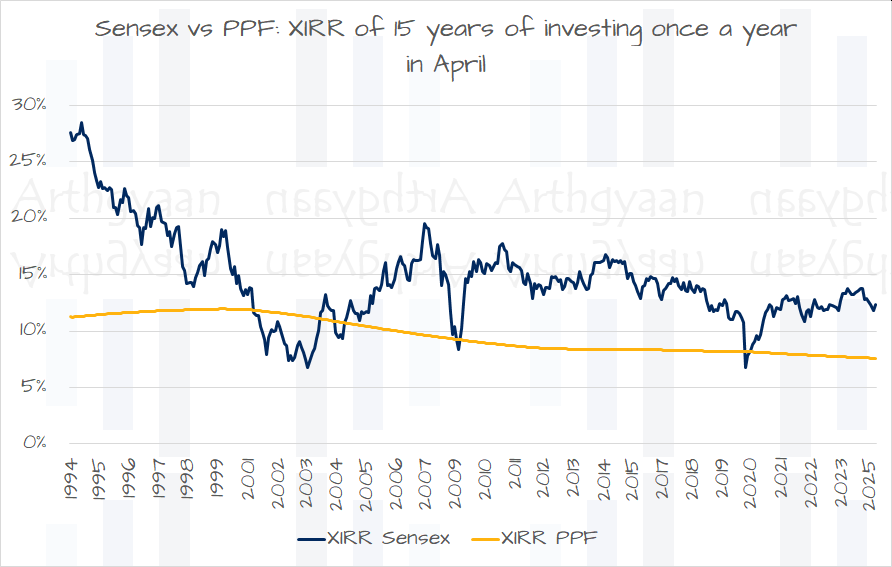

In this article, we will show the results of running a 15-year investment in PPF vs the Sensex (to represent stock investing via mutual funds) in this way:

We did not have mutual funds in 1979, but we have today, and not having mutual funds in the 1970s does not invalidate the conclusions below.

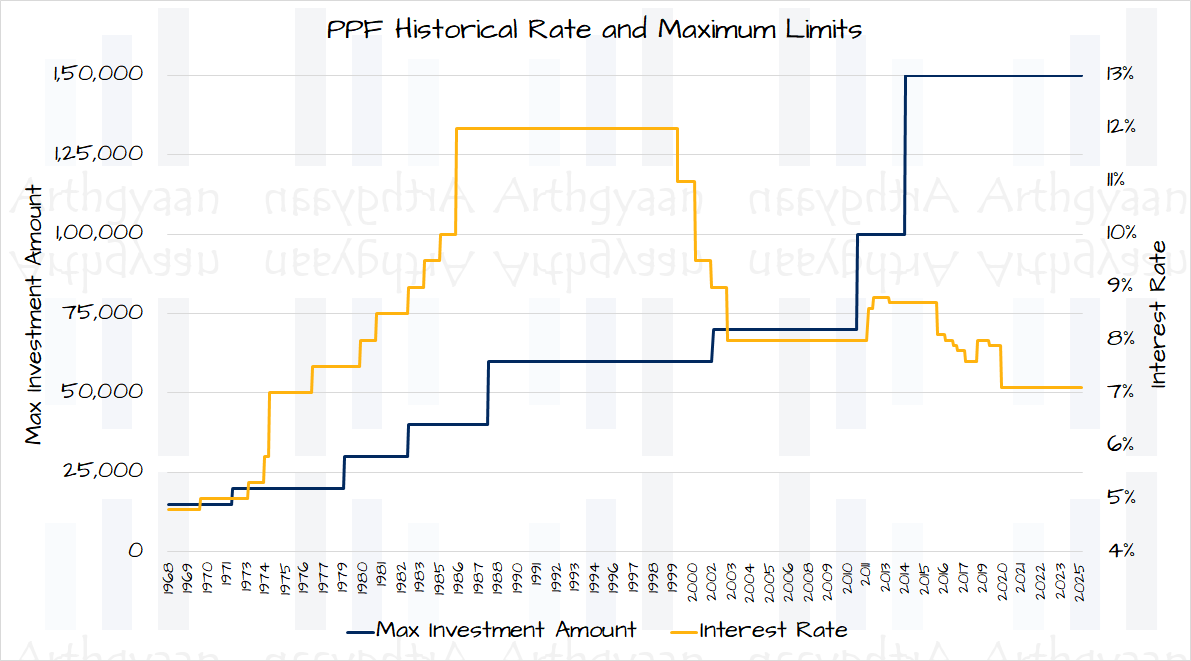

Using data from the National Savings Institute, we plot the historical interest rates and limits of PPF investment since 1968.

Some observations:

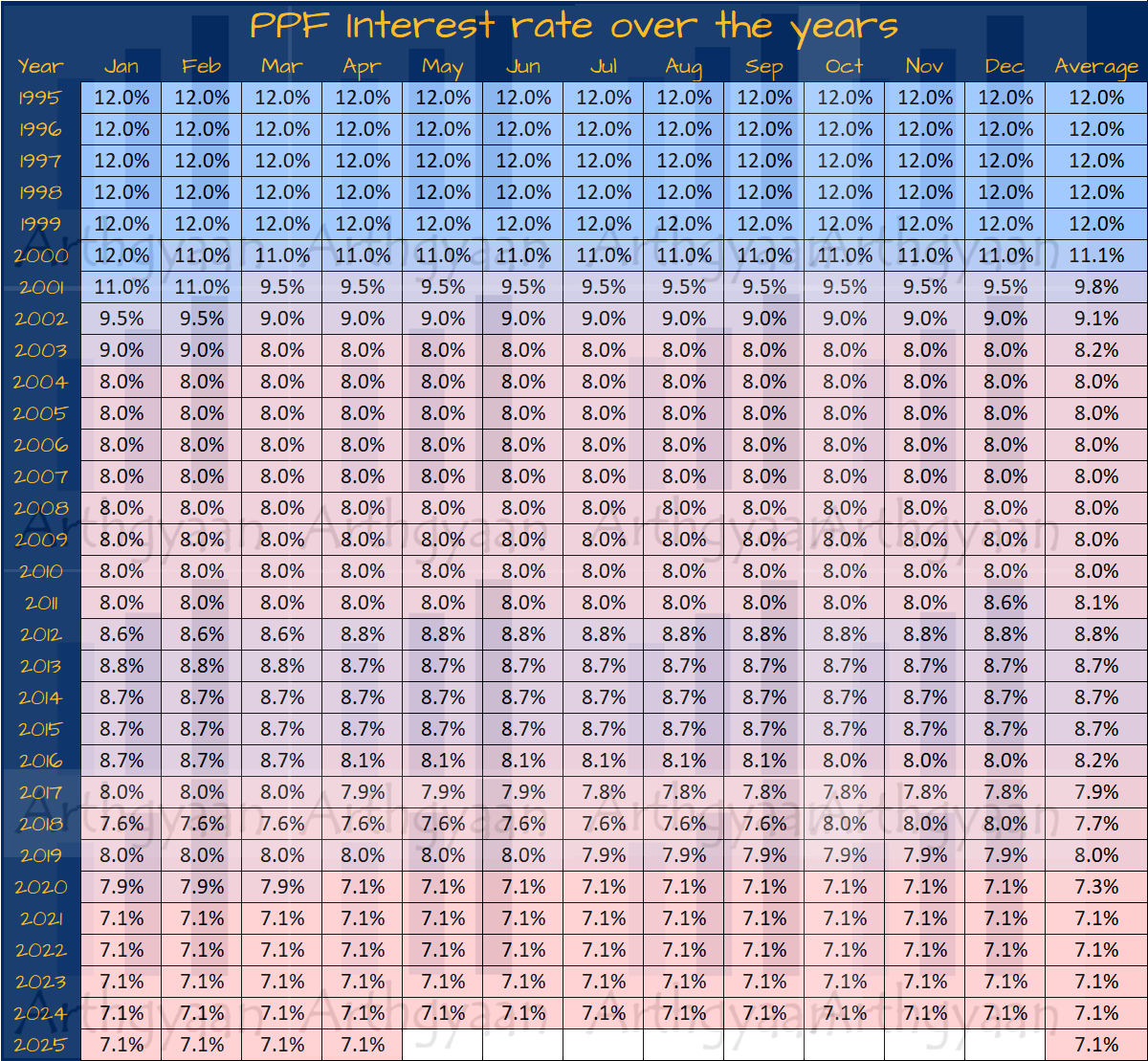

Here is another view of the same data but for every month since 1995:

We will invest the same amount at the beginning of the month in PPF or Sensex. The amount is 1/12th of the investment limit of PPF that was allowed at that time. Since PPF interest is calculated on the minimum balance between the 5th and the end of the month, this method maximises the interest we can get via investing monthly in PPF. The interest rate taken is the actual PPF rate in that period. We also use the actual Sensex returns for the final portfolio value over the period.

The result shows that in most of the 300+ cases in this simulation, Mr S, the stock investor, comes out ahead. Only in some extreme market events, like the post-Harshad Mehta years, the 2008 global financial crisis or the 2020 COVID-19 crash, did the PPF portfolio do better in 18% cases.

In this chart, we see how the returns of the PPF investment have risen and later fallen with PPF rates while that of the Sensex investment has been unpredictable.

We should keep in mind the following points while concluding anything from this analysis:

We have done an analysis of rolling over your PPF maturity amount into aggressive hybrid funds if you don’t need an exact amount in 5-years: PPF Account Maturity in 2025: How Much Higher Returns Can You Get if You Withdraw and Invest in Mutual Funds?

Can we use this data to say that “stocks are usually better than PPF”? That is mostly true. However, PPF has some benefits like guaranteed tax-free returns that stocks do not have.

We should not construct a portfolio for long-term goals only with stocks since we have shown before that the end result of such a portfolio is unknown. The better option is to create a portfolio with both debt and equity as asset classes and rebalance between the two per an appropriate glide path.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled PPF vs. mutual funds: which is better? first appeared on 08 Jun 2022 at https://arthgyaan.com